Search

Recent comments

- dystopian....

12 min 21 sec ago - losses....

1 hour 2 min ago - board of war....

2 hours 24 min ago - help...

4 hours 6 min ago - APOLOGY....

4 hours 44 min ago - humanoids....

6 hours 45 min ago - refugees....

8 hours 45 min ago - tonight....

8 hours 55 min ago - 10 days?....

9 hours 5 min ago - MI6 parrot.....

9 hours 58 min ago

Democracy Links

Member's Off-site Blogs

from the front of the bus .....

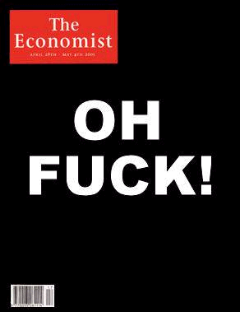

In a sign of the panic gripping Washington's policy-makers, one of Barack Obama's key economic advisors, Paul Volcker, has warned a gathering of his leading peers that the crash of 2008 might be "the mother of all financial crises... I don't remember any time, maybe even the Great Depression, when things went down quite so fast, quite so uniformly around the world".

Volcker, chairman of the president's Economic Recovery Advisory Board and former chair of the Federal Reserve, told a conference at Columbia University's Centre for Capitalism and Society on 20 February that the crisis was "characterised by being very international" and was the product of deep global imbalances.But it is not only for their candour about the scale of the crisis that Volcker's Columbia comments are notable. The former Fed chief admitted to his star-studded audience (including celebrity economist Jeffrey Sachs, George Soros and three Nobel Prize winners) that the profession of which they were all a part had failed. The breakdown of the world financial system has "occurred in the face of almost all policy and intellectual analysis... Even the experts don't know what's going on".

Obama's chief advisor on economic recovery went on to concede that he himself had no answers, saying: "The first priority is to restore some semblance of stability and order in the market and restore the flow of credit. I'm not going to talk about that. I haven't got—if I had the answer I might talk about it, but I'm not sure I have it, so I think we'll neglect that for the moment."- By John Richardson at 14 Mar 2009 - 5:39am

- John Richardson's blog

- Login or register to post comments

the 3 amigos .....

If you start with Wal-Mart and its multi-billion dollar progeny, it's one big giant sucking hole of jobs to China. Sure, if Americans who are underpaid or on unemployment get to spend more because of the "stimulus" package, many of them will spend their money at Wal-Mart.

And who benefits most from increased spending at Wal-Mart: the untold wretchedly low-paid workers at Wal-Mart Chinese manufacturing plants. Indeed, Wal-Mart is the largest American company doing business in China.It's become so cozy with the autocratic Chinese government that there are Wal-Marts in China. But at least in China, the consumers are buying goods manufactured in their own country, thus really creating jobs for Chinese workers.

So economically stressed Americans who have seen their incomes redistributed to the wealthiest in the U.S. and the Chinese who shop at Wal-Mart are both accomplishing one goal: creating more employment for the Chinese.As for Wall Street, while the "Masters of the Universe" gambled hundreds of billions on exotic financial games -- such as derivatives and default swaps -- and then lost their bets, they left the American economy on the brink of a total meltdown.

That is, until the Bush Administration came in and bailed them out -- bonuses, limos, hooker accounts and all - with Wall Street welfare that may reach two trillion dollars.And where do the loans come from to cover the massive gambling debt of Wall Street? Well, a large percentage of them come from - you guessed it - China. China will be covering a lot of the recovery package too.

Of course, they can afford to because of all those products that they are manufacturing for Wal-Mart and other American and Western companies.However, the loan line may get cut soon, since the Chinese governnment has expressed concern in the last couple of days about the financial stability of the U.S. government.

http://buzzflash.com/articles/editorblog/200