Search

Recent comments

- stenography.....

11 hours 27 min ago - black....

11 hours 25 min ago - concessions.....

12 hours 27 min ago - starmerring....

16 hours 32 min ago - unreal estates....

20 hours 18 min ago - nuke tests....

20 hours 22 min ago - negotiations....

20 hours 25 min ago - struth....

1 day 10 hours ago - earth....

1 day 10 hours ago - sordid....

1 day 11 hours ago

Democracy Links

Member's Off-site Blogs

a life on credit...

The income tests for Family Tax Benefits A and B, which cost $20 billion a year according to the budget papers, are far too high, which also results in the Schoolkids Bonus and the Baby Bonus also being poorly targeted as safety net measures.

Childcare fee assistance costs $4.4 billion a year, parents' income support $5.3 billion, higher education support $7 billion, private health insurance subsidies cost $4.5 billion, and the first home owners' grant costs $270 million (and does nothing but push house prices up).

Better means testing of welfare and health services would save billions. In addition, the Federal Health Department employs around 5,000 people: what on earth do they all do, if health services are supplied by the states?

The disability support pension currently costs $14.8 billion a year. To this the ALP proposes to add an NDIS, to be called DisabilityCare, at a cost of $8 billion, partly offset by a 0.5 per cent addition to the Medicare levy, which will raise $3.2 billion. It's possible, but so far unstated, that the rest of the NDIS will be funded by a reduction in the current disability support pension. If so, that will probably remain unstated - a quiet double shuffle.

Stephen Anthony of Macroeconomics says about $8 billion per year is spent on procurement of capital equipment and buildings. "We understand that none of these contracts include explicit economic incentives which allow the contactors to benefit if they save money for the Australian Government. Why not use contract incentives?"

Irrigation infrastructure and water buy-backs will cost $4.5 billion in 2014-15. These are just handouts to irrigators: there is no requirement for cost recovery.

And so on. What's really needed is a spring clean for the public finances, which usually requires a change of government.

http://www.abc.net.au/news/2013-05-01/kohler-budget-problems/4662224

----------------------------

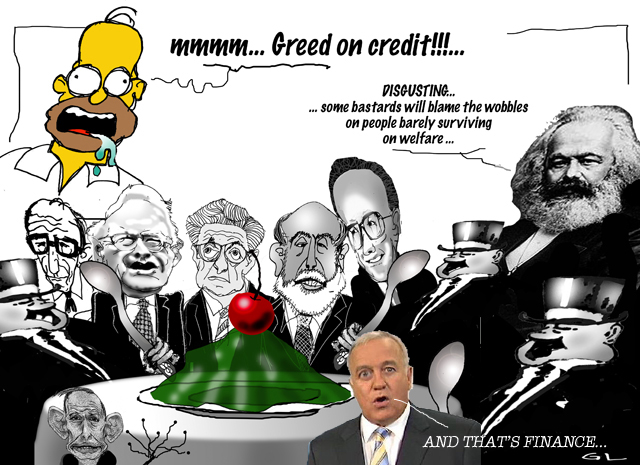

I disagree with Kohler and I am not the only one... For example tax breaks for the rich, including negative gearing, tend to cost far more to the public purse than having to spend a few pretty pennies on helping "useless" people... As well, tax minimisation with a head office in the Bahamas and bordering on tax evasion is costing the country far more than welfare. At that point, the Liberal (conservative) stance usually is that the people on welfare are leeches, of course... These people provide nothing while the rich provide the trickle...

In fact, the trickle is no more than a tap-drip compared to the flow of capital from the poor people towards the rich. Don't get me wrong, the conservatives don't mind helping the people in distress but they do it mostly from a charitable base... with a discreet placard that says "I am charitable and it's tax deductible"...

Here again nothing wrong with this, but often many needy people miss out because they are not in the charitable loop and the charity is "targeted"... This happens because some poor people still have some pride, or are totally oblivious to what's happening around them, and sometimes less needed people have taken their spot at the table...

But I suppose, many people think that no one deserves more hand outs than the rich geezers, to bail out their banks and tax deduction to provide the trickle

... No matter what, we're screwed, should the conservative get their hands on capitalism.

- By Gus Leonisky at 1 May 2013 - 2:20pm

- Gus Leonisky's blog

- Login or register to post comments

trephination sounds nice...

AUSTRALIA’S PRIME MINISTER has just delivered an earnest speech similar to that of most of her counterparts around the globe. Though with notably brighter news.

