Search

Recent comments

- hoped....

1 hour 28 min ago - murdering kids....

2 hours 29 min ago - saving....

2 hours 57 min ago - a speech never made....

16 hours 28 min ago - wardonald...

18 hours 1 min ago - MAGA fools

1 day 3 hours ago - the ugliest excuse to go to war.....

1 day 13 hours ago - morons....

1 day 15 hours ago - idiots...

1 day 15 hours ago - no reason....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

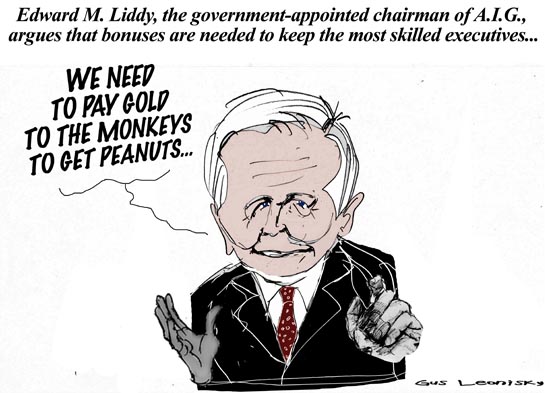

from the monkey house .....

“There are a lot of terrible things that have happened in the last 18 months, but what’s happened at A.I.G. is the most outrageous,” said Lawrence H. Summers, President Obama’s chief economic adviser, during an appearance Sunday on ABC’s “This Week With George Stephanopoulos.” “What that company did, the way it was not regulated, the way no one was watching, what’s proved necessary - is outrageous.”

The bonus plan established for the financial products unit before the federal government stepped in called for $220 million in retention pay for 400 employees for 2008. About $55 million of that was paid in December and the remaining $165 million was paid on Friday.

The retention plan also calls for another $230 million in bonuses for 2009 that are due to be paid by March 2010. Combined with the 2008 bonuses, that would bring the total retention pay for financial products executives to $450 million.But in response to pressure from Treasury Secretary Timothy F. Geithner, A.I.G. agreed to reduce its 2009 bonuses for the financial products unit by 30 percent.

http://www.nytimes.com/2009/03/16/business/16aig.html?_r=1&hp=&pagewanted=print

- By Gus Leonisky at 16 Mar 2009 - 10:26pm

- Gus Leonisky's blog

- Login or register to post comments

a sick joke .....

This sordid story of government helplessness in the face of massive taxpayer commitments illustrates better than anything to date why the government should take over any institution that's "too big to fail" and which has cost taxpayers dearly.

Such institutions are no longer within the capitalist system because they are no longer accountable to the market. To whom should they be accountable? As long as taxpayers effectively own a large portion of them, they should be accountable to the government.But if our very own Secretary of the Treasury doesn't even learn of the bonuses until months after AIG has decided to pay them, and cannot make stick his decision that they should not be paid, AIG is not even accountable to the government.

That means AIG's executives - using $170 billion of our money, so far - are accountable to no one.http://www.alternet.org/workplace/131721/aig_bonuses_scandal%3A_ceos_take_our_billions_and_are_accountable_to_no_one/

the peter principle writ large .....

When Barack Obama announced his champion to rescue the world from economic ruin, it was the first time most Americans had ever heard the name Tim Geithner.

The initial impression was good. The stockmarket surged and the pundits swooned. "Exactly a decade ago, he was Uncle Sam's golden-boy emissary sent into the stormy centre of what was then the world's worst financial crisis [the Asian crisis]," reported The New York Post.If anyone in the US media had thought to ask a former Australian prime minister for his assessment, they would have heard a different view. And they would not have been so surprised at Geithner's performance since.

In a speech to a closed gathering at the Lowy Institute in Sydney on Thursday, Paul Keating gave a starkly different account of Geithner's record in handling the Asian crisis: "Tim Geithner was the Treasury line officer who wrote the IMF [International Monetary Fund] program for Indonesia in 1997-98, which was to apply current account solutions to a capital account crisis."

In other words, Geithner fundamentally misdiagnosed the problem. And his misdiagnosis led to a dreadfully wrong prescription.

Exactly who was the "gigantic fool"? It was, obviously, the man who wrote the program, Geithner, although Keating is prepared to put the then managing director of the IMF, the Frenchman Michel Camdessus, in the same category.Worse, Keating argued, Geithner's misjudgment had done terminal damage to the credibility of the IMF, with seismic geoeconomic consequences: "The IMF is the gun that can't shoot straight. They've been making a mess of things for the last 20-odd years, and the greatest mess they made was in east Asia in 1997-98, so much so that no east Asian state will put its head in the IMF noose."

http://www.smh.com.au/opinion/obamas-economic-saviour-savaged-as-keating-lets-rip-20090306-8rk7.html?page=-1legal tortuous bypass...

The president said that he has instructed Timothy F. Geithner to “pursue every single legal avenue” to block bonuses to the ailing insurer’s executives.

------------

More lawyers, more expenses...

Just sack everyone and sundry who take the "bonuses", but make sure these "entitlements" (bonuses) are geared to their collective failure — thus a massive minus-bonus and a life-long of living under bridges. Make them consider that their massive failure can be considered as fraud, or massive incompetence at best, collectively AND individually — brand them like cattle, on their butt, or better still on their forehead.

