Search

Recent comments

- "CIA"....

37 min 44 sec ago - provoked....

45 min 4 sec ago - war footing....

54 min 16 sec ago - vote....

1 hour 9 min ago - don't relax....

1 hour 53 min ago - 1939–1945....

2 hours 36 min ago - no time?....

2 hours 51 min ago - framing....

6 hours 46 min ago - huckabee v tucker.....

7 hours 1 min ago - EU degeneration....

7 hours 48 min ago

Democracy Links

Member's Off-site Blogs

happy new year.......

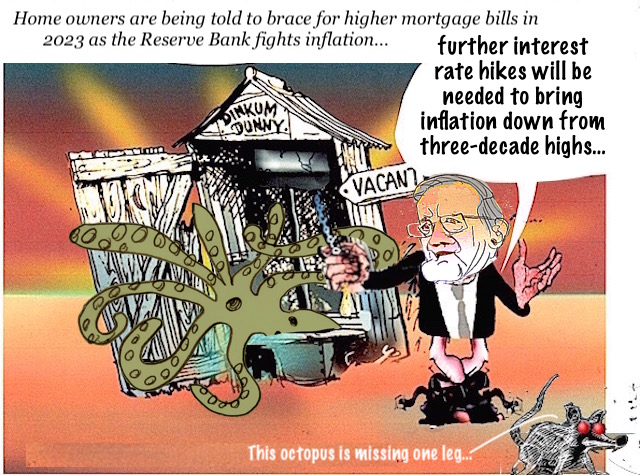

Home owners are being told to brace for even higher mortgage bills in 2023 as the Reserve Bank’s inflation fight approaches a second year.

The RBA unveiled an eighth interest rate hike at its final meeting of 2022 on Tuesday, lifting its target by another 0.25 percentage points to a decade high of 3.1 per cent.

It capped off an unprecedented run of rate rises that’s seen more than $800 added to typical monthly mortgage bills for millions of households.

As RBA boss Philip Lowe warns further increases will be needed to bring inflation down from three-decade highs, economists say families must now brace for at least another $200 in additional mortgage pain.

“We will see more people struggling and having to reach out to their lenders,” KPMG senior economist Sarah Hunter told The New Daily.

Moving forward, economists said the trajectory for interest rates will be determined by how tightly consumers hold onto their purse strings over Christmas, with expectations of a slowdown in the New Year.

READ MORE:

https://thenewdaily.com.au/finance/finance-news/2022/12/06/christmas-interest-rates-2023/

PLEASE DROP THE CLICHE....

FREE JULIAN ASSANGE NOW.....................

- By Gus Leonisky at 7 Dec 2022 - 9:12am

- Gus Leonisky's blog

- Login or register to post comments

self-funded losses.....

by Kim Wingerei and Michael West

Dixon Advisory clients will get 4c in the dollar back from their savings if they accept PwC’s deed at the creditors’ meeting today. A classic case of hubris, greed, hard-selling and poor management, Kim Wingerei and Michael West report on the Dixon wash-up.

It was sometime after the Global Financial crisis when the second author of this story, then working at the SMH, was threatened with a defamation lawsuit by Dixon Advisory. We had been told by a contact “this thing is going to blow up” but Dixon was keen to muzzle adverse publicity and used its lawyers to threaten journalists.

Pity because we had also warned of the collapse of Storm Financial and City Pacific (earning legal threats from the City Pacific white shoe brigade too). A small point now, after the fact, and after Dixon has wiped out much of the savings of 4,606 creditors, delivered $368m in losses and a smorgasbord of fees for liquidators and lawyers.

In any case, it is worth saying that investors might be spared greater losses if Australia did not have such oppressive defamation laws.

Cleaning up from conflicts of interestThe Dixon Advisory & Superannuation Services (Dixon) was one of Australia’s largest managers of self-managed superfunds (SMSFs). But it didn’t just manage the funds. It concocted and promoted investment products for its clients to invest in too. More fees that way. Way more conflicts of interests too, not that that seemed to bother its hard-selling investment advisors.

One of these Dixon funds was the US Masters Residential Property Fund (URF). It didn’t go well, clients complaining as losses mounted. ASIC took them to court.

Then kaboom, it was all over, in January this year when Dixon directors called in the administrators, partners of Big Four firm PWC, citing its inability to meet its payments to creditors, many of them aggrieved investors in URF.

The URF was conceived after the Global Financial Crisis and it seemed a good idea at the time: buy up a bunch of under-valued properties in New York metropolitan areas, renovate them, rent them out and wait for the property values to recover. The extra “kicker” for Australian investors in the sales spiel was the expectation that the $A – then at parity with the greenback – would fall, making the $US property worth more and lifting the prospect of a windfall.

