Search

Recent comments

- UNAC/UHCP...

2 hours 35 min ago - crafty lingo....

3 hours 59 min ago - off food....

4 hours 7 min ago - lies of empire...

5 hours 7 min ago - no peace....

6 hours 15 min ago - berlinade....

6 hours 40 min ago - difficult...

8 hours 15 min ago - no nukes...

8 hours 24 min ago - hairy...

10 hours 40 min ago - beaudifool....

11 hours 48 min ago

Democracy Links

Member's Off-site Blogs

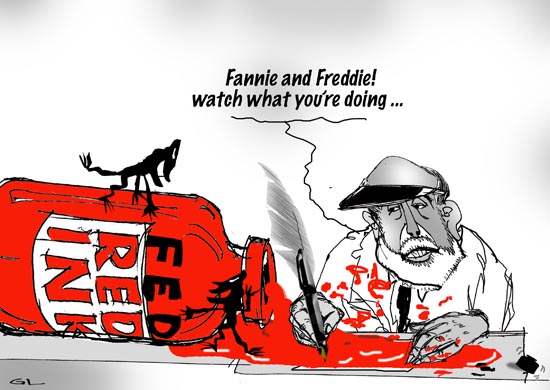

cookin' the books .....

A Treasury Department plan to bolster beleaguered mortgage giants Fannie Mae and Freddie Mac will be added to a massive housing package working its way through Congress, to be to the president's desk within days, key lawmakers said today.

In an interview, House Financial Services Committee Chairman Barney Frank said he will incorporate the Treasury initiative - which would extend unprecedented government support to the two shareholder-owned, government-chartered companies -- into the housing package. The measure will be put to a vote in the House on Thursday and then go to the Senate for final approval, and on to the White House early next week, Frank said.

"I do think there's a reason for speed," Frank (D-Mass.) said. He and other observers added that some Republican lawmakers, particularly in the Senate, are likely to oppose the initiative. But, Frank said, "I don't see a major problem."

A handful of Republicans have used Senate rules to slow down the housing package, which would create a strong new regulator for Fannie and Freddie, modernize the Federal Housing Administration and extend a financial lifeline to hundreds of thousands of homeowners who took out exotic mortgages with rapidly rising monthly payments and are now at risk of foreclosure.

After Fannie and Freddie stock nosedived last week on fears that the companies had insufficient cash to cover bad mortgage debts, Treasury Secretary Henry M. Paulson Jr. proposed expanding the legislation to include a plan to increase the amount the companies can borrow from the government and to make it possible for Treasury to invest government money in the firms by buying their stock.

That plan, announced yesterday, eased the pressure on Fannie and Freddie in the stock market today. Shares of both companies rose steeply in the morning but fell as the day progressed.

Lawmakers Fast-Track Help For Mortgage Giants

---------

in the local neighbourhood …..

In the Los Angeles area, lines snaked around IndyMac Bancorp branches for blocks, as customers made withdrawals from the bank, which failed last week. In Cleveland, National City Corporation denied a rumor that its customers were also demanding their money.

In Washington, federal regulators tried to broadcast the message that plummeting stock prices should not cause consumers to panic about the safety of their savings.

And on Wall Street, analysts began circulating lists of regional and local banks that might be next to fall.

Investors continued to beat down bank stocks, fearing that the government’s resolve to help Fannie Mae and Freddie Mac, the giant companies at the center of the nation’s mortgage market, would not hold back the rising tide of bad loans unleashed by the weakening housing market and faltering economy. Financial stocks, a Merrill Lynch analyst wrote bluntly, are “value traps.”

Stocks on Standard & Poor’s 500 Bank Index fell nearly 10 percent, and regional banks were particularly hard hit, declining nearly 11 percent. Several regional banks lost nearly a third of their value, as investors bet that these smaller banks might be the ones the government would let fail.

"We have seen a ‘too big, too important to fail’ instance,” said William H. Gross, the chief investment officer of the bond fund Pimco. “The market wonders: which institution is too small to bail out? Where is the dividing line? They seem to have picked on the regional banks as potential candidates to be the ones too small to bail out."

Banking analysts put out reports warning against the sector. Goldman Sachs said regional banks may cut their dividends to restore capital — pushing down shares of banks like Zions Bancorporation and First Horizon National. And Lehman Brothers said that Washington Mutual, the nation’s largest savings and loan, might end up with a whopping $26 billion in cumulative losses.- By Gus Leonisky at 15 Jul 2008 - 11:26pm

- Gus Leonisky's blog

- Login or register to post comments

So why did he take the job?...

