Search

Recent comments

- thus war....

2 hours 37 min ago - trump's gift....

3 hours 55 min ago - friendly fire....

4 hours 28 sec ago - energy vs energy....

14 hours 46 min ago - killing kids....

17 hours 43 min ago - the die is cast....

19 hours 35 min ago - SICKO.....

19 hours 56 min ago - be brave, albo....

22 hours 26 min ago - epstein class....

23 hours 31 min ago - in writing....

23 hours 42 min ago

Democracy Links

Member's Off-site Blogs

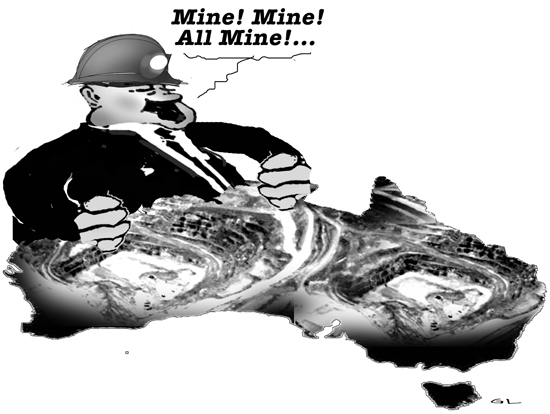

mine! mine!

Prime Minister Kevin Rudd will meet with mining magnate Andrew Forrest in Perth today to try to end the bitter row over the Government's proposed resources super profits tax.

Mr Rudd has promised to pour $2 billion into infrastructure in Western Australia in a bid to garner support for the tax, but has failed to convince fierce critics like Mr Forrest.

Mr Forrest told Lateline Government officials have made it clear the consultation process for the proposed tax is a charade.

"The consultation process started with Fortescue at 8:00am in Canberra on the first day," he said.

"The first words were 'this tax is binary Mr Forrest, if you want to change this tax you have to change the Government' - that's a direct quote.

"It frankly has upset me to this day, I don't see any change in behaviour from the Prime Minister, from the Treasurer."

Mr Forrest says Mr Rudd is treating the mining industry with contempt.

-------------

Yep... The mining industry is treating Australia with contempt — as if it was its own pot of gold...

- By Gus Leonisky at 10 Jun 2010 - 9:52am

- Gus Leonisky's blog

- Login or register to post comments

mine, all mine...

Under the new tax the Government would be liable for 40 per cent of losses from a failed project.

Mr Forrest told Lateline that is a major liability for taxpayers.

"This is a high-risk business and what the Australian mum and dad doesn't get is that under this tax, if Ken Henry was right, they could be wearing billions and billions of dollars of those unforecast out-of-budget losses," he said.

"They're no good to me but they hit the mums and dads, Ken Henry does not understand."

-----------------------

Gus: the number of successful projects versus the number of failed ones would offset the probability of loss, but in most cases, the miners would have to show they did not "sabotage" the project for "profit"... The alternative to this fair mining tax would be to double/triple the royalties on firm sales, in order for all Australians to get value for their dirt. It's not the miner's dirt whether they have a lease on it or not — and whether we like mining or not... The miners are a bit like Daffy Duck when he and Bugs Bunny find Ali Baba's treasure: "Mine! Mine! All mine!..."

meanwhile in the forrest front...

China is taking steps towards imposing a resources tax for the first time, countering assertions by the mining magnate Andrew Forrest at a rally in Perth yesterday.

Mr Forrest, chief executive of the iron ore miner Fortescue Metals, held up China as an exemplary economy that was turning its back on communism by lowering resources taxes.

''In China right now there's a fierce debate about how to lower their resources tax to encourage the mining industry," he told an ''axe the tax'' protest before a speech by the Prime Minister, Kevin Rudd.

''I ask you which communist is turning capitalist and which capitalist is turning communist?''

Analysts in China were perplexed by Mr Forrest's comments, as China is in fact taking steps towards imposing a resources tax, which Beijing sees as a means of conserving resources, slowing environmental destruction and rebalancing an economy that delivers bloated corporate profits at the expense of households.

---------------------------

Ah crap.. The Aussie miner caught out telling porkies...

It's all about the election stupid! Mk 2.

What can be said about the obvious set-up of the only "Australian" Mining CEO at his "people's rally"? I have news for “Treeless” Forrest – “Ming the merciless” would claim that those impudent words are Communist.

