Search

Recent comments

- war criminals.....

20 min 29 sec ago - aussieoil.....

1 hour 9 min ago - sobering....

1 hour 52 min ago - iran's....

3 hours 23 min ago - blind interceptors....

3 hours 42 min ago - ARTIFINTEL....

5 hours 22 min ago - don't mention it....

6 hours 21 min ago - fear godot....

6 hours 25 min ago - no regeem change....

7 hours 11 min ago - blind maddow....

7 hours 21 min ago

Democracy Links

Member's Off-site Blogs

Australians apprehensive about their economic future...

Developments this week should make many Australians apprehensive about their economic future. Alan Austin reports.

IT LOOKS HIGHLY LIKELY that lower middle and low income groups will take a pretty awful hit in next month’s Federal budget.

Incomes will almost certainly be driven down. And taxes will rise substantially. Probably including the regressive goods and services tax (GST).

Several recent events make this evident.

Firstly, Joe Hockey has started softening up the populace for hefty tax rises and cuts to services and benefits, impacting the disadvantaged.

In code for “hitting the poorest of the poor”, Hockey said on Tuesday:

“Everyone is going to have to make a contribution — big business, small business, all people from all demographics across the community.”Secondly, Treasury secretary Martin Parkinson issued warnings to the Sydney Institute on Wednesday. He revealed indirectly that he believes the recent period of effective economic management has ended. He seems resigned to the fact that the lacklustre efforts of the Howard years have returned under Abbott.

But he also offered significant signs of hope, beyond the dismal period Australians will experience in the short term.

Recent figures show that, at the end of 2013, Australia’s rate of expansion of gross domestic product (GDP) – that is, the measure of how strongly the economy is growing overall – was a healthy 2.8%.

That puts Australia in the top six wealthy developed economies; just behind Iceland, South Korea, Israel, Sweden and New Zealand — all countries with much smaller budgets and workforces to manage.

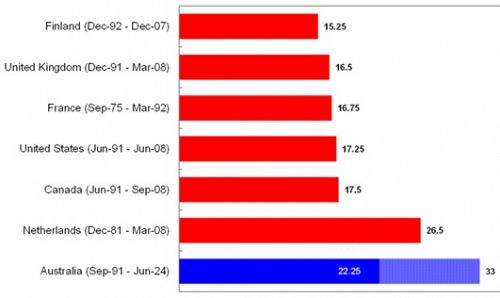

Dr Parkinson showed that, following reforms implemented by Paul Keating in the 1980s and 90s, Australia has had 22 years of continuous growth – alone in the world – and this is now projected to stretch to 33.

Chart 12: Years of continuous GDP growth

(Source: Haver Analytics and CEIC)

So, Australia’s economy after six years of Labor is travelling remarkably well and offers no grounds for Hockey or Abbott to accuse their predecessors of laying booby traps or other dastardly deeds.

So what are the challenges ahead? Dr Parkinson highlighted four:

- The resources boom is moving from the investment to the export phase. This offers fewer jobs.

- Australia’s productivity performance, although boosted from 2009 to 2012, remains too low and is projected to decline under the Coalition.

- Australia’s terms of trade – the price of exports relative to the price of imports, which reached record levels in 2011 – is now falling.

- The gap between the nation’s projected payments and its income – that is, the budget deficit – is unacceptably large and looks like staying high for a decade.

So what to do? The path to wisdom, always, is to ask: What would Paul Keating do?

Faced with the worst global downturn in 60 years, Wayne Swan asked this and got the answers pretty right. Peter Costello seldom needed to ask this because he was bequeathed an economy requiring no further fixing. Or, as Keating memorably put it, “Costello was hit in the arse by a rainbow”.

It appears the Abbott government is planning to reduce support for the disadvantaged, including the national disability service and increase both income taxes and the GST.

This week looked disturbingly like another 'inadvertent border incursion' situation.

In January, the Abbott cabinet was advised privately on Wednesday 15th that several naval vessels had violated Indonesia’s borders.