Today’s economic challenges are worldwide. The downturn is continuing. Profits are being squeezed, job opportunities are declining and wages are not rising. Hence government tax revenues are diminishing. Grim remedies are required.

The U.S. president told his nation this in February:

“Most Americans – Democrats, Republicans, and Independents – understand that we can’t just cut our way to prosperity. They know that broad-based economic growth requires a balanced approach to deficit reduction, with spending cuts and revenue, and with everybody doing their fair share. And that’s the approach I offer tonight.”

Prime Minister David Cameron admonished the Brits in March:

“There are some people who think we don’t have to take all these tough decisions to deal with our debts. They say that our focus on deficit reduction is damaging growth, and what we need to do is to spend more and borrow more. It’s as if they think there’s some magic money tree. Well let me tell you a plain truth: there isn’t.”

François Hollande addressed the French two weeks ago:

“What I want is genuine budget discipline, essential to reducing indebtedness in the medium term. Unless there’s a commitment in terms of public accounts, there will be no return to confidence and therefore growth. It all goes together.”

Many Australian commentators seem unaware of several highly significant realities.

1. Australia handled the initial impact of the global financial crisis in 2009-10 better than any nation bar none. No other government responded to the first shocks with the same mix of cash handouts and rapid infrastructure spending. Poland came close. No other nation avoided recession, widespread job losses and cuts to services and benefits. Poland came second.

The Gillard Government appears to be responding appropriately now.

2. Australia is clearly better off now than anywhere else in the world. On all economic indicators Australia is streets ahead of whoever is second. Some claim this is Switzerland, others Canada. Norway and Israel are sometimes mentioned also. None has anywhere near Australia’s sustained growth, strong productivity, strong currency, excellent economic freedom, low inflation, low unemployment, low debt, and well-placed interest rates, pension levels and superannuation.

3. Australia is also better off than at any time in its history. Yes, there have been brief periods of more rapid growth or lower deficits. But never before top ranking in the world on all the major indicators.

http://www.independentaustralia.net/2013/politics/debt-and-deficit-downunder-dont-be-so-damned-depressed/

Last night on the whatever ABC programme, Peter Costello was giving his two bobs worth of advice... The last man to get a financial advice from, I'd say... He complained that the price of whatever ore was not as high as that of today so he could not save more bikkies... So he was let to rabbit on about his credentials of having made a measly surplus of 45 billions since he did not spend any money on infrastructure... I say measly because he did not have to endure an economic rat-baggery like the GFC, as Alan Kohler has the grace to acknowledge:

It was Labor's misfortune to first win office 24 days after the stock market peaked in 2007 and then to just win again three years later as the 10-year commodity price boom was coming to an end.

That's life: you don't always get to choose your moment and it's true that some elections are good ones to lose.

The timing of Kevin Rudd's moment in 2007 and Julia Gillard's in 2010 means that the number 200,000,000,000 will be hung around the party's neck like a dead albatross for a generation. That's the aggregate budget deficit that will have been incurred by the ALP between 2007 and 2013. It's an unhappily round number.

That last comment is as useful as a dead monkey to an organ grinder...

Don't let Tony Abbott in charge of this caper...

He is an idiot on most issues, especially climate change (global warming) which should be mentioned as we're now in May, and there is a late cyclone approaching Cape York... and if I trust the gauge on my chariot, the temperature is a balmy 26 in Sydney...

you say millions, I say trillions...

Banks Resist Strict Controls of Foreign Bets

By ERIC LIPTONWASHINGTON — Wall Street bankers and some of the world’s top finance ministers are waging a bitter international campaign to block Washington financial regulators from extending their policing powers far beyond the nation’s shores.

The effort — centered on oversight of the $700 trillion marketplace of the financial instruments known as derivatives — is just one front in the battle still being waged nearly three years after Congress passed the Dodd-Frank law, which revamped financial regulations in the United States in hopes of curtailing the risky trading practices blamed for the global financial crisis in 2008.

Industry players have spent tens of millions of dollars to avert, delay or weaken new rules that are being drafted as part of the law. Members of Congress from both parties have joined in the effort, directed at an obscure but increasingly powerful agency, the Commodity Futures Trading Commission, which has written and must approve some of the most contentious provisions.

Banks and overseas regulators are resisting an agency proposal, intended to go into full effect as early as mid-July, that would require overseas offices of American-based banks, foreign institutions and hedge funds to turn over information on foreign trades if they involve United States customers, or are guaranteed by a financial institution with American ties, requirements that the industry calls redundant and excessive.

