Search

Recent comments

- struth....

7 hours 18 min ago - earth....

7 hours 58 min ago - sordid....

8 hours 21 min ago - distraction....

8 hours 39 min ago - F word....

9 hours 42 min ago - not losing....

14 hours 54 min ago - herzog BS....

15 hours 16 min ago - freedom to say.....

18 hours 12 min ago - wanton barbarism....

1 day 7 hours ago - little nazi....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

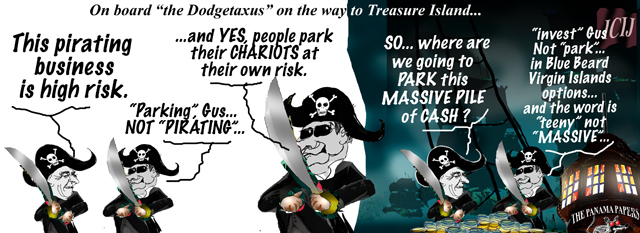

parking of the Caribbean...

.

.

Wilson Parking seems to be burdened by uncannily high costs.

On the car-parks it manages, Wilson has only averaged a profit of 5 per cent over 14 years. For all the business risk, on its published numbers, it would have done better to have its money on term deposit at the bank.

"The profit and income tax paid appears to defy economic reality,' says Jeff Knapp. "Why would any entity conduct a billion dollar business if it can only scrape out a 4 per cent or 5 per cent return before tax?"

The same might be asked of most multinationals. Some rake their profits offshore by financing costs on loans and by royalties to related entities, and most bulk up their costs in Australia, so as to eradicate as much profit as they can because tax is levied not on revenue but on profit. The name of the game is making as little profit as possible in this country.

"These multinationals are not for-profit entities but for-revenue-and-as-little-profit-as-can-be-entities," says Knapp.

Virgin Island Havens

Also, like many of its ilk, Wilson has parent companies in tax havens. There used to be the enigmatic Covert Investments Ltd (incorporated in the British Virgin Islands). Now there is the parent Wilson Parking Holdings Pte Ltd (Singapore), and its ultimate holding companies, Wilson Offshore Group Holdings Limited and Genuine Result Limited, both registered in the British Virgin Islands.

Wilson veritably bristled at the suggestion from these quarters that Australian parking fees might somehow wend their way to the tax sanctuaries of the Caribbean, even threatening to sue should such an imputation be conveyed.

"We can categorically state that none of the income that you refer to has in any way been transferred or has in any way 'made its way' to any BVI and/or related entities or associated entities of any entities whatsoever including all the entities that you refer to," said an emailed response to questions.

One wonders then what the point is of having BVI parentage if not to hide things. In any case, besides the standard Big Four auditor (PwC), the "irregularities" (as Knapp dubs them), the standard large revenue but small profit and tax numbers and the standard piqued cry, "We comply with all our obligations under the law" (no you don't), there is some colourful accounting.

Read more: http://www.smh.com.au/business/wilson-parkings-tax-numbers-appear-to-defy-economic-reality-20160408-go1w4u.html#ixzz45ERJNtoa

Follow us: @smh on Twitter | sydneymorningherald on Facebook

- By Gus Leonisky at 8 Apr 2016 - 9:05pm

- Gus Leonisky's blog

- Login or register to post comments

parking tax in the virgin islands...

Taxation in the British Virgin Islands is relatively simple by comparative standards; photocopies of all of the tax laws of the British Virgin Islands would together amount to about 200 pages of paper.[1]Taxation in the British Virgin Islands is mostly notable for what is not subject to taxation. The British Virgin Islands has:

There is technically still income tax assessed in the British Virgin Islands for companies and individuals, but the rate of taxation has been set at zero.[2] However, individuals are subject to a payroll deduction made of up to 8% for employees with 12% paid by employers, in relation to all salaries over US$10,000 per annum.

The absence of most major forms of taxation in the Territory has led to the country being included on most recognised lists of tax havens,[3] although the jurisdiction prefers to style itself as a modern offshore financial centre.

There are a number of forms of taxation and revenue collection in the British Virgin Islands, but the majority of the Government's revenues are obtained directly from annual licence fees for offshore companies incorporated in the jurisdiction.

read more https://en.wikipedia.org/wiki/Taxation_in_the_British_Virgin_Islands

Enough incentive to make you swim there...

no violation of the law...

For wealthy Americans trying to conceal their cash, stashing millions of dollars away in secret offshore shell companies is not as simple as it used to be.

International laws, whistleblower bounties and embarrassing data breaches such as the one being dubbed the Panama Papers have made the lives of would-be U.S. tax cheats increasingly perilous, according to tax lawyers and former government prosecutors and investigators.