The mass produced and identical printing of the so-called "people's protest" cards (Commo) was all too obviously "Business oriented" and a very poor attempt at mimicking a worker’s protest.

In addition, “Treeless” has been outed for lying about China’s intentions to lower their Resources Tax when the truth is that they are thinking of introducing one for the benefit of the “People”. Struth Treeless!

There are many truths arising out of the murky waters of the Foreign Corporations War against the Australian government along with their Liberal Reps in Parliament.

1. The Media is supporting their Liberal Party lies even though they must know by now that what Kevin Rudd told “Treeless” in their first meeting was NOT so much an argument but a prediction as to how the Coalition of the Miners/ Liberals and Murdoch would use their unlimited finances and their unregulated abuse of opinion, to defeat the Rudd Government. How right he was? In any War he would be considered a worthy leader – because he read the enemy and their tactics and he prepared for it on behalf of the Australian people.

2. “Treeless” Forrest is knowingly being used in an effort to ignore the powerful foreign interests as opposed to those of our people and our Government. He very foolishly argued against Ken Henry and added insult to injury by shouting “Who voted for him”!!!! Fair dinkum “Treeless” WHO voted for you or any of your fellow foreign predators?

3. Should the Rudd government not survive, we will be thrown back into the bad old days of the 1950’s. And for what? A tax on wealth? Struth.

4. If there ever was an economically based argument against the Rudd government’s Super Profits Tax it would be that Rudd/Gillard/Swan and Tanner have bent over backwards to be fair to all parties. That is not the Capitalist way.

5. The ultra-cheap shot at the “Gang of four” is reminiscent of the false claims that Whitlam did not have a say in his government. Fair dinkum. If this nation’s primary economic architects are the “Gang of four that I have mentioned, then they have replaced the Howard/Costello Gang of two. So what?

While we have market rises – lowering unemployment – economic security improvement in health – better relations with the States - wage rises and protection of employment – and after a worldwide recession an Aaa rating - we are the only nation in that supreme position in the entire industrialized world. Greece/Spain/Portugal/Hungary/and Iceland are demonstrating against their governments for allowing Capitalist greed to force them to fall into a recession of the 1930’s magnitude.

However, in the War of the Classes in Australia the Abbott Coalition is supporting the foreign Miners in attacking the Australian Government with lies and Media madness.

God Bless Australia and give us the reasoning and logic to know that the foreign Corporations have discovered a weakness in our character to believe that “It was in the Australian”. NE OUBLIE.

more of mine...

The Australian share market is higher after stocks climbed almost 3 per cent on Wall Street overnight.

The All Ordinaries index had added 51 points to 4,500 shortly before 1:00pm (AEST), and the ASX 200 has risen 53 points to 4,489.

Mining stocks are leading the gains, with BHP Billiton up 73 cents at $38.35.

The company has written another letter to shareholders saying the Federal Government has failed to acknowledge what the company sees as the major flaws with the tax.

BHP says it does not support the 40 per cent tax rate, the application of the tax to the future profits of existing mines and the application of a uniform tax rate across all minerals.

All the banks are higher - Westpac was 50 cents higher at $23.14.

The Australian dollar has continued to rally and was worth 84.55 US cents.

----------------------

Gus: tax the bastards!...

the russians knew that...

A US survey has uncovered at least $US1 trillion ($A1.18 trillion) in mineral deposits in Afghanistan, officials say, but there are doubts as to how the war-torn and graft-prone country can manage the windfall.

The study by US geologists found Afghanistan had reserves of valuable minerals on a much larger scale than previously believed, a Pentagon spokesman says.

The value of the minerals - including lithium, iron, gold, niobium and cobalt - was estimated at nearly $US1 trillion, according to the study. But that was a conservative estimate, Colonel Dave Lapan told reporters on Monday.

"There's also an indication that even the trillion-dollar figure underestimates what the true potential might be," he said.

President Hamid Karzai said in January the deposits could help the impoverished nation become one of the richest in the world, based on preliminary findings of the United States Geological Survey.

In the past few months, US officials have briefed Afghan leaders on the final results of the study, which followed an initial assessment by geologists in 2007, the Pentagon said.

The studies were part of a US government effort designed to assist Afghanistan build up viable industries, and advisers were working with the Kabul government to attract "world-class" mining companies, Lapan said.

The Afghan ministry of mines said the mineral wealth offered great promise.

-----------------------

Gus: rediscovering what we knew all along... "There's gold in them hills"... And what better way than to get "private" companies to come and take it, while paying small dues to a "corrupt" government?...

superfund tax...