The battle — led by high-powered lawyers and lobbyists, including former top regulators and Congressional staff members, like a former aide to retired Representative Barney Frank, a chief author of the law — has played out in hundreds of meetings with Gary Gensler, the chairman of the commission, other commission members and major players on Capitol Hill.

It has divided Democrats in Congress, caused strains in the commission and provoked public charges by industry officials that Mr. Gensler is overreaching his authority and private complaints that he is “reckless” and “stubborn.”

A former investment banker, Mr. Gensler defends his proposals, arguing that too many bad bets in the global derivatives market can be traced to overseas locations — including the $6 billion loss last year by a JPMorgan Chase trader called the London Whale — and threatened markets in the United States.

http://www.nytimes.com/2013/05/01/business/banks-criticize-strict-controls-for-foreign-bets.html?hp&_r=0&pagewanted=print

In some articles, I might have overstated the value of the derivatives betting market by a factor of two... I placed the derivatives market at US$1500 trillions but this article states it as US$700 trillions... (World GDP around US$80 trillions). One problem here is most of these derivatives are "secret' business and to know the full value of this market is difficult. I am prepared to accept it's still between US$1000 and US$1300 trillions... Definitely more than 700 trillions...

not walking backwards, hopefully...

INDEPENDENT MP Tony Windsor has called on Prime Minister Julia Gillard to bring on a vote for legislation for a levy to fund a national disability insurance scheme.

Ms Gillard announced a policy reversal on Wednesday to impose a 0.5 percentage point rise in the Medicare levy to fund DisabilityCare Australia and said she would take the plan to the election.

The levy increase to two per cent would cost the average wage earner about $1 a day and go into a special fund that would collect about $20 billion by the time the disability scheme is fully operational in 2018/19.

Key independent Mr Windsor said Ms Gillard should just get on with passing legislation for the levy, regardless of the coalition's position.

"I'd say to both of them... let's get on with it," Mr Windsor told ABC Radio on Thursday.

"If this gets voted down in parliament, I'll walk out backwards."

Read more: http://www.news.com.au/breaking-news/national/bring-on-ndis-levy-vote-windsor/story-e6frfku9-1226633548942#ixzz2S51LACA4

I had not noticed "a policy reversal"... I had understood that all funding options were on the table and the funding through medicare is one of them — but then I am in favour of the NIDS so I did not pay attention to the "various" funding proposals. I know some Liberals (conservatives) who would prefer funding through charity at fund-raising dinners rather than a "socialist" impost, but I also know some Conservatives (Liberals) who support the NIDS.

Hopefully, Windsor won't have to walk backward out of wherever...

backwards shopping...

Retail giant Myer is experiencing a customer backlash to comments by the company's chief about the national disability insurance scheme.

Yesterday, Myer's chief executive, Bernie Brookes, told a Sydney conference that the levy proposed to fund the scheme was not good for customers and not good for the discretionary income world.

Mr Brookes said the extra half a percentage point increase in the Medicare levy would take money from households that might otherwise be spent in Myer's stores.

http://www.abc.net.au/news/2013-05-02/myer-faces-backlash-over-ndis-comments/4664668

Meanwhile at the turkey factory...

A US jury has awarded $240m (£203m) to 32 mentally disabled men who suffered decades of abuse while working at a turkey processing company in Iowa.

Jurors in Davenport heard how the men had been kicked, verbally abused and denied toilet breaks by their employers from Henry's Turkey Service.

One expert said the disabled workers - who were each paid only $65 per month - had been "virtually enslaved".

The verdict is in addition to $1.3m in back wages awarded to the men in 2012.

'Great emotion'On Wednesday, the jury determined that the now-defunct Henry's Turkey Service had violated the Americans with Disabilities Act.

It said the company had created a hostile environment and discriminating conditions of employment for the men, who had learning difficulties and worked at the West Liberty plant under the company's oversight since the 1970s.

The award gives each worker $7.5m in compensation.

The authorities say they will now seek to recover the award from the remaining assets of the liquidated firm.

http://www.bbc.co.uk/news/world-us-canada-22376860

meanwhile at business fiddle co...

A Treasury issues paper to be released today by the Assistant Treasurer, David Bradbury, has examined the evidence on tax avoidance by multinational companies operating in Australia.

In the new global economy, it is easier than ever for big companies to avoid tax by shifting their profits to low tax countries.

