Search

Recent comments

- nothing....

53 min 39 sec ago - daily tally....

2 hours 15 min ago - new tariffs....

4 hours 7 min ago - crummy....

22 hours 20 min ago - RC into A....

1 day 13 min ago - destabilising....

1 day 1 hour ago - lowe blow....

1 day 1 hour ago - names....

1 day 2 hours ago - sad sy....

1 day 2 hours ago - terrible pollies....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

from the verandah...

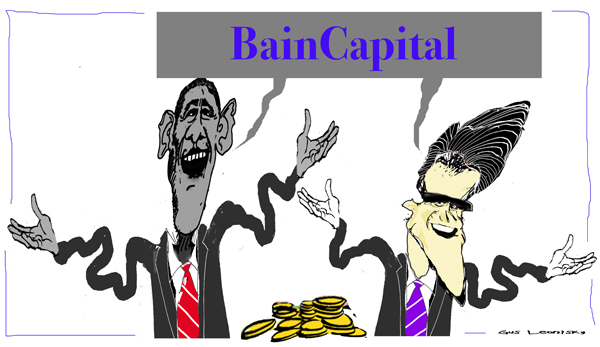

Previously unreported details, documented in Massachusetts corporate filings and other public records, show that Bain Capital was enmeshed in the largely opaque world of international high finance from its very inception.

The documents don't indicate any wrongdoing, and experts say that such financial vehicles are common for wealthy foreign investors. But the new details come as President Obama has criticized Romney for profiting from Bain Capital's own offshore investment entities, which are unavailable to most Americans.

The Romney campaign declined to comment on the specifics of Bain's early investors. Romney has argued that his offshore investments are entirely proper, and that he has paid all the U.S. taxes that he owes. The offshore funds do provide tax advantages for foreign investors, allowing Bain to attract billions of dollars.

The first outside investor in Bain was a leading London financier, Sir Jack Lyons, who made a $2.5 million investment through a Panama shell company set up by a Swiss money manager, further shielding his identity.

About $9 million came from rich Latin Americans, including powerful Salvadoran families living in Miami during their country's brutal civil war.

That first investment fund - used to invest in start-up companies and leveraged buyouts - paid out a stunning 173 percent in average annual returns over a decade, according to a prospectus prepared by an outside bank. It was the start of the private equity powerhouse that ultimately fueled Romney's political career.

At the time Romney launched Bain Capital - a spinoff of Bain & Co., the Boston consulting company he joined when he graduated from Harvard Business School - U.S. officials were accusing some exiles in Miami of funding right-wing death squads in El Salvador. Some family members of the first Bain Capital investors were later linked to groups responsible for killings, though no evidence indicates those relatives invested in Bain or benefited from it.

- By Gus Leonisky at 22 Jul 2012 - 10:50am

- Gus Leonisky's blog

- Login or register to post comments

collection plates...

London—In fairness to Mitt Romney, he did not schedule his $75,000-a-plate money grab at the altar of international finance when he heard that—via the Libor bank-rate scandal—Londoners were practicing his kind of crony capitalism.

Even before the Bain capitalist knew that bankers in London were lying to regulators and fixing interest rates in order to run up their profits—engaging in activities that the governor of the Bank of England said “meet my definition of fraud”—Romney was excited about getting a piece of the London bankster action.

But Romney campaign has gone to Olympian lengths to make their candidate’s British sojourn seem to be about something other than the looting of London.

The Republican presidential contender’s international fundraising operation—and, yes, he does have an international fundraising operation—scheduled two major events to coincide with the opening of the Olympic Games. As a candidate who is having trouble touting his business experience (Bain Vulture Capital) and his governing experience (RomneyCare), the presumptive Republican presidential nominee calculated that it might be a good idea to take a trip across the pond to highlight his (somewhat less controversial) management of the 2002 Winter Olympics in Salt Lake City.

http://www.thenation.com/blog/168975/romney-goes-gold-londons-libor-village#

-------------------------------

Meanwhile at the charitable mezzanine level:

Mezzanine financings can be completed through a variety of different structures based on the specific objectives of the transaction and the existing capital structure in place at the company. The basic forms used in most mezzanine financings are subordinated notes and preferred stock. Mezzanine lenders, typically specialist mezzanine investment funds, look for a certain rate of return which can come from (each individual security can be made up of any of the following or a combination thereof):

Mezzanine lenders will also often charge an arrangement fee, payable upfront at the closing of the transaction. Arrangement fees contribute the least return and are aimed primarily to cover administrative costs and as an incentive to complete the transaction.

http://en.wikipedia.org/wiki/Mezzanine_capital

trust me...

