Search

Recent comments

- rape....

20 min 45 sec ago - devastation.....

2 hours 32 min ago - bibi's dream....

4 hours 21 min ago - thus war....

8 hours 32 min ago - trump's gift....

9 hours 50 min ago - friendly fire....

9 hours 55 min ago - energy vs energy....

20 hours 41 min ago - killing kids....

23 hours 38 min ago - the die is cast....

1 day 1 hour ago - SICKO.....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

amazing scenes .....

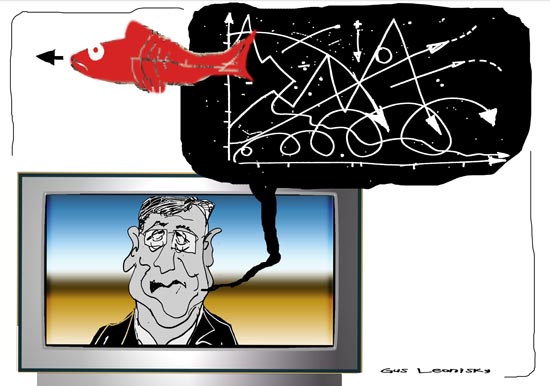

On channel Seven 4:30 afternoon news today, (29/10/08) Westpac's Global Head of Economics, Bill Evans, said something stupefying... Amazingly, he did not understand the way money was ebbing and flowing anymore...

Imagine!!!!

I fell of my chair... Apparently the US was lowering its interest rates down to one per cent the next day and punters could still make at least 5 per cent in Aussieland, yet the money flowed counter-current like mad salmons jumping in foaming rapids towards the dry source of the trouble... The USA...

Well, Bill Evans did not say that specifically but that is what I understood...

It must be an indication of weirdo-oddity that — as the best of the best economist in town is flounderingly flabbagasted by the phenomenon — we're still at the mercy of sneaky sharks and big crocs in the financial waters — creatures who call themselves 'currency traders' or such... or could it be that under global warming conditions, the supercharged salmon libido is working overtime towards death before sex for the doomed beasts?...

meanwhile, at the coal face of destroying homes...

Almost two months ago, the government sought to revive the nation's ailing mortgage sector by seizing Fannie Mae and Freddie Mac and pumping money into the home-loan market. But so far, the measures have yet to achieve their intended effect.

Backed by taxpayers, the mortgage finance giants have spent billions in an attempt to push down loan rates and make it easier for people to borrow money to buy homes. But mortgage rates have gone up.

The Treasury Department has also started buying $10 billion in mortgage bonds issued by the companies, with the ultimate goal of ensuring that mortgage lenders have a ready stream of money to lend. But the effort has been offset by a global sell-off of these bonds.

And even though Fannie Mae, of the District, and Freddie Mac, of McLean, have taken steps to help thousands of people avoid foreclosure, some housing advocates say the companies are not doing enough to help others keep their homes.

Federal Deposit Insurance Corp. Chairman Sheila C. Bair has urged the companies and their regulator to be more aggressive in helping people avoid foreclosure, according to people familiar with the matter.- By Gus Leonisky at 30 Oct 2008 - 5:50am

- Gus Leonisky's blog

- Login or register to post comments

and talking about salmons...

"There may be some delayed mortality of Columbia River smolts caused by the stress of passage through the hydro-system that is not manifested until the fish reach the ocean."

He added one factor could be that the fish channel their energy into navigating and surviving the series of dams rather than investing the energy in growing bigger.

But the researchers added that the tagging technology had proved to be a valuable tool in terms of gaining a clearer picture on what was happening under the water.

Analysis of the data revealed that two tagged juveniles had taken three months to complete a 2,500km (1,550-mile) migration from a tributary of the Columbia River into the Pacific Ocean, and north to Alaska.

------------------------

Meanwhile at the coalface of liquidity...

US consumer confidence has fallen to a record low in October, as global stock markets fall, homes are repossessed and firms lay off workers.

The Conference Board said the monthly consumer confidence index fell to 38, down from a revised 61.4 in September and below analysts' expectations of 52.

It is the lowest since the board began tracking consumer sentiment in 1967.

The survey of 5,000 US households is a gauge of consumer spending - which makes up two-thirds of the US economy.

--------------------------

meanwhile at the carfeist of carbon dioxide:

The European Union (EU) has backed the possibility of granting carmakers on the continent loans at attractive rates in the wake of the economic downturn.

Carmakers have requested 40bn euros ($50.98bn; £31bn) to help develop cars which meet EU CO2 emissions targets.

