Search

Recent comments

- escalationing....

8 hours 29 min ago - not happy, john....

12 hours 49 min ago - corrupt....

18 hours 10 min ago - laughing....

20 hours 4 min ago - meanwhile....

21 hours 33 min ago - a long day....

23 hours 27 min ago - pressure....

1 day 15 min ago - peer pressure....

1 day 15 hours ago - strike back....

1 day 15 hours ago - israel paid....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

out to lunch .....

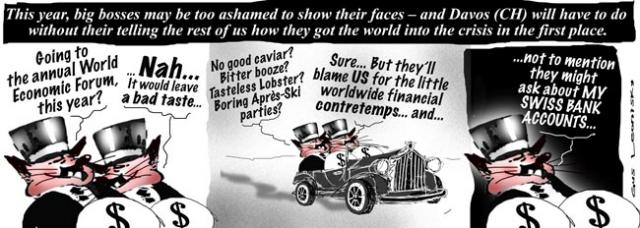

The annual World Economic Forum, kicks off today in the pleasant Swiss ski resort of Davos.

For the past three decades and more, the elite of the world's business financial and political elites – about 2,500 movers and shakers, plus another 5,000 hangers on and media – have gathered here to discuss the state of the world, do some deals and take in a little skiing.In the boom years, the evening parties became more lavish, the noise of mutual congratulation louder, and you could almost sniff the arrogance polluting the crisp, alpine air. The triumph of capitalism and its promise of never-ending prosperity was celebrated, often none too subtly, over canapés and champagne.

In the good times, none were more sure of themselves than the bankers. They came to Davos in ever-increasing numbers to see each other and to be seen. Not now.This year, it seems, they are too ashamed to show their faces – and Davos will have to do without their telling the rest of us how they got the world into the crisis in the first place. At the last moment, Bob Diamond, president of Barclays Capital, one of the highest earning bankers in the world, dropped out.

Economic summit: When Davos freezes over...http://www.independent.co.uk/news/business/news/economic-summit-when-davos-freezes-over-1517845.html

- By Gus Leonisky at 28 Jan 2009 - 7:35pm

- Gus Leonisky's blog

- Login or register to post comments

of clams and CEOs...

From the SMH

Don't meddle with our pay, bosses tell MPs

Jacob Saulwick March 2, 2009BUSINESS is warning against letting executive pay become the whipping boy of the economic crisis, and cautioning of the unintended consequences of knee-jerk "tabloid regulation".

The Federal Government is canvassing ideas for tightening loopholes used by business, and the Opposition is pushing for shareholders to be given greater power to determine executive pay.

Both have responded to anger at the $3 million payout for Telstra's Sol Trujillo and at Pacific Brands executives being given big pay rises before they retrenched 1850 workers.

One option the Government is considering is decreasing the maximum payment a company can make to a departing executive without asking shareholders for approval.

But the chief executive officer of the Australian Institute of Company Directors, John Colvin, warned that trying to limit executive pay could produce perverse effects. He said clever executives would find ways to sidestep the regulation, which could drive their rewards even higher.

"I liken it to squeezing a balloon," he said. "You clamp down on one end and all the air and the pressure comes out somewhere else."

-----------------------

Gus: "I liken it to squeezing a balloon," he said. "You clamp down on one end and all the air and the pressure comes out somewhere else." Sure... but wouldn't it be fun, just to squeeze the balloon anyway... and see a couple of distorted faces despite getting more pocket money... It would be therapeutic, would it not?.... And the balloon could blow up too, like in the adverts for that fizz that last the whole drink through... The whole financial system needs to blow up... and be rewritten with far less greed in its underpinning. Otherwise may as well say goodbye to the planet now.

Cash being given out to banks is not going to solve the bigger problems behind the present problem... How long can we fork out dough? Hey? Should a small business be run like the banks have been so far, the police and the creditors would have already closed the place down and the CEO would be in Majorca, the Balearic Islands, avoiding court cases and prison... Remember the Christopher Skases of this world? Well, he was an amateur... The professional swindlers multiplied but they thought that running piddly business was iffy so they went on to become CEOs of bank...

Better go and sit on the bags where the money is, hey?

In greater "moral' times, the CEOs of banks AND the presidents of countries — who helped the financial system to be rorted beyond the comprehension by mere mortals — would be in prison. But we live in the era of the spineless easy go lucky where the disastrous leadership is rewarded with hush money... Because the top pollies and the top CEOs are all with their snout in the same trough...

