Search

Recent comments

- peer pressure....

4 hours 12 min ago - strike back....

4 hours 18 min ago - israel paid....

5 hours 21 min ago - on earth....

9 hours 51 min ago - distraction....

11 hours 1 min ago - on the brink....

11 hours 10 min ago - witkoff BS....

12 hours 25 min ago - new dump....

1 day 17 min ago - incoming disaster....

1 day 25 min ago - olympolitics.....

1 day 30 min ago

Democracy Links

Member's Off-site Blogs

artisanal laundry...

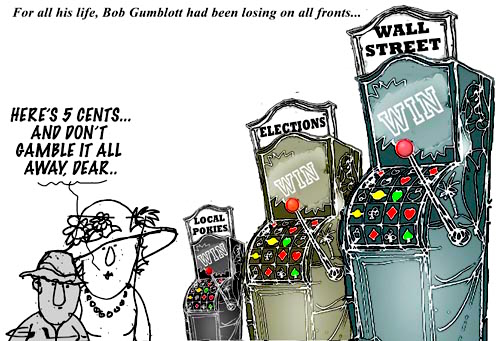

gamble...

gamble...

The money laundry: Pubs and clubs the next frontier for crime

Over five years, a single young woman put $38 million in dirty money through the pokies. But she wasn’t doing this in the glitz of a casino, she was visiting your neighbourhood club.

By Nick McKenzie and Joel Tozer

In August last year, amid a cacophony of flashing, whirring poker machines in a NSW club, a 33-year-old Sydney woman got to work. Gambling was not the Vietnamese-born woman’s primary business, nor was it her hobby. Rather, she was in the business of cleaning dirty money. Millions and millions of dollars of it.

In a nation which, according to estimates by the Australian Criminal Intelligence Agency has a dirty money problem measured in the billions of dollars, this woman, who we will call “the cleaner”, might have gone unnoticed if not for one key aspect of her operation: she was using poker machines to ply her illicit trade.

In the past five years, this single woman has gambled at least $38 million, the proceeds of crime, at pokie venues and casinos in NSW, Canberra and Victoria. But her case is far from unique. She is emblematic of a much larger problem in which criminal cash from drug sales and human trafficking is laundered through neighbourhood poker machines as the powerful clubs lobby courts politicians and resists reform.

Claims that poker machines are used to clean dirty money have long been dismissed by the gambling industry and its lobbyists as a myth propagated by wowsers like federal independent MP Andrew Wilkie and the Reverend Tim Costello.

But at least three federal and state law enforcement agencies have concluded that electronic gaming machines were among the cleaner’s means of washing tainted funds. Four official sources briefed on it but not permitted to talk publicly, say her activities involved gaming venues down the length of Australia’s east coast.

The cleaner had been excluded from gambling twice by The Star in Sydney and her suspicious financial activity was noted by several banks. But since 2015, she gambled at pokies venues within clubs and pubs, mostly in NSW, with impunity. Her case shows suspected money launderers use both large casinos and small pokies venues as viable places to operate, and suggests that recent regulatory crackdowns on casinos might be driving even more dirty money into the suburbs and through the pokies.

Read more:

FREE JULIAN ASSANGE NOW NOW NOW NOW !!!!!!

- By Gus Leonisky at 28 Nov 2021 - 7:04am

- Gus Leonisky's blog

- Login or register to post comments

professional laundry...

"Finance Ministers Often Couldn't See Through Them"

For close to 25 years, EU member states have been trying to put a stop to practices in the bloc that see some European countries competing against others to offer the lowest corporate taxes. In an interview, Dutch researcher Martijn Nouwen explains why those efforts have failed.

For decades, a handful of European member states have lured large corporations to set up shop there in exchange for extremely low tax rates that have meant billions in extra earnings. Martijn Nouwen, 37, spent years conducting detective work on the practice, collecting more than 2,500 internal documents from a European Union panel that is supposed to be working to combat these tax-dumping practices. Together with its partners in the European Investigative Collaborations (EIC), DER SPIEGEL reviewed the documents and revealed how nearly 25 years of efforts by the Code of Conduct Group to stop competition for lower corporate tax rates within the EU have been in vain. In an interview, Nouwen, who is now an assistant professor at the University of Leiden, discusses the reasons, some of which are to be found in Berlin.

DER SPIEGEL: Mr. Nouwen, the EU has been trying for a quarter of a century to thwart the business of European tax havens like Luxembourg, Cyprus and the Netherlands. Why has the success so far been modest?

Nouwen: Above all, there is a lack of transparency. The deliberations of the Code of Conduct Group, which the European Union created for this purpose, take place behind closed doors. Its documents and minutes are confidential. It was known that this body had an important function, but how it works and whether it was effective in tackling harmful tax practices of countries was largely unknown until now. The aim of my work was above all to shed more light on this darkness.

DER SPIEGEL: You have analyzed around 2,500 internal EU documents from the Group. What is your verdict?

Nouwen: The results are mixed. The group has reached impressive results, and tax competition has become a much more transparent and regulated game. Many harmful competitive tax regimes of countries have been changed or eliminated. At the same time, when a tax loophole was plugged a new one was created and exploited by member states. For example, tax avoidance with aggressive tax business models, letterbox companies and tax rulings are still not adequately addressed. Both small and large member states are still frustrating the development of effective solutions for these problems.

DER SPIEGEL: The goal of governments has always been to lure corporations into their own countries with tax advantages. In this way, they wanted to secure additional income at the expense of their neighbors. Where do the fronts run in this competition?

Read more:

https://www.spiegel.de/international/world/tax-havens-in-europa-finance-ministers-often-couldn-t-see-through-them-a-d06f7761-eb3a-4a65-94a5-900912f47dc9

FREE JULIAN ASSANGE NOW NOW NOW NOW !!!!!!