From the Washington Post

There is no question that the Superfund program, first established 30 years ago, is facing a budget crunch. For 15 years, the federal government imposed taxes on oil and chemical companies and certain other corporations that went directly into a cleanup trust fund, which reached its peak of $3.8 billion in 1996. But the taxes expired in 1995, and because Congress refused to renew them, the fund ran out of money.

Now the Obama administration will push to reinstate the so-called Superfund tax. The Environmental Protection Agency, which rarely urges the passage of specific bills, will send a letter to Congress as early as Monday calling for legislation to reimpose the tax.

The move will spark an intense battle on Capitol Hill, with Democrats and the administration lining up against oil companies and chemical manufacturers. The measure's proponents say it will ease the burden on taxpayers, who are currently funding the cleanup of "orphaned" sites, where no one has accepted responsibility for the contamination. Opponents suggest that it amounts to an unfair penalty.

"This is really about who should pay for the cleanup," said Mathy Stanislaus, assistant administrator for the EPA's Office of Solid Waste and Emergency Response. "Should it be the taxpayer, who has no responsibility for contaminating the sites, or should it be those individuals who create hazardous substances that contaminate the site?"

Since the fund ran out of money at the end of fiscal 2003, the federal government has appropriated public dollars each year to pay for orphaned sites, which account for 606 of the 1,279 sites across the nation. But that has slowed the rate of cleanup. The program completed just 19 sites last year, compared with 89 in 1999, the EPA says.

---------------------------

Hey, Mr Rudd, why not call the super tax on mining the "superfund contribution"...?

a worthwhile reform.

The International Monetary Fund has given its support to the Federal Government's planned Resource Super Profits Tax.

The deputy head of tax policy at the IMF Philip Daniel has told a tax conference in Sydney this morning the proposal is a worthwhile reform.

He says there are a number of benefits in the RSPT which could also be adopted in other countries.

"IMF staff welcome the RSPT proposal in principle. It shifts the whole Australian resource tax system strongly in the direction of neutrality," he said.

"It offers strengthening of Australian public finances over the long term, reduces risk of absolute loss for investors, while leaving a substantial share of resource profits in private hands."

The IMF also says there is no indication that the Federal Government's proposed RSPT would hurt Australia's economic prospects.

------------------------

see toon of scrooges at top...

smart woman...

Julia Gillard will can the Government's mining tax ads as one of her first acts as prime minister, and has called on the mining lobby to do the same.

She says reaching an agreement on the Resource Super Profits Tax is one of her first priorities after being elevated to the top job by the Federal Parliamentary Labor Party, although she has reiterated that the Government will not abandon the RSPT.

"Australians are entitled to a fairer share of our inheritance, the mineral wealth that lies in our grounds, they are entitled to that fairer share," she said in her first press conference as Labor leader.

"But to reach a consensus, we need to do more than consult, we need to negotiate, and we must end this uncertainty which is not good for this nation."

However, she has emphasised that the mining industry must play its part and be willing to give some ground to reach a compromise on the tax.

"Today, I am throwing open the Government's door to the mining industry and I ask that, in return, the mining industry throws open its mind," she added.

Ms Gillard says she will act today to stop further Government advertisements on the RSPT as a sign of good faith, and has called on the mining industry to do the same with their ads.

"Today, I will ensure that the mining advertisements paid for by the Government are cancelled and, in return for this, I ask the mining industry to cease their advertising campaign as a sign of good faith and mutual respect."

digging the dirt on the miners...

The Organisation for Economic Cooperation and Development (OECD) has called on Australia to extend its controversial mining tax to all companies operating in the sector.

The body said the planned tax, which has proved very unpopular with miners, was "justified" and should also be extended to all commodities.

Under current plans, the tax will only hit the largest miners in some sectors.

Several mine firms had threatened to cancel projects because of the tax.

http://www.bbc.co.uk/news/business-11753127

---------------------

see toon at top... Now why would any journalists in their report put "justified" in between quotes as if it was "questionable", though the OECD has indicated that the mining tax is JUSTIFIED? And should be EXTENDED... Was it to please a Son-of-Rattus (Tony Abbott) led opposition who is opposed to any "new" "big" "taxes" (that would be good for the country) and were prepared to give the "poor miners" a cash payment of 420 million "at the last election"? .

"see toon at top"...

not all of it...

