Search

Recent comments

- EU gas storage....

2 hours 30 min ago - wrong trousers....

2 hours 42 min ago - failure.....

3 hours 3 min ago - remembering....

4 hours 56 min ago - wrong target....

14 hours 14 min ago - aerosols....

14 hours 33 min ago - middle powers....

14 hours 54 min ago - disgraceful....

15 hours 53 min ago - bets on war....

16 hours 19 min ago - graham's crap....

19 hours 17 min ago

Democracy Links

Member's Off-site Blogs

hasta la vista...

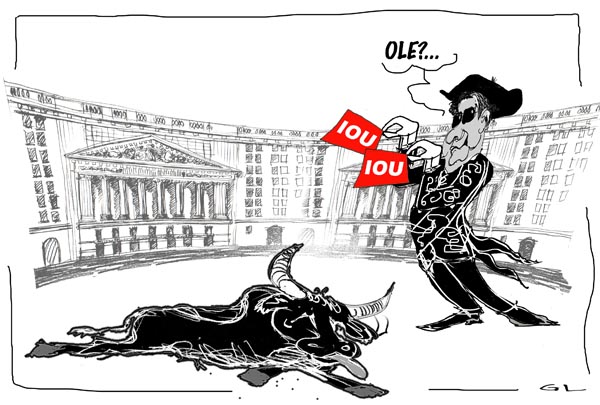

The flames of the eurozone crisis leapt higher yesterday, as fears spread about the state of the Continent's most vulnerable banks.

Shares in the Spanish lender, Bankia, plummeted 30 per cent at one stage in trading, following a report that customers had withdrawn €1bn in deposits since the Madrid government was forced to part-nationalise the bank last week.

Bankia released a statement in the afternoon saying that the deposit fall was simply a seasonal effect rather than a bank run. This served to stabilise the share price, but the lender still ended up losing 14 per cent of its value.

Market fears intensified last night when the credit rating agency Moody's downgraded 16 Spanish banks, a move likely to push up the cost of funding and further undermine confidence. Santander UK was also downgraded, but has a higher rating than its Spanish parent company.

http://www.independent.co.uk/news/world/europe/europe-rocked-by-spanish-banking-crisis-7763992.html

- By Gus Leonisky at 18 May 2012 - 6:13pm

- Gus Leonisky's blog

- Login or register to post comments

lunch at the soup kitchen...

The Australian share market has hit a six-month low, wiping $32 billion off the All Ordinaries Index, as investors headed for the exits amid fears about the ongoing instability in the eurozone.

Investors are following their overseas counterparts and pulling out of the share market, with the benchmark ASX 200 index losing 2.7 per cent to 4,047 and the broader All Ordinaries giving up 2.6 per cent to close at 4,099.

After a relatively flat close yesterday, investors hit the sell button at the start of trade, and Patersons Securities analyst Marcus Padley says there was nowhere to hide today.

"One of our advisors got asked by a client this morning what they should be buying, and she said 'the only thing I'll be buying you today is lunch'," Mr Padley said.

http://www.abc.net.au/news/2012-05-18/australian-share-market-slumps-further/4020136?WT.svl=news0

little red riding hood...

The Madrid government is to ask the Wall Street bank Goldman Sachs to audit the books of the struggling lender, Bankia. Sixteen other Spanish banks were downgraded by the credit agency Moody's on Thursday. Speculation is rising the Spanish government will be forced to apply for help from the bailout fund, the European Financial Stability Facility, to recapitalise its banks.

http://www.independent.co.uk/news/world/politics/capitalism-at-a-crossroads-7767040.html

Okay, la abuela (granny) is sick... Who do we call for? The big bad wolf... Makes me cry...

— Abuelita, abuelita, ¡qué dientes más grandes tienes!

— Son para... ¡comerte mejor! — y diciendo esto, el lobo malvado se abalanzó sobre la niñita y la devoró, lo mismo que había hecho con la abuelita.

where did the easy cash came from?...

What are the sick suffering from?

A surfeit of debt, which, because of the credit crunch, and fears of default in the markets, is costing far more than it once did to service – plus overborrowing in the years of easy credit, a too-rapid expansion of public sectors, and, in the case of Ireland and Spain especially, an implosion of property prices. Greece now owes 160 per cent of its GDP, Ireland 110 per cent, Portugal 107 per cent and France 89 per cent. And, as economies contract, inefficient tax collection means these countries have even less cash.

http://www.independent.co.uk/news/world/europe/casualty-the-eurozone-sickness-spreads-7768858.html

--------------------------

Where did the "easy" credit come from?... The US banks of course... They sold rotten sub-quality financial packages to the Europeans ast premium prices, as a sure bet to make money with... But the whole thing was a mirage of worth hiding worthless less junk... It's a bit as the whole thing was designed to crash the Euro nations and that's what I believe... Banks like Goldman Sachs were betting against the product they sold... Isn't this an indication of a hidden purpose?...

Meanwhile:

US President Barack Obama has said there is an "emerging consensus" that European countries must now focus on jobs and growth.

Speaking after the G8 summit of some of the world's leading economies, he said the US was confident that Europe can meet its challenges.

President Obama said leaders had made good progress on a range of issues.

In addition the eurozone crisis, they discussed Iran, Afghanistan and global energy supply.

http://www.bbc.co.uk/news/world-us-canada-18135042not going for a song...

SPAIN'S Eurovision contestant has been advised not to win because the country can't afford to host the event next year. According to the rules, the public broadcaster of the state that wins the song competition hosts the costly extravaganza the following year.

The BBC reports that directors from Spanish broadcasters TVE joked to this year's Spanish Eurovision entrant, Pastora Soler: "Please, don't win!" Soler later admitted in an interview: "If we won, I think it would be impossible to stage the next edition because it costs so much money.

Read more: http://www.theweek.co.uk/music/eurovision-2012/47112/spains-eurovision-contestant-told-country-cant-afford-win#ixzz1vvTfPuw3they've got their own barnaby in spain...

The Spanish government has admitted to making a typographical error which increased the country's public debt figure by about $14.5 billion.

Four days after announcing the national 2014 debt figure to the world, the economy ministry has issued a correction.

"It is an erratum," an economy ministry spokeswoman said.

It turns out that Spain's public debt in 2014 is expected to be the equivalent of 98.9 per cent of total economic output, not the originally published figure of 99.8 per cent, or 1.05 trillion euros ($1.53 trillion).

The error was not due to a problem in mathematical computations. Rather, the person who typed the number just mixed up the last two digits.

The difference may seem minimal, but when dealing with an economy the size of Spain's, which is the fourth biggest in the eurozone, it is equivalent to about 10 billion euros (about $14.5 billion).

Even after trimming the excess 10 billion euros from the forecast, economists say Spain's debt is rising at a worrying speed as it struggles to emerge from a double-dip recession triggered when a property bubble imploded in 2008.

http://www.abc.net.au/news/2013-10-04/typo-adds-24145-billion-to-spanish-debt/4998082

---------------------------

Not as rich as our own Barnaby Joyce mixing his billions with billions... or gazillions... or terazillions... who knows...

See toon at top...