Search

Recent comments

- the ugliest excuse to go to war.....

4 hours 7 min ago - morons....

5 hours 59 min ago - idiots...

6 hours 1 min ago - no reason....

7 hours 6 min ago - ask claude...

10 hours 26 min ago - dumb blonde....

17 hours 50 min ago - unhealthy USA....

18 hours 23 min ago - it's time....

18 hours 45 min ago - pissing dick....

19 hours 4 min ago - landings.....

19 hours 15 min ago

Democracy Links

Member's Off-site Blogs

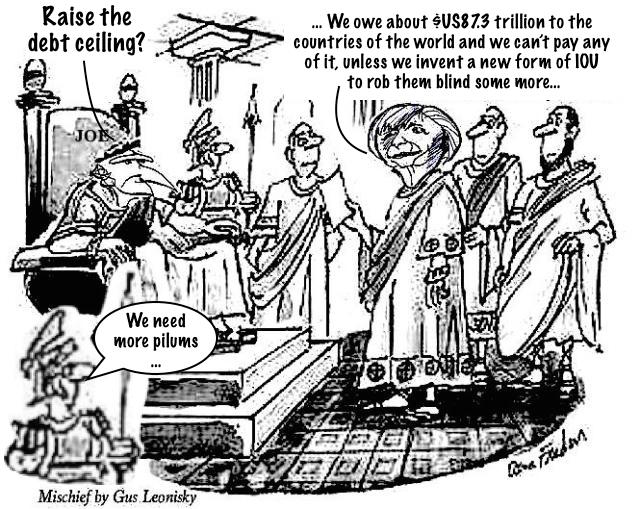

debtpocalypse or dollargedon...

ceiling

ceiling

US federal debt surpassed $28 trillion in March, with every man, woman and child in the country owing more than $85,000 for the federal government’s spending. Combined debt – which includes federal debt plus all other public and private obligations, stands at over $85 trillion – or over four times the US’ annual GDP.

The federal government might run out of money and go into default in August unless Congress raises the debt ceiling, Biden Treasury Secretary Janet Yellen has warned.

Speaking before a Senate appropriations subcommittee hearing this week and discussing the Treasury’s budget, Yellen stressed that “defaulting on the national debt should be regarded as unthinkable,” and said that “failing to increase the debt limit would have absolutely catastrophic economic consequences.”In her words, these consequences would include the precipitation of a financial crisis, and threaten jobs and savings at a time when the US is still recovering from the economic fallout caused by the coronavirus.

The economist indicated that the current suspension of the debt ceiling, agreed to by Congress in 2019, is set to run out on 31 July, and that unless it is raised and/or suspended again, the federal government will not be able to borrow money to cover expenses, including interest payments on debt.

“It’s possible we could reach that point while Congress is out in August, and I would really urge prompt action on raising the limit or suspending it,” Yellen said, referring to Congress’s traditional summer recess, which runs the entire month of August and half of September.

Following Yellen’s remarks, House ways and means committee chair Richard Neal, a Democrat from Massachusetts, urged his fellow lawmakers to avoid any “brinksmanship” on the debt issue and to address it “before the current suspension expires next month.”

In the past, Democrats and Republicans have sometimes used the debt ceiling issue as a means to pressure one another to push through policies favouring one or the other party’s priorities. A 2011 play by Republicans to link their agreement for a higher debt limit prompted stock prices to fall, and caused the Standard & Poor’s international rating agency to downgrade the US from its AAA debt rating to AA+.

In recent months, GOP lawmakers have been aggressively searching for ways to slash away at what they perceive to be the Democrats’ liberal spendthrift agenda, forcing the president’s party to cut back on his signature multitrillion-dollar infrastructure bill, and causing other sweeping initiatives on issues including gun control, police reform and elections to get bogged down.