At Freddie Mac, Chief Discarded Warning Signs By CHARLES DUHIGGThe chief executive of the mortgage giant Freddie Mac rejected internal warnings that could have protected the company from some of the financial crises now engulfing it, according to more than two dozen current and former high-ranking executives and others.

That chief executive, Richard F. Syron, in 2004 received a memo from Freddie Mac’s chief risk officer warning him that the firm was financing questionable loans that threatened its financial health.

Today, Freddie Mac and the nation’s other major mortgage finance company, Fannie Mae, are in such perilous condition that the federal government has readied a taxpayer-financed bailout that could cost billions. Though the current housing crisis would have undoubtedly caused problems at both companies, Freddie Mac insiders say Mr. Syron heightened those perils by ignoring repeated recommendations.

In an interview, Freddie Mac’s former chief risk officer, David A. Andrukonis, recalled telling Mr. Syron in mid-2004 that the company was buying bad loans that “would likely pose an enormous financial and reputational risk to the company and the country.”

Mr. Syron received a memo stating that the firm’s underwriting standards were becoming shoddier and that the company was becoming exposed to losses, according to Mr. Andrukonis and two others familiar with the document.

But as they sat in a conference room, Mr. Syron refused to consider possibilities for reducing Freddie Mac’s risks, said Mr. Andrukonis, who left in 2005 to become a teacher.

“He said we couldn’t afford to say no to anyone,” Mr. Andrukonis said. Over the next three years, Freddie Mac continued buying riskier loans.

Mr. Syron contends his options were limited.

“If I had better foresight, maybe I could have improved things a little bit,” he said. “But frankly, if I had perfect foresight, I would never have taken this job in the first place.”

Mr. Andrukonis was not the only cautionary voice at Freddie Mac at the time. According to many executives, Mr. Syron was also warned that the firm needed to expand its capital cushion, but instead that safety net shrank. Mr. Syron was told to slow the firm’s mortgage purchases. Instead, they accelerated.

Those and other choices initially paid off for Mr. Syron, who has collected more than $38 million in compensation since 2003.

But when housing prices began declining in 2006, choices at Freddie Mac and Fannie Mae proved disastrous. Stock prices at both companies have fallen by more than 60 percent since February, destroying more than $80 billion of shareholder value.

elastic accounting

Loan Giant Overstated the Size of Its Capital Base

By GRETCHEN MORGENSON and CHARLES DUHIGG

Published: September 6, 2008

The government’s planned takeover of Fannie Mae and Freddie Mac, expected to be announced on Sunday, came together after advisers poring over the companies’ books for the Treasury Department concluded that Freddie’s accounting methods had overstated its capital cushion, according to regulatory officials briefed on the matter.

The proposal to place both companies, which own or back $5.3 trillion in mortgages, into a government-run conservatorship also grew out of deep concern among foreign investors that the companies’ debt might not be repaid. Falling home prices, which are expected to lead to more defaults among the mortgages held or guaranteed by Fannie and Freddie, contributed to the urgency, regulators said.

Investors who own the companies’ common and preferred stock will suffer. Holders of debt, including many foreign central banks, are expected to receive government backing. Top executives of both companies will be pushed out, according to those briefed on the plan.

The cost of the government’s intervention could rise into tens of billions of dollars and will probably be among the most expensive rescues ever financed by taxpayers.

Both presidential nominees expressed support for the government’s plans. Senator Barack Obama, Democrat of Illinois, said as he campaigned in Indiana that not acting could place the housing market in further distress.

read more at the NYT

Mae and Mac mince meat...

The US Government has launched a massive takeover of the nation's two biggest mortgage companies to try to contain the damage from the devastating housing slump.

The historic intervention has targeted mortgage giants Fannie Mae and Freddie Mac, which have a hand in half of all mortgages in the United States.

read more at the ABC

"possible fraud"...

Key finance firms 'probed by FBI'

The FBI has begun an investigation into four major US financial institutions caught up in the current financial crisis, US media say.

Investigators are reportedly examining possible fraud by mortgage giants Fannie Mae and Freddie Mac, the failed bank Lehman Brothers and insurer AIG.

Top managers at those firms are also being investigated, the reports say.

In the past year, as the US housing market slumped, the FBI began a broad inquiry across the financial sector.

