Search

Recent comments

- loneliness....

52 min 21 sec ago - insight....

1 hour 23 min ago - conspiracy....

21 hours 10 min ago - brutal USA....

23 hours 5 min ago - men....

23 hours 26 min ago - oil....

1 day 2 min ago - system....

1 day 49 min ago - not invited....

1 day 1 hour ago - whistleblow.....

1 day 14 hours ago - demosocialism....

1 day 23 hours ago

Democracy Links

Member's Off-site Blogs

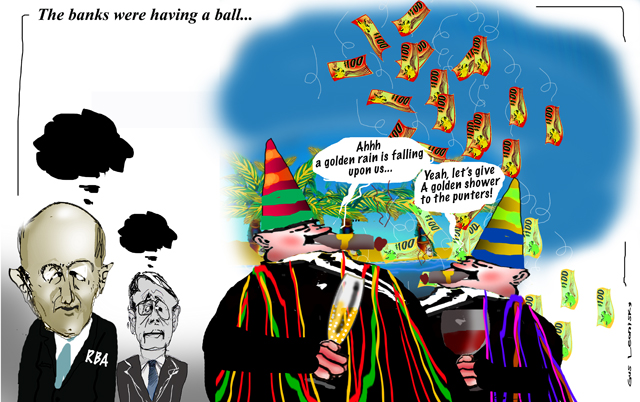

the golden age of banking...

- By Gus Leonisky at 2 May 2012 - 9:49am

- Gus Leonisky's blog

- Login or register to post comments

robbing the punters...

HOME and business borrowers are likely to get just two thirds of the 0.50 percentage point interest rate cut delivered by the Reserve Bank yesterday after the Bank of Queensland went out ahead of its rivals and delivered only 0.35 points.

The bank's decision to cut its variable rate to 7.11 per cent rather than 6.96 per cent will deny a customer with a $300,000 mortgage $28 a month.

Herald calculations suggest that if all the banks withheld as much of the cut as the Bank of Queensland they would hang on to an extra $1.2 billion a year.

Read more: http://www.smh.com.au/business/banks-hold-back-on-bumper-rate-cut-20120501-1xxak.html#ixzz1tfIqvDw0

phoney costs...

The big four banks save $12 million for each day they don’t pass along the Reserve Bank’s rate cut, research shows.None of the four major banks have announced changes to their mortgage rates since the RBA lowered the cash rate by 0.5 percentage points yesterday, in order to spur the ailing domestic economy.

The Australia Institute derived the $12 million figure from the $1.1 trillion in total housing loans outstanding held by the big four according to the Australian Prudential Regulation Authority and then calculating the difference between a 50 basis point in the banks' combined revenue for one day. The Institute also assumed only 80 per cent of the mortgage market was in standard variable rates.

“The banks are engaging in a phoney debate about the cost of borrowing,’’ said senior research fellow David Richardson. He added that it was easy to see how a bank like ANZ, which posted nearly $3 billion in half-year profit today, could remain profitable while withholding mortgage rate reductions.

Read more: http://www.smh.com.au/business/taking-time-on-rates-worth-12m--every-day-20120502-1xyhn.html#ixzz1tgWxnPOa

caving in fractionally...

National Australia Bank has become the first of the big four banks to lower its standard variable rate - but it will not pass on the full Reserve Bank rate cut.

The bank this afternoon said it would cut its standard variable home loan rate from 7.31 per cent to 6.99 per cent, effective on Friday.

The 32 basis point cut means NAB will hold back 18 basis points from consumers.

Read more: http://www.smh.com.au/business/nab-first-out-of-the-blocks-to-cut-rates-20120502-1xyt5.html#ixzz1thK6D6zf

still hogging some dosh...

Westpac has cut its standard variable home loan rate by 37 basis points to 7.09 per cent, deciding not to pass on the full half percentage point by the RBA.

Its variable rate on business loans has been cut by 50 basis points.

Westpac group executive retail and business banking Jason Yetton downplayed the influence of the RBA's rate cut in the bank making the decision.

“It is now widely acknowledged that the link between the RBA’s cash rate and the actual cost of money to banks – in effect our own borrowing costs – plays an increasingly small role," he said. "Other ones, such as the relatively high cost of deposits and wholesale funding, have assumed critical importance,” said Mr Yetton.

Read more: http://www.smh.com.au/business/westpac-fails-to-pass-on-full-rba-cut-20120504-1y3bw.html#ixzz1tsrdlxsZ

If I understand the gobbledeegook from Mr Yetton, it costs money to the bank, for me to have my money in the bank... May be I should have a talk with my mattress and save the bank some pain...

a proportion of the cake...

