Search

Recent comments

- EU gas storage....

2 hours 34 min ago - wrong trousers....

2 hours 47 min ago - failure.....

3 hours 7 min ago - remembering....

5 hours 50 sec ago - wrong target....

14 hours 18 min ago - aerosols....

14 hours 38 min ago - middle powers....

14 hours 59 min ago - disgraceful....

15 hours 58 min ago - bets on war....

16 hours 24 min ago - graham's crap....

19 hours 21 min ago

Democracy Links

Member's Off-site Blogs

reaching "advanced status"….

Encouraging innovation and the rapid adoption of digital technologies can enable China to avoid middle-income trap

The first decade of the 21st century saw Western economies take the world to the brink of economic collapse. China's economic management enabled the West to recover from its self-inflicted injuries. Despite this, some commentators cling to the idea that China cannot escape the middle-income trap in which countries are unable to reach advanced economic status.

China's policy initiatives clearly show an awareness of the challenge and provide structural solutions for escaping this "trap".

By DARYL GUPPY | China Daily Global

The structural challenge is a move from growth based on cheap labor and cheap capital to growth based on high productivity and innovation. Strategic change requires new processes and finding new markets to maintain export growth.

A key focus is increasing domestic demand, so the expanding middle-income group can use its purchasing power to buy high-quality, innovative products to help drive growth. Development rests on investment in physical and digital infrastructure. It encourages creativity to support breakthroughs in science and technology, so these can be applied to expand the economy.

Many economies guided by Adam Smith's principle of an "invisible hand" have found it difficult to break free of the middle-income trap. China's economic policy approach is more considered and the 2022 Government Work Report clearly explained the structure and focus of measures being taken to avoid the middle-income trap.

Encouraging innovation and the rapid adoption of new processes are key structural changes on the development path. China has developed the world's most advanced digital economy ecosystem. This includes the digitalization of industries and building smart cities to improve economic efficiency and enhance economic management with the use of big data.

China's progress toward a cashless society is well-established with WePay and Alipay. These digital services are so entrenched in China that it is difficult to appreciate just how revolutionary they are in terms of the structure of the economy.

The focus on these services enables the growth of the digital economy for consumers and suppliers. Such digital services deliver options for those who were previously unable to access bank services, including access to capital. The digital service empowers people by providing easy access to advanced services that use digitally delivered artificial intelligence and blockchain technology.

Now the roadside fruit seller in Dunhuang, a city in Northwest China's Gansu province, has the same access to digital trade services as the retail store in metropolitan Shanghai; once unthinkable business growth with instant access to a China-wide market is now just a touchscreen away.

These structural developments will be further advanced with the introduction of the digital renminbi. The digital currency will allow the government to collate big data resources to track spending patterns in the economy. The information collected will help improve economic management because these big-data transaction details can be used to fine tune economic policy responses.

These innovations and new processes increase domestic demand by lowering the cost of products and services and by expanding access to new domestic and international market segments. And the structural changes underpin the new dual circulation development paradigm that aims to change the structure and focus of the economy, decreasing the economic reliance on exports and boosting domestic demand. This is being applied in an economy that has already transitioned from being a low-cost labor provider to delivering a more sophisticated and highly paid labor force.

The mandated rises in the minimum wage, most recently in August 2021, enable increased domestic demand that feeds economic expansion. The resulting trickle-up demand results in the purchase of innovatively produced domestic products, many of which further enable engagement with the digital economy.

The widespread ownership of advanced Chinese-designed smartphones encapsulates the way that the domestic demand underpins company expansion and the continued innovation in these products. Additionally, it is these improvements in digital connectivity that open up participation in the digital economy for both consumers and businesses.

The dual circulation development paradigm reduces, but does not eliminate, reliance on export markets. The Belt and Road Initiative is, in part, designed to identify and expand new export markets and so reduce reliance on slow-growing Western markets. China is Africa's largest trading partner and Africa is a market with room to grow further.

Thousands of Chinese companies are using the renminbi in cross-border transactions with Africa. The application of a Chinese digital currency stops cross-border trade being held hostage to the United States-dominated Society for Worldwide Interbank Financial Telecommunications (SWIFT) currency transfer system.

The Belt and Road Initiative includes a focus on trade infrastructure, including the removal of trade barriers and the standardization of trade regulation. Trade settlement processes are an essential enabler of trade. Soft infrastructure is essential because it deals with payment systems and protocols. This is an essential ecosystem that includes a broader application of blockchain certification for payments.