The figures do not compute:

60 trillion clams for the world GDP

120 trillion clams for the slosh fund

550 trillion clams of unregulated paper bets on the health of the 120 trillion clams

Considering that 50 per cent of the bets will go one way or the other on average, put simplistically without the financial jargon or subtleties, this means that 250 trillion clams HAS TO BE PAID FOR WITH 120 trillion and leave enough for the rest of us to live — and for the planet to survive?

No go... Something will have to give — massively... One can hope for "differential delays" on the payments... For example that the payments would spread over ten or more years... But in reality SOME ARE DUE NOW, some are due in a couple of years and most within four years... We're in deep shivers... So far the rescue mission of governments around the world tally up to something like 10 trillion clams... Will it be enough?...

see toon at top

A racket...

From Ross Gittins at the SMH

I'd be happy to defend high executive remuneration if I believed it was, as many executives claim, a product of market forces. In truth, it's more easily explained as an instance of market failure. It's just not possible to believe the ever-growing sums these executives are paid bear any relationship to the value of their contribution to their company's success.

There doesn't seem to be any correlation between executives' pay and their company's profits or share price. When the sharemarket soars and the economy booms their remuneration rockets. But when, as now, the market plummets, the economy turns down and company profits take a dive, we might see, at best, senior executives forgo an annual increase.

Executives will tell you all they're doing is keeping up with the going rate. Each year company boards employ independent remuneration consultants to advise them on the adequacy of their executives' pay.

This is a racket.

See comment above this one... and toon at top.

gone on holidays — pay the milkman...

Undisclosed Losses at Merrill Lynch Lead to a Trading Inquiry

By LOUISE STORY and ERIC DASHCHARLOTTE, N.C. — One Merrill Lynch trader apparently gambled away more than $120 million in the currency markets. Others seemingly lost hundreds of millions on tricky credit derivatives.

But somehow all this red ink did not spill into plain view until after Merrill earmarked billions for bonuses and staggered into the arms of Bank of America.

Inside Bank of America headquarters here, executives are asking why. The bank is investigating how Merrill accounted for wayward trades in the final, frantic months of 2008 — and why at least one big loss was slow to appear on Merrill’s books.

Of particular concern are the activities of a Merrill currency trader in London, Alexis Stenfors, whose trading has come under scrutiny by British regulators, according to people briefed on the investigation. The loss Mr. Stenfors is believed to have incurred so alarmed Bank of America that this week the bank examined the books of other traders who were on vacation.

------------------

see toon at top and visit back holes where the word derivative appears on this site...

joining the dots....

From the Washington Post — January

For 40 years there's been a consensus view at the Davos World Economic Forum that globalization's increasingly free cross-border flow of ideas, information, people, money, goods and services is both irreversible and a powerful force for prosperity. As with meetings of the G7 group of industrialized nations, there was broad agreement on the proper role for the state in the performance of markets. Sure, a French cabinet official and an American investment banker might spar over the relative merits of state paternalism and Anglo-Saxon labor laws, but the bargaining table was still reserved for champions of Western-style free market capitalism.

No more.

Davos has always had its critics. For those who believe globalization empowers the rich at the expense of the poor, the forum exists to allow the wealthy to pretend they're at a film festival. There are the Hugo Chavez/Mahmoud Ahmadinejad-type critics who insist that Davos represents post-modern imperialism with an alpine backdrop. There are the NGO critics who argue that the forum is more about partying than problem-solving. There are the conspiracy theorists who charge that Davos is simply the spot where Council on Foreign Relations commissars and their bosses at the Trilateral Commission make plans for the future and make time on the slopes.

But for the first time, some of the most powerful folks inside the Davos event are challenging the value of globalization. These aren't the have-nots of years past. These are the men and women driving some of the world's fastest-growing economies.

This massive change has its roots in 2009, when Davos served as the world's single most important multilateral gathering. The discussion was much franker and more open here than anything on display at the London and Pittsburgh meetings of the G20, the United Nations General Assembly or the climate change conference in Copenhagen. At Davos, leaders from the public and private sectors gathered for open discussion of the still-developing crisis, as a financial tsunami created a heightened sense of unity.

Now the sense of crisis is gone -- and so is the unity. Sure, there are still plenty of delegates warning of the lasting effects of the financial crisis and global slowdown, plenty of anxiety that jobs aren't coming back quickly enough and that the worst is yet to come on sovereign debt defaults. But other delegates have moved beyond fear of what has already happened to anticipation of what's to come. They're talking about a wave of populism and protectionism -- and the momentum behind the drive by some governments to use state-owned companies, privately owned national champion firms, natural resources and sovereign wealth funds to dominate markets for political advantage. This talk of a need for new barriers and of the virtues of state-managed capitalism suggests that Davos -- and the global economy -- have turned a corner, and that free market capitalism now has new competition. We survived the shipwreck, and now we're free to go our separate ways.

