Search

Recent comments

- religious war....

9 hours 43 min ago - underdogs....

9 hours 55 min ago - decentralised....

10 hours 17 min ago - economy 101....

20 hours 14 min ago - peace....

21 hours 3 min ago - making sense....

23 hours 41 min ago - balls....

23 hours 44 min ago - university semites....

1 day 32 min ago - by the balls....

1 day 46 min ago - furphy....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

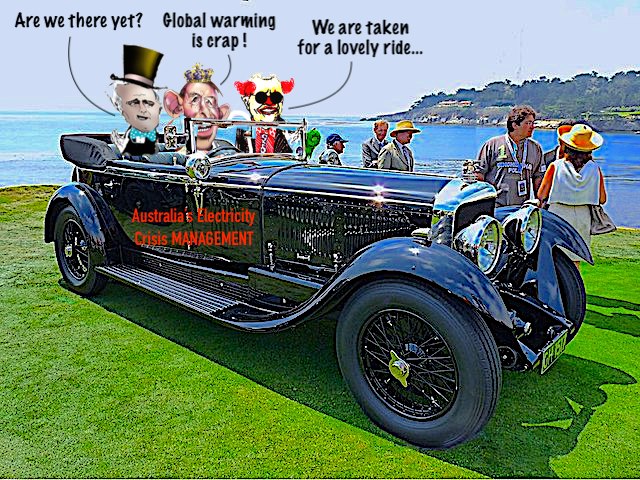

on the way to nowhere with CONservative policies…...

As Australians pay the price for decades of poor energy planning, the two single greatest beneficiaries of high electricity prices are Hong Kong billionaires Michael Kadoorie and Li Ka-Shing. Callum Foote reports on two of the big winners from Australia’s electricity crisis.

It’s another big week in the energy crisis. It’s clear who are the losers: Australians. We have been let down by a decade of policy paralysis on the transition to clean energy. The winners are becoming clear too. Not only have energy companies been “gaming” the market operator AEMO by withholding supply to force the operator to pay them more but they also stand to win enormous compensation payments because AEMO has shut down the market.

The latest development in the drama is the Australian Competition and Consumer Commission has moved to investigate predatory behaviour in the energy market. Decisive action by the competition regulator is long overdue. Clare Savage, head of the Australian Energy Regulator called out generators last week for forcing the Australian Energy Market Operator (AEMO) to shut the market in the expectation of winning greater compensation than would exist under a market cap.

In other words, they win if they game the regulators, and they win if the regulators shut the market are have to pay them penalties.

It remains to be quantified, who are the big winners from gaming of the regulator that is and how much they won; however, we can already point to a few of the main suspects.

The gas cartel of Santos, Origin, Exxon/BHP and Shell have been able to make a killing selling Australian gas to Australians at international prices. But the big 3 ‘Gentailers’ EnergyAustralia, AGL and Origin also stand to gain (they are called gentailers because they are vertically integrated conglomerates which both generate, distribute and retail electricity and gas). They will receive “compensation” from AEMO for shutting the market.

Energy Australia: the billionaire and the ‘black hole’EnergyAustralia is one of the country’s largest energy retailers with around 1.7 million electricity and gas customers across eastern Australia. The company was formed from the purchase of public energy infrastructure sold off in a privatisation sweep during the 1990s.

With the help of auditors and tax advisers PwW, the company then structured itself and its associates to be owned in the tax haven of the British Virgin Islands, although the ultimate owner is a Hong Kong energy juggernaut CLP Holdings.

This once state-owned enterprise now is controlled by its ultimate holding company, Hong Kong juggernaut CLP Holdings, which in turn is controlled by billionaire Michael Kadoorie whose family owns an 18% share.

After having been exposed in these pages for siphoning out profits from its Australian operations through a British Virgin Island parent company in 2019 – and avoiding a lot of tax in this country – EnergyAustralia restructured, taking out the BVI connection. Now the primary Energy Australia company, EnergyAustralia Investments is owned by another CLP subsidiary, EnergyAustralia Holdings.

EnergyAustralia a tax dodger tooEnergyAustralia hadn’t paid any tax on $30 billion in revenue in the five years leading up to 2019 when it was hit with a massive $241 million tax bill and a subsequent $83 million paid in 2020, according to the Australian Tax Office’s Corporate Tax Transparency dataset.

