Search

Recent comments

- it's time....

49 sec ago - pissing dick....

19 min 38 sec ago - landings.....

30 min 55 sec ago - sicko....

13 hours 19 min ago - brink...

13 hours 35 min ago - gigafactory.....

15 hours 22 min ago - military heat....

16 hours 4 min ago - arseholic....

20 hours 48 min ago - cruelty....

22 hours 4 min ago - japan's gas....

22 hours 45 min ago

Democracy Links

Member's Off-site Blogs

restoring public confidence .....

The problem is that the markets no longer have any faith that the world financial system they helped create has any future.

The model is bust. It is encouraging that both the Americans and Germans are now moving towards what they considered ideologically unthinkable a fortnight ago - they are preparing to follow the British lead, take big public stakes in banks and offer guarantees to the interbank market.

But while this is a necessary condition for stabilisation it is not sufficient.

What needs to happen on top is an assault on the dark heart of the global financial system - the $55 trillion market in credit derivatives and, in particular, credit default swaps, the mechanisms routinely used to insure banks against losses on risky investments.

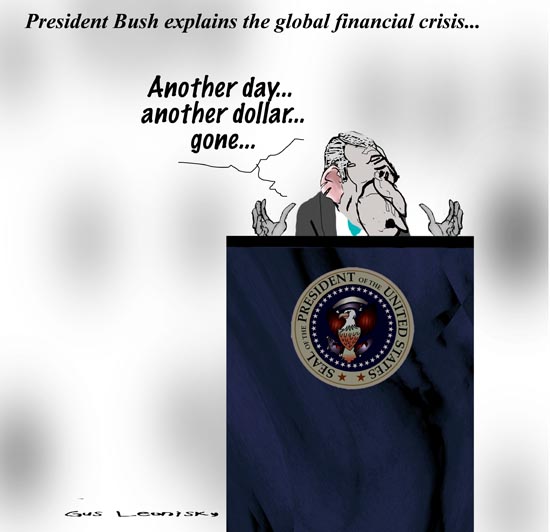

This is a market more than twice the size of the combined GDP of the US, Japan and the EU. Until it is cleaned up and the toxic threat it poses is removed, the pandemic will continue. Even nationalised banks, and the countries standing behind them, could be overwhelmed by the scale of the losses now emerging.- By Gus Leonisky at 13 Oct 2008 - 10:17pm

- Gus Leonisky's blog

- Login or register to post comments

pass the parcel

After Britain and the US injected massive amounts of capital into their banks, Switzerland has taken emergency measures to try to shore up its banking system. Sean Farrell reports

Friday, 17 October 2008

In an extraordinary move for a nation proud of its financial prudence and stability, Switzerland was forced to take emergency measures yesterday to shore up its two biggest lenders to prevent a collapse in confidence in the country's banking system.

The state will inject SFr6bn (£3.1bn) into UBS, its biggest bank, in return for a 9.3 per cent stake, and will allow UBS to unload $54bn (£31bn) of toxic assets, including sub-prime mortgages and Alt-A securities, into a fund controlled by the central bank.

Credit Suisse, the No 2 Swiss lender, obeyed instructions from the central bank by raising about SFr10bn from investors in the market, including the Qatar Investment Authority, which is already a big shareholder and is a major stakeholder in Barclays. The fundraising, which allows Credit Suisse to meet tough new Swiss capital rules, represented about 12 per cent of the bank's existing equity.