---------------------------

From Komisar

Pretty much everyone agrees that putting derivatives trades on a clearinghouse is a good idea and that it will reduce systemic financial risk. It isn’t a perfect cure: There are deals in the derivatives market—which includes everything from CDS to ordinary stock options and hog-belly futures—that are one of a kind and don’t fit into a clearinghouse system because there is no price history.

But much of the $600 trillion derivatives market can be cleared. And that will help the financial system because clearing establishes public prices and sets limits on the amount of debt financing that derivative traders can use. And, critically, members of a clearinghouse are responsible for one another’s losses. That means they are likely to set limits on one another, and in the event of a catastrophe, the odds of a public bailout are reduced.

“As the AIG situation has made clear, massive risks in derivatives markets have gone undetected…. Today, to address these concerns, the Obama administration proposes a comprehensive regulatory framework for all over-the-counter derivatives,” the Treasury Department said on May 13, 2009. It said that the Commodity Exchange Act and the securities laws should be amended to require clearing of all standardized over-the-counter derivatives through regulated central counterparties, or clearinghouses.

Nearly one year later, the administration is a long way from making sure that derivatives are traded through a clearinghouse whenever possible. And even if that requirement does become law, the big banks that created the derivatives crisis may well end up managing the process—and profiting from it too.

Story on portfolio.com

--------------

from the New Internationalist...

In September 1993 Mexicans were, it was said in high places, about to be liberated from their historic destiny: ‘So far from God, so close to the United States.’ The solution was simply to merge with the US and Canada in the North American Free Trade Agreement (NAFTA), leaving the rest to take care of itself. Ciudad Juárez, across the Rio Grande from El Paso, Texas, was on the front line of this radical advance, and I went there to take a look.

On the outskirts of the city giant metal boxes were laid out across the desert – maquila factories, their workers huddled around them in dusty shacks, making anything from car parts to potato crisps for transnational corporations. Duty- and tax-free, all the finished goods were dispatched ‘just-in-time’ across the Rio Grande to the US. This was what corporate globalization already meant for many Mexicans, and NAFTA promised to make it so for many more.

However, no maquila would let me in to sense what this meaning might be. One evening I was in a bar with a spirited collective of prostitutes who offered to help. The very next day I was inside a maquila that assembled TVs for Philips. All the workers were young women, mutely tending to the production line and, it seemed to me – when I was allowed to talk with some of them during a meal break – on the verge of illness, hunger and despair.

Today, Ciudad Juárez must surely be hell. Hundreds of young women have been raped, murdered, disappeared, their tortured bodies tossed from time to time on to garbage tips in the desert. No-one is ever convicted of a crime. Young men in their thousands die horribly in open warfare over drugs. The city is said to have informed what might otherwise read like a wildly dystopian fantasy, Roberto Bolaño’s novel 2666. I failed to figure it out at the time, but I have since learned to fear for the fate of those remarkable young women, who gathered together to celebrate or resist only as prostitutes.1

-----------------------

and Chavez... etc... See last year's toon at top.

Are the RC dominated nations waking up?

G'day Gus,

I do not pretend to have the knowledge to understand the machinations of the World Trade Organization but, I will give you my layman's opinion of the issue as I see it.

Our irresponsible capitalist media has, in my opinion, censored the world wide condemnation of the World Trade Organization's objectives.

We have been able to see enormous demonstrations in European countries against the very idea and we have had an American Marine give his life (and many others) to make the point that this is an oppressive method of citizen control. And he said he had been trained to ignore collateral damage!

So, again we are denied the truth. Do we, as citizens of Australia, really understand the intentions of the Big 8? Is it fair to say that the architects of such a plan are all extremely wealthy power bases in the richest countries in the world? Isn't that right?

I believe that with technology including robots, the employment of ordinary citizens will become too costly. To whom? This will mean a massive loss of jobs for even the most skilled of people? If I remember correctly, the French had an upsurge of youth objections when the government suggested (as I understand it) that age would be a deciding factor in whether or not they could obtain employment. Fair dinkum.

Using the KISS principle - IF the rich want to remain rich and even increase their riches - there has to be a massive drop in costs (employment?) along with an increase in trade? If the number of rich states decrease, by the "funnel" syndrome, it begins to reduce the number of survivors who will have to find another Planet to exploit.

Perhaps before my time (I hope) I have always believed that the only known political system, that can satisfy the problems between employer and employee, is Socialism.