The Federal Government's mining tax passed through the House of Representatives early this morning after a late-night deal was struck with the Greens.

The tax will apply to iron ore, coal and petroleum, but the Opposition has promised to repeal it if it wins Government.

It finally went through the Lower House early this morning after a special extended session of Parliament.

The legislation will now go to the Senate early next year.

The Greens agreed to back the deal after receiving assurances about how the Government would cover a $20 million shortfall on the original revenue forecasts.

The shortfall emerged after independent MP Andrew Wilkie negotiated an amendment to raise the tax's threshold in a move he said would be more fair to smaller mining companies.

The tax will now kick in when a company makes $75 million per year in profit rather than $50 million.

The Greens will not give details of how the shortfall will be covered but MP Adam Bandt says the party is satisfied that it is a "progressive measure and that the savings will now not be coming from schools, from childcare, from hospitals."

"I'd like to tell you what that offsetting measure is, but the Government has said that they'll make that announcement in the next couple of days."

Federal Treasurer Wayne Swan says the tax is in the national interest because the revenue raised will help fund tax breaks for small business, higher superannuation and infrastructure projects.

http://www.abc.net.au/news/2011-11-23/mining-tax-passes-lower-house/3687770?WT.svl=news1

See toon at top...

mindless opposition from mr no to anythink...

It's true the sky-high prices we're getting at present won't last, but nor will they crash back to what we used to get. And we'll have a much bigger mining industry selling a lot more of the stuff than we used to. They may be non-renewable resources, but we've got a mighty lot of 'em.

What else can we do? What most of us have always done: sell services to one another and to foreigners. In these days of the information and communication revolution, most of the highly skilled, highly paid jobs are in the services sector. Those who find this intangibility discomforting are hankering after a bygone century.

It is true, however, that we must ensure we end up with something to show for this boom and that too much of the huge profit being made doesn't just end up in the hands of the mining industry's owners (about 80 per cent of whom are foreign). After all, the minerals they're mining are owned by all Australians, not the miners.

That's why it's good to see Julia Gillard's profit-based mining tax finally being passed by the House of Representatives, even though Tony Abbott's mindless opposition to it allowed the three big foreign mining companies to butcher the tax.

Read more: http://www.smh.com.au/opinion/politics/facts-count-because-whats-mined-is-yours-20111122-1nsqo.html#ixzz1eUAQnBBl

from the deck of the titanic .....

Since when did Australia protect its future through mining interests?

My following book review appeared in last weekend’s Melbourne’s Sunday Age and Sydney’s Sun Herald:

The news late last year that Australia’s richest man, Andrew ”Twiggy” Forrest, had not paid any corporate tax for seven years was unsurprising.

Fortescue Metals’s tax manager, Marcus Hughes, conceded to a parliamentary committee in December: ”We have not cut a corporate tax cheque to date.”

Author Matthew Benns would have a few words to say about that. He begins this striking, investigative book, Dirty Money: The True Cost of Australia’s Mineral Boom, with a sordid tale about copper company Anvil Mining’s alleged complicity in a massacre in the Democratic Republic of Congo in 2004. Examples of Australian company criminality are shown from the Philippines to Papua New Guinea.

Tragically, these are not atypical stories. Many Australian firms scour the globe looking for cheap resources and exploitation. It is often not illegal but it is largely a reality hidden from the population. We want cheap petrol and minerals; we rarely want to know from where they come.

Benns documents a litany of dirty deals, grubby environmental catastrophes and health scares. The only conclusion from this essential book is that Australia has a bipartisan belief in giving the resource industry whatever it wants and screwing the long-term expense. Our political leaders preach about a budget surplus but give little thought to building our Future Fund from the revenue.

It is a point equally well made by fellow writer Paul Cleary in his recent book Too Much Luck. At the Sydney book launch, Cleary told the audience that Australia preaches to a country such as Papua New Guinea – a land truly cursed by a resource boom that benefits few locals – that they should establish a sovereign fund for future generations and yet we neglect our own Future Fund.

Benns would share this argument. ”We are dancing on the deck of the Titanic,” Benns writes. ”The rest of the economy is being run down in favour of minerals. But mining companies only employ 3 per cent of the Australian population.”

Such points are rarely heard within the mainstream political and media elites, too keen to promote ”growth” and ”development”. The three-year election cycle has turned us into lemmings approaching the cliff.

Dirty Money

Matthew Benns

William Heinemann, $34.95

Antony Loewenstein