However, this is where the weirdness comes in, both of these CLP subsidiaries are each other’s parent company. In other words, they appear to own each other outright with no visible links to their Hong Kong-based ultimate holding company CLP.

As a result, it is not possible to follow Energy Australia’s company structure beyond these shores. Yet CLP’s BVI connections remain.

According to the Group’s latest financial accounts filed with the Hong Kong Securities Exchange, there are at least four BVI-based companies under the CLP umbrella.

Li Ka-Shing cashing inA second Hong Kong billionaire, Li ka-Shing, also owns a considerable amount of Australia’s energy infrastructure.VicPower is majority-owned by CK Infrastructure and Power Assets Holdings, which are in turn controlled by Hong Kong billionaire Richard Li (son of Li Ka-Shing) via the CK Group.

The ASX-listed company Spark Infrastructure controls the remaining 49% of the CitiPower and Powercor electricity networks. Ka-Shing also owns a majority share in South Australia’s ETSA Utilities and the APA Group sold its 33% interest in Australian Gas Networks Limited which operates natural gas transmission pipelines and distribution networks in South Australia, Victoria, Queensland, New South Wales, and the Northern Territory to Li Ka-Shing’s companies.

Now, with prices through the roof for generators, two Hong Kong billionaires are two of the biggest winners from Australia’s electricity customers.

EnergyAustralia back to no taxWith a poor performance in 2021 as prices for electricity plateaued, EnergyAustralia has now lapsed back into paying zero tax.

The group recorded a loss before income tax of $52.9 million – down from profit before income tax of $451.7 million in 2020 – although there were large windfall gains to the bottom line made in derivatives.

The Gentailer predicts that it will actually earn a tax benefit of $9 million from the taxpayer despite its poor performance this year. This stems from a half-billion-dollar drop in receipts from customers.

Overall revenue dropped from $4.975 billion to $4.45 billion last year while net cash inflow dropped to $347.5 million from $1.14 billion. However, a drop in other costs meant the company ended up with roughly the same amount of cash on hand at the end of the year.

All the while, Energy Australia’s directors decided to give the top brass a nice little pay rise of $5 million up to $15 million split between executives.

Overseas transfersLast year, $322 million, compared to just over $1 billion the year before, was transferred overseas before being taxed in the form of transfers to related companies, while another half-billion was siphoned off in recharges to unspecified associates.

There is simply not enough disclosure about where the money is going or why, but the activities of EnergyAustralia on the tax front have not escaped the attention of the Tax Office. The group disclosed that the ATO had been investigating its affairs.

One of EnergyAustraia’s Mount Piper generators in NSW came online on Tuesday morning, but too late according to a release filed in Hong Kong which said that the company is out billions in potential profit from electricity forward contracts. The company was forced to purchase expensive electricity from the market after having troubles with both its Mount Piper and Yallourn power stations in Victoria.

The company said the overall increase in energy prices will yield higher returns in the long run, so long as it can keep its coal and gas power stations in operation and “purchase fuel as required, generate and dispatch electricity at the higher prices”.

READ MORE:

FREE JULIAN ASSANGE NOW...................

- By Gus Leonisky at 23 Jun 2022 - 8:24am

- Gus Leonisky's blog

- Login or register to post comments

gaming the crisis…...

BY Keith Mitchelson

Chris Bowen has announced reconfiguration of the energy generation system will not ‘commence until 2025’. Can Labor and Australia wait that long?

Labor has set a target of 43% reduction in CO2 emissions by 2030 in their quest to bring emissions to the atmospheric equilibrium of ‘net zero’ by 2050. However, Climate Change and Energy minister Chris Bowen has just announced measures to reconfigure the energy generation system will not ‘commence until 2025’.

In 1928 Leroy Carr and Scapper Blackwell released their seminal Blues song with the haunting refrain – ‘How Long, How Long Baby, Baby How Long?’ expressing acute loss and regret. The world has read of the tragic prospects for our planet due to excess emissions of fossil fuels ever since it was published in numerous newspapers back in year 1912, in Australia and elsewhere – the cause of the climate problem has been public for 110 years already! Atmospheric CO2 is still increasing at nearly 1.97 ppm per year – so by the end of 2025 another 7.9 ppm will be circulating globally and our planet’s heating will be accelerated that much more.

