Search

Recent comments

- crummy....

14 hours 15 min ago - RC into A....

16 hours 7 min ago - destabilising....

17 hours 11 min ago - lowe blow....

17 hours 43 min ago - names....

18 hours 20 min ago - sad sy....

18 hours 45 min ago - terrible pollies....

18 hours 55 min ago - illegal....

20 hours 7 min ago - sinister....

22 hours 29 min ago - war council.....

1 day 8 hours ago

Democracy Links

Member's Off-site Blogs

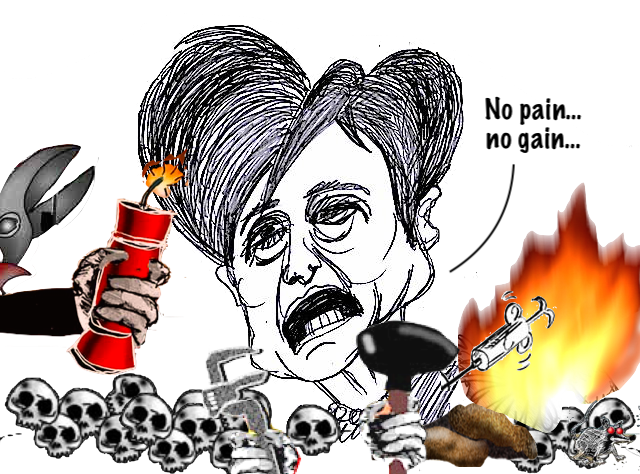

IMF predicts more pain…….

The United States may have to endure economic “pain” in order to rein in rampant inflation, the head of the International Monetary Fund (IMF) said on Friday, noting that a downturn might be the “necessary price to pay” for recovery.

Speaking to reporters during a Friday press conference, IMF Managing Director Kristalina Georgieva predicted a rough ride for the US economy, which is experiencing decades-high inflation with soaring prices for a number of staple goods.

“Success over time [in lowering prices] will be beneficial for global growth, but some pain to get to that success can be a necessary price to pay,” she said, soon after the IMF slashed its growth forecast for the US by nearly a full percentage point, down to 2.9%.

Georgieva added that the United States faces a “narrowing path to avoiding a recession,” but that tackling inflation must be the “top priority,” even if it means an economic slow-down.

Nigel Chalk, the number two official at the IMF's Western Hemisphere branch, also warned of the risk of a recession, but predicted that any downturn would be short-lived, pointing to robust savings and labor markets in the country.

The comments from the international lender come after the US Federal Reserve pushed through the highest interest rate hike in 28 years last week, in what Fed chair Jerome Powell described as an effort to counteract inflation. He has since acknowledged, however, that the central bank does not have control over prices for many key goods, including food and gas, explaining “There’s really not anything that we can do” about rising oil and grain costs.

READ MORE:

https://www.rt.com/business/557785-imf-us-inflation-pain-price/

FREE JULIAN ASSANGE NOW..................

- By Gus Leonisky at 26 Jun 2022 - 9:00am

- Gus Leonisky's blog

- Login or register to post comments

a storm on the horizon…..

The world is in the grip of a perfect storm. Food prices have been rising for two years after the impact of the COVID pandemic and disruptive weather patterns.

Russia's invasion of Ukraine has added to the crisis. Supplies of grains and fuel have been hit. Ukraine is considered one of the world's breadbaskets, its farmers produce enough grain to feed hundreds of millions of people. The war has choked off those supplies.

[GusNote: Russia is more of a bread basket to the world than Ukraine, but the sanctions against Russia have stopped delivery from Russia... AND THE MINES BY UKRAINIAN FORCES HAVE STOPPED SHIPPING FROM UKRAINIAN PORT OF ODESSA]

Inflation is skyrocketing into double digits in many countries.

The head of the United Nations World Food Programme, David Beasley, said this week that "if people can't feed their children and their families, then the politics unsettles".

Beasley said the UN has already had to start rationing food supplies. Harsh choices are being made to divert food from hungry people to starving people.

"If we're not there with a safety net program, then the political extremists or whatever the case may be, will exploit that," Beasley said. "Next thing you know, you've got riots, famine, destabilisation and then mass migration by necessity."

He warned that in 2023 the world will see mass food shortages. Beasley said five years ago around 80 million people were "marching toward starvation" that number nearly doubled during COVID now the number of people facing critical food shortage has doubled again to over 270 million and tens of millions are facing famine.

It all puts our own travails in Australia into perspective. We may complain about a shortage of lettuce and having to make do with cabbage on our burgers, but we are not starving.

Beasley is calling on rich countries to do more. But of course everything is relative and wealthy countries are dealing with their own angry people.

Australia has not escapedHere Australians are being warned to brace for spiking inflation, ever higher interest rates and falling asset prices.

We are being told to wind back expectations of wage rises.

And it is the most vulnerable who will be hit the hardest. Inflation is a tax on the poor who are already facing mortgage stress or rental crisis.

The rich have a buffer. They have been stashing away cash. Economists say there is a global savings glut. Wealthier people have been hoarding money rather than spending or investing.

The savings of the richest 10 per cent in the United States have far outstripped the savings of the remaining 90 per cent.

The savings glut has forced down interest rates and pushed up housing prices. But now interest rates are on the move upwards, the rich can divest or cushion the blow, poorer people will be left with harder choices.

...

