Search

Recent comments

- EU gas storage....

48 min 26 sec ago - wrong trousers....

1 hour 44 sec ago - failure.....

1 hour 21 min ago - remembering....

3 hours 14 min ago - wrong target....

12 hours 32 min ago - aerosols....

12 hours 51 min ago - middle powers....

13 hours 12 min ago - disgraceful....

14 hours 11 min ago - bets on war....

14 hours 37 min ago - graham's crap....

17 hours 35 min ago

Democracy Links

Member's Off-site Blogs

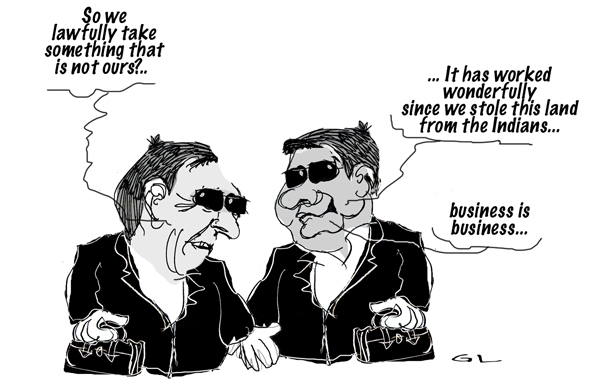

small debt slavery in the USA... a subprime debacle in the making... or how to rob the poor using the law... in broad daylight..

From the Washington Post

On the day Bennie Coleman lost his house, the day armed U.S. marshals came to his door and ordered him off the property, he slumped in a folding chair across the street and watched the vestiges of his 76 years hauled to the curb.

Movers carted out his easy chair, his clothes, his television. Next came the things that were closest to his heart: his Marine Corps medals and photographs of his dead wife, Martha. The duplex in Northeast Washington that Coleman bought with cash two decades earlier was emptied and shuttered. By sundown, he had nowhere to go.

All because he didn’t pay a $134 property tax bill.

The retired Marine sergeant lost his house on that summer day two years ago through a tax lien sale — an obscure program run by D.C. government that enlists private investors to help the city recover unpaid taxes.For decades, the District placed liens on properties when homeowners failed to pay their bills, then sold those liens at public auctions to mom-and-pop investors who drew a profit by charging owners interest on top of the tax debt until the money was repaid.

But under the watch of local leaders, the program has morphed into a predatory system of debt collection for well-financed, out-of-town companies that turned $500 delinquencies into $5,000 debts — then foreclosed on homes when families couldn’t pay, a Washington Post investigation found.

As the housing market soared, the investors scooped up liens in every corner of the city, then started charging homeowners thousands in legal fees and other costs that far exceeded their original tax bills, with rates for attorneys reaching $450 an hour.

How you could lose your home

Property owners in the District risk losing their homes over relatively small amounts in unpaid property taxes. Here’s a look at the process:

HOMES FOR THE TAKING:

LIENS, LOSS AND PROFITEERS — Part 1 of 3

COMING SOONPart 2 — As federal agents investigated a sweeping bid-rigging scheme at Maryland’s tax auctions, some of those same suspects were in the District, engaging in dozens of rounds of unusual bidding. Coming Monday.

Part 3 — District tax officials have made hundreds of mistakes in recent years by declaring property owners delinquent even after they paid their taxes, forcing them to fight for their homes. Coming Tuesday.

Read more:http://www.washingtonpost.com/sf/investigative/2013/09/08/left-with-nothing/?hpid=z1

- By Gus Leonisky at 8 Sep 2013 - 4:47pm

- Gus Leonisky's blog

- Login or register to post comments

idiotische Weltanschauung...

The art of the law is in the argument, not in the truth.

The art of religion is in the bigoted creed, not in reality.

The art of politics is to sell bigoted arguments.

Science is the exacting refinement

Of our interpretation of reality and truth.

Thus science is at the mercy of lying lawyers,

of idiotic weltanschauung priests

and of greedy political merchandising machines,

Though the earth and the universe don't care

As we're creating winter like summers

and summers like hell.

translated from a poem by Gunter Leonisky, Erderwärmung

police shooting of a very old senior...

107-year-old man killed in standoff when Arkansas SWAT officers say he shot at them in homeBy Associated Press, Updated: Monday, September 9, 12:49 AM

PINE BLUFF, Ark. — Police in the southeast Arkansas city of Pine Bluff say a 107-year-old man is dead after SWAT officers shot back at him during a standoff at a home.

Pine Bluff Lt. David Price tells KATV (http://bit.ly/17hlUlC ) that police officers called to the home Saturday were told Monroe Isadore had pointed a weapon at two people there.

http://www.washingtonpost.com/national/107-year-old-man-killed-in-standoff-when-arkansas-swat-officers-say-he-shot-at-them-in-home/2013/09/08/d120d366-1895-11e3-80ac-96205cacb45a_print.html

What?... Shooting a 107 year old man?... What is the world coming to?

repo terminator...

The firm that threatened to foreclose on hundreds of struggling D.C. homeowners is a mystery: It lists no owners, no local office, no Web site.

Aeon Financial is incorporated in Delaware, operates from mail-drop boxes in Chicago and is represented by a law firm with an address at a 7,200-square-foot estate on a mountainside near Vail, Colo.

Yet no other tax lien purchaser in the District has been more aggressive in recent years, buying the liens placed on properties when owners fell behind on their taxes, then charging families thousands in fees to save their homes from foreclosure.

Aeon has been accused by the city’s attorney general of predatory and unlawful practices and has been harshly criticized by local judges for overbilling. All along, the firm has remained shrouded in corporate secrecy as it pushed to foreclose on more than 700 houses in every ward of the District.

“Who the heck is Aeon?” said David Chung, a local lawyer who said he wasn’t notified that he owed $575 in back taxes on his Northwest Washington condominium until he received a notice from Aeon. “They said, ‘We bought the right to take over your property. If you want it back — pay us.’ ”

Aeon’s story underscores how an obscure tax lien company — backed by large banks and savvy lawyers — can move from city to city with little government scrutiny, taking in millions from distressed homeowners.

http://www.washingtonpost.com/sf/investigative/2013/12/08/debt-collecting-machine/

--------------------------

Repo terminator... That's Latin for machines that destroy your home...