Bowen admittedly has a very great problem. Those neolithic knuckle-draggers of the previous government trumpeted $3 billion back in 2019 to fix our energy supplies. The Energy Security Board (ESB) was tasked in early 2021 to recommend to federal and state energy ministers how to achieve new post-2025 market demands. The National Cabinet only endorsed the final package of national electricity market (NEM) reforms in October 2021. In February and March 2022 the east coast had two consecutive ‘once in a century’ climate-related floods, bringing over $3 billion in insurance damages, one of the Australia’s highest ever disaster costs. Then in May 2022 we had the election which brought Labor to power.

These new post-2025 market arrangements are the most recent plans available, inherited by the Albanese’s government from the Coalition which they now hope will facilitate implementation of their election promises. Their 43% reduction of course is of our entire national emissions, not just the energy generation component. Since power generation represents a major element of emissions and is potentially the easiest sector to affect the 43% reduction target, it demands a massive transition to carbon–free power. The ESB’s Post-2025 plan, as a Coalition era deliberation, naturally includes coal- and gas-fired power.

The current energy price crisis demands both energy supply continuity and compliance with Labor’s promise of low power prices. This is a very difficult combination to achieve. And if we consider the principal role that lower emissions must be achieved for a 43% total emissions reduction, a plan to continue burning coal and gas is not credible.

After the resounding vote from Australians for decisive action to reduce climate damage, we know the Coalition-era plans cannot achieve Labor’s target. We can see why Prime Minister Albanese does not want to be accused of breaking election promises by increasing the emissions target, but missing it would be even more tragic. The resounding vote for the Green and the Teal co-recipients of the public’s plea – ‘How Long, How Long ‘til You Act?’ seems not to have entered government considerations.

The proposals of the ESB involve prolonging the use of coal- and gas-fired power stations. We are told by Australian Energy Market Commission (AEMC) that these measures are to provide energy stability and thus aid implementation of renewables, while also combatting the energy crisis. Actually, it is an energy price crisis, which Labor seems acutely aware could bring claims of profligacy if we pay the exorbitant fees the power companies are demanding.

The power-companies have been ‘gaming’ the energy price crisis, and it has worked absolutely in their favour – they have already spooked Albanese’s government to obey their conservative inclinations, rather than the aspirational inclinations of Australians that his government promised to address.

Sure the power generators and fuel production companies were taking advantage of the elevated international gas price, hence the price for all fuels increased accordingly. But they were also playing another game too – their retention of their existing facilities with continuing high returns becomes more compelling than spending fresh money to build renewables infrastructure. International investment financiers BlackRock predicted recently that delaying renewables and continuing with fossil fuels would be the prevailing international trend for the immediate future – a self-fulfilling prophecy since they have such large influence on global investment directions.

And then there are rising international bank interest and falling bond rates too. Of course, Australia is aligned here too. So the financial markets are totally back in control, and behind the scenes those BlackGuards, the international fossil fuel companies, are playing a controlling role and influencing the international markets.

We should have known the fossil fuel companies would not take the Paris and Glasgow Climate Accords lying down. They are fighting hard to roll back the implementation of alternative energy in that skilful behind the scenes way that the Ukraine conflict provides for them – elevated windfall prices that make their products much more financially attractive and so worthy of further investment. Our own dear old Murdoch press echoes this – it is continually full of praises for the windfall profits coming to our miners and fossil-fuel producers.

I am realist enough to know that aligning policy between our states, assembling the blueprints, hiring the contractors and skilled workers, and building the renewables infrastructure would take time if it was all commencing from scratch. But our renewables industry is already out there, and is well organised. We have been building solar farms and wind farms, and putting on roof-top solar for decades already. What does seem to be missing is a powerful government commitment to increase storage in batteries and pumped-hydro, increasing electric vehicle utility, and accelerating the rewiring and expansion of our power-grid infrastructure to accommodate renewable energy sources. And there is Saul Griffith’s argument that we should see private roof-top solar and people’s private electric cars as national infrastructure, and build for a highly disseminated electricity grid – Australia is waiting and expecting Chris.

If there was aggression against us as a nation, we would not accept waiting four years for the army to stand up and repel it. We would demand it happened now. And obviously, some enormous aggression is being applied.

Another four years until action is one whole parliamentary term. Does Labor really think the people will sit waiting silently for this wonderful Coalition-era plan to start – What plan? We haven’t even seen it yet.

Bye, Bye Baby, Baby Too Bad.

READ MORE:

https://johnmenadue.com/keith-mitchelson-how-long-how-long-blues/

READ FROM TOP.

RREE JULIAN ASSANGE NOW................