According to Treasury's analysis, the proportion of profit that companies pay to the federal government is as low today as it was during the 1990s recession.

According to Treasury: "In comparison with other countries, Australia's corporate tax collections have fallen by more and recovered by less since the onset of the GFC."

Read more: http://www.news.com.au/money/money-matters/rich-get-richer-poor-pay-their-taxes/story-e6frfmd9-1226634224506#ixzz2SDBkli1Z

In the long run we are all dead...

British historian Niall Ferguson has apologised for remarks he made suggesting economist John Maynard Keynes did not care about future generations because he was gay and childless.

The academic and author, who is a professor at Harvard University, described his comments at a conference in California last Thursday as "stupid" and said they had been made in an "off-the-cuff" manner following a presentation.

He said he was asked about Keynes' famous observation: "In the long run we are all dead."

A blogger present posted a transcript on the remarks, while other attendees also voiced surprise.

"Keynes was a homosexual and had no intention of having children. We are not dead in the long run, our children are our progeny," Ferguson was quoted as saying by blogger Lance Reports on his StreetTalk Live website.

I should not have suggested... that Keynes was indifferent to the long run because he had no children, nor that he had no children because he was gay.

Niall Ferguson"It is the economic ideals of Keynes that have gotten us into the problems of today," Ferguson added.

"Short term fixes, with a neglect of the long run, leads to the continuous cycles of booms and busts."

In an apology posted on his own blog, Ferguson said: "I should not have suggested... that Keynes was indifferent to the long run because he had no children, nor that he had no children because he was gay.

http://www.abc.net.au/news/2013-05-05/british-historian-sorry-over-anti-gay-remarks-in-us/4670158

-----------------------------

John Maynard Keynes, 1st Baron Keynes,[1] CB, FBA (pron.: /ˈkeɪnz/ kaynz; 5 June 1883 – 21 April 1946) was a British economist whose ideas have fundamentally affected the theory and practice of modernmacroeconomics, and informed the economic policies of governments. He built on and greatly refined earlier work on the causes of business cycles, and is widely considered to be one of the founders of modern macroeconomics and the most influential economist of the 20th century.[2][3][4][5] His ideas are the basis for the school of thought known as Keynesian economics, as well as its various offshoots. In many ways, subsequent developments in 20th century economics can be viewed as either building on Keynes' ideas or reacting against them.

In the 1930s, Keynes spearheaded a revolution in economic thinking, overturning the older ideas ofneoclassical economics that held that free markets would, in the short to medium term, automatically provide full employment, as long as workers were flexible in their wage demands. Keynes instead argued that aggregate demand determined the overall level of economic activity, and that inadequate aggregate demand could lead to prolonged periods of high unemployment. He advocated the use of fiscal andmonetary measures to mitigate the adverse effects of economic recessions and depressions. Following the outbreak of the Second World War, Keynes's ideas concerning economic policy were adopted by leading Western economies.

http://en.wikipedia.org/wiki/John_Maynard_Keynes

-----------------------------------------

One of the major factor that has been missing from all economic models is the ENVIRONMENT. As humans become more and more numerous, like rats in sewer pipes, humans encroach on the natural environment in ways never experienced before by humans. By its demand on resources, food and space plus its waste products, humanity is changing the surface of the planet. This leads to subterranean distortions not yet appearing in any economic models — except on the margins such as carbon pricing, ETS, "game" parks and "national Parks"... But overall, the present economic equations are hell-bend towards the modification of the planet — towards "irreversible" (within about 10 to 20 generations) dire consequences.

A couple of decade or so ago, we had the ozone layer depletion. Few people would have argued against the necessity of doing something quick worldwide...

Now, a different threat is looming. Global warming. But the source of this warming is ourselves and this warming is not as obvious as getting cancer because the O3 layer has gone. Should the global warming be "obvious" to us, mere mortals, the planet would be "cooked" within five years... The process is slow and full of feedback and slow-back mechanisms... That we are not paying attention to this slow process (fast in geological timelines) is at our future generations' peril...

In the times of Keynes, his views were to help stabilise societies against the booms and busts of "market" forces... Some economic experts have defined that booms and busts are beneficial to development of economies, but as economies become more advanced, booms and busts are detrimental to stability and people suffer. This has been the case of the last bust — the so-called GFC — that is still troubling many economies in the developed world...