It was prompted by concerns over the way high-risk, "sub-prime" mortgages were being sold.

The FBI has been looking at lenders who sold home loans to buyers on low or unpredictable incomes and also the investment banks that packaged these loans and sold them on.

see toon at top....

more red ink...

Freddie Mac Seeks U.S. Aid After Posting Loss

By THE ASSOCIATED PRESSWASHINGTON — Freddie Mac, the mortgage finance giant, is asking for an initial injection of $13.8 billion in government aid after posting a large quarterly loss.

The mortgage finance company is making the first request to tap the $200 billion promised by the Treasury Department to keep it and sibling company Fannie Mae afloat after the two were seized by federal regulators more than two months ago. Freddie Mac said it expected to receive the money by Nov. 29.

The company, which is based McLean, Va., posted a loss Friday of $25.3 billion, or $19.44 a share, for the third quarter.

The results compared with a loss of $1.2 billion, or $2.07 a share, in the year-ago period. Analysts were looking for a loss of 89 cents a share for the latest quarter, according to Thomson Reuters.

The loss was mainly because of a $14.3 billion charge to reduce the value of tax assets, but also was driven by $9.1 billion in write-downs on mortgage securities, and $6 billion in credit losses because of soaring mortgage delinquency rates and foreclosures.

Freddie Mac said that rising unemployment rates, tightening credit and deteriorating economic conditions “contributed to a substantial increase in the number of delinquent loans,” including prime loans made to borrowers with strong credit.

bonuses in red ink...

Fannie and Freddie Detail Retention Bonuses

Just a few weeks after retention bonuses at American International Group became a national scandal, Fannie MaeFreddie Mac, the two mortgage-financing giants that the government rescued last fall, have outlined plans to pay an additional $159 million in bonuses to retain employees in 2009 and 2010, on top of the nearly $51 million already paid out last year. and

James B. Lockhart of the Office of Federal Housing Enterprise Oversight, which now oversees the two companies, disclosed the bonus programs in a letter to Sen. Charles E. Grassley of Iowa, the ranking Republican member of the Senate Finance Committee.

In the letter, Mr. Lockhart defended the payouts as a way to “keep key staff without rewarding poor performance.” (Download the full letter below.)

Lawmakers have harshly criticized some bailed-out companies that later offered bonuses to workers, and the House passed legislation this week that would seek to limit compensation and bonuses at such firms.

Last month, Mr. Grassley called on Fannie and Freddie to justify their bonus retention programs, and demanded they release the names and titles of any employee who received, or was set to receive, a retention bonus of more than $100,000.

Mr. Lockhart did not provide the names in his letter, citing “personal privacy and safety reasons.”

------------------

The sad part is that many people work hard, yet the system they work for goes down the tube... Thus either "mistakes" were made or "bad planning" or ... whatever...

Fannie and Freddie freak tab...

By BINYAMIN APPELBAUM

CASA GRANDE, Ariz. — Fannie Mae and Freddie Mac took over a foreclosed home roughly every 90 seconds during the first three months of the year. They owned 163,828 houses at the end of March, a virtual city with more houses than Seattle. The mortgage finance companies, created by Congress to help Americans buy homes, have become two of the nation’s largest landlords.

Bill Bridwell, a real estate agent in the desert south of Phoenix, is among the thousands of agents hired nationwide by the companies to sell those foreclosures, recouping some of the money that borrowers failed to repay. In a good week, he sells 20 homes and Fannie sends another 20 listings his way.

“We’re all working for the government now,” said Mr. Bridwell on a recent sun-baked morning, steering a Hummer through subdivisions laid out like circuit boards on the desert floor.

For all the focus on the historic federal rescue of the banking industry, it is the government’s decision to seize Fannie Mae and Freddie Mac in September 2008 that is likely to cost taxpayers the most money. So far the tab stands at $145.9 billion, and it grows with every foreclosure of a three-bedroom home with a two-car garage one hour from Phoenix. The Congressional Budget Office predicts that the final bill could reach $389 billion.

Fannie and Freddie increased American home ownership over the last half-century by persuading investors to provide money for mortgage loans. The sales pitch amounted to a money-back guarantee: If borrowers defaulted, the companies promised to repay the investors.

-----------

see toon at top...

it should make you very, very afraid...

GREG WILPERT: Welcome to The Real News Network. I’m Greg Wilpert.