The more Americans mistrust politics, the news media, business and virtually every other major institution, the more demand there is for the documents, the proof, the evidence we need to get to the “real truth.”

But we never quite get there.

Does anyone believe that questions about Mitt Romney’s wealth and his ability to connect with middle-class voters would somehow be settled if he released a raft of tax returns in addition to his 2010 return, which showed taxes of $3 million paid on income of $21.6 million? Conversely, would those disclosures really damage the Republican presidential candidate more than the video of his car elevator, stories about his wife’s horses, or his awkward remarks about firing people and making $10,000 bets?

For many months, President Obama resisted releasing his birth certificate to prove that he was born in this country. When he finally did so last year, many Americans who had been skeptical of the president’s origins had their doubts allayed: In a Washington Post poll, the portion of Americans who said they believed that Obama was born in Hawaii jumped to 70 percent, compared with 48 percent in 2010. Among Republicans, the share who said Obama was not born in the United States fell from 31 percent in 2010 to 14 percent.

http://www.washingtonpost.com/opinions/romneys-tax-returns-obamas-birth-certificate-and-the-end-of-trust/2012/07/20/gJQA2eZbyW_print.html

rigging the votes in the USA...

Suppose Mitt Romney ekes out a victory in November by a margin smaller than the number of young and minority voters who couldn’t cast ballots because the photo-identification laws enacted by Republican governors and legislators kept them from the polls. What should Democrats do then? What would Republicans do? And how would other nations respond?

As suppositions go, this one isn’t actually far-fetched. No one in the Romney camp expects a blowout; if he does prevail, every poll suggests it will be by the skin of his teeth. Numerous states under Republican control have passed strict voter identification laws. Pennsylvania, Texas, Indiana, Kansas, Tennessee and Georgia require specific kinds of ID; the laws in Michigan, Florida, South Dakota, Idaho and Louisiana are only slightly more flexible. Wisconsin’s law was struck down by a state court.

Instances of voter fraud are almost nonexistent, but the right-wing media’s harping on the issue has given Republican politicians cover to push these laws through statehouse after statehouse. The laws’ intent, however, is entirely political: By creating restrictions that disproportionately impact minorities, they’re supposed to bolster Republican prospects. Ticking off Republican achievements in Pennsylvania’s House of Representatives, their legislative leader, Mike Turzai, extolled in a talk last month that “voter ID . . . is gonna allow Governor Romney to win the state of Pennsylvania.”

How could Turzai be so sure? The Pennsylvania Department of State acknowledges that as many as 759,000 residents lack the proper ID. That’s 9.2 percent of registered voters, but the figure rises to 18 percent in heavily black Philadelphia. The law also requires that the photo IDs have expiration dates, which many student IDs do not.

The pattern is similar in every state that has enacted these restrictions. Attorney General Eric Holder has said that 8 percent of whites in Texas lack the kind of identification required by that state’s law; the percentage among blacks is three times that. The Justice Department has filed suit against Southern states whose election procedures are covered by the 1965 Voting Rights Act. It is also investigating Pennsylvania’s law, though that state is not subject to some provisions of the Voting Rights Act.

http://www.washingtonpost.com/opinions/harold-meyerson-gops-voter-id-tactics-could-undermine-a-romney-win/2012/07/24/gJQAKQcZ7W_print.html

asset raiders?...

Virgin Australia's administrator Deloitte says it has agreed to sell the bankrupt airline to American private equity giant Bain Capital, after rival bidder Cyrus Capital Partners withdrew its rescue offer.

Cyrus - which was a founding investor alongside Richard Branson in Virgin America - said on Friday morning that it was pulling out of the sale "due to lack of engagement" by Deloitte.

Deloitte said in a following statement that it had entered into a sale and implementation deed with Bain which - subject to approvals including a vote of creditors in August - will result in the sale and recapitalisation of Virgin.

"Bain Capital has presented a strong and compelling bid for the business that will secure the future of Australia’s second airline, thousands of employees and their families and ensure Australia continues to enjoy the benefits of a competitive aviation sector," joint administrator Vaughan Strawbridge said in a statement.

Read more:

https://www.smh.com.au/business/companies/bain-set-to-buy-virgin-australia-after-cyrus-withdraws-bid-20200626-p556d3.html

Read from top...