Search

Democracy Links

Member's Off-site Blogs

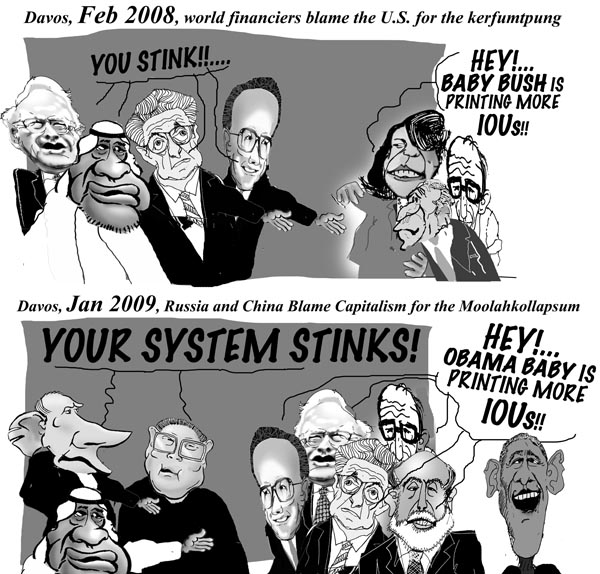

tin men .....

January 24, 2008

From the New York TimesU.S. Policies Evoke Scorn at Davos

By MARK LANDLERDAVOS, Switzerland — Over the years, the United States has fulfilled many roles at the World Economic Forum: dot-com dynamo, benevolent superpower, feared aggressor. Now add wounded giant.

On the first day of the annual conference here, a parade of bankers, economists and government officials expressed deep fears about the faltering American economy — and blunt criticism, particularly of the Federal Reserve, which some blame for sowing the seeds of today’s crisis.For George Soros, the financier who made a fortune betting against the British pound, the slump now goes beyond subprime loans. It signals a reordering of the postwar economy and the end of dollar dominance.

“The current crisis is not only the bust that follows the housing boom,” Mr. Soros declared. “It’s basically the end of a 60-year period of continuing credit expansion based on the dollar as the reserve currency.”

Suggestions of a new economic order abounded here: India’s commerce and industry minister, Kamal Nath, said that China had overtaken the United States as his country’s largest trading partner, buttressing his view that India could come through an American recession unscathed.The head of the National Bank of Kuwait, Ibrahim S. Dabdoub, said Americans who opposed sovereign wealth funds, like the one run by the Kuwaiti government, need to come to terms with the new reality.

And an American economist, Nouriel Roubini, said bluntly, “The United States looks like an emerging market,” with large deficits and a weak currency....------------

January 29, 2009

From the New York TimesRussia and China Blame Capitalists

By CARTER DOUGHERTY and KATRIN BENNHOLDDAVOS, Switzerland — The leaders of the former bastions of the Communist bloc took the stage here on Wednesday to rebuke their capitalist brothers for dragging the world into crisis but also to assure them that, working together, they can rapidly restore the global economy to health.

In the official opening address of the World Economic Forum, Prime Minister Vladimir V. Putin of Russia spoke of a financial “perfect storm” that has decimated the old system, rendering it obsolete.“A year ago, American delegates speaking from this rostrum emphasized the U.S. economy’s fundamental stability and its cloudless prospects,” he said, speaking through a translator. “Today, investment banks, the pride of Wall Street, have virtually ceased to exist.”

But the damage goes beyond Wall Street, he said. “The entire economic growth system, where one regional center prints money without respite and consumes material wealth, while another regional center manufactures inexpensive goods and saves money printed by other governments, has suffered a major setback.”The Chinese premier, Wen Jiabao, left little doubt that Beijing blamed the United States for the economic breakdown. “Inappropriate macroeconomic policies,” an “unsustainable model of development characterized by prolonged low savings and high consumption,” the “blind pursuit of profit” and “the failure of financial supervision” all contributed, he said.

------------------

Gus: Read more at The New York Times and remember the more things change the more they stay the same... See toon above.... Please study Sovereign Wealth Funds...

- By Gus Leonisky at 31 Jan 2009 - 10:29pm

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

14 min 27 sec ago

2 hours 3 min ago

6 hours 14 min ago

7 hours 31 min ago

7 hours 37 min ago

18 hours 23 min ago

21 hours 20 min ago

23 hours 12 min ago

23 hours 33 min ago

1 day 2 hours ago