Search

Recent comments

- hoped....

1 hour 26 min ago - murdering kids....

2 hours 26 min ago - saving....

2 hours 55 min ago - a speech never made....

16 hours 26 min ago - wardonald...

17 hours 58 min ago - MAGA fools

1 day 3 hours ago - the ugliest excuse to go to war.....

1 day 13 hours ago - morons....

1 day 15 hours ago - idiots...

1 day 15 hours ago - no reason....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

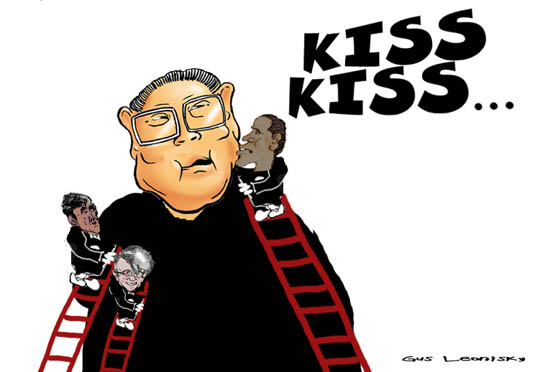

the long kiss goodnight .....

The Chinese premier, Wen Jiabao, expressed concern about his country's $US1 trillion ($1.5 trillion) holdings of US government bonds.

"We've lent a huge amount of capital to the US, and of course we're concerned about the security of our assets. And to speak truthfully, I am a little bit worried."That was all it took.

It marked a threshold moment in relations between the current superpower and the potential one - Beijing demonstrated that it is prepared to use its financial power over the US as an instrument of pressure.- By Gus Leonisky at 17 Mar 2009 - 8:19pm

- Gus Leonisky's blog

- Login or register to post comments

china on the mend...

China's economy is showing some signs of recovery from the global financial crisis, the country's Prime Minister Wen Jiabao has said.

The economy is showing "positive changes" but still faces "very big difficulties", he said on the sidelines of Thailand's cancelled Asean summit.

China has already implemented a 4tn yuan ($585bn;£399bn) stimulus package to boost economic activity.

Mr Wen also said he would spend more if necessary to boost the economy.

Despite its problems, China's economy - the third biggest in the world - is forecast to grow by at least 5% this year, in stark contrast to many major global economies that are shrinking.

meanwhile:

China has unveiled plans to establish a $10bn (£6.8bn) investment fund for south-east Asian countries.

It has also offered credit of $15bn to the Association of South-East Asian Nations, or Asean.

Chinese Prime Minister Wen Jiabao had planned to announce the fund at the cancelled Asean summit this weekend.

Asean was set up in 1967 in part to counter influence from communist China but has since become a vehicle for close ties.

The collapse of the Asean summit, scheduled in Pattaya, Thailand, this weekend, delayed the conclusion of a key investment agreement between China and the economic bloc.

That deal is intended to create the world's largest free trade area, covering nearly two-billion people.

China funds

China's Foreign Minister, Yang Jiechi, announced the new funding plans in Beijing to a gathering of envoys from the 10 members of Asean - Indonesia, Singapore, Malaysia, Thailand, the Philippines, Brunei, Burma, Laos, Cambodia and Vietnam.

The $10bn investment fund was designed for cooperation on infrastructure construction, energy and resources, information and communications, China's state news agency Xinhua quoted Mr Yang as saying.

Over the next three to five years, China planned to offer $15bn in credit, including loans with preferential terms of $1.7bn in aid for cooperation projects.

-------------------

meanwhile:

HONG KONG — Reversing its role as the world’s fastest-growing buyer of United States Treasuries and other foreign bonds, the Chinese government actually sold bonds heavily in January and February before resuming purchases in March, according to data released during the weekend by China’s central bank.

China’s foreign reserves grew in the first quarter of this year at the slowest pace in nearly eight years, edging up $7.7 billion, compared with a record increase of $153.9 billion in the same quarter last year.

China has lent vast sums to the United States — roughly two-thirds of the central bank’s $1.95 trillion in foreign reserves are believed to be in American securities. But the Chinese government now finances a dwindling percentage of new American mortgages and government borrowing.

In the last two months, Premier Wen Jiabao and other Chinese officials have expressed growing nervousness about their country’s huge exposure to America’s financial well-being.

Chinese reserves fell a record $32.6 billion in January and $1.4 billion more in February before rising $41.7 billion in March, according to figures released by the People’s Bank over the weekend. A resumption of growth in China’s reserves in March suggests, however, that confidence in that country may be reviving, and capital flight could be slowing.

The main effect of slower bond purchases may be a weakening of Beijing’s influence in Washington as the Treasury becomes less reliant on purchases by the Chinese central bank.

Asked about the balance of financial power between China and the United States, one of the Chinese government’s top monetary economists, Yu Yongding, replied that “I think it’s mainly in favor of the United States.”

----------------

meanwhile:

China's central bank yesterday reaffirmed its commitment to ensuring sufficient liquidity to sustain economic growth, dousing speculation that it may tighten the availability of credit after new loans soared to record highs in March.

The statement from People's Bank of China came as the country's prime minister, Wen Jiabao, said the Chinese economy is showing signs of recovery from the global financial crisis.

The Chinese central bank said it will "implement moderately loose monetary policy and maintain the continuity and stability of policy". It also said it would provide "ample liquidity" to "ensure money supply and loan growth meet economic development needs," on its website yesterday.

The US and UK governments are likely to welcome such measures, if they stimulate appetite for foreign imports into China and help to rebalance the Chinese economy towards domestic demand away from export-led growth. While China's economic output has slowed from the stratospheric growth of 13 cent in 2007, its economy remains a vital engine room of global growth.

-------------

see toon at top...

Paradigm shift ...

old readings...