Immigration Minister Scott Morrison immediately called a press conference for that afternoon with the purpose of solemnly announcing, using Lieutenant-General Angus Campbell as spokesman, that

“... our activities and assets have never and will never violate the sovereign territory of another country.”Morrison then called another press conference two days later to admit that, to his profound dismay and astonishment, Australian ships had, in fact,

“... inadvertently entered Indonesian territorial waters on several occasions.”He was, of course, terribly sorry about it and had had no idea that could possible ever happen — his sincerity proven by his assurances just two days before.

On the GST increase, Joe Hockey's office said on Thursday:

“We are not changing the GST—full stop, end of story. Our position hasn’t changed.”Foreign minister Julie Bishop gave the same assurances to the ABC:

“We're not changing the GST … Our promise at the last election was that there'd be no increase to the GST and that remains our position.”Does that suggest there may soon be an inadvertent GST incursion?

We shall see.

So what would Keating do?

He would quite likely:

- Keep the GST where it is.

- Leave tax rates on low and middle income where they are.

- Maintain wages and conditions to keep domestic demand steady.

- Restore the mining tax, tweaked to make it effective as well fair.

- Restore the carbon tax, pretty much as it was;

- Reintroduce indexation of the petrol excise, which John Howard abolished.

- Reduce tax exemptions to the big mining companies.

- Increase capital gains tax.

- Abandon the paid parental scheme (PPS).

- Apply the targeted tax on companies mooted to pay for the PPS, but direct the proceeds to crucial infrastructure;

- Take back the $8.8 billion Hockey gave the Reserve Bank in October, in a tricky political ploy.

- Retain Medibank Private and other public assets, and apply the dividend stream to debt reduction. Asset sales do not affect the budget.

- Reduce superannuation tax concessions for the wealthy, as promised by Labor but un-promised by Abbott.

- Shift up, by one year, the age for superannuation and the aged pension.

- End, or at least tweak, negative gearing on investment housing.

- Encourage expansion of agriculture to meet predicted demand from Asia; and

- encourage high-value manufacturing to meet the same regional demand.

Keating would do these with consultation and persuasion and ensuring protection for the most vulnerable first and foremost.

He would explain Australia’s debt is not spiralling out of control and that expanding borrowings modestly at a time of low interest rates will have long-term benefits.

Australia still has the best economy in the world.

Australia’s prospects are extraordinarily bright, if things are well-managed.

Unfortunately for Australia, Joe Hockey is no Paul Keating.

- By Gus Leonisky at 5 Apr 2014 - 2:37pm

- Gus Leonisky's blog

- Login or register to post comments

saving Mordor ....

Yes, well .....

The hearts of citizens across the land must surely have been warmed by news of the unexpected rapprochement between treasury secretary Martin Parkinson & his political bosses in Mordor, as evidenced by his enthusiastic readiness to tout their ideological line & the eleventh hour delay in his departure from the scene of the crime.

Whilst the keeper of our nation’s numbers spruiked the dangers of not imposing an increase in taxes on ordinary Australians, whilst bemoaning our failure to be ever more productive, his views, like those of his masters, are those of a one-eyed Cyclops.

Lecturing from his lofty perch about our shortcomings on the productivity front, Martin was content to ignore our real success in that regard as evidenced by the record levels of profitability being achieved by the private sector.

At the same time, in commenting on the dangers of a decline in tax revenues, the government’s loyal servant had nothing to say about the fact that company income tax as a share of GDP has never been lower. He had nothing to say about the ‘free ride’ being enjoyed by the corporate sector, as evidenced by the fact that almost 60% of companies & 70% of mining companies pay no income tax at all, whilst hypocritically echoing the argument of Uncle Joe that ‘everyone must pull their weight’.

For my part, I’ll start listening to Martin Parkinson & his handlers the day they cancel the licences to pillage & steal that are freely handed-out to both foreign & local corporations, whilst ordinary Australians are expected to pay a whole lot more, receive a whole lot less & be grateful for the privilege!!