Search

Recent comments

- murdering kids....

30 min 34 sec ago - saving....

59 min 7 sec ago - a speech never made....

14 hours 30 min ago - wardonald...

16 hours 2 min ago - MAGA fools

1 day 1 hour ago - the ugliest excuse to go to war.....

1 day 11 hours ago - morons....

1 day 13 hours ago - idiots...

1 day 13 hours ago - no reason....

1 day 14 hours ago - ask claude...

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

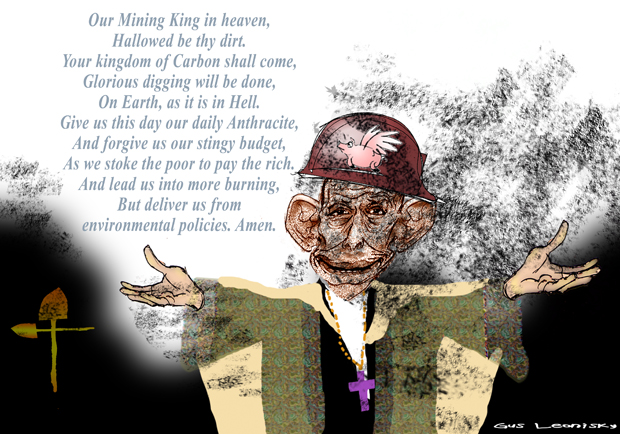

king coal con...

Tony Abbott might be our global coal ambassador but it appears he is increasingly out of step with the rest of the world, writes Mungo MacCallum.

Last week the world-renowned American environmentalist, Bill McKibben, declared that our Prime Minister now apparently saw his principal role in international affairs as the global ambassador of coal, his only real concern being to protect Australia's own coal industry.

The immediate cause of McKibben's description was the television image of Tony Abbott being presented with an over-sized Stetson hat by some of America's biggest oil barons, to which our man responded with a somewhat embarrassed "yee ha".

Now McKibben is himself a global ambassador against coal, which he regards as the dirtiest and most polluting of all fuels, and the greatest driver of climate change: he is hardly an impartial observer. But he has a point. In Texas Abbott spruiked the need to prevent the ostracising of any particular fuel source and earlier in Canada he had warned that we should not clobber the economy in order to reduce emissions and combat climate change.

So it is clear that he sees the environment and the economy as fundamentally opposed, with the economy being paramount. The idea that both can be developed in harmony is dismissed as wishful thinking, a fanciful utopia. This approach is totally consistent with Abbott's goodies versus baddies view of the world, but it is increasingly being left behind by his more sophisticated global peers, and not just the political ones.

Last week the GetUp organisation announced triumphantly that four major financial institutions - Deutsche Bank, HSBC, Credit Agricole and now the Bank of Scotland - had withdrawn their financial support from the Abbot Point coal loader, whose construction may be detrimental to the Great Barrier Reef.

The UNESCO World Heritage Commission had warned of the dangers when giving the Australian Government a year to act or the reef would be added to the list of protected sites considered "in danger".

GetUp understandably attributed the rejections to the public campaign, which it said was now being extended to Barclay's Bank, among others; but a dispassionate observer might consider that cold-hearted economics had something to do with it as well. The world price of coal is now in decline - European prices are the lowest for five years and there is no expectation that the trend will be reversed.

- By Gus Leonisky at 23 Jun 2014 - 5:29pm

- Gus Leonisky's blog

- Login or register to post comments

the price of fish...

Perhaps rather than wait for the US to fix our currency problems, Reserve Bank chief Glenn Stevens should take matters into his own hands, writes Ian Verrender.

The Tony-Barack show stole the limelight earlier this month as they canoodled on the couch and whispered sweet nothings in the White House.

While the political commentariat sifted and raked over every bit of body language between the pair - toothy grin or gritted teeth? - the real power couple in the Australia-US alliance was largely ignored.

That was unfortunate. Because for those of us Down Under, Janet and Glenn simply do not see eye to eye any more, and everyone is starting to suffer.

We may be some way from divorce, but there's a definite frostiness that, frankly, is becoming uncomfortable. And perhaps the time has come to consider separation.

Late last year, after quite some deliberation, Glenn decided he'd had enough, leaving no doubt in anyone's mind that he reckoned the Australian dollar was overvalued. Hell, he even put a number on it, something any central banker is loathe to do.

After the tiniest bit of prompting - perhaps it was even a Dorothy Dixer - he said the Aussie battler should be about 85c against its American counterpart. And for a few months after that he kept hammering home the point.