Taking about cakes, I a not referring to that interview between Mike Willesee and John Hewson when he wanted to inflict the GST on Australians... Sure, his successor, Rattus the First, succeeded after having told us NEVER-EVER, but this is another story... No, this is about "interest rates"...

I suspect banks prefer interest rates to be quite high... Because they make their money on the differential... That is to say for example, the RBA interest is 3 percent and the bank is charging you 6 per cent to borrow... That means the bank is making 3 per cent on the money traffic (about double the moneys — banks usually triple the differential but say "double" for this exercise)... Now imagine the RBS is lending money to the bank at 6 per cent but the bank in a generous gesture lends it to you at 11 per cent... The bank is thus "making 5 per cent". On the profit report the total amount of cash raked in is near double compared with expenditure... As interest rates go up, the less work the banks have to do to siphon more dosh out of your pocket...

I may have got this one wrong, though...

25 billion bickies in a dunking market...

The Commonwealth Bank has reported a full-year profit of $7.09 billion, the largest result by a non-mining company in Australia.The annual net profit for the year to June 30 was up 11 per cent, aided by cost cuts and drop in bad debt provisions. The earnings compared with market expectations of about $7.15 billion.

Cash profit after tax came in at $7.113 billion, up 4 per cent on the previous year.

The bank, Australia's largest by market value, will pay a dividend of $1.97 per share for the second half, slightly more than analysts had tipped. Full-year dividends totalled $3.34, fully franked.

CBA said it remains positive about Australia's medium- to long-term outlook but the global economic prospects remain uncertain.

Australia’s big four banks are battling weak demand growth for their financial products as wary firms and household opt to repay debt rather than take on new loans. Even so, the four are likely to come close to reporting full-year profits in the range of the previous year’s total of about $25 billion as they trim staff and other costs and bad debt charges shrink.

Read more: http://www.smh.com.au/business/earnings-season/cba-posts-record-71b-profit-20120815-247gc.html#ixzz23ZB9VOAe

the golden age of lawyering...

A correction is in order regarding the class action against ANZ over the bank's penalty fees.Reports referred to lawyers “representing customers” - that's not totally correct.

Oh, in a technical sense I suppose ambulance chasers Maurice Blackburn Lawyers are representing customers and no doubt complying with the letter of their ethical obligations, but in practical terms the firm's own self-interest and that of litigation funder IMF are hardly of passing importance.

And while self-generating a rich source of fees, such legal firms have made Australia second only to the United States in the burgeoning class action business - a dubious distinction for our increasingly litigious society.

In my opinion, they have debased a worthwhile and socially valuable legal structure while creating fees for themselves and opportunities for litigation funders to bet on court results.

What makes it worse is the sanctimonious claptrap the firms are wont to sprout, the image they seek of taking on the big bad banks to correct a dreadful injustice. What nonsense - the firms involved were nowhere to be seen when the real work was being done to curtail the banks' penalty fee gouge.

They have merely landed to feed on the corpse well after the event.

Consumer action template

A little history is in order. The anti-penalty fee campaign in Australia was kicked off by Channel 7's Sunrise program in February 2007 on the back of the Office of Fair Trade highlighting the dubious legality of UK bank penalty fees.

Read more: http://www.smh.com.au/business/raiding-the-bank-penalty-money-pot-20120815-24853.html#ixzz23aXrLU9p

I have fought penalties from "my" bank a few times, arguing truthfully that I had made arrangements with my former bank manager, for a modest overdraft with no penalty nor interest whenever it occurred, say between meals, before banks introduced computerised penalties...

As well as bank branches closed, other branches took over the business with "different" rules from their "new" managers (now having to rule according to the computerised version of pinching my moneys...) Even with my bank accounts in negative territory, the simple threat of going to do business elsewhere was enough to be "lenient" and remove the bank's hand from my poor empty cookie jar... I told the fellow in charge it was not a case of leniency but a case of agreement attached to my bank accounts made with a handshake with the bank manager at the time... One cannot shake hand with a computer, I believe...

Now the bank is so lenient it offers overdrafts — with no penalty — the size of which one could buy a small car with... Times are weird...

beating the banks...

...a locksmith who refuses to open locked doors; neither will he replace their locks with new ones. What may seem a disastrous strategy for Iker de Carlos, a 22-year-old Spaniard starting out in the world of cylinders, pins, bolts and lock springs in his home city of Pamplona, is actually part of a growing civic rebellion in support of the biggest losers in Spain's five-year story of failing, mismanaged banks – those being thrown out of their homes after falling behind on mortgage payments.

Tired of accompanying court officials to evict unemployed people as banks foreclosed mortgages, De Carlos consulted his fellow Pamplona locksmiths before Christmas. In no time at all, they came to an agreement. They would not do the dirty work of banks whose rash lending pumped up a housing bubble and then, after it popped, helped bring the country to its knees.