EU Industry Commissioner Guenter Verheugen said such loans made through the European Investment Bank (EIB) should now be accepted "in principle".

He had met executives from top firms such as Daimler and Peugeot Citroen.

The ACEA European carmakers' association had requested the loans to help them remain competitive in the face of plans to provide huge loans to their US rivals.

Meanwhile in the land of the rising suns

TOKYO, Oct. 29 -- In Japan, the global financial crisis seems to have singled out some of the world's best-known and best-managed companies for an especially bloody thrashing.

Consider Toyota Motor Corp., whose stock has lost almost two-thirds of its value since February of last year. Like many Japanese exporters, Toyota has been doubly clobbered this fall, first by collapsing consumer demand in the United States and Europe, and then by the exploding value of the yen against the dollar and the euro.

Still, the automaker is exceptionally rich and well positioned for the future. It has about $47 billion in liquid assets, the lowest manufacturing costs in its industry and global leadership in fuel-sipping hybrid cars such as the Prius. It announced this week that it will build a seventh factory with its joint-venture partners in China, where sales, although slowing, have jumped 24 percent so far this year.

Meanwhile as mentioned on this site before some things are on high octane in the fast lane:

The sports car giant Porsche has pulled off one of the greatest share killings on record in a coup that has left some of the world's largest hedge funds nursing combined losses that could total $20bn (£12.6bn).

--------------------

But Porsche needs to realise the hedge-funds hedgermasters are most likely to be their primal customers — pimply traders at the peak of their driving libido, thus should the hedge-funds hedgemasters be searching for scraps in public parks to survive, Porsche won't sell many cars unless they lend some money back to the youthful hedgers for another round of lively bets... Who knows?

With all these EU and US moneys being generously given by the truckloan with super-elastic repayments (if and when), and the Chinese Toyota factories booming, the Aussie car industry will have to reinvent the wheel — smarter, cheaper and more economical... like running on an oily rag, solar panels, pedals or salmon oil.

regulations...

Of course, Bill Evans (see above) was relieved on the 30/10/08 Seven 4:30 afternoon news, showing he knew what he was talking about since the Aussie dollar went from 60 cents to 68 cents overnight, once the US Fed Bank officially dropped interest rates down to one per cent... . He's a good analyst... The strong anomaly was definitely puzzling, especially for mugeconomics like me...

I would say that things should stabilise soon, bottoming in about a month — despite a large black hole ( US$5000 trillion debt over 30 years on sub-prime alone... plus other large non-serviceable US debts) still looming out there. Hedgers might feel the pinch and bite the dust... and the need for regulations of the money market is urgent. Civilising global capital... not socialisation of bad debts and privatisation of profit (like most bank rescue and such so far by the Fed bank) but a more equitable way to share for all, while not killing the goose of ethical enticement. Despite the groaning from the opposition in this country, Kevin Rudd got it 99 per cent right when helping the pensioners with a one-off payment and with other measures. Without those, things would have gone totally wacko. Fast action was required... and the opposition would have had to tell Rudd to do what he's just done.

Bush cannot fix the larger problem. If he had had any clue about things financial, this crisis would never had happened. Thus whatever he tries to do will be a completely botched-job while trying to protect his fanatical beliefs in "free markets" — an abhorrent illusion of whatever crook, all bloated with subsidies, rescue packages and payola under the tables...

Corrupt? you bet...

Bill's not the only one....

Stocks Soar After Volatile Session on Wall Street

By JACK HEALYAfter slumping to its lowest level of the year, Wall Street soared in a late rally on Thursday and closed dramatically higher, during a chaotic session in which the Dow ranged across nearly 900 points.

The Dow Jones industrials, which were briefly down 316 points, closed up more than 550 points, or nearly 6.9 percent. The broader Standard & Poor’s 500-stock index finished up almost 7 percent, hours after it plunged to its low for the year.

The market’s abrupt about-face left investors and analysts grasping for explanations.

“I have no idea,” said Michael Feroli, an economist at J.P. Morgan Chase. “The markets have two minds here. On the one hand, the data continues to be terrible. On the other hand, I think there’s people trying to pick bottoms here.”

see cartoon and comment at top and Meanwhile:

November 12, 2008Buying Binge Slams to Halt

By DAVID LEONHARDTJust as one crisis of confidence may be ending, another may be coming.

The panic on Wall Street has eased in the last few weeks, and banks have become somewhat more willing to make loans. But in those same few weeks, American households appear to have fallen into their own defensive crouch.

