Search

Democracy Links

Member's Off-site Blogs

Gus Leonisky's blog

remember: no connection between Iraq and 9/11...

An email is doing the rounds at the moment...

Here is part of it:

------------------

- By Gus Leonisky at 22 Oct 2009 - 8:59pm

- 4 comments

- Read more

cost of financial crisis...

Mervyn King, the governor of the Bank of England, has launched a blistering attack on Britain's banks, describing the £1tn government support given to them as "breathtaking".

In an outspoken speech last night, in which he made his clearest call yet for the banks to be broken up, King warned that the British people will be paying for the cost of the financial crisis for a generation.

- By Gus Leonisky at 21 Oct 2009 - 9:14pm

- 4 comments

- Read more

of camel and guns...

Guns given to Somali quiz winners

Guns given to Somali quiz winnersThe winners of a quiz organised by Somali Islamists have been given weapons and ammunition as prizes.

Prizes included AK-47 assault rifles, hand grenades and an anti-tank mine.

The quiz ran during the holy Muslim month of Ramadan in the port city of Kismayo, and included questions about the Koran and Somali geography.

A representative for the al-Shabab militant group said the quiz aimed to stop young men from wasting their time and focus on defending their territory.

- By Gus Leonisky at 19 Oct 2009 - 4:47pm

- 2 comments

- Read more

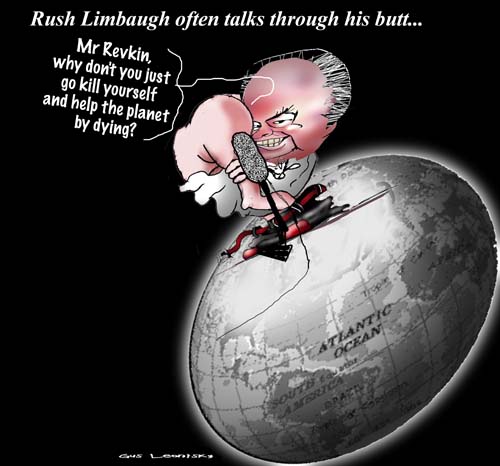

fun fun fun no more...

Of the Greek rubber chicken...

From the SMH, Anthony Ackroyd

---------------------

"Come to the edge, he said. They said: We are afraid. Come to the edge, he said. They came. He pushed them and they flew." These are the words of Guillaume Apollinaire, a French writer well-credentialled as an artist who lived at the edge.

...

To put it bluntly, a rubber sword won't cut through the bullshit, and that is one of the most vital functions of comedy.

-------------------

- By Gus Leonisky at 17 Oct 2009 - 12:15pm

- 3 comments

- Read more

feet of clay, toys of rust...

keels of contention...

Our heroes who are inspiration to most of our democratic ideals, often are not democratic. Just who cares? They have attributes of folly that succeed in slaying the dragons.... In a democracy, there would have been an endless array of general meetings on why the dragons would have to be protected — or cut to pieces in times of famine...

- By Gus Leonisky at 15 Oct 2009 - 12:47pm

- 2 comments

- Read more

scat to the rescue...

Gorilla dung could conceivably be the salvation of the planet.

A leading UK wildlife expert today said protecting the large primates he called the "gardeners of the forest" could provide the easy fix for global warming envisaged by international reforestation programmes.

America and other industrialised countries are looking to reforestation programmes in Africa, South-east Asia and South America to help contain the effects of climate change.

- By Gus Leonisky at 14 Oct 2009 - 8:02pm

- 8 comments

- Read more

on planet crap...

Food production will have to increase by 70% over the next 40 years to feed the world's growing population, the United Nations food agency predicts.

The Food and Agricultural Organisation says if more land is not used for food production now, 370 million people could be facing famine by 2050.

The world population is expected to increase from the current 6.7 billion to 9.1 billion by mid-century.

Climate change, involving floods and droughts, will affect food production.

- By Gus Leonisky at 13 Oct 2009 - 10:41am

- 5 comments

- Read more

scare tactics

Visit Barnaby's site and read the comments below his media release...

- By Gus Leonisky at 13 Oct 2009 - 8:28am

- 2 comments

thailand by-night..

- By Gus Leonisky at 10 Oct 2009 - 11:39am

- 7 comments

- Read more

peace prize

Lower-ranking Russian politicians were quicker to weigh in, expressing everything from cautious congratulations to frustration about Obama winning the prize. They were virtually united in the opinion that the award went to the U.S. president as a downpayment on his future actions to reinforce global peace rather than for his accomplishments so far.

Many of them noted Europe's disappointment with the policies of Obama's predecessor, George Bush, and hope that the new White House would take a more peaceful approach to its foreign policy.

- By Gus Leonisky at 10 Oct 2009 - 10:23am

- 22 comments

- Read more

not a blank czech...

The Eurosceptic Czech President, Vaclav Klaus, wants a new two-sentence footnote to be added to the EU's Lisbon Treaty before signing it, Sweden says.

The new condition came up during a phone conversation between Mr Klaus and Swedish PM Fredrik Reinfeldt, current holder of the EU presidency.

Mr Reinfeldt said the requested footnote was linked to the EU's Charter of Fundamental Rights.

- By Gus Leonisky at 9 Oct 2009 - 7:58am

- 2 comments

- Read more

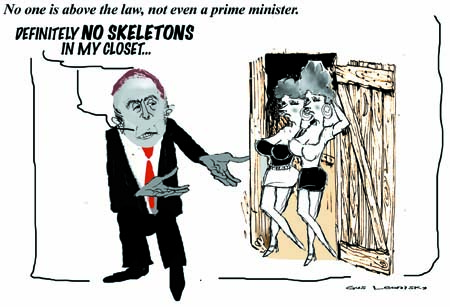

The law is an arse....

No one is above the law, not even a prime minister.

That is the conclusion of one of the most eagerly awaited court decisions in recent Italian history.

The country's Constitutional Court has ruled that Silvio Berlusconi and three other people in public life - the president of the republic and the two parliamentary speakers - should not have immunity from prosecution while they are in office.

But, just like the country as a whole, it seems the judges were divided over the issue. The judges voted nine to six against the law.

So what are the implications? Well, it is best to divide them into two.

- By Gus Leonisky at 8 Oct 2009 - 11:54am

- 11 comments

Recent comments

9 min 30 sec ago

2 hours 54 min ago

4 hours 4 min ago

14 hours 30 min ago

14 hours 59 min ago

15 hours 5 min ago

19 hours 9 min ago

19 hours 16 min ago

19 hours 30 min ago

1 day 2 hours ago