Countries involved in the Belt and Road Initiative participate in a harmonized set of trade and trade settlement standards that make cross-border trade more efficient and expand export markets in new areas.

The final component of the development path is the structural expansion of China's capital markets to draw in both domestic and foreign capital. Attracting increasingly sophisticated capital committed to long-term investment initiates structural economic change where financial markets are seen as a store of wealth rather than a short-term profit opportunity. The continuing focus is on the further opening of the capital account, debt markets and the liberalization of investment conditions.

China's economic trajectory is not accidental. It rests on well-considered analysis and management of the structural economic framework. A coordinated collection of policy initiatives ensures that China remains a major economic force in the global economy. Economic self-reliance sustained by innovation in the digital economy can generate common prosperity that enables an escape from the middle-income trap. This escape brings with it inevitable changes to the geopolitical landscape as the digital economy expands.

DARYL GUPPY is an international financial technical analysis expert and a national board member of the Australia China Business Council. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

READ MORE:

https://www.chinadaily.com.cn/a/202205/11/WS627af8f6a310fd2b29e5bd8e.html

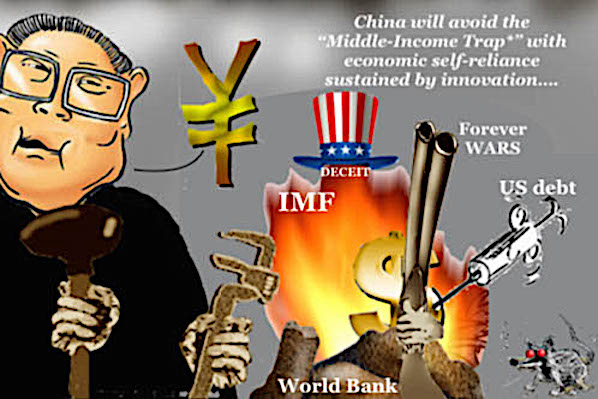

GusNote: "the Middle-Income-Trap" is "an invention" or "accidental discovery" of the World Bank, so named in 2006, and defined as the 'middle-income range' countries with gross national product per capita that remains between $1,000 to $12,000 at constant exchange rates. According to GusEconomics, this MIT is so designed to keep "developing countries" in a dependency status to the US dollar (and US patents), via unserviceable capital loans — made by the IMF and the World Bank — or any such AID from America...

Presently the USA is "forking out $40 billions to Ukraine", moneys which actually go to US armament manufacturers (in addition to the already gross Pentagon budget) for making more bombs which hopefully will never reach Europe... That's the trick of the US deficit...

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!!!!!!

- By Gus Leonisky at 11 May 2022 - 7:30pm

- Gus Leonisky's blog

- Login or register to post comments

the arabs' view….

The Middle East media have not stopped commenting on recent developments in Ukraine through the prism of their perception in the region. Particular attention is paid to the topic of the sanctions imposed on Moscow and their resonance in the Arab world.

As can be seen, attitudes towards these measures are negative in the region. After all, a number of Arab countries that refused to follow the dictates of the US and the West in their policies have been subjected to sanctions. Their inhumane nature has damaged the economy, led to the death and suffering of civilians, but has not caused the fall of regimes in Libya, Iraq, Syria. However, Arab lawyers remind that in the case of both the Arabs and Russia, the sanctions are unilateral and contrary to the letter and the spirit of the UN Charter.

Observers see duplicity in the authors of these coercive measures under the pretext of “taking over” Ukraine. They are annoyed that action of this kind has not been taken against Israel in many decades of occupation of Arab lands. They note that the media and politicians immediately rushed to condemn Russia in relation to Ukraine, but have been silent for 19 years on the US-British aggression in Iraq and the results of the disaster it has brought to its people. Those results include the destruction of the infrastructure of that country, the economic and humanitarian losses, the distress and impoverishment of the population, etc.

The headlines in the media – “Why is the world paying the price?”, “The conflict in Ukraine and its impact on our weak peoples”, “Will the Arabs starve?” and others – are telling. Their authors do not hide their concern about the possible consequences of sanctions against Russia, the shadow of which is being cast over the political landscape in the region and wider world.