On the same subject, Joe Hockey, a while back, wrote a paper on "no more handouts" or whatever he calls welfare... This morning he was quizzed by Andrew Bolt about the contradiction contained in his paper and Tony Abbott acquiescing to Julia's disability welfare scheme... Of course, a thinner but still lying Joe fumbled through his answers selling us the idea that the conservatives (his Liberals) would manage the scheme better than Labor — to which Andrew skilfully added amongst the disabled, the drug addicts, the bad-backers and those we hate to see getting a hand-out because they don't do cocaine the way we snort it...

Meanwhile Joe was using the Singapore model as a base for his paper of "no favours to the poor"... Singapore is a totalitarian government with phoney elections from time to time... Meanwhile at the moment as the rich get richer in Singapore, the poor are getting poorer and a level of resentment is starting to brew despite bans on "unrests"...

Not giving global warming and general protection of the environment the attention they deserve in our economic models, will give humans a few headaches sooner than we think. Australia being in the firing line...

The economic fiction literature...

The economic literature is full of excellent articles that are not read outside small academic circles. There are, however, important exceptions. “Growth in a Time of Debt”, by Carmen R. Reinhart and Kenneth S. Rogoff, published in the American Economic Review (Papers and Proceedings), May 2010, is one of these exceptions.

Technically speaking, the paper is not particularly sophisticated. But it conveys a strong message: high public debt levels reduce economic growth. To prove this point, Reinhart and Rogoff looked at historical data for 20 advanced economies. They found that “median growth rates for countries with public debt over roughly 90% of GDP are about one percent lower than otherwise”.

Policymakers, especially in Europe, have often quoted the work of Reinhart and Rogoff to provide an intellectual foundation to the fiscal austerity policies that they have used to try to address the ongoing Eurozone crisis.

But just a few days ago, this powerful intellectual structure cracked.

FormulagateLast week, Thomas Herndon, Michael Ash, and Robert Pollin published a working paper that casts serious doubts on the validity of Reinhart’s and Rogoff’s analysis.

Herdon, Ash, and Pollin argue that the results of Reinhart and Rogoff heavily depend on some unorthodox methodological choices. Even more importantly, they uncovered an error in one of the Excel formulas used by Reinhart and Rogoff to compute averages of public debt and growth across countries.

Once more orthodox methodological choices are applied and the coding errors removed, Herdon, Ash and Pollin obtain results that look quite different from those reported by Reinhart and Rogoff.

http://www.independentaustralia.net/2013/politics/the-economists-error-and-the-misguided-push-for-austerity/

The analysis critical of the Reinhart and Rogoff paper was mentioned on this site a few days ago BUT... PLEASE PAY ATTENTION TO THE ENVIRONMENT.... (see comment above)...

fiscal cynicism...

Hmm. Between World War II and 1980, every US president left the debt ratio lower when he left office than when he entered. Reagan/Bush I broke that pattern; Clinton brought it back; then came Bush II. And yes, debt is up under Obama, but a depressed economy in a liquidity trap is precisely when you’re supposed to do that.

So the story isn’t “irresponsible politicians will always squander the good years”; it is “conservative Republican politicians run up debt even in good years, because they want to force cuts in social programs.” Kind of a different story, isn’t it?

The point, then, is that the seemingly worldly-wide cynicism that seems to be the last defense against the economically obvious is in fact based on an imaginary history that looks nothing like what actually happened.

http://krugman.blogs.nytimes.com/2013/05/05/naive-fiscal-cynicism/

Of course when reading "Republicans" in this article, substitute "conservatives" (Australian Liberals)... In a way, I would say that "our" (Australian) conservatives are less cynical but far more moronic and hypocritical about the price of fish... Hum... if we multiply moronic and hypocritical the result is clueless cynicism... For example, Joe Hockey's answers on "Bolt" were typical figments of clueless cynicism... while Andrew Bolt king-hit him with a kiss on the cheek...

capitalism in the hands of conservatives is dangerous...

However, if Abbott avoided the risk of being cast as a kicker of cripples, some of his fellow conservatives were less wary. A couple of weeks earlier a Liberal Party strategist named Toby Ralph had published a piece in which he averred that the real cure for the economy could be found not, as Craig Emerson had suggested, by a slight increase on the superannuation of the fabulously rich, but by a judicious cull of the enormously poor.

"In contrast to the fabulously rich, the enormously poor make little useful contribution to society," Mr Ralph wrote. "They consume more than they contribute, putting tremendous strain on the national budget. A modest cull would strike at the root of our fiscal dilemma. This bold initiative would rid us of indolent students, hapless single mums, lower-order drug dealers, social workers, performance artists, Greenpeace supporters and the remaining processing personnel in our collapsing yet heavily subsidised manufacturing industries."