Rising inflation is not just a question of whether we renew our television streaming subscriptions; it is a question of whether millions of people have enough food to eat. It is life and death.

It will lead to more desperation, more disruption, more mass movement of people and inevitably anger.

Political opportunists will exploit this for their own ends. And governments desperate to appease people – or quite rightly try to soften the economic blow – may pursue short term policies that only prolong or exacerbate inflation and economic stress.

We are only half way through 2022 and already we are looking ahead to darker days in 2023.

Bob Marley warned that "them belly full, but we hungry", the poet William Blake cast it in even more apocalyptic terms: "A dog starved at his master's gate predicts the ruin of the state."

Stan Grant is the ABC's international affairs analyst and presents China Tonight on Monday at 9:35pm on ABC TV, and Tuesday at 8pm on the ABC News Channel, and a co-presenter of Q+A on Thursday at 8.30pm.

READ MORE:

https://www.abc.net.au/news/2022-06-26/inflation-supply-chain-cost-of-living-wages-inequality-unrest/101180436

Political opportunists? The West lives in a crap bubble in an ANTI-RUSSIA-ANTI-CHINA crab basket....

The BRICS cooperation mechanism has developed a multi-tier, systemic set of institutions that is yielding remarkable progress in key areas, and it could now speak as one voice in the global arena on behalf of emerging markets and developing countries, experts said.

They made the observation as the leaders of the five member states-Brazil, Russia, India, China, and South Africa-will convene virtually on Thursday for the 14th BRICS Summit.

Zhu Jiejin, a professor at Fudan University's School of International Relations and Public Affairs, said "one of the milestones" in the progress made by BRICS over the past 16 years is the establishment of its New Development Bank and its emergency reserve.

Following its opening in Shanghai in 2015, the bank expanded its membership for the first time last September to include the United Arab Emirates, Uruguay and Bangladesh.

"This symbolizes a major step in the bank marching toward becoming an international multilateral development bank, and it will offer financial support to more emerging markets and developing countries boosting their say and influence in the global financial system," Zhu said.

Ren Lin, head of the Department of Global Governance at the Chinese Academy of Social Sciences' Institute of World Economics and Politics, said the BRICS countries have established a collaboration system with a wide spectrum and multiple levels, and it "has made remarkable progress in several critical areas concerning the reform of the global governance system".

In terms of development, the BRICS countries are deepening collaboration in areas such as fulfilling the United Nations 2030 Sustainable Development Agenda, tackling climate change and advancing green development, she said.

"And in the area of security, the BRICS nations have made their coordination and contacts even closer and mutually respect sovereignty, security and development interests," she said.

Ren highlighted the synergy of BRICS' different cooperative agenda items, such as the link between its financing function and sustainable development projects.

"BRICS' New Development Bank will offer $30 billion in financing over the next five years for member states, and 40 percent of the funding will be used in easing climate change," she noted.

Chen Fengying, an economist and former director of the Institute of World Economic Studies at the China Institutes of Contemporary International Relations, said the BRICS cooperation mechanism, now led by the annual summit, includes affiliated events such as the annual meetings of foreign ministers, trade representatives, think tanks and forums, forming a well-organized architecture of institutions.

"The mechanism has become a powerful platform for emerging market countries and developing countries to consolidate their consensus and speak out as one voice," Chen said.

In particular, this mechanism could still function properly even if there were some disagreements among certain members, and they always honor the spirit of inclusiveness, openness and mutual benefit, "drawing a sharp contrast to some cliques pursued by some countries that are based on ideology and hegemony", she said.

Future tasks

In the midst of the lingering COVID-19 pandemic, inflation, supply chain disruptions and impulses to counter globalization, BRICS should strengthen its cooperation, boost its resilience, develop emerging sectors and counter policy risks brought by other countries, observers said.

Chen said the BRICS nations should further reinforce the New Development Bank, build up its emergency reserve, and do more to bolster developing countries' financial resilience.

"Also, the five countries should work even closer in cutting-edge areas such as the digital economy and AI-driven production, join hands to secure the safety of production chains and supply chains, closely track global inflation, coordinate macroeconomic policy and tackle post-pandemic recovery," she added.

Feng Xingke, secretary-general of the World Finance Forum and director of the Center for BRICS and Global Governance, said the BRICS nations should strive for a greater role in global financial governance reform and seek more voting rights and a greater say in key institutions such as the International Monetary Fund.

"To avoid possible sanctions imposed by some Western countries and boost their immunity against external risks, the BRICS nations should seek more local currency settlement among them in the context of international economic cooperation. They could also consider establishing a cross-border payment clearance system to boost their cross-border financing, investment and trade," Feng said.

Hu Biliang, an economics professor and executive dean of the Belt and Road School at Beijing Normal University, said future BRICS cooperation should be aimed at greater quality, and it should take the opportunities offered by digital technologies and the Fourth Industrial Revolution.

"Only a greater quality of their cooperation could make it possible to effectively advance the United Nations 2030 Sustainable Development Agenda and better translate into reality the China-proposed Global Development Initiative," he said.

Zhu, the Fudan University professor, said the BRICS nations could take the lead in prompting developed countries to fulfill their commitment to offer more funds, technologies for developing countries and facilitate their capacity buildups.

[email protected]

READ MORE:

https://www.chinadaily.com.cn/a/202206/22/WS62b24d32a310fd2b29e67b69.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW...................