It worked for a while. In fact the local dollar already was on the slide in mid December when he urged it lower and for the briefest period he appeared a master currency conjurer.

Since then, however, it has reversed course and Glenn, deflated and defeated, has given up. No point highlighting the impotence.

read more: http://www.abc.net.au/news/2014-06-23/verrender-how-the-us-is-squeezing-australia-dry/5542324

---------------------------------

Not so strangely, the fluctuation of currencies are not "entirely" due to "market supply and demand pricing"... Overall, there are four major banks in the world that decide the price of fish every day, not in regard as to how many people want to buy or how many people can supply, but in accordance with HOW MUCH PROFIT they will make on that day and the next day and the following year. This banking Mafia decides, we buy. And to some extend, the Australian financial market SHOULD NOT BE LEFT FLOTSAMILY TO OVERSEAS banking influences.

Mind you, central banks have lost their mojo to banks like Goldman Sachs and the likes...

currency trading, pork bellies and bank profits...

For those who watched Alan Kolher tonight on the ABC news would have noticed that he mentioned a graph "he has never seen before"... Wow! Woah! That graph explains in a simplistic way the differential between "Central Banks" interest, their money printing policies and major bank PROFITS... Hello? Anyone there?

That has been my point over the many years here of my beef with rampant "economics"... Look, I am a mathematician who can do derivatives... Okay? But the point here as seen above is that "we" are at the mercy of FOUR major banks who manipulate (dictate) the value of currencies. They do not do it "illegally" but they have the power to "deal between themselves", without breaking laws, to control the price of pork bellies should pork bellies still be a measuring stick which it is not anymore since the NY stock exchange got rid of it.

old man coal .....

Yes Gus,

And from the Australia Institute …..

In the old Chinese proverb, the frog in the well thinks he knows everything about the world, based on the little patch of sky he can see. Those of us who live outside the well know the world is a lot bigger and more complicated than that.

The view from the bottom of an open-cut coalmine might be a little wider than that of a well, but NSW Minerals Council chief executive Stephen Galilee’s discussion of the role of mining royalties in NSW is just as narrow (‘‘Time for coal cash to fill some of the holes’’, Herald, 20/1).

Mr Galilee’s claim that the $1.3billion in coal royalties paid last year helps ‘‘to pay for hospitals, schools and public transport’’ is true – but it needs to be put in context.

Total NSW government revenues for 2012-13 were $59.9billion.

Coal royalties accounted for just 2per cent of state government revenues.

The real funding for our hospitals, schools and public transport comes from the Commonwealth (47per cent) and from state taxes (37per cent).

Coal royalties are less important to the state than gambling taxes ($1.8billion) or taxes on motor vehicles ($2.1billion).

Let’s also consider how much it costs to fund schools, hospitals and transport.

According to the latest budget papers, NSW spends $11.2billion on schools, $12.7billion on hospitals and $11.3billion on transport.

If we relied on royalties alone, these services would run for only two weeks of the year.

If you include all the other services provided by the state – such as police and courts – coal royalties would only fund a few days.

It is pleasing to see Mr Galilee lobbying for more money to be spent in mining-affected local government areas.

Considering the negative impacts on air quality, noise and amenity to which some residents are subjected, this seems only fair.

The compensation about which he is talking is trifling, however – $160million over four years, or $40million a year.

As NSW produces about $16billion worth of saleable coal a year, this is about a quarter of 1percent of the value of the coal.

By lobbying for this money to come out of existing royalty revenues, Mr Galilee is taking money away from schools and hospitals elsewhere in the state.

If he were serious about using coal revenues to assist the NSW community, he would look at raising royalty rates, rather than redistributing what is currently paid for the state’s coal.

But the last thing the NSW Minerals Council wants is for the NSW community to get more for its coal. This would take money away from the largely foreign companies that the lobby group represents.

The NSW and Hunter economies are diverse and modern, with an emphasis on services.

It is Mr Galilee’s job to present a favourable image of his industry.

For the public, it is important to take his claims with a grain of salt.

His frog’s-eye view of NSW is limited by the walls of the coalmine.

Rod Campbell is an economist at The Australia Institute, a Canberra-based think tank, www.tai.org.au

Coal royalties a tiny part of state revenue

an open letter to nick xenophon...

Dear Honorable Senator Xenophon,

Whatever you do, do not trust the Abbott regime one bit. Tony and his henchmen will con you to believe in Santa Claus and the Tooth Fairy. They are that good at telling lies. They lie. THEY LIE. THEY LIE!