Suddenly, our consumer society is doing a lot less consuming. The numbers are pretty incredible. Sales of new vehicles have dropped 32 percent in the third quarter. Consumer spending appears likely to fall next year for the first time since 1980 and perhaps by the largest amount since 1942.

With Wall Street edging back from the brink, this crisis of consumer confidence has become the No. 1 short-term issue for the economy. Nobody doubts that families need to start saving more than they saved over the last two decades. But if they change their behavior too quickly, it could be very painful.

Already, Circuit City has filed for bankruptcy, and General Motors has said that it’s in danger of running out of cash. If the consumer slump continues, there is a potential for a dangerous feedback loop, in which spending cuts and layoffs reinforce each other.

confidence in the doldrums...

meanwhile:

November 12, 2008Everglades Deal Now Only Land, Not Assets

By DAMIEN CAVEMIAMI — United States Sugar Corporation has agreed to sell 181,000 acres of farmland to the State of Florida for $1.34 billion in a slimmed-down deal intended to rescue the Everglades while letting the company stay in business.

The price is $410 million less than Gov. Charlie Crist offered for the entire company in June. It is also a simpler transaction involving only real estate — U.S. Sugar would retain its mill, citrus processing facilities and other assets — leaving open the possibility of preserving the company’s 1,700 jobs.

“This is a unique opportunity,” said Robert Coker, a senior vice president with U.S. Sugar. “We’re going to go back and re-evaluate our business.”

Over the long term, Mr. Coker said, the company would consider producing biofuels and finding other uses for assets like its sugar mill and railways.

In the short term, he said, little would change. Business would continue in Clewiston, the central Florida town where the company has been based since the 1930s. U.S. Sugar, the nation’s largest sugar producer, would lease its former land from the state for the next seven crop cycles, paying a total of about $60 million.Of course, it could appear as an extra form of subsidy to the sugar coating industry... but who knows...

meanwhile

November 14, 2008Gas Prices Fall, but Americans Still Don’t Feel Rich

By CHRISTOPHER MAAGCLEVELAND — Drivers are breathing a sigh of relief as gasoline prices plunge across the country. Gas below $1.50 a gallon has appeared in a few places in recent days, and the national average has dropped almost in half since July, to $2.18 a gallon.

But even as worry about gas prices fades, it is being replaced by fear about the broader economy. Each 10-cent drop in gasoline prices puts $12 billion back in consumers’ pockets. Instead of spending that cash, people are trying to save it or cut their debt, many said in interviews.

“All that money is going right into paying off my credit cards,” said Jose Martinez, 33, as he pumped gas into his Dodge Charger at Ohio Gas Station No. 1 in Cleveland.

Moreover, the fall in gasoline prices is not translating into improved fortunes for automakers, at least not yet. Consumers said they remained wary of gas-guzzling cars on the theory that prices would rise again.

“I don’t think anyone who’s been paying attention for the last eight years would think that now is the time to go out and buy a Hummer,” said Geoff Sundstrom, spokesman for AAA, the automobile club.

any excuse shall do...

The leading measure of how Australian consumers are feeling has fallen in August, with some analysts blaming Olympic disappointment.

The Westpac - Melbourne Institute Index of Consumer Sentiment fell 2.5 per cent this month to 96.6 - that is further below the 100 point level that indicates when optimists equal pessimists.

Westpac's chief economist Bill Evans says the result is particularly disappointing given a better run of domestic and international economic news over the past few months.

"News that retail spending was boosted in the first half of the year; unemployment remains low; the Government has released $1.9 billion in fiscal compensation over the May–June period; the Reserve Bank had cut the overnight cash rate by 0.75 per cent in May/June; and the president of the European Central Bank has been promising to "do whatever it takes" to save the euro has been unsuccessful in sustaining an upswing in sentiment," he noted in the report.

http://www.abc.net.au/news/2012-08-15/consumer-confidence-dips/4199906

See toon at top...

optimism is not in the pocket of the stock holder...

Share market turmoil both in Australia and globally has helped drive a sharp deterioration in consumer confidence.

The Westpac Melbourne Institute has fallen to a reading of 93.9, well below the 100 level that separates optimism from pessimism.

The reading has been below 100 for 17 of the past 19 months.

Westpac chief economist Bill Evans said the fall in confidence was not surprising, with several factors feeding consumer worries.

"The deluge of the disturbing news around the violent gyrations in the Australian and overseas equity markets, poor economic data from China, disappointing result on Australia's growth rate, not the mention the weakness of the Australian dollar," he said.

"So all of those were going to drag down confidence."

http://www.abc.net.au/news/2015-09-09/sharp-consumer-confidence-downturn/6761448

Read from top...