Sure, there are "mitigating" factors including the deregulation of financial markets. New emergency retrospective laws can by-pass that crap. And the former president should be put in the docks for lying to go to war and for letting the market get away with the murder of itself.

In Australia, directors (even honorary directors) whose company is bankrupt (owe moneys) have to pay for the damage, and most of these people are more careful with the way the business is run (although management "alla american cowboy" has corrupted some businesses). Executives with non-directorship can be indicted too.

see toon at top...

ps: Fraud? I hear you say... Well one has to consider that a "special fund was set up" separate from the general company revenue to pay the "bonuses"... There is only a small step to take, to prove that the executive body knew that business was going fast down the gurgler (sinkhole) and this was a way to 'embezzle funds' before the full state of the accounts were made public... because as everyone knows, the health of a company's finances is known well in advance by the "insiders". This is why "insider trading" is banned from the market...

It could be said that the bonus fund was actually a clever form of an "insider trading scheme"... Fraud.

the sanctity of contracts?...

The Case for Paying Out Bonuses at A.I.G.

By ANDREW ROSS SORKINDo we really have to foot the bill for those bonuses at the American International Group?

It sure does sting. A staggering $165 million — for employees of a company that nearly took down the financial system. And heck, we, the taxpayers, own nearly 80 percent of A.I.G.

It doesn’t seem fair.

So here is a sobering thought: Maybe we have to swallow hard and pay up, partly for our own good. I can hear the howls already, so let me explain.

Everyone from President Obama down seems outraged by this. The president suggested on Monday that we just tear up those bonus contracts. He told the Treasury secretary, Timothy F. Geithner, to use every legal means to recoup taxpayers’ money. Hard to argue there.

“This isn’t just a matter of dollars and cents,” he said. “It’s about our fundamental values.”

On that last issue, lawyers, Wall Street types and compensation consultants agree with the president. But from their point of view, the “fundamental value” in question here is the sanctity of contracts.

That may strike many people as a bit of convenient legalese, but maybe there is something to it. If you think this economy is a mess now, imagine what it would look like if the business community started to worry that the government would start abrogating contracts left and right.

---------------

Gus: excuse me. But should the firm had gone down the pits, would these bonuses still be paid out — of red ink? Was this money, set aside for the bonuses, before or after the execs knew the firm already owed moneys it could not pay?... Even so, had the firm been closed down, a lot of other contracts than those of the bonuses would have not been worth the paper they're printed on... So tough titties and remember what I wrote above:

---------------

ps: Fraud? I hear you say... Well one has to consider that a "special fund was set up" separate from the general company revenue to pay the "bonuses"?... There is only a small step to take, to prove that the executive body knew that business was going fast down the gurgler (sinkhole) and this was a way to 'embezzle funds' before the full state of the accounts were made public... because as everyone knows, the health of a company's finances is known well in advance by the "insiders". This is why "insider trading" is banned from the market...

It could be said that the bonus fund was actually a clever form of an "insider trading scheme"... Fraud.

-------------

The sanctity of contracts? "oh god!" the writer brings in morality, in a soup of mismanagement, in which other contracts are worth peanuts?... Fraudulent outcome, most possibly...

too opaque and half of it back...

The boss of US insurer AIG has called the bonuses paid to executives "distasteful" and said he asked some recipients to return at least half.

But Edward Liddy said the Federal Reserve knew in November of the $165m (£119m) bonus payments to executives that have caused such a furore in US.

"Mistakes were made at AIG on a scale that few could have imagined possible," he told a Congressional hearing.

He also admitted that AIG is "too complex, too unwieldy and too opaque".

Mr Liddy said that he had asked AIG executives receiving a bonus of more than $100,000 to pay at least half of it back.

anonymus bonus returnum

Attorney General Andrew M. Cuomo of New York announced late Monday afternoon that 9 of the top 10 bonus recipients at the American International Group were giving back their bonuses.

He also said 15 of the largest 20 bonus recipients in A.I.G.’s financial products division had agreed to give back the money, for a total that he estimated at about $30 million. “Those bonuses will be returned in full,” Mr. Cuomo said during a conference call with reporters.

The attorney general noted that about 47 percent of $165 million in retention bonuses was awarded to Americans, accounting for nearly $80 million. All told, Mr. Cuomo said, A.I.G. employees have agreed to return about $50 million in bonuses.

Mr. Cuomo acknowledged that some bonus recipients declined to give back bonuses, especially those overseas who are outside the jurisdiction of New York State.

He said he did not think it would be in the public interest to release the names of those who gave back their bonuses.

--------------------

Most business people are decent... Yet the competition in being top dog can make some of them forget the intricacy of the knowledge, the secret relationships, the desire and the luck that have given them extraordinary powers over us, the mere mortals. For these demigods to return their extra cash to "us" (the government of the toilers at the boilers), may show a great sacrifice in downgrade of secret status, but they would know where the money came from: mostly our slaving pockets — in the future. Had they been left to their own device in the sinking ship, there could have been blood on the floor or some spectacular drownings.

See toon at the top... We salute the anonymous who gave to Cesar what belonged to Cesar who saved their sinking ship...