The US Treasury Department is proposing to end federal government control over the Federal Mortgage Association and the Federal Home Loan Mortgage Corporation, also known as Fannie Mae and Freddie Mac. The two entities have been under federal conservatorship since the 2008 financial crisis. This has meant that the federal government observed their losses, amounting to $220 billion for Fannie Mae and $72 billion for Freddie Mac, since then. However, since the end of the housing crisis, the two corporations have returned to profitability, and the same amount of profits has been returned to the federal government. According to Treasury Secretary Steven Mnuchin, his proposals will “protect taxpayers and help Americans who want to buy a home.”

Joining me now to examine what this means for home buyers and for the economy more generally is Richard Wolff. He is Professor Emeritus of Economics at the University of Massachusetts, Amherst and the New School University. He is the author of many books, including Capitalism’s Crisis Deepens: Essays on the Global Economic Meltdown. Thanks for joining us again, Richard.

RICHARD WOLFF: Glad to be here.

GREG WILPERT: So first, before we get into the heart of the effect of this Treasury Department proposal, we need to clarify for our viewers exactly what is the function and importance of Fannie Mae and Freddie Mac. What do they do and why are they important? And why did the federal government take them over into conservatorship in 2008?

RICHARD WOLFF: Well, the important thing about Freddie Mae and all of these kinds of programs is that people understand where they began. The federal government, in the depths of the Great Depression, 1938 to be precise, understood that one of the ways out of the Depression was to give people the chance to buy a home, because that would provide work for everybody who would build a home and provide the furnishings for it, and so on. But in the depths of the Depression, nothing was more obvious than that people didn’t have the money to buy a home, and therefore couldn’t buy one. So what the government did to stimulate the economy was to create a federal insurance program.

And here’s how it worked. The government went to the bank, all of them in America, and said, “If you lend money to a homeowner, and you follow certain basic rules, you will be able to get, in effect, an insurance policy. We the government will, in effect, guarantee that mortgage.” The financial details aren’t important. The idea was that the bank could now take the risk of lending to American working people money that they would never have lent to them before because it would have been too risky, because the risk was now gone, because the government stepped in and said, “We will guarantee,” very clearly, if the person who took out the mortgage cannot keep the payments going, the government will step in and do it for them, thereby removing the risk for the banks. We did it first in 1938. We did it again in the 1950s.

And it’s an important fact to understand, that the housing business in the United States that we’ve become used to over the last half century was, throughout that time and to the present, guaranteed by and supported by the government of the United States. The housing industry was never a private enterprise. And until this current proposal, it was understood that it had to be that way, or else the American dream of owning your own home would again become a dream for only the top 10% or 20% of our people.

That’s the first step. Second step, in the great crash of 2008, what happened was, so many people lost their jobs, so many businesses went belly up, that millions of Americans could not repay their mortgages. And as a result, the government had to step into these special things— Fannie Mae, Freddie Mac, and so on— and basically take them over because they didn’t have the money in them, as half-private enterprises, to cover all of the mortgages they were technically responsible for. So the government stepped in with literally hundreds of billions of dollars to bail out the housing industry that they had always supported. So as of 2008 and 2009, the government didn’t have an independent group of companies, Fannie Mae and Freddie Mac. It simply took them over and did directly, what it had before done indirectly.

The problem here is that it puts the government in a position of having, in a way, the last word in the housing business. Because whatever the government charges— either the private banks or anybody else— to play in this game, they don’t want to be charged by the government. They want to control it themselves. So what Mr. Trump and Mr. Mnuchin have done, as they have done across the board in deregulating every other aspect of our economy, taking away the role of the government to protect us, and giving us back to the private enterprises that got us into the Great Depression in the first place and into the Great Recession in 2008. We’re going backwards to re-establish the private control that led to the creation of these “special entities,” as they are called, in the first place. So think of this simply as a big fat regressive going backwards for the benefit of private finance, at the expense of government control.

GREG WILPERT: Give us a little bit more detail as to what that would mean. I mean, the proposal itself has something like 50 different elements, which are actually all quite complicated, but I think there’s two that really stand out, one of which you already mentioned, which is the return to private control. Now, one could say that the interest rates are very low at the moment, this actually shouldn’t have much of an effect, perhaps. What’s your reaction to that? I mean, one of the things that Mnuchin, as I mentioned earlier, said, is that this would actually benefit the consumer. What do you think?