He was, of course, joking; this was a satire in the vein of Jonathan Swift's 1792 Modest Proposal that the poor of Ireland avert the famine by selling their children as food for the rich. Swift was actually pleading for relief for the poor, while Ralph was simply taking a callous free kick, but at least he wasn't serious.

However, the CEO of Myer, Bernie Brookes, was totally sincere when he deplored the levy as a bad idea because it meant that people would be handing over their dollar-a-day to the government instead of spending it productively in his stores. Yes, really. And in response to the inevitable backlash, Brookes was only prepared to say that he was sorry if he had offended anybody; he did not resile from a single brutal word. Truly, this is capitalism red in tooth and claw.

But perhaps we should not have been surprised. The other big news of the week was that Westpac, the last of the big four banks, had announced its final profit, and, as always, it was another all-time record. The banks' economic model dictates that this has to be the case every year: not just a massive profit but an all-time record profit. And if that means raising fees, cutting services and sacking staff, well, so be it. That's what they call economic rationalism.

http://www.abc.net.au/unleashed/4671752.html

See also : http://www.yourdemocracy.net.au/drupal/node/26454#comment-27476

jealousy amongst greeders...

'I never did anything for money. I never set money as a goal. It was a result." So says Bob Diamond, formerly the chief executive of Barclays. In doing so Diamond lays waste to the justification that his bank and others (and their innumerable apologists in government and the media) have advanced for surreal levels of remuneration – to incentivise hard work and talent. Prestige, power, a sense of purpose: for them, these are incentives enough.

Others of his class – Bernie Ecclestone and Jeroen van der Veer (the former chief executive of Shell), for example – say the same. The capture by the executive class of so much wealth performs no useful function. What the very rich appear to value is relative income. If executives were all paid 5% of current levels, the competition between them (a questionable virtue anyway) would be no less fierce. As the immensely rich HL Hunt commented several decades ago: "Money is just a way of keeping score."

The desire for advancement along this scale appears to be insatiable. In March Forbes magazine published an article about Prince Alwaleed, who, like other Saudi princes, doubtless owes his fortune to nothing more than hard work and enterprise. According to one of the prince's former employees, the Forbes magazine global rich list "is how he wants the world to judge his success or his stature".

The result is "a quarter-century of intermittent lobbying, cajoling and threatening when it comes to his net worth listing". In 2006, the researcher responsible for calculating his wealth writes, "when Forbes estimated that the prince was actually worth $7 billion less than he said he was, he called me at home the day after the list was released, sounding nearly in tears. 'What do you want?' he pleaded, offering up his private banker in Switzerland. 'Tell me what you need.'"

Never mind that he has his own 747, in which he sits on a throne during flights. Never mind that his "main palace" has 420 rooms. Never mind that he possesses his own private amusement park and zoo – and, he claims, $700m worth of jewels. Never mind that he's the richest man in the Arab world, valued by Forbes at $20bn, and has watched his wealth increase by $2bn in the past year. None of this is enough. There is no place of arrival, no happy landing, even in a private jumbo jet. The politics of envy are never keener than among the very rich.

http://www.guardian.co.uk/commentisfree/2013/may/06/politics-envy-keenest-rich

Meanwhile at struggle tax evasion street:

If you earn enough money, paying tax can be optional. Tax Office data reveals that 70 Australians with incomes of more than $1 million each in 2010-11 paid no income tax.

The statistics released last week show that the 70 earned $194 million among them but by the time their accountants had finished, that had been cut to less than $20,000 in taxable income, or $1 of taxable income for every $9999 that went untaxed.

Only 30 of them claimed deductions for tax advice but between them, they paid their accountants and lawyers $33 million, or more than $1 million each.

Since their average declared income was less than $3 million, and no one in their right mind gives a third of their income to their accountant, that implies their real earnings were much higher than $3 million.

Most of their tax liability was wiped out by deducting tax losses from earlier years. In 2010-11, the 70 claimed $118 million in prior tax losses, and still had another $360 million left to carry over to use in future years.

The cost of tax advice was their second biggest deduction. Only 20 claimed deductions for charitable giving, but they claimed $1 million each. Between them, they claimed $26 million in deductions for interest bills.

Read more: http://www.smh.com.au/opinion/political-news/the-70-mega-rich-who-dont-pay-tax-20130506-2j3ng.html#ixzz2SaxLc8oF