Search

Recent comments

- stenography.....

11 hours 29 min ago - black....

11 hours 27 min ago - concessions.....

12 hours 28 min ago - starmerring....

16 hours 33 min ago - unreal estates....

20 hours 20 min ago - nuke tests....

20 hours 23 min ago - negotiations....

20 hours 26 min ago - struth....

1 day 10 hours ago - earth....

1 day 10 hours ago - sordid....

1 day 11 hours ago

Democracy Links

Member's Off-site Blogs

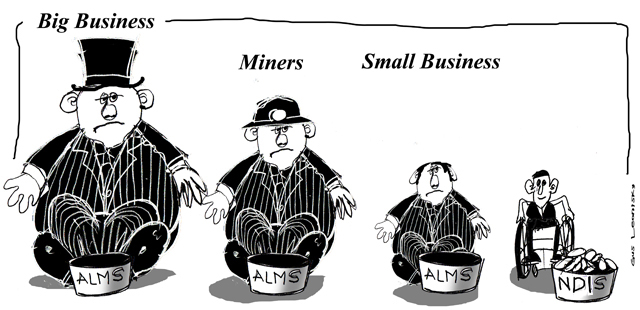

why I love this budget...

In dollar terms this fall means that last year Wayne Swan was budgeting for an extra $56.8 billion in revenue over the four years to 2015-16 than he is now.

Why did that not come through?

Part of it is the MRRT. Last year the Government expected to receive $7.1 billion in resource rent taxes, and $8.2b in 2013-14. Now they're expecting just $1.7 billion this year and $3.1 billion next year. But there was also a drop in the expected amount of individual income tax of $3 billion and a jaw dropping $6 billion less in company tax.

Mostly this came down to a fall in the expected growth in nominal GDP.

For all the criticism of last year's budget having outlandish predictions, they weren't too bad.

It predicted Real GDP growth of 3.25 per cent and it came in at 3 per cent. It predicted an unemployment rate of 5.5 per cent - and the average through 2012-13 was actually a touch lower.

But the big miscalculation was on nominal GDP (ie GDP in current dollars). Last year it was expected to rise by 5 per cent, instead it came in at a near-recession-like 3.25 per cent. This figure flowed through into assessments of tax revenue and was also affected by the terms of trade falling by 7.5 per cent instead of an expected fall of 5.75 per cent.

Ironically, low inflation - normally something a treasurer would like - hurt the budget.

And this brings us to the predictions. Overall the revenue predictions are below average, but they are based on Treasury's estimate of nominal GDP recovering to around 5.25 per cent over the next four years. This remains well below the 20-years average, but part of this rests on an assumption that our terms of trade will only fall by 0.75 per cent this coming year and 1.75 per cent in 2014-15. That is rather optimistic given last week the RBA noted, "with large increases in the global supply of bulk commodities still in train, the terms of trade are expected to resume their decline from their current very high level".

- By Gus Leonisky at 15 May 2013 - 8:39pm

- Gus Leonisky's blog

- Login or register to post comments

budget hole across the pacific...

Meanwhile in America, the deficit is near the size of the Australian government entire budget and could have been worse...:

CBO sees brighter economy with budget deficit to plunge to $642 billion this year

By Lori Montgomery, Wednesday, May 15, 5:30 AMThe budget deals of the past two years and a recovering economy are rapidly mopping up the tide of red ink that swept over Washington after the 2007 recession.

After four years of budget deficits in excess of $1 trillion, the nonpartisan Congressional Budget Office forecast Tuesday that this year’s deficit will plummet to $642 billion, or 4 percent of the nation’s total economic output.

That’s $200 billion lower than the CBO forecast in February. Analysts attributed the sunnier outlook to higher-than-expected tax revenue and about $95 billion in higher payments from mortgage giants Fannie Mae and Freddie Mac, which are profiting from a recovering housing market.

The forecast puts the nation on track for its smallest deficit since 2008, before the recession hit in full force. And the CBO predicts that the gap between revenue and spending will continue to shrink through 2015, when it will fall to just over 2 percent of the economy — well within the bounds of what economists consider to be economically sustainable.

http://www.washingtonpost.com/business/economy/cbo-budget-deficit-to-plunge-to-642b-this-year-lower-than-expected/2013/05/14/e46112fe-bccb-11e2-97d4-a479289a31f9_print.html

opportunity knocks....

meanwhile the pope....

Pope Francis has called on world leaders to end the "cult of money" and to do more for the poor, in his first major speech on the financial crisis.

Free market economics had created a tyranny, in which people were valued only by their ability to consume, the pontiff told diplomats in the Vatican.

"Money has to serve, not to rule," he said, urging ethical financial reforms.

Meanwhile, the Vatican's own bank announced it would publish its annual report for the first time.

The Institute for Works of Religion, which has been at the centre of various financial scandals in recent years, is to hire an external accountancy firm to ensure it meets international standards against money laundering.

The bank would launch a website and publish its annual report in an effort to increase transparency, new president Ernst Freyberg said.

The institute is considered one of the world's most secretive banks.

'Golden calf'Pope Francis said life had become worse for people in both rich and poor countries, the BBC's David Willey in Rome reports.

In a biblical reference, the pontiff said the "worship of the golden calf" of old had found a new and heartless image in the current cult of money.

He added that reforms were urgently needed as poverty was becoming more and more evident.

People struggled to live, and frequently in an undignified way, under the dictatorship of an economy which lacked any real human goal, Pope Francis said.

http://www.bbc.co.uk/news/world-europe-22551125