The coronavirus crisis prompted the government to pump over $6 trillion in additional money into the economy, causing mild inflation and adding to the federal debt. However, unlike most countries, which suffer major inflationary penalties and other macroeconomic problems if they print too much money or accumulate too much debt, the United States’ unique position in the world as the issuer of the dollar, which enjoys the status of the de facto world currency, has enabled Washington to rack up debt and print money without fear of major repercussions for decades now. In recent years, however, a growing number of economists, banks and policymakers have sounded the alarm and argued that sooner or later, the decades-long ‘free ride’ enjoyed by the US will come to an end.

Read more:

OBVIOUSLY the article above is Russian propaganda, even if the information is true... Of course Gus knows that the plural of pilum is "pila", but in our modern times it does not sound as dramatic as "pilums" to express the budget allocation to the Pentagon. Meanwhile the total derivative market (speculation on values — i.e. financial "gambling") of the entire planet stands at more than US$2,000 trillion...

FREE JULIAN ASSANGE NOW ÷÷÷÷÷÷÷÷÷÷÷÷≥≥≥≥≥≥≤≤≤≤!!!!

- By Gus Leonisky at 26 Jun 2021 - 6:21am

- Gus Leonisky's blog

- Login or register to post comments

meanwhile on wall street...

targeting the irish......

Treasury Secretary Janet Yellen is preparing to launch a congressional lobbying blitz to corral support for a “Global Minimum Tax,” which has emerged as a key part of President Joe Biden’s efforts to rehabilitate the liberal international order damaged by the Trump presidency. The Biden administration sees the initiative as a way to build support for his ambitious domestic tax hikes as well as garner favor with liberal-minded allies abroad.

The plan, negotiated by the Organization for Economic Co-operation and Development, is vague, but focuses on two main pillars: first, ending revenue-shifting practices of American tech firms, and second, establishing a global minimum tax of 15 percent on large multinationals. To achieve this, the Biden administration is hoping to ratify two treaties codifying the new minimum tax.

The plan has been vigorously challenged by Republican leadership, including Ways and Means Ranking Member Kevin Brady and Senate Minority Leader Mitch McConnell. Their arguments make a strong economic case against the global tax treaties. However, conservative opposition must also defend the principle of subsidiarity against liberalization and integration. Models, profits, and the endless measures of economic success may change, but the American citizens’ autonomy must be considered absolute throughout.

The proposed global tax treaty, as presented in a characteristically vague five-page memo, should be plainly understood as a threat to American sovereignty. If implemented, it will lead to the erosion of the Constitution’s revenue collection system in favor of a European-style international bureaucracy that will paralyze critical domestic political institutions and allow economic exploitation by foreign rivals.

Our Constitution says plainly that “All Bills for raising Revenue shall originate in the House of Representatives”—not unaccountable, international organizations. In a country founded in resistance to taxation without representation, submitting Congress’s power of the purse to faceless global managers would be ridiculous. Yet the project is sadly just another episode in the Biden administration’s dismantling of traditional American political and social values.

Ongoing negotiations have captured the support of 130 of the 139 member nations of the Organization for Economic Cooperation and Development. If the tax treaty were ratified by the Senate, Americans would be transferring control of their taxation to the diplomatic whims of Parisian leftists, London traders, and Japanese manufacturers. Arbitrary, internationally fixed tax rates would render fiscal decisions by Congress meaningless, and by extension the will of their constituencies meaningless, creating a crisis of federal sovereignty.

More concerning is the scant mention of enforcement and organization in the tax treaty’s plan, leaving open the prospect of European Union-style integration and nightmarish bureaucratic overreach. As a rule, international organizations engage in mission creep that tends to massively expand the power of their charters and decrease the power of the people and nations they are created to serve. Take for examples the failure and abuse inherent in the actions of the WTO, IMF, and litany of E.U. projects.

Like the WTO, a bloated, inefficient international tax bureaucracy could deny Congress the ability to stay nimble in an increasingly competitive economic race with China. In the same way the WTO has allowed China to mock the rules-based order and operate as a rogue mercantile state, the governing authority of the new tax scheme could easily be thwarted by our adversaries.