“If you are someone with serious money and you want to hide it from the government, you have a good reason to be nervous,” said Daniel Reeves, who founded the offshore compliance division of the Internal Revenue Service and now works as a tax compliance consultant. “Today, there are many different ways people can find out about your activities. It’s not the same world of secrecy.”

Reeves and other offshore experts say they are not surprised by the paucity of Americans in the massive data leak of 11.5 million records that has unmasked accounts belonging to world leaders and a rogues gallery of international criminals.

Panama, the base of operations for the law firm at the center of the unfolding financial scandal, has never been a favorite place for Americans to hide their money. The nation’s reputation for bank fraud and drug smuggling has prompted U.S. citizens to send their money to more stable shores and nations, including the Isle of Man, the Cayman Islands and Switzerland, according to the offshore experts.

One of the founders of the Panamanian law firm, Mossack Fonseca & Co., had another explanation for the dearth of U.S. names in the data leak. He and his business partner have never courted U.S. clients.

“My partner is German, and I lived in Europe, and our focus has always been the European and Latin American market,” Ramon Fonseca told the Daily Mail in London on Thursday.

Mossack Fonseca said in a statement issued to The Washington Post that the firm has not violated the law.

https://www.washingtonpost.com/investigations/for-us-tax-cheats-panama-papers-reveals-a-perilous-new-world/2016/04/08/a3467e9a-fd9f-11e5-886f-a037dba38301_story.html?hpid=hp_hp-top-table-main_offshore-4pm%3Ahomepage%2Fstory

holding back info... or selective release?...

In this special edition of The Listening Post, we look at the Panama Papers, the world's largest ever data leak that has been exposing how the rich and powerful use tax havens to hide their wealth.

The papers - 11.5 million documents in all - have revealed how Mossack Fonseca, a Panama-based law firm, allegedly helped current and former world leaders, as well as businessmen, criminals, celebrities and sports stars, evade or avoid tax via anonymously owned shell companies and offshore accounts.

In terms of the size of the leak and the scale of the journalistic collaboration, the story has garnered wall-to-wall coverage and dominated the front pages of newspapers across the world.

The International Consortium of Investigative Journalism, a non-profit group in the US, coordinated the reporting with 376 journalists from 109 news organisations and 76 countries poring over the files.

Such multi-newsroom collaborations are growing more common in an age of big data leaks, partly because newsrooms are shrinking while the influential players they are trying to hold accountable are growing in size, power and complexity.

But despite the success of the collaboration, the select group of media organisations that had access to the data have been criticised for how they tackled the story.

One of the main criticisms has been the way they went after wealthy business figures and some political leaders while largely shying away from the corporate side of the story that has enabled trillions of dollars, euros, pounds and rubles to be hidden offshore.

This has in turn raised a larger question: can the corporate-owned news media really be expected to hold the corporate world to account?

Talking us through the Panama Papers and how the story came together are: Gerard Ryle, director of the ICIJ; Wolfgang Krach, editor-in-chief at Suddeutsche Zeitung; Jacqueline Kubania, a reporter at the Daily Nation, Kenya; and investigative journalist Steven Topple.

Covering megaleaks: An exclusive interview with Julian Assange

One person who knows more than others about leaks, journalism and whistleblowing on a grand scale is WikiLeaks cofounder and editor-in-chief, Julian Assange.

In an exclusive interview, The Listening Post sat down with Assange to get his view on the Panama Papers, document leaks, multi-newsroom cooperation and the ethics of holding back information that could be in the public interest.

http://www.aljazeera.com/programmes/listeningpost/2016/04/panama-papers-media-censored-story-160409095509553.html

helpless dogs...

It’s one of the more famous experiments in modern psychology. In the late 1960s and early 1970s, Martin Seligman set about electrocuting dogs.

In the classic experiment, he divided the animals into three groups. The dogs in group one were subjected to painful electric shocks but could easily avoid them by a simple action. The second group received jolts of the same intensity at the same time. Their pain, however, couldn’t be escaped, no matter what they did. The dogs in a fortunate third group – the control – were not electrocuted at all.

Seligman then transferred all his subjects into so-called “shuttle boxes” – apparatuses in which the beasts could escape pain by leaping over a dividing barrier to the non-electrified side.

The dogs from group one and three discovered the trick quickly, bounding to safety whenever the experimenters flicked the switch. The dogs from group two reacted differently. They didn’t jump the barrier. They didn’t do anything at all. They remained still and they passively suffered until the scientists turned off the electricity.

The dogs had learned from the first procedure that they were helpless. Concluding their circumstances could not be changed, they resigned themselves to endure.