RICHARD WOLFF: I think if you take what he says seriously, it means you’ve never understood the history of the American banking system. When the government stepped in to take over Fannie Mae and Freddie Mac back in 2008 and 2009, it made exactly the same statement. What they were doing was guaranteeing that the American dream would not get lost, that American homeowners could continue to buy and own their own homes. Mr. Mnuchin And Mr. Trump, going in exactly the opposite direction, make the same promise. It has no value in the first case, and it has none now.

Let me explain the specifics. When you go to a bank and get a mortgage, okay, you believe, in your mind that you are borrowing money to buy your home and that you’ll make a payment every month. What actually happens is that the bank turns around and sells the mortgage, your obligation to pay, say for 15 or 20 years or whatever it is, they sell that, usually to a bank. The bank puts it together and calls that a security, a mortgage-backed security. It is now a piece of paper like a share of a company, but instead of having a share of a company, what you have is a share of all those mortgages. And as each of us pay our monthly to the bank, the bank turns around and shifts that money, keeping a little bit for itself, to whoever put those mortgages together into this mortgage-backed security.

And the bank that does this then sells those securities to rich investors around the world who like to do that because the rate of return you get on that kind of a security is better than many other options you have, so it’s attractive. And what really makes it attractive, and here we go now, is that Fannie Mae and Freddie Mac were these agencies that guaranteed to pay off … if the mortgage couldn’t be paid, the investor will have no risk because these were quasi government-backed entities that would guarantee that the risk was low. When that was private enterprise, it was still guaranteed by the government because everybody believed the government would step in, in the event that the mortgages weren’t being paid and that actually happened in 2008. The government stepped in and what they want to do now is to go back to what it was before, which leads any reasonable person to say, “Well, if it got us into terrible trouble before, why would we want to go back to what it was then that got us into this great difficulty?” Number one.

And number two, the simplest answer, nobody knows, if you give this back to the private companies, if Freddie Mac and Fannie Mae become private, what the new arrangements will be, how much they will charge for the banking that they do, how responsible they’ll be. All I can suggest to your audience is, we know that the crash of 2008 had to do with extraordinary gimmicks developed by banks, CDOs, mortgage-backed securities, debt swaps, that got us into an unbelievable crash, the second worst in the history of capitalism. Turning housing from the government back into the hands of people who have performed this badly, the same banks that have been fined for money laundering, for excessive fees, for manipulating international interest rates, this is an extraordinary vote of confidence in a banking industry that should have deprived itself of confidence by what they’ve done in the last 10 years.

GREG WILPERT: Now, another element of this deal, or this proposal, is that Fannie Mae and Freddie Mac would pay the government a sort of insurance policy. That is, in other words, they would basically be bailed out if they get into trouble again, and in exchange for that, they would pay the government a certain fee, which presumably would cover that. Now, shouldn’t that allay some of those fears that you’re talking about of a possible bankruptcy should there be a new downturn in the housing market?

RICHARD WOLFF: It should make you very, very afraid. And let me tell you why. Banks, in case folks are not familiar with them, are entities that are privately-owned capitalist firms. Their first responsibility, or they like to call it their “bottom line,” is profit, and returning, profitably, dividends to their shareholders, and capital gains to their shareholders, and so on. They will, therefore, turn around, if and when they pay a fee to the government to be the insurance policy, as you describe it, they will turn around and do in the future what they did in the past, which is charge the homeowner a fee, or to raise the interest rate, or however they plan on doing it, to recover that money, and probably make a little profit off the whole arrangement on top of it.

That’s why any promise by Mr. Trump or Mr. Mnuchin that the hustle that they’re perpetrating will, in the end, make it more affordable for Americans to own their own home, that is almost certainly not true. Because what we can count on the banks doing, because they do it in every other line of business, is squeezing as much profit as possible. And that includes recouping any insurance payment they make to the government for a future eventuality by charging us, the homeowners, more in closing fees, in points, as it’s called in some areas, or in the interest rate itself. The money is to recoup anything that they pay to the government.

GREG WILPERT: Well, we’re going to leave it there for now. I’m speaking to Richard Wolff, Professor Emeritus of Economics at the University of Massachusetts, Amherst, and also host of the YouTube program, Economic Update. Thanks again, Richard, for having joined us today.

RICHARD WOLFF: Thank you, Greg. And best to you.

GREG WILPERT: And thank you for joining The Real News Network.

Read more:

https://therealnews.com/stories/trump-to-return-fannie-mae-and-freddie-m...

Read from top.