Search

Recent comments

- crummy....

11 hours 31 min ago - RC into A....

13 hours 24 min ago - destabilising....

14 hours 27 min ago - lowe blow....

14 hours 59 min ago - names....

15 hours 36 min ago - sad sy....

16 hours 2 min ago - terrible pollies....

16 hours 12 min ago - illegal....

17 hours 23 min ago - sinister....

19 hours 45 min ago - war council.....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

ruled by fools .....

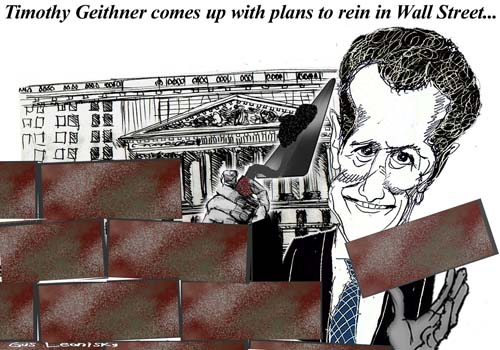

US Treasury Secretary Timothy Geithner has outlined far-reaching plans to strengthen government authority over the US financial system.

The measures are designed to prevent the kind of systemic risk-taking among banks that has contributed to the current financial crisis.Mr Geithner told a US House Committee that a simpler, more effective regulatory system was needed.

He said the government had not had "adequate tools" to handle the crisis.- By Gus Leonisky at 27 Mar 2009 - 9:35pm

- Gus Leonisky's blog

- Login or register to post comments

when bricks should be shoes .....

This 12 minute video is eminently watchable by anyone who understands the simplest balance sheet structure. The person doing this explains ever so well who the bagholders are likely to be under Geithner's latest plan to buy the toxic assets from the banks.

It's either horrendous bailouts like these or else more sensible and just bankruptcy-like procedures. Paulson and Geithner and other Wall Street insiders continue to rape the American public with plans to transfer HUGE wealth to the banks who made the bad loans. These guys need to be stripped and made to walk down Wall Street naked in front of the press corps.And if Congress approves, the American public should barricade Capitol Hill.

http://www.youtube.com/watch?v=n-arbfLTCtIloopholes in the brickwork...

From the NYT

Questions for Reform

Treasury Secretary Timothy Geithner sounded the right notes last week when he presented a first draft of the administration’s plan to reform the financial system. He said the system had failed “in fundamental ways” and would require comprehensive overhaul. “Not modest repairs at the margin,” he told Congress, “but new rules of the game.”

It is too early to say whether a fleshed-out proposal — and what Congress eventually passes — will amount to a game changer. Some of Mr. Geithner’s proposals do appear aimed at limiting dangers that have lurked for too long in dark corners of the markets. Others may simply preserve Wall Street’s prerogative to party on once the current storm has passed.

For instance, Mr. Geithner called for all large hedge funds and private equity firms to register with the Securities and Exchange Commission, a move that could bring much-needed disclosure and oversight to vast pools of capital that fed the bubble economy. But the S.E.C. would not have the full authority to resolve all concerns. Rather, it would report its findings up what could turn out to be a convoluted chain of regulatory command.

Similarly, Mr. Geithner called for oversight of unregulated derivatives, like the credit default swaps at the heart of the debacle at American International Group. But he made a troubling distinction between “standardized” derivatives and “non-standardized” ones, and proposed different regulation for each. That looks like a loophole disguised as a new rule.loss-ridden assets at discounts...

From the Washington Post

Geithner's Hedge Fund

By Robert J. Samuelson

Monday, March 30, 2009; A17

Call it Uncle Sam's hedge fund. The rescue of the American financial system proposed by Treasury Secretary Timothy Geithner is, in all but name, a gigantic hedge fund. The government would lend vast sums to private investors to enable them to buy loss-ridden assets at discounts from banks with the prospect of making sizable profits. If that's not a hedge fund, what would be? The hope is that the $14 trillion U.S. banking system would expand lending if it could get rid of many of the lousy securities and loans already on its books.

Almost everyone thinks that a healthier banking system is necessary for a sustained economic recovery. Can the Geithner plan work? Maybe, though obstacles abound. One is political. Private investors may balk at participating because they fear populist wrath. If the plan succeeds, many wealthy people will become even wealthier. Congress could subject them (or their firms) to humiliating hearings or punitive taxes. Why bother? Another problem: Investors and banks may be unable to agree on prices at which assets would be bought.

But succeed or fail, Geithner's plan illuminates a fascinating irony. "Leverage" -- borrowing -- helped create this mess. Now it's expected to get us out. How can this be? It's not as crazy as it sounds. Start with the basics on how leverage affects investment returns.

Suppose you bought a stock or bond for $100 in cash. If the price rises to $110, you make 10 percent. Not bad. Now, assume that you borrowed $90 of the purchase price at a 5 percent interest rate. Over a year, the stock or bond still increases to $110, but now you've made more than 50 percent. You pay $4.50 in interest and pocket a $5.50 gain on your $10 investment. Note, however, that if the price fell to $95, you'd be virtually wiped out ($4.50 in interest paid plus $5 lost on the security).

------------------------

Gus: who looses wins not...

on yer bike...

US Treasury Secretary Timothy Geithner says he is prepared to oust executives and directors at banks that require "exceptional" government assistance.

He said the government would consider forcing out senior management to ensure that US taxpayers were protected.

His comments to CBS television come after the US government removed GM boss Rick Wagoner from his post.

Critics say that financial firms have not been subject to the same government intervention despite massive bail-outs.

Mr Wagoner was forced to leave as a condition for possible additional loans.

"If, in the future, banks need exceptional assistance in order to get through this, then we'll make sure that assistance comes with conditions," Mr Geithner said.

---------------

see toon at top.