Please, DEFEND THE CARBON PRICING WHICH IS THE BEST WAY TO MAINTAIN OUR COMMITMENT TO PROTECT THE PLANET FROM AN INCREASING GLOBAL WARMING. Even the US is looking at it.

Thank you, Mr Xenophon.

Gus Leonisky

Your local Global waming expert

an open letter to David Leyonhjelm...

Dear Honorable Senator David Leyonhjelm,

Your ignorance of global warming is a bit shattering. You call this ignorance as being "agnostic about the science" which is akin to being dumb about intelligence... It's time to remember some of your past and call upon your investigative intelligence a bit more, please...

Whatever you do, do not trust the Abbott regime one bit. Tony and his henchmen will con you to believe in Santa Claus and the Tooth Fairy. They are that good at telling lies. They lie. THEY LIE. THEY LIE!

Please, DEFEND THE CARBON PRICING WHICH IS THE BEST WAY TO MAINTAIN OUR COMMITMENT TO PROTECT THE PLANET FROM AN INCREASING GLOBAL WARMING. Even the US is looking at it.

Trust me: Global warming is real and is a real threat to the future human comforts on this planet. Present global warming is anthropogenic (induced by humans on this planet).

Thank you, Mr Leyonhjelm.

Gus Leonisky

Your local global waming expert

record wind energy supply,,,

Australia’s wind energy records have been blown away by the wintry storm that ripped through the country’s south-east, with turbines supplying almost one-fifth of the electricity at its peak.

Total wind energy supplied to the states of NSW, South Australia, Tasmania and Victoria reached a record 2598-megawatt at 10.30pm according to National Electricity Market data analysed by Pitt & Sherry. That supply met 14.9 per cent of total demand.

Wind’s share was even higher at 4.30am, with 19.2 per cent of the market, said Hugh Saddler, Pitt & Sherry’s principal consultant.

Read more: http://www.smh.com.au/business/carbon-economy/storm-smashes-wind-energy-records-20140625-zskza.html#ixzz35dPvlCFs

king con is dirty about the age of entitlement...

Ending the age of entitlement for coal

NICHOLAS ABERLE

ABC Environment

10 JUL 2014

Governments, both state and federal, keep handing buckets of money to the Latrobe Valley coal industry. When will they learn it's a strategy that's not working?

JUST A LITTLE OVER two years ago the now-Treasurer Joe Hockey proclaimed to a conservative think tank in London that the "age of entitlement is over" but nowhere in his speech did he mention the coal industry.

If he had, perhaps he would have reflected on the folly of tens of millions of government funds wasted on speculative coal demonstration projects involving promises of burning dirty brown coal in Victoria's Latrobe Valley.

But Hockey didn't. Instead, the Abbott and Napthine Governments have recently announced that they have doled out $25 million to an Australian subsidiary of a giant Chinese power company, Shanghai Electric Power. Taxpayers are being tapped to cover almost a quarter of the construction and 'operation costs' for a new demonstration plant making briquettes out of brown coal in the Latrobe Valley.

Shanghai Electric Power is not from struggle street: its ultimate parent company is the China Power Investment Corporation, one of China's biggest publicly-owned power generators and polluters.

The grant to Shanghai Electric Power's Australian subsidiary is the latest from a new $90 million joint federal-state government program, Advanced Lignite Development, to subsidise companies with grand dreams of converting brown coal into everything from oil to fertiliser.

read more: http://www.abc.net.au/environment/articles/2014/07/10/4041826.htm

king con murdoch, via his con premium content lackeys...

A prime example of the rubbish spread by fossil fuel fans was an opinion piece by Liberal Democrat senator David Leyonhjelm published in The Australian, writes Lachlan Barker.

WHAT HAS BECOME CLEAR to me in this debate about scrapping the Renewable Energy Target (the RET) is that the Federal Government and the conservative state governments, have been massively successful at spreading the message that the RET is a bad thing.

RET bad, coal good; or, renewable energy expensive, coal cheap.

And a prime example of this was the rubbish printed by The Australian on August 27, 2014 in an opinion piece by Liberal Democrat senator David Leyonhjelm.

This piece was entitled:

‘Ditch RET to set economy free.'When I returned to reread this piece for this article, I was astonished to discover that the full article was no longer visible on the Oz website, and was now hidden away in the ironically titled ‘Premium Content’ section.

As you’re about to see, if this rubbish from the senator is premium content, I dread to see what’s non-premium.

However, I found another link to the full article, if your blood pressure is too low, you can read it here.

read more: http://www.independentaustralia.net/environment/environment-display/rubbishing-the-ret-for-king-coal-by-david-leyonhjelm-and-the-australian,6863

see toon at top...