Search

Recent comments

- framing....

2 hours 50 min ago - huckabee v tucker.....

3 hours 5 min ago - EU degeneration....

3 hours 53 min ago - a major war?....

6 hours 7 min ago - WAR!?....

5 hours 2 min ago - saint rube....

7 hours 48 min ago - patience....

9 hours 57 min ago - pretending....

11 hours 24 min ago - stenography.....

1 day 1 hour ago - black....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

the collective impoverishment, economic suicide and degradation of europe…….

The vulnerability of the world, especially Europe, to importing fossil fuels from abroad was already shown by the oil crisis of the 1970s. Europe began to gradually cope with it only a decade later. In a way, the winning move at that time was to actively build nuclear power plants in order to produce high-tech energy themselves.

Given the disastrous effects of the 1970s energy crisis on European economies dependent on energy imports, it is not surprising that the United States chose this very direction to break up its main foreign policy and economic rival, Europe. And no one doubts both this and the man-made nature of the current economic crisis raging in Europe, especially no one in Europe.

BY Vladimir Odintsov

As a result, the fanatical crusade against Moscow by EU bureaucrats, closely allied to the US and directed from Washington, is resulting in the collective impoverishment, economic suicide and degradation of Europe.

However, as a result of Washington-inspired energy provocations and restrictions on Russian energy supplies to the European market, America could also face a gas crisis of its own, The Wall Street Journal reported. Stock levels are now lower than usual and winter could see price spikes. As a result, the United States’ vigorously proclaimed friendship with Europe will not survive the winter cold.

Describing the current misery in Europe, the Belgian MEP Tom Vandendriessche points out that the average annual energy bill for Flemish families is now 9,000 euros, record inflation is destroying savings and the purchasing power of the population. The average annual heating and electricity bill now exceeds the monthly wages of low-paid workers in most EU countries, as reported by the European Trade Union Confederation. However, this is only the tip of the iceberg, as the consequences of the energy crisis are much more severe. Production is stopping everywhere, unemployment is rising, industry is leaving Europe and will probably never return.

The European steel industry, the backbone of industrial production for most commodities, has been threatened by the energy crisis. High energy prices have made the industry particularly expensive and uncompetitive, and factories have announced complete or partial shutdowns. Sharp fluctuations in energy prices and persistent problems in supply chains threaten to usher in an era of European de-industrialization. Faced with exorbitant natural gas prices, other energy-dependent industries in Europe, which serve as the main economic activity, such as the chemical, automotive, cement and many other industries, are facing similar problems. In this very difficult and so far desperate situation, European industrialists are actively exploring options for relocating their production elsewhere. And in this respect, they are primarily attracted to countries with no dependence on energy imports, more stable energy prices and strong government support.

In order to lure European industries and thereby further deplete the European Union (which was Washington’s objective when it initiated the energy crisis in Europe), it is the United States that has recently become increasingly active in luring European industries into its territory. After all, this not only promises to increase the tax revenue in the US budget system, crisis-ridden and running a multibillion-dollar deficit, but also to create thousands of new jobs in the United States, and hence resolve internal social tensions.

And now, according to The Wall Street Journal, Ahmed El-Hoshy, chief executive of Amsterdam-based chemical firm OCI NV, has already announced in September the “expansion of the plant” to produce ammonia in Texas. Danish jewelry company Pandora and German carmaker Volkswagen have also announced “expansions” in the United States, while Tesla is pausing its plans to produce batteries in Germany and expand it in the US itself, using the Inflation Reduction Act signed into law by President Biden in August. Many other European industrialists from various EU countries have similar intentions.

Analysts and investors argue that Europe remains a welcome companion to advanced manufacturing technologies and can boast a skilled workforce. Therefore, it is not only the US that is interested in relocating European production to its territory. In particular, there is already interest from energy-rich countries in the Middle East, as well as Asia, Africa and Latin America, which still have cheap labor.

The southern CIS states, especially those in the Transcaucasus and Central Asia, are also counting on this “relocation” of European production, which has initiated in recent weeks their desire to “move away” from Russia in order to avoid European sanctions and become more attractive to the economic “re-distribution” of EU production to the outside world.

With the US itself admitting that American shale producers will not be able to save Europe in the coming years and that the US will face the same energy nightmare as Europe, the EU’s economic and energy collapse will clearly be protracted and the problem of European de-industrialization is becoming more pronounced, according to Bloomberg estimates.

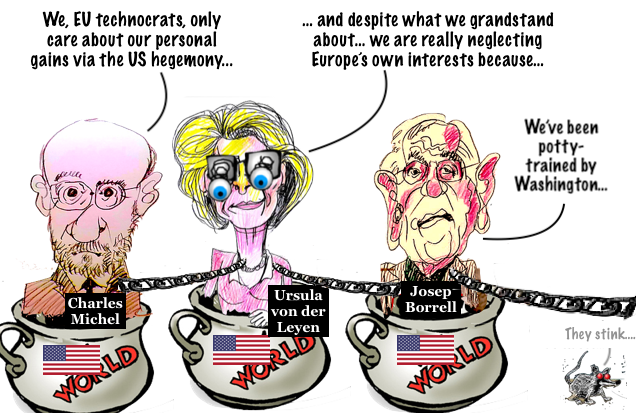

Britain, which had learned in advance about secret US plans to break up the European Union, has already left the EU. A number of countries in the European community are also thinking of following suit to secure themselves from the dictates of overtly pro-American European officials like Ursula von der Leyen, Josep Borrell, Charles Michel, who only care about their personal gains and US hegemony, neglecting Europe’s own interests. At the same time, in the impending de-industrialization of Europe and the transfer of many industries out of the EU, many European officials and the current European political elite clearly see for themselves a way to preserve their own elite position. The inevitable retribution for their blatant anti-European activities on the part of the growing resentment of the masses could diminish as a result. In particular, through a forced exodus of the current anti-government forces to other countries, following the “transfer” of European industrial capacity. Hence the continuation and further escalation by these pro-American European officials of a policy of anti-Russian sanctions, which only worsen the situation in Europe itself. And this despite the fact that, according to numerous analysts, experts and even MEPs, it is in strengthening cooperation with Russia, rather than following Washington’s provocative and destructive plans, that Europe is now most likely to emerge from the economic and energy crisis that has engulfed it.