The rise in inflation that has plagued Europe is somehow being transferred to the Middle East region, pushing up consumer prices for the population. This exacerbates the external debt of a number of countries, especially where it is high: Egypt and Tunisia.

This year, according to the World Bank, global food prices are at their highest level since they began to be formally recorded 60 years ago. At the same time, the cost of grain has risen by 42% this year and that of sunflower oil by 30%, while energy prices have grown by 50%.

Arab countries are major importers of cereals and food products. Here Egypt leads the way (13 million tonnes per year). These countries meet 63% of their needs for grain, 65% for sugar, 55% for vegetable oil, etc. through imports. Meanwhile, they meet 42% of their grain needs from the Russian Federation and 40% from Ukraine.

Russia is also at the forefront of fertilizer production, especially in nitrogen. Fertilizer prices were already at an all-time high before the conflict erupted, affecting overall food security.

The effects, the Arab Monetary Fund suggests, will affect the Arabs in varying degrees. For example, the region’s oil-producing countries will earn more from the energy they sell in 2022 due to a surge in energy prices following the escalation of events in Ukraine. But they will have to increase the cost of importing foodstuffs, especially grain, as well as industrial products and equipment. Those members of the Arab world that import hydrocarbons will be more affected.

Media reports and analysts have sounded the alarm about supply chain disruptions, failures in the supply of some goods, especially foodstuffs. General tensions could affect the tourism sector, a source of important foreign exchange earnings in a number of Arab countries. All this has the potential for food shortages, the threat of hunger, volatility due to possible outbreaks of discontent, etc.

A number of local analysts are outraged as to why the region should somehow “pay the bills of hatred” of the West towards Russia. Sanctions are designed to bleed Russia white and set it back, but they also make the world pay the price for the US to remain on the throne as the planet’s sole ruler, even if its allies suffer as a result.

Given the impact of the possible detrimental effects of the anti-Russian sanctions, local experts urge the authorities to monitor the situation and act wisely for the sake of their national interests.

In general, it is not in the interest of the Middle East and its individual states to spoil relations with Moscow, as each country has its own ties to Russia. One way or another, countries in the Middle East interact with the Kremlin and therefore need it, Al-Quds stresses.

Observers refer to the fact that their mutual trade has been growing markedly in recent years. They conclude that the Arabs should move in two directions: increasing trade with Moscow, which exceeded $18 billion in 2021, and following India and China in switching to local currencies. In addition, they advise to take advantage of the departure of American and European companies that are investing in the Russian market. Arab capital has great opportunities to take their place and compete successfully in this Russian market.

Russia is a strategic partner of the Gulf countries when it comes to oil and security issues. In these countries, as partners in the OPEC+ agreement, everyone has an interest in the stability of oil prices on world markets. Therefore, a win for one side at the expense of the other would not serve the interest of the balance sought in the hydrocarbon market, but would only risk increasing chaos in the field.

American politicians should understand, commentators argue, that Russia is an organic part of the OPEC+ alliance which will not oppose Moscow or take any part of its oil exports from the market. The Russian Federation will remain in OPEC even after the Ukrainian crisis is over.

Western attempts to press oil-producing countries to increase hydrocarbon production and exports must be seen in the context of the economic diversification policies implemented by a number of Arabian monarchies. They envisages a shift away from oil and gas dependence, innovation in everyday life, etc.

In recent years, Gulf countries have been implementing modernization programs called Qatar National Vision 2030, Saudi Arabia Vision 2030, and Oman Vision 2040, etc. They are dictated by pragmatic considerations and economic benefits that are emerging in the light of new realities.

Arab countries have been victims of the unipolar world since the end of the Cold War, when the era was marked by the US turning their region into a battle and rivalry field, a Jordanian political scientist believes.

Today, in the light of the crisis in Ukraine and the accompanying changes looming, they have a chance to make things right. It is a matter of local players using their large financial, economic and natural resources to diversify politics and international relations more actively. So that as they shift their political navigation towards Russia and China, they can have their own say.

Yury Zinin, a senior researcher at the Center for Middle Eastern Studies of Moscow State Institute of International Relations of the Ministry of Foreign Affairs (MGIMO), exclusively for the online magazine “New Eastern Outlook”.

READ MORE:

https://journal-neo.org/2022/05/12/sanctions-against-russia-reactions-from-the-middle-east/

READ FROM TOP.

FREE JULIAN ASSANGE NOW %%%%%%%%%%%%%%%%%%%%%