Search

Recent comments

- witkoff BS....

35 min 1 sec ago - new dump....

12 hours 27 min ago - incoming disaster....

12 hours 34 min ago - olympolitics.....

12 hours 39 min ago - devil and devil....

16 hours 17 min ago - bully don.....

20 hours 14 min ago - impeached?....

1 day 1 hour ago - 100.....

1 day 9 hours ago - epibatidine....

1 day 15 hours ago - cryptohubs...

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

the old bipartisonship trick .....

"Working together, we are confident we will pass a responsible bill in the very near future," they said.

The House is not due to meet again until Thursday as many members have gone home for a Jewish holiday.- By Gus Leonisky at 2 Oct 2008 - 7:12am

- Gus Leonisky's blog

- Login or register to post comments

from the former economic master of the Aussie-universe

Main Street missed out on party but is footing bill

Peter Costello

October 2, 2008

When the United States Treasury Secretary, Henry Paulson, made an appeal to Congress for $US700 billion to bail out the US financial system, he observed that there were 5 million homeowners in foreclosure or in delinquency on their mortgages.

He observed that lax lending practices "earlier this decade led to irresponsible lending and irresponsible borrowing". With 5 million owners in default, there are millions of properties up for sale. The value of real estate is plummeting and the security for these mortgages has collapsed in value. Millions of these mortgages are now worthless. So who was responsible for supervising these lax credit practices in the US? As it turns out, no one.

...

The US has a law that puts a ceiling on government debt. For this year that ceiling is about $US9.6 trillion. The ceiling will have to be lifted so the Government can borrow more to fund the bail-out.

----------------------

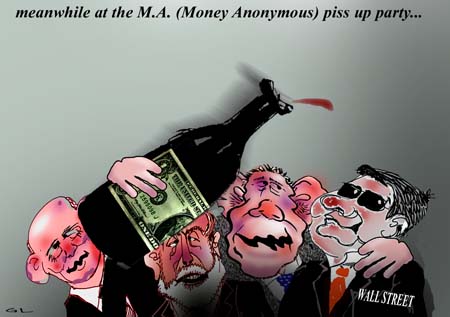

Good one Pete. Yes, during the boom times, the US CEOs drank, dined and danced like if it was raining buxes, getting heart-flutter at betting OUR money on games that had no values. And the major problem, although part of it was "lack of regulation", was that these fantastic financial wizards did not see it coming... Hang on a minute... They saw it coming but decided to push the joke to its limit until main street (us) had to yellow laugh when the US government "friend of the Financiers" had to bring on the rescue brigade, with tall ladders and firehoses throwing MORE MONEY at the party... Ah... It's all in good fun... The party continues on the top floor... See toon above...

passing stools...

Update

The US Senate has passed a revised $US700 billion ($890 billion) financial bail-out bill, bringing the rescue plan one step closer to final passage.

The vote was expected to send a positive signal to global markets that there may be some systemic relief to the crisis that has ensnared global banking, threatening the world's economy.

read more at the SMH and see toon at top...