Search

Recent comments

- 100.....

1 hour 49 min ago - epibatidine....

7 hours 40 min ago - cryptohubs...

8 hours 38 min ago - jackboots....

8 hours 46 min ago - horrid....

8 hours 54 min ago - nothing....

11 hours 17 min ago - daily tally....

12 hours 39 min ago - new tariffs....

14 hours 31 min ago - crummy....

1 day 8 hours ago - RC into A....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

banker's rules .....

Federal regulators approved a radical plan to stabilize Citigroup in an arrangement in which the government could soak up billions of dollars in losses at the struggling bank, the government announced late Sunday night.

The complex plan calls for the government to back about $306 billion in loans and securities and directly invest about $20 billion in the company. The plan, emerging after a harrowing week in the financial markets, is the government’s third effort in three months to contain the deepening economic crisis and may set the precedent for other multibillion-dollar financial rescues.

http://www.nytimes.com/2008/11/24/business/24citibank.html?hp

- By Gus Leonisky at 26 Nov 2008 - 9:56pm

- Gus Leonisky's blog

- Login or register to post comments

cash converters .....

In his press conference today, Obama says he wants Detroit automakers to come up with a "plan" before they can receive a bridge loan that will keep three million jobs from being lost as we teeter on the edge of a global depression.

I guess this is the plan for Citibank and AIG:

AIG, Citibank and a number of other federally bailed-out financial institutions have no plans to cancel hundreds of millions of dollars in sports team sponsorships, even as they take billions in taxpayer support, ABC News has found.

In boom times, the sponsorships were seen as a way to advertise the firms' "brands" and appeal to potential customers. Even today, at least one bank told ABC News that a naming deal was increasing its revenue. But critics, including a member of Congress, say the decision to continue them now is hard to defend.

http://www.alternet.org/blogs/peek/108429/

meanwhile …..

Talk about biting the hand that feeds you!

Last week, while Congress was engineering a bailout package of the taxpayers’ money to rescue Citibank and save the economy, Citibank was sending out notices to its cardholders of a new and usurious policy — a policy that could drown consumers and help sink the economy.

Usury is nothing new to bankers who issue credit cards. For example?

While banks, on average, were paying their customers 1.25% on interest checking and 2.40% on money market accounts, they were charging credit card holders an average of 11.27% overall to borrow the same money. That's according to this morning’s Bankrate.com. And that’s just the average

Those are the kinds of rates that used to get loan sharks from the Bonano family put away for 10 to 20 years in Sing Sing. But it’s worse than that.

http://thenewyorkcrank.blogspot.com/2008/11/citibank-thanks-america-for-filling-its.html

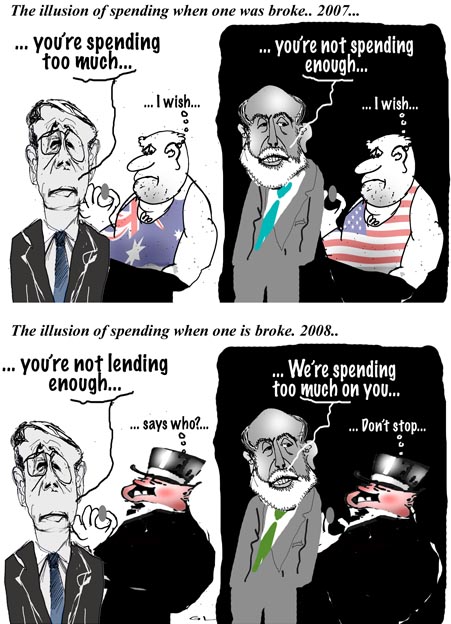

addicted to spend...

Rudd urges Australians to spend stimulus funds

Prime Minister Kevin Rudd has urged Australians to quickly spend money they receive as part of the Government's economic stimulus package.

From tomorrow, families, pensioners and some low income earners will start receiving payments as part of the Government's $10.4 billion package designed to keep the economy out of recession.

Mr Rudd says by spending the money quickly, everyone can help to avoid a rise in unemployment.

-------------------------------

How long is a coiled rope... and is there a noose at the end? At both ends? See toon at top...

hefty hand in the dwindling lolly jar...

What Red Ink? Wall Street Paid Hefty Bonuses

By BEN WHITEBy almost any measure, 2008 was a complete disaster for Wall Street — except, that is, when the bonuses arrived.

Despite crippling losses, multibillion-dollar bailouts and the passing of some of the most prominent names in the business, employees at financial companies in New York, the now-diminished world capital of capital, collected an estimated $18.4 billion in bonuses for the year.

That was the sixth-largest haul on record, according to a report released Wednesday by the New York State comptroller.

While the payouts paled next to the riches of recent years, Wall Street workers still took home about as much as they did in 2004, when the Dow Jones industrial average was flying above 10,000, on its way to a record high.

Some bankers took home millions last year even as their employers lost billions.

-------------------

see toon at top and read more at the NYT... Wall street song: You win we win... you loose we win...

eating in two troughs at once...

Lloyds, one of the banks bailed out by the government, has been accused in court by the Treasury this week of using a subsidiary to pour hundreds of millions into transatlantic tax avoidance schemes.

Huge loans to American financial institutions were disguised as commercial investments for tax purposes, it is alleged in a case against the bank being brought by HM Revenue & Customs, a department of the Treasury. As a result, the money from the deals was treated differently for tax purposes on each side of the Atlantic.

The revelation of the court action comes on the day that Lloyds TSB executives appear before the Treasury select committee to explain their role in the current banking crisis. Lloyds Banking Group is 43% owned by the government.

The sting of the HMRC case is that millions of pounds of income, received in the UK as distributions from US investments, was granted tax relief on the basis that US tax had already been paid.

But in the US, where the cash was treated as interest payments on a debt, it was also granted tax relief. This type of practice is known to tax experts as "double dipping".

read more at The Guardian and see toon at top.

The caricature is good. it