Vladimir Odintsov, political observer, exclusively for the online magazine “New Eastern Outlook”.

READ MORE:

https://journal-neo.org/2022/10/04/where-will-europe-have-to-move-its-industrial-production/

FREE JULIAN ASSANGE NOW........................

- By Gus Leonisky at 9 Oct 2022 - 7:03am

- Gus Leonisky's blog

- Login or register to post comments

euro blues......

The euro has fallen to a 20-year low threatening to inflict further pain on an economy that's already having to contend with a surge in inflation. And the bad news is that the common currency's slide may not stop here.

The euro sank below $0.99 to a new 20-year low on Monday after Russia's halt to gas supplies down its main pipeline to Europe heightened fears about a deepening energy crisis across the region.

In recent months, the common currency's value has been increasingly correlated with natural gas prices, with the euro falling when prices of the energy source rise.

Europe is scrambling to wean itself off Russian supplies and build up reserves before the cold winter months, but investors reckon the hit to its economy will be huge.

The current slide has been swift: Just before Russia launched its war in Ukraine, €1 was worth $1.15.

Why is the euro falling?The general worsening of the eurozone's outlook amid soaring gas prices and fears of Russia cutting off natural gas supplies is dragging down the shared currency. The oversized reliance of major economies such as Germany and Italy on Russian gas has left investors unnerved, with economists forecasting a much quicker and more painful recession in the euro area than in the US.

Added to that is the difference in interest rate levels in the US and the eurozone. The US Federal Reserve has been more aggressive in hiking interest rates in its battle against inflation. While the US central bank has raised key rates by a combined 225 basis points since March, the European Central Bank (ECB) has so far executed only a 50-basis point.

"The money would go to the place with a higher yield," Carsten Brzeski, chief economist for Germany and Austria at ING, told DW.

The US dollar is also benefiting from its safe-haven appeal. Amid all the gloom and doom and uncertainty around the global economy, investors are taking comfort in the relative safety the dollar offers, being less exposed to some of the big global risks right now.

READ MORE:

https://www.dw.com/en/why-the-euros-weakness-is-a-big-deal/a-62909600

READ FROM TOP.

SEE ALSO: exposing economic fudge.......

FREE JULIAN ASSANGE NOW..............

less electricity....

Damage to energy infrastructure caused by Moscow’s air strikes has forced Ukraine’s government to cut off electricity exports to the European Union, taking away a supply source that Kiev claims helped its partners reduce their reliance on power generated with Russian natural gas.

“Today’s missile strikes, which hit the thermal generation and electrical substations, forced Ukraine to suspend electricity exports from October 11, 2022, to stabilize its own energy system,” the Ukrainian energy ministry said on Monday in a statement.

The ministry noted that even after losing control of the Zaporozhye nuclear power plant to Russian forces in March, Kiev had been able to meet its export commitments to European partners, but Monday’s attacks were the largest of the entire conflict. “The cynicism is that the entire supply chain has been hit,” Energy Minister German Galushchenko said. “It’s both electricity distribution systems and generation. The enemy’s goal is to make it difficult to reconnect electricity supplies from other sources.”

Russian President Vladimir Putin said Monday’s air strikes on Kiev and other major Ukrainian cities – targeting military, energy and communications infrastructure – came in response to Ukraine’s attack on the strategic Crimean Bridge on Saturday.

“If there are further attempts to conduct terrorist attacks on our soil, Russia will respond firmly and on a scale corresponding to the threats created against Russia,” Putin announced.

READ MORE:

https://www.rt.com/russia/564438-ukraine-halts-electricity-export-eu/

THE ENEMY ISN'T RUSSIA. THE ENEMY IS THE KIEV NAZI REGIME..... THE EU MEMBERS SHOULD INSERT THIS CONCEPT IN THEIR LITTLE CABOOSHES.... STOP THE SANCTIONS ON RUSSIA AND START TO BE MORE ASSERTIVE ABOUT LITTLE SHIT ZELENSKY....

READ FROM TOP.

FREE JULIAN ASSANGE NOW.....................

Borrell is a US useful idiot....

For too long the EU’s prosperity has been dependent on China and Russia, while security has been outsourced to the US, top EU diplomat, Josep Borrell, has said.

The statement comes amid soaring energy prices and attempts to curb Russian oil and gas supplies as part of sanctions over Moscow’s military operation in Ukraine.

“Our prosperity has been based on cheap energy coming from Russia. Russian gas – cheap and supposedly affordable, secure, and stable. It has been proved not [to be] the case,” Borrell said in a speech at an EU ambassadors’ conference on Monday.

The diplomat added that the 27-member bloc also relied too much on trade with China, as well as Chinese investment and “cheap goods.”

“I think that the Chinese workers with their low salaries have done much better and much more to contain inflation than all the Central Banks together,” Borrell argued.

READ MORE:

https://www.rt.com/news/564454-eu-prosperity-russia-china/

READ FROM TOP.

BORRELL IS A US STOOGE.... and talks shit.

FREE JULIAN ASSANGE NOW ••••••••••••••••••••••••••••