If China decides to treat the global tax treaty with the same contempt they have historically treated international law and agreements, the rules-abiding U.S. would be obligated to place justice in the hands of an international bureaucracy and hope for fair arbitration. As we have seen with the performance of the World Health Organization, these kinds of recourse are unreliable at best and corrupt at worst. The U.S. could find itself in a state of total paralysis as our remaining industries move overseas and a years-long state of competitive disadvantage wreaks havoc on U.S. output.

Once already in such an agreement, if the American people came to regret their leaders’ poor decision, the U.S. would be forced into a grueling project of unilateral disentanglement for which the current political environment is not suited. The political unraveling would more closely resemble the institutionally wrenching Brexit debate than even the heated debates surrounding the Paris Climate Accord or the Iranian nuclear deal in U.S. politics.

Unwinding a web of complex international treaties, adjusting the already controversial domestic tax code, and cajoling our allies in Europe away from continued integration with China would be a task that would require bipartisan and cross-agency unity unthinkable in our current political climate. Even in a swell of bipartisan action against bad foreign actors, rolling back a key achievement of the liberal international project would be an impossible sell to two-thirds of the Senate. The consequence would be a free hand for China to scheme against indentured nations while U.S. political willpower would be exposed as insufficient to lead the rules-based liberal order it created.

The Biden administration is gambling that a new generation of liberal internationalist projects will save their fledgling ideological pursuits. But a dual disaster in which further globalization allows China and other competitors to land yet another blow to the American worker—and where those afflicted citizens are denied just recourse after being stripped of their representation—is predictable and avoidable. It remains up to Congress to decide if international cooperation on a “Global Minimum Tax” should destroy the American people’s right to self-governance.

Read more:

https://www.theamericanconservative.com/articles/global-minimum-tax-threatens-american-sovereignty/

If Silicon Valley does not laugh at the proposal, it's because it already died of laughter at the proposal...

Read from top.

FREE JULIAN ASSANGE NOW ΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩ!

no deal?...

WASHINGTON — Senate Republicans on Monday blocked a spending bill needed to avert a government shutdown this week and a federal debt default next month, moving the nation closer to the brink of fiscal crisis as they refused to allow Democrats to lift the limit on federal borrowing.

With a Thursday deadline looming to fund the government — and the country moving closer to a catastrophic debt-limit breach — the stalemate in the Senate reflected a bid by Republicans to undercut President Biden and top Democrats at a critical moment, as they labor to keep the government running and enact an ambitious domestic agenda.

Republicans who had voted to raise the debt cap by trillions when their party controlled Washington argued on Monday that Democrats must shoulder the entire political burden for doing so now, given that they control the White House and both houses of Congress.

Their position was calculated to portray Democrats as ineffectual and overreaching at a time when they are already toiling to iron out deep party divisions over a $3.5 trillion social safety net and climate change bill, and to pave the way for a bipartisan $1 trillion infrastructure measure whose fate is linked to it.

The package that was blocked on Monday, which also included emergency aid to support the resettlement of Afghan refugees and disaster recovery, would keep all government agencies funded through Dec. 3 and increase the debt ceiling through the end of 2022. But after the bill cleared the House a week earlier with just Democratic votes, it fell far short of the 60 votes needed to move forward in the Senate on Monday.

The vote was 48 to 50 to advance the measure. Senator Chuck Schumer of New York, the majority leader, was among those voting “no,” a procedural maneuver to allow the bill to be reconsidered at some point. But there were no immediate details about next steps.

Read more: https://www.nytimes.com/2021/09/27/us/politics/republicans-block-government-funding-bill-debt-limit.html

Read from top.

increasing the debt...

The Treasury secretary, testifying alongside Jerome H. Powell, the Federal Reserve chair, implored Congress to raise or suspend the nation’s borrowing cap before an Oct. 18 deadline.

WASHINGTON — Treasury Secretary Janet L. Yellen warned lawmakers on Tuesday of “catastrophic” consequences if Congress failed to raise or suspend the statutory debt limit in less than three weeks, saying inaction could lead to a self-inflicted economic recession and a financial crisis.