Seligman’s wretched animals come to mind in respect of the so-called Panama Papers. Iceland’s prime minister, Sigmundur Davíð Gunnlaugsson, has been forced to resign by revelations of a family connection.

http://www.theguardian.com/commentisfree/2016/apr/11/the-panama-papers-told-us-what-we-already-knew-how-we-respond-will-be-the-story

Cameron should have resigned. But he won't. He will guide the UK through more crap in the same fashion as Tony Blair did before him. Not much difference between the two men. Blair did his catch up with cash after having been dumped. Cameron did his cash before being elected. Both are intelligent men but totally soaked in sociopathy.

tax neutrality?... rubadub... it's tax avoidance...

International financial hubs also offer tax neutrality. This means that they can protect companies that operate in multiple jurisdictions from double taxation, as they would only pay the taxes that are required in their home countries. Many global investors favour these centres as they can provide a flexibility of corporate structures, simple incorporations, the issuance of different share classes and a sound legal system.

A point that is all too often overlooked is that offshore centres offer legitimate financial refuge for those in countries where there is economic and political turmoil, such as extremely volatile currency and expropriation of assets. And some extremely high net worth individuals who live in countries where there is economic, political or social unrest do indeed value another characteristic offered by some such hubs: privacy.

http://www.theguardian.com/commentisfree/2016/apr/13/offshore-panama-papers-murky-investors

Nigel Green is the founder and CEO of deVere Group, an independent international financial consultancy providing advice to expatriate clients and investors around the globe

------------------

Politicians who insist there’s no money for wages, pensions, benefits or public services had their secret hoards exposed this week writes Socialist Worker UK.

The Panama Papers revealed the clients of just one of the world’s top tax dodging offshore banks. They include 12 former and serving heads of state, three top Tories and David Cameron’s dad.

Much of the media coverage focused on Russian president Vladimir Putin and senior figures in China and North Korea. But these corrupt tyrants are part of the same ruling class that lords over us here.

The papers included 9,000 names from Britain and thousands more from other Western countries.

In theory tax-dodging breaks our rulers’ own rules. But they’re almost all at it—so it’s no wonder they get tangled up in hypocrisy.

Cameron huffed and puffed that tax dodging was “morally wrong” when comedian Jimmy Carr was in the spotlight. But when it comes to Cameron’s inheritance, tax dodging is a “private matter”.

When Google’s tax arrangements came under fire in 2012, boss Eric Schmidt had a more honest defence of the schemes he was “very proud of”.

“It’s called capitalism,” he said. “We are proudly capitalistic. I’m not confused about this.”

Capitalism is built on accumulation—turning money into more money. It’s enforced by ruthless competition. Capitalists who fail to grab as much as they can risk being torn apart by the rest.

Far from opposing this competition, states and their laws are deeply embedded in it. They enforce and underwrite it at home and get stuck in against competitors abroad.

http://enpassant.com.au/2016/04/12/panama-papers-scandal-shows-how-capitalism-works-and-why-we-need-to-get-rid-of-it/

un-australian detention...

Sorry...

According to the Melbourne Magistrates’ Court, the writing of‘WILSON: Human Rights Abusers’ in easily removable liquid chalk on a glass window of a Wilson Security building is “offensive”.

It’s offensive nature is deemed to be “defacement” that is worth $500. Well, $300 on review by a magistrate, who advised compliance to “lawful” means of protest. They also recommended not using other protest methods if one is too poor to pay $500. An apology to Wilson Security is required by the court to avoid a conviction for “defacement” being recorded against my name.

Precisely, it is the material words that are judged as being offensive. Meanwhile, the actual Wilson Security staff who allegedly committed human rights abuses against asylum seekers held in Australia’s immigration prisons on Manus Island, PNG, and Nauru remain unaccountable and at large. They continue to act with impunity as they collect their considerable salaries paid for with our tax dollars. Wilson Security, along with other government contractors, including Broadspectrum (owned by Ferrovial), G4S, Serco, IHMS, Toll Holdings and others, continue to profit on the bodies of asylum seekers. It seems that the Court would rather not hear about any of that. Peter Dutton, Minister for Immigration and Border Protection, and his government, would rather you didn’t.

The Court Registrar called me “The graffiti artist”. I’m flattered, mind, but I can make no claim to that moniker. I am, however, a person who believes in acting for social justice. In our increasingly dystopian society, caring about fellow human beings is viewed as being dysfunctional; we are encouraged to look the other way when faced with acts of injustice. Preferably, our sight should be aimed at screens that promote acquisition of consumer goods and hatred of the constructed “other”. The dominant voices of the media claim false equivalency between those who promote hatred and those who uphold human rights. So called “social justice warriors” are derogated as people to be scorned. Lawyers who represent asylum seekers for free are “un-Australian”.

read more:

https://independentaustralia.net/life/life-display/not-sorry-for-writing-wilson-human-rights-abusers,10720

See also:

http://www.smh.com.au/national/protesters-to-blockade-wilson-security-car-parks-over-detention-centre-20160626-gpsgg0.html

Read from top...