Search

Recent comments

- journalism....

8 hours 47 min ago - day three.....

9 hours 31 min ago - lawful law?....

9 hours 50 min ago - insurance....

9 hours 58 min ago - terrorists....

10 hours 8 min ago - nukes?...

12 hours 16 min ago - rape....

12 hours 55 min ago - devastation.....

15 hours 7 min ago - bibi's dream....

16 hours 56 min ago - thus war....

21 hours 7 min ago

Democracy Links

Member's Off-site Blogs

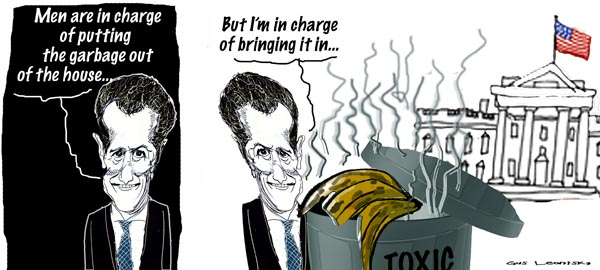

the trillion dollar dustman .....

Treasury Secretary Tim Geithner, who finished testimony before the Senate Budget committee moments ago, reaffirmed that the cost of cleaning up all the toxic assets clogging the balance sheets of sick financial institutions will be at least $1 trillion.

It is a number Geithner first floated in February and will be made up of some mix of government and private funds.Sen. Judd Gregg (R-N.H.) pressed Geithner as to whether the government - meaning, taxpayers - will guarantee the profits of private investors to lure them into buying toxic assets, but Geithner could not provide a solid answer.

"That depends on the precise structure" of the partnership, Geithner said, but added that "we want to limit the downside exposure of government."Geithner: Author Smick Is Wrong on Cost of Toxic Assets

Geithner disputed the pricing of toxic assets put forth in a Washington Post opinion piece from earlier this week headlined "Tim Geithner's Black Hole" written by financial author David Smick.http://www.washingtonpost.com/wp-dyn/content/article/2009/03/09/AR2009030902232_pf.html

-----------------------------

On November 24, 2008, President-elect Barack Obama announced his intention to nominate Geithner to be Treasury Secretary.[22][23] The Secretary of the Treasury earns $191,300 per year.

Tax problems

At the Senate confirmation hearings, it was revealed that Geithner had not paid $35,000 in self-employment taxes for several years,[24] even though he had acknowledged his obligation to do so, and had filed a request for, and received, a payment for half the taxes owed.The failure to pay self-employment taxes was noted during a 2006 audit by the Internal Revenue Service (IRS), in which Geithner was assessed additional taxes of $14,847 for the 2003 and 2004 tax years. Geithner also failed to pay the self-employment taxes for the 2001 and 2002 tax years until after Obama expressed his intent to nominate Geithner to be Secretary of Treasury.[25] He also deducted the cost of his children's sleep-away camp as a dependent care expense, when only expenses for day care are eligible for the deduction.[26] Geithner subsequently paid the IRS the additional taxes owed,[27] and was charged $15,000 interest, but was not fined for late payment.[28]

As President of the Federal Reserve Bank of New York, Geithner annually completed an ethics statement noting any taxes due or unpaid, along with any other obligations. Geithner's completed statement did not surface during confirmation hearings.In a statement to the Senate panel considering his nomination, Geithner called the tax issues "careless," "avoidable" and "unintentional" errors, and he said he wanted to "apologize to the committee for putting you in the position of having to spend so much time on these issues."[27] Geithner testified that he used TurboTax to prepare his own return and that the tax errors are his own responsibility.[29]

This statement is in conflict with statements by the Obama campaign that Geithner was advised by his accountant that he did not owe the taxes.[30] The Washington Post quoted a tax expert who said that TurboTax has not been programmed to handle self-employment taxes when the user identifies himself as being employed.[31]Geithner said at the hearing that he was always under the impression that he was an employee, not a self-employed contractor,[31] while he served as director of the Policy Development and Review Department of the IMF.[7] Geithner comments are contradicted by the Senate report that showed he was not only informed of his status, but that he actively applied for the allowance.[32]

Confirmation

Geithner is sworn in as Treasury Secretary

On January 26, 2009, the U.S. Senate confirmed Geithner's appointment by a vote of 60–34.[33][34] Geithner was sworn in as Treasury Secretary by Vice President Joseph Biden and witnessed by President Barack Obama.[35]Bank bailout

Geithner has the authority to decide what to do with the second tranche of $350 billion from the $700 billion banking bailout bill passed by Congress in October 2008. He does not need Congressional approval, but went to Congress on February 10-11 to explain his plans.He proposes to create one or more "bad banks" to buy and hold toxic assets, using a mix of taxpayer and private money. He also proposes to expand a lending program that would spend as much as $1 trillion to cover the decline in the issuance of securities backed by consumer loans. He further proposes to give banks new infusions of capital with which to lend.

In exchange, banks would have to cut the salaries and perks of their executives and sharply limit dividends and corporate acquisitions. Criticism has centred on what some see as the vagueness of his plans.- By Gus Leonisky at 20 Mar 2009 - 11:32pm

- Gus Leonisky's blog

- Login or register to post comments

"protection money"...

By MARY WILLIAMS WALSH and SEWELL CHAN

WASHINGTON — In heated questioning that at times took on the air of a cross-examination, Treasury Secretary Timothy F. Geithner on Wednesday defended his role and the government’s actions in bailing out the American International Group, saying Washington did what was necessary to prevent “a second Great Depression.”

But Mr. Geithner, who led the New York Federal Reserve Bank at the time, said he was not involved in the decision not to release information about deals that sent billions of taxpayer dollars from the bailout of A.I.G., the insurance giant, to big banks.

“I withdrew from monetary policy decisions,” Mr. Geithner said, “and day-to-day management of the New York Fed.”

The committee called Mr. Geithner, former Treasury Secretary Henry M. Paulson Jr. and other officials to explain, once again, the confounding results of an $85 billion rescue loan made to A.I.G. in September 2008. The loan sheltered big banks from any losses, but saddled A.I.G. with a debt so crushing that the Treasury soon had to step in and provide even more rescue money.

The questions aimed at Mr. Geithner focused almost immediately on his role in the A.I.G. bailout and why those negotiating on behalf of the taxpayers did not push the banks to make concessions, like returning the collateral to A.I.G. or accepting less than full value for their contracts with the insurer.

Throughout the morning, Mr. Geithner tried to persuade lawmakers that the government acted “in the best interests of the American people,” and not in the interests of big banks, in particular, as many lawmakers asserted, Goldman Sachs. Mr. Geithner, while keeping his composure throughout the questions, was forceful in his defense.

“I think the commitment to Goldman Sachs trumped the responsibility that our officials had to the American people,” Representative Stephen F. Lynch, Democrat of Massachusetts, told Mr. Geithner. His voice rising, his finger pointed at Mr. Geithner, Mr. Lynch expressed his frustration at the financial bailouts, and the bonuses now being paid by banks. “It stinks to the high heavens what happened here,” Mr. Lynch said. “I don’t like the obfuscation. And to top it all off, the disclosure was not there.”

See toon at top...