Search

Recent comments

- iran's....

1 hour 11 min ago - blind interceptors....

1 hour 30 min ago - ARTIFINTEL....

3 hours 9 min ago - don't mention it....

4 hours 8 min ago - fear godot....

4 hours 12 min ago - no regeem change....

4 hours 58 min ago - blind maddow....

5 hours 8 min ago - detour 101....

5 hours 28 min ago - stupidolitics....

5 hours 40 min ago - on the golf course....

6 hours 9 min ago

Democracy Links

Member's Off-site Blogs

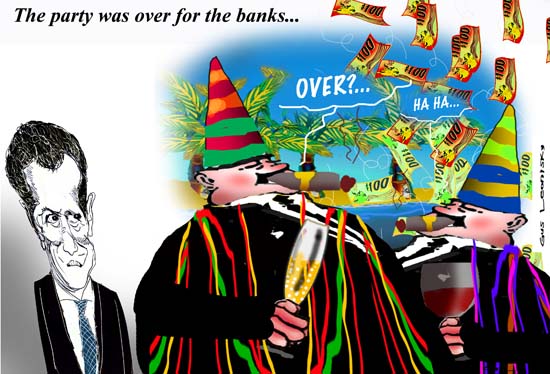

a party of bankers...

Chancellor of the Exchequer Alistair Darling has warned bankers that the party is over and they must realise the world has changed.

He made the comments in a BBC interview before leaving for the G20 summit.

He wants a limit on bonuses, and rules to allow banks to get them back if bankers make losses later.

But he said there was a limit to how much could be achieved by regulation, and bankers needed to realise that they had to change their behaviour.

------------------

US Treasury Secretary Timothy Geithner said G20 countries had reached a consensus on the "basic outline" of a proposal to limit pay and bonuses by the end of 2009.

------------------

... Taking the fun out of business...

- By Gus Leonisky at 25 Sep 2009 - 4:28pm

- Gus Leonisky's blog

- Login or register to post comments

dumb banks?...

"What's the origin of this crisis? It's frankly that banks started buying and selling products that they didn't understand," Mr Darling said.

------------------

What a lot of poopee-scoop... The banks would have had to know what they were doing otherwise they're not worth more than a dead cat. Mr Darling is a dummy to claim things like this...

What did happen is some clever bastards saw that the market — helped by banks bidding DELIBERATELY and KNOWINGLY — was poised like a poker game in which the kitty had reached a king's ransom underwriten on collaterals that were flimsier than movie saloon-chairs... The sheriff came along to help the Banks sit back at the table but meanwhile the bandits had fled with the loot... And no-one saw the winning hand...

And more than likely the whole thing was set up by some of the banks like a sting... They got their loot back, didn't they? Only a few banks bit the dust: "those that were too small to be rescued"...

We, the unwahsed. are the bunnies...

more empty gestures .....

Closer to home Gus .....

from Crikey .....

Bonuses are back, investment bankers rejoice

Andrew Crook writes:

"Bonuses are back" screamed the Fleet Street headlines two months ago after it was revealed Goldman Sachs was funnelling government bail-out money into the pockets of its top investment bankers and deal makers.

The revelations stoked the ire of activists, who held Bonuses are Back pig parties, complete with fake blood and papier mache heads. The Daily Mail went to town on the issue, naming and shaming Goldman staff.

Surely such excess couldn't happen in egalitarian Australia, where the PM has been going very public about the evils of a fat-cat resurgence?

Think again. If the latest talk among local investment bankers is correct, it seems the nation's rainmakers are back at the trough through a murky mechanism known as "salary guarantees".

Current and former investment bankers, none of whom were keen to talk on the record, say guarantees are back in favour among the finance community, some of whom have locked in under-the-radar payments exceeding their base salaries. The guarantees, paid in cash, shares and options, are often used alongside sign-on fees as an inducement to switch jobs. A performance-based bonus structure at one firm is locked in at another, an irresistible lure for the industry's rising stars.

In late August, the local arm of Bank of America/Merrill Lynch shelled out at least $13 million, and possibly up to $27 million, to draft 10 UBS bankers into its real estate investment banking team, which until then only comprised three members. In retaliation, UBS then poached a team of seven property investment bankers from JP Morgan. According to insiders, both teams are now said to be on fat packages and that's before any fresh deals have been done.

This morning, The AFR published a comprehensive list of recent industry moves, with the merry-go-round suggesting the big money has returned. The big names on that list, including Brett Le Mesurier, Brian Johnson and Craig Drummond, are unlikely to have made their moves without substantial inducements.

You can add to that list another relatively junior media industry banker, who recently shifted from UBS to Goldman Sachs on a guaranteed annual salary of $1.5 million, according to insiders. That move raised eyebrows among the investment banking community, especially given his unproven track record at the highest level.

The temperature inside the investment banking industry is notoriously difficult to gauge and usually attracts less scrutiny because bankers' salaries, unlike those of executives, don't appear in annual reports. But according to the Fin, mid-ranking Morgan Stanley managing directors doubled their base pay in the last year, from $300,000 to $600,000.

Another catalyst has been the return of headhunter activity among mid-tier firms. Bankers have told Crikey that job offers from the multinationals -- including UBS, Merrill and JP Morgan -- have been flooding in after an 18-month lull. The headhunters rarely name the "multinational investment bank" involved, but offer guaranteed cash for those who want in. Any performance-based bonuses previously mooted at the current employer are locked in as part of the job offer.