"It only took us 15 minutes to reach a decision,"

http://www.guardian.co.uk/world/2013/jan/05/pamplona-spain-banks-homes

bank shock ....

The major banks are supercharging their profits at the expense of customers. Their funding costs have fallen, not risen, as they claimed when refusing to pass on Reserve Bank interest rate cuts.

Their action has hurt not only mortgage holders but savers, small businesses and all other bank customers, according to research by Milind Sathye, a former central banker and now professor of banking and finance at the University of Canberra.

Professor Sathye has debunked claims that the banks' high cost of funding has forced them to hold back rate cuts.

And former Reserve Bank governor Bernie Fraser said the big banks had room to cut their mortgage rates, but had failed to do so because they had put profits first.

Professor Sathye said the three main sources of bank funding - deposits, long-term debt and short-term debt - had become much cheaper in recent years, even as the banks had claimed they were rising.

Since November 2011, the Reserve has lowered the cash rate by 1.75 percentage points to 3 per cent. But the banks dropped their mortgage rates by only 1.36 percentage points to the standard variable rate of 6.42 per cent. That means almost a quarter of the Reserve's cuts - billions of dollars' worth - has gone into the banks' coffers.

Professor Sathye cites the online savings account interest rate easing from 7.3 per cent in July 2008 to 3.05 per cent in January this year, a 4.25 percentage-point fall.

Term deposits fell from 7.95 to 4.25 per cent in the same period, a drop of 3.7 percentage points as the Reserve's cash rate came down further, from 7.25 to 3 per cent. But as the drop in interest paid by banks is smaller than the drop in what it charges, their profit has increased.

That shows up in the profit figures. The pre-tax combined profit of the big four banks was $22.6 billion in 2008 and $33 billion last year, a jump of 46 per cent.

All eyes will be on the banks this week if the Reserve Bank moves the cash rate on Tuesday.

Professor Sathye's analysis concludes that the greatest threat to bank profitability has come not from external funding pressures or from competition, but from a blow-out in operating costs.

His findings follow a report from UBS Investment Research last week that said the banks were in such a ''purple patch'' that they risked government intervention if they did not start making their own mortgage rate cuts outside the Reserve Bank cycle.

''Banks are now making more money from originating a mortgage than any time previously,'' UBS analyst Jonathan Mott wrote.

Last month Commonwealth Bank delivered a $3.8 billion net profit for the half-year. This put the big four - Commonwealth, Westpac, ANZ and National Australia Bank - comfortably on track to surpass their collective bottom-line profit of $25 billion last year.

It also endorsed Commonwealth's sharemarket valuation, which shot through $100 billion in the new year, further polishing the reputation of Australia's banks as among the most profitable in the world - and arguably the safest.

Professor Sathye, a former central banker in India, said this sharemarket performance ''is coming out of the pocket of somebody … and that somebody is the Australian borrower".

Even though people and business are borrowing less since the global financial crisis and despite the rise in the banks' operating costs, profits have risen because of lower funding costs and fattening credit ''spreads'' - the difference between what banks pay for money and what they charge for it when they lend.

"The majors continue to make record profits and at the same time harp on about high funding costs to justify their higher lending rates," Professor Sathye said.

Deposits are the single largest source of bank funding. They contribute just above 50 per cent of funding, according to the Reserve Bank. The Australian Bankers Association has argued that competition for deposits has pushed up the interest rates on them.

But Professor Sathye says deposit rates have fallen. In fact, they had declined more sharply than lending rates, meaning funding costs had dropped, not risen.

"So [it's] not just the mortgage holder but all bank customers who are suffering,'' he said.

The Big Banks' Big Lies

big fees for small potatoes...

Federal Court documents show the ANZ bank knew as far back as 2006 that it would need to adjust the fees it charged customers, or risk being exposed to legal action and growing consumer anger.

The internal ANZ documents, which include emails and board meeting minutes, were obtained by lawyers representing the claimants of the biggest class action in legal history.

Maurice Blackburn is representing 38,000 customers who are disputing the fees they were charged over a seven-year period.

The central claim is that the excessive fees charged would be considered penalties and therefore would be illegal.

The bank is alleged to have charged exorbitant fees of between $20 and $45 for services that would only cost a matter of cents or a few dollars to administer.

Although some parts of the documents have been redacted because they are commercially sensitive, they reveal the private deliberations of ANZ's executive management team and board.

The documents trace the growing public campaign by consumer groups and media reporting about the fees, and the legislative changes that would cause the bank to change its fee structure.

One of the internal documents outlines the concerns the bank had about adjusting its fees. The revenue raising options to offset losses included increasing account servicing fees.

http://www.abc.net.au/news/2013-12-13/anz-class-action-memos-show-bank-considered-fees-as-revenue/5153856