The "Have and Have not’s" history of this world of ours is thankfully dying due to the emergence of education and appreciation of skill and its rewards. The ancient method of trade was magnificent?

That is my "take" on the WTO. It has the unrestricted support of all of the wealthy people of the wealthy nations of the world. Crazy and unbelievable is it not?

Where do we get our doctored information from? The obscene wealthy!

And when Hockey and his ilk claim that we are jealous of their wealth, they are right because every Australian citizen (even Murdoch) is entitled to some benefit due to our natural resources.

Whether I am right or not Gus - that's my take.

God Bless Australia and make us share in our natural resources. NE OUBLIE.

from the parallel universe .....

Barclays Bank has been forced to admit it paid just £113m in UK corporation tax in 2009 - a year when it rang up a record £11.6bn of profits.

The admission stunned politicians and tax campaigners. It was revealed on the eve of a day of protests planned against the high street banks by activists from UK Uncut, a group set up five months ago to oppose government cuts and corporate tax avoidance.

The Labour MP Chuka Umunna, who lobbied Barclays' chief executive, Bob Diamond, to reveal the tax paid by the bank, described the figure - just 1% of its 2009 profits - as "shocking".

The current rate of corporation tax in the UK is 28%, although global banks such as Barclays - which has hundreds of overseas subsidiaries, including many in tax havens - do not generate all of their profits in their domestic market.

Max Lawson, of the Robin Hood Tax Campaign, said: "This is proof that banks live in a parallel universe to the rest of us, paying billions in bonuses and unhampered by the inconvenience of paying tax.

Barclays Bank

the great reset….

How about the “Great Reset?”

All of those bumper sticker political narratives were popularized by the World Economic Forum.

Have you read about the ESG (Environmental, Social, and Governance) movement?

That’s also a WEF favorite.

Davos 2022 includes the usual components of WEF’s “you’ll own nothing and you’ll be happy” totalitarian eco statist agenda. Topics discussed and panels at the 2022 meeting will include:

Experience the future of cooperation: The Global Collaboration Village

Staying on Course for Nature Action

Future-proofing Health Systems [GusNote see: a dystopian disease….]

Accelerating the Reskilling Revolution (for the “green transition”)

The ‘Net’ in Net Zero

The Future of Globalization

Unlocking Carbon Markets

And of course, a Special Address by Volodymyr Zelenskyy, President of Ukraine

The American contingent will include 25 politicians and Biden Administration officials. US Secretary of Commerce Gina Raimondo will join Climate Czar John Kerry as the White House representatives there. They will be joined by 12 democrat and 10 republican politicians, including 7 senators and two state governors

Without further delay, I’ve provided the entire list of attendees who are showing up to Davos next week. I’ll list the Americans below and the rest are linked below that in an attached document.

Gina Raimondo Secretary of Commerce of USA USA

John F. Kerry Special Presidential Envoy for Climate of the United States of America

Bill Keating Congressman from Massachusetts (D)

Daniel Meuser Congressman from Pennsylvania (R)

Madeleine Dean Congresswoman from Pennsylvania (D

Ted Lieu Congressman from California (D)

Ann Wagner Congresswoman from Missouri (R)

Christopher A. Coons Senator from Delaware (D)

Darrell Issa Congressman from California (R)

Dean Phillips Congressman from Minnesota (D)

Debra Fischer Senator from Nebraska (R)

Eric Holcomb Governor of Indiana (R)

Gregory W. Meeks Congressman from New York (D)

John W. Hickenlooper Senator from Colorado (D)

Larry Hogan Governor of Maryland (R)

Michael McCaul Congressman from Texas (R)

Pat Toomey Senator from Pennsylvania (R)

Patrick J. Leahy Senator from Vermont (D)

Robert Menendez Senator from New Jersey (D)

Roger F. Wicker Senator from Mississippi (R)

Seth Moulton Congressman from Massachusetts (D)

Sheldon Whitehouse Senator from Rhode Island (D)

Ted Deutch Congressman from Florida (D)

Francis Suarez Mayor of Miami (R)

Al Gore Vice-President of the United States (1993-2001) (D)

Full list of confirmed attendees of 2022 World Economic Forum Annual Meeting

Here’s the PDF File in case the link goes down.

READ MORE:

http://ronpaulinstitute.org/archives/featured-articles/2022/may/20/the-globalists-here-is-the-full-roster-of-davos-2022-attendees/

READ FROM TOP.

FREE JULIAN ASSANGE NOW √√√√√√√√√√√√√√√√√√√√√√√√√√