Salary guarantees mean publicly (and politically) unpalatable bonuses get obscured by bolstered base salaries and the "business as usual" largesse is locked in -- a culture slammed by Kevin Rudd in his speech to the UN yesterday morning. Although the official response will be settled after Pittsburgh, clearly the pay inequality debate in this country doesn't end with the $10.7 million paid to Qantas' Geoff Dixon for five months work or the millions sent Rod Pearse's way at Boral.

The PM has promised to link bankers' pay to banks' capital adequacy requirements through to prevent the "excessive risk-taking" that was the hallmark of the descent into chaos that claimed Lehman Brothers. But it's now these same banks who are returning to the bad old days, seemingly without compunction.

In Britain, the Goldman payouts were the biggest in the company's 140-year history.

see the funny caps in the toon at top...

Top European Union officials have struck an agreement on a package of financial laws that includes capping bankers' bonus payments at a maximum of one year's basic salary, in a move politicians hope will address public anger at financial sector greed.

The bonuses will only be allowed to reach twice the annual fixed salary if a large majority of a bank's shareholders agrees.

Thursday’s agreement, announced by diplomats and officials after late-night talks between EU country representatives and the bloc's parliament, means bankers face an automatic cap on bonus payouts at the level of their salary.

"This overhaul of EU banking rules will make sure that banks in the future have enough capital, both in terms of quality and quantity, to withstand shocks. This will ensure that taxpayers across Europe are protected into the future," said Ireland's Finance Minister Michael Noonan, who led the negotiations for 27 governments.

read more: http://www.aljazeera.com/news/europe/2013/02/2013228153911331.html

exchange rate fixing and a whole lot of cash...

The chairman of UK Financial Investments, the body responsible for the Government's stake in Royal Bank of Scotland and Lloyds Banking Group, has warned that RBS could face further fines from regulators over sales linked to the US sub-prime mortgage crisis.

Robin Budenberg, who joined UKFI in 2010 from UBS, told the Treasury Select Committtee (TSC) on Tuesday that while it was difficult to estimate future liabilities, potential fines had formed a “fundamental part of discussions” between the RBS board and the Bank of England’s Prudential Regulation Authority. Making reference to JP Morgan, which last month agreed to pay $5bn to settle a string of legal cases relating to sales of mortgage-backed securities, Mr Budenberg said mortgage trading was one of the outstanding issues RBS faced.

“It is clear that the PRA is rightly concerned, as is the board of RBS about these potential liabilities,” said Mr Budenberg. James Leigh-Pemberton, the new chief executive of UKFI, added that the matter was “of great concern”.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/10444373/Fresh-wave-of-banking-scandals-could-hit-RBS-warns-UKFI-boss.html

-----------------------------------------------

Meanwhile:

L'enquête internationale menée sur de possibles manipulations des taux de change concerne une quinzaine des plus grands établissements bancaires du monde et s'est étendue à de nouvelles devises, écrit mercredi 13 novembre le Financial Times.Selon le journal, qui fait référence à deux sources proches du dossier, l'autorité britannique chargée des marchés, la Financial Conduct Authority (FCA), a demandé des informations à "au moins quinze banques" dans le cadre de ses investigations sur de possibles manipulations sur l'énorme marché des changes (5 300 milliards de dollars d'échanges chaque jour).

Des enquêtes similaires sont actuellement également menées aux Etats-Unis, en Suisse, à Hongkong et au niveau européen.

(Translation by google: The international investigation into possible manipulation of exchange rates for fifteen of the largest banks in the world has been expanded into new currency, writes The Financial Times (Wednesday 13 November).

According to the newspaper, which refers to two sources familiar with the matter, the British market authority, the Financial Conduct Authority (FCA), requested information "at least five banks" under investigations about manipulating the huge forex market (5300 billion trade every day).

Similar investigations are now also conducted in the United States, in Switzerland, Hong Kong and Europe.)

http://www.lemonde.fr/economie/article/2013/11/13/manipulation-des-taux-de-change-une-quinzaine-d-etablissements-suspectes_3512753_3234.html

----------------------------------

Transactions on the foreign exchange market increased by more than a third over the past three years, reaching 5,300 billion (more than 4,000 billion) per day, or about 90% of the annual GDP of Japan ($5670,357,000,000), bed be a report of the Bank for International Settlements (BIS).

The three-year report shows that this growth is fueled by the rising powerful hedge funds and other non-bank stakeholders, as London says his status up predominantly for exchange and the dollar remains by far the most traded currency.http://imms.com.vn/AD_14961_86_1_the-foreign-exchange-market-is-5-300-billion-per-day.html#.UoNHwUZ_VsF

And I watch my pennies.... See toon at top...

gilding the lily in china...

To promote its standing in China, JPMorgan Chase turned to a seemingly obscure consulting firm run by a 32-year-old executive named Lily Chang.

Ms Chang’s firm, which received a $US75,000 ($80,000)-a-month contract from JPMorgan, appeared to have only two employees. And on the surface, Ms Chang lacked the influence and public name recognition needed to unlock business for the bank.

But what was known to JPMorgan executives in Hong Kong, and some executives at other major companies, was that “Lily Chang” was not her real name. It was an alias for Wen Ruchun, the only daughter of Wen Jiabao, who at the time was China’s prime minister, with oversight of the economy and its financial institutions.

Read more: http://www.smh.com.au/business/china/jpmorgan-allegedly-paid-80000-a-month-to-wen-jiabaos-daughter-20131115-2xket.html#ixzz2kfueAGH3