Search

Recent comments

- 100.....

1 hour 51 min ago - epibatidine....

7 hours 42 min ago - cryptohubs...

8 hours 40 min ago - jackboots....

8 hours 48 min ago - horrid....

8 hours 56 min ago - nothing....

11 hours 20 min ago - daily tally....

12 hours 42 min ago - new tariffs....

14 hours 33 min ago - crummy....

1 day 8 hours ago - RC into A....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

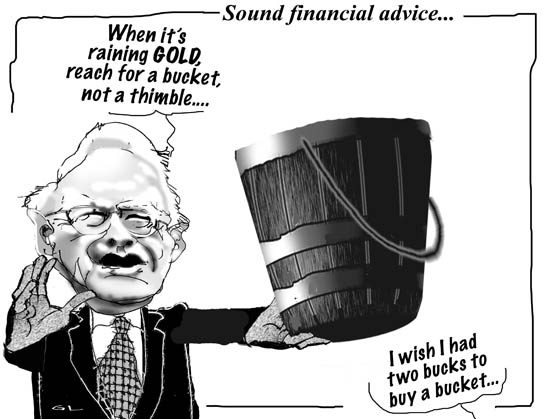

a packet for a good bucket...

Mr. Buffett used his letter to crack jokes and issue more of his trademark aphorisms. The so-called Sage of Omaha, he is America’s most listened-to investor, and his annual letter is watched closely by investors for his assessment of his businesses and of the economy.

It has, however, taken on somewhat less importance in recent years as Mr. Buffett, 79, has raised his profile with more public speaking and interviews.

In characteristically blunt terms, he had harsh words for unnamed chief executives and directors who oversaw disasters at their companies during the crisis but “still live in a grand style.”

He said, “They should pay a heavy price,” and that there must be a reform of the way executives are rewarded for their performance. “C.E.O.’s, and in many cases, directors, have long benefited from oversized financial carrots; some meaningful sticks now need to be part of their employment picture as well.”

He also admitted mistakes of his own, saying he had closed a troubled credit card business, which had been his idea, and had given too much time to turn around the NetJets business, long a burden.

But he dwelt also on the lucrative positions he took in a string of companies over the last year and a half, pouring $15.5 billion into shares of companies like Goldman Sachs, General Electric and Wm. Wrigley Jr. Wishing he had taken greater advantage of the opportunities offered, he said, “When it’s raining gold, reach for a bucket, not a thimble.”

read more at the New York Times

- By Gus Leonisky at 28 Feb 2010 - 1:43pm

- Gus Leonisky's blog

- Login or register to post comments

stats for economic revision...

The US economy grew at an annualised rate of 5.9% in the last three months of 2009, revised official figures have shown.

The rate is higher than the first estimate of 5.7%.

The figures confirm the world's largest economy is emerging rapidly from recession.

----------------