At a Senate Banking Committee hearing where she testified alongside the Federal Reserve chair, Jerome H. Powell, Ms. Yellen laid out in explicit terms what she expects to happen if Congress does not deal with the debt limit before Oct. 18, which the Treasury now believes is when the United States will actually face default. In her most public expression of alarm about the matter, she described the standoff within Congress as a self-inflicted wound of enormous proportions.

Her warnings came as the stock market suffered its worst day since May, as investors fretted over a cocktail of concerns, including the potential for the government to shut down and default on its debt, persistent inflation, the Delta variant and the Fed’s plans to soon withdraw some economic support. The S&P 500 fell 2 percent and yields on government bonds spiked to their highest level since June, reflecting expectations that the Fed will begin to slow its bond purchases as prices rise and the economy heals.

Congress was scrambling to figure out how to resolve its two immediate problems: funding the government past Thursday and raising the debt limit so that the United States can continue borrowing money to pay its bills.

After Senate Republicans on Monday blocked an emergency spending bill that would have funded the government through early December and lifted the debt limit, Democrats huddled privately to discuss their options but have not settled on a solution.

In a phone call on Monday, Democratic congressional leaders spoke with President Biden about the possibility of steering around Republican opposition and raising the debt ceiling unilaterally. They could do so by using a fast-track process known as reconciliation that shields fiscal legislation from a filibuster — the same maneuver they are employing to push through their sprawling social policy and climate change bill. But Democrats have publicly resisted that option, which would be complex and time-consuming, and would most likely force them to cast a series of politically tricky votes on an array of issues.

Ms. Yellen warned that the effects of inaction would be felt across the economy: Older adults could see their Social Security payments delayed, soldiers would not know when their paychecks were coming and interest rates on credit cards, car loans and mortgages would rise, making payments more costly, she said. And she suggested that a default would jeopardize the dollar’s status as the international reserve currency, which Democrats argue would be a gift to China.

“It would be disastrous for the American economy, for global financial markets, and for millions of families and workers whose financial security would be jeopardized by delayed payments,” Ms. Yellen said.

America’s two top economic policymakers also warned lawmakers on Tuesday that the Delta variant of the coronavirus had slowed the economic recovery, though they expressed optimism that the economy would continue to strengthen.

Their testimony came at a critical moment in the recovery. Businesses are facing labor shortages and consumers are coping with rising prices amid a resurgent pandemic. Inflation has been rapid this year, climbing by 4.2 percent in the year through July, and it threatens to remain high for some time.

Skyrocketing shipping costs and global factory shutdowns caused by the coronavirus have been a major driver of this year’s price increases. Cars in particular have been in limited supply amid a semiconductor shortage, and recent comments from auto industry leaders and analyst reports have suggested that may not be resolved quickly. A Bloomberg index that tracks various commodity prices — including those tied to oil, gas, metals, sugar and coffee — hovered at its highest level in a decade on Tuesday. Higher raw material expenses can feed into steeper prices for the things people consume every day.

“Inflation is elevated and will likely remain so in coming months before moderating,” Mr. Powell told lawmakers.

Jitters about China, which has so far been reluctant to bail out the teetering Evergrande Group, a beleaguered residential developer with $300 billion in debt, along with the possibility of persistent inflation in the United States, helped tank sentiment on Wall Street on Tuesday.

“Nerves, as far as inflation expectations, have really started to take over,” said Fiona Cincotta, a senior financial markets analyst at Forex.com. “We’ve seen this before, but they’re back because inflation might not be as transitory as central banks initially thought.”

Investors are waking up to the reality that Mr. Powell’s Fed is poised to provide less support to markets and the economy in the coming months, both because inflation has moved up and because the labor market is healing. The central bank signaled clearly last week that it could as soon as November announce a plan to pare back the $120 billion in government-backed security purchases it has been making each month.

Read more:

https://www.nytimes.com/2021/09/28/business/economy/yellen-powell-senate.html

The lady wants to print more money. Capice?

READ FROM TOP.

wrong yellen.....

https://www.youtube.com/watch?v=FQGrIsQdnRw

READ FROM TOP.