All good in theory, and for a while in practise too. The URF opportunity was heavily promoted by Dixons for the first few years, including tax refundable junkets for clients to go to “seminars” in New York and see the real estate they kinda’ owned. The fund was listed on the ASX in 2012, the share price reached an all-time high of $2.31 in 2015. It is now $0.28, reflecting the massive losses incurred on its underlying assets.

Cleaned up by conflicts of interestThere was a big issue here. The conflict of interest in Dixon flogging its own investments despite professing to be giving independent advise as per the dictates and intentions of the “FOFA” reforms enacted to curtail the conflicts.

The first signs that things were not going so well for URF came in 2018, when the Australian Financial Complaints Authority (AFCA) received the first of many complaints about both the mismanagement of the fund’s assets and the manner in which Dixon clients had been misled, including insufficient disclosure of related party transactions. ASIC commenced proceedings against Dixon in September 2020, alleging in the Federal Court that the company had not acted “in the best interest of its clients.”

ASIC has not had a great track record winning court cases for some years, so instead they came to an agreement for Dixon to pay $8.2 million in penalties and costs in July 2021, subject to court approval. Given that the Administrators have since calculated the total losses for Dixon clients to be $368m, the fine now seems a mere slap on the wrist.

Enter the vultures. Eyeing an opportunity for a fee-fest, Piper Alderman and later Shine Lawyers entered the fray and launched class actions on behalf of some of the 4606 Dixon clients in late 2021, predicting – or maybe predicating – the company seeking protection from creditors by entering administration.

Dixon is now part of ASX listed E&P Financial Group Ltd (EP1), the result of an earlier merger between another advisory firm and fund manager, Evans & Partners, and Dixon Advisory. E&P is a limited guarantor for Dixon, including for the payment of the ASIC fees, but whatever is left for the creditors is what the Administrator can wrest from the remnants of Dixon, and that is meagre pickings.

The recommended proposal before the creditors is a Deed of Company Arrangements (DOCA) that nets (at best) $21.6 million for distribution. But first the Administrator (PWC) will deduct their $5.3 million, trade creditors get $663,000, leaving the aggrieved investors with $16 million to share between 4606 claimants – or just about 4 cents to the dollar of their average losses of $79,880 each, as estimated by the administrators.

And that is before the class action lawyers get their share, most likely at least a third – there goes another $5.3 million. As their claims were stayed (but not discontinued) when the administrator was appointed, they have had little to do and in reality serves no purpose other than to ride off the back of the work of the administrators, who has identified the creditors and evaluated their claims.

In summary: $21.6 million in the pot, the administrator and the lawyers get just about half of it.

READ MORE:

https://michaelwest.com.au/dixon-advisory-creditors-gets-little-the-lawyers-and-accountants-do/

READ FROM TOP

FREE JULIAN ASSANGE NOW..................

a deranged expert in housing....

When Gabriel Metcalf first visited Sydney on a study tour from the US, he fell in love with the city and its harbour. So, when a headhunter approached him about a job here years later, “I knew that was a phone call I should answer”.

In January, Metcalf will return to San Francisco after four years at the helm of the Committee for Sydney, an urban policy think tank. Back in California, he will be confronted by an eerily similar political environment, where housing affordability is a wicked problem and property ownership is the great social divide.

READ MORE:

https://www.smh.com.au/national/nsw/australia-warned-we-ve-made-the-same-mistake-as-us-on-housing-20221128-p5c1x4.html

BON VOYAGE.... THIS GUY HAS NEVER UNDERSTOOD ANYTHING ABOUT WHAT REAL PEOPLE LOVE AND IT'S NOT A 15 STOREY BUILDING NEXT TO YOUR LITTLE COTTAGE. SOME AREAS ARE ALSO PART OF HERITAGE PRECINCTS, A BIT LIKE FIRENZE, ROME OR THE PARIS CENTRE WHICH IN MANY PARTS IS NOT AS OLD AS SOME SUBURBS OF SYDNEY...

IT ALSO APPEARS THIS GUY'S MIND HAS BEEN THOUROUGHLY HOAXED BY THE "SYDERNEY" PEOPLE HE MIXED WITH IN REGARD TO "MELBURN".... SO ONCE MORE, PISSORF HAPPILY BACK TO THE USA WHERE THE SUN SETS ON THE OTHER SIDE OF PLANET... (JOKE!)....

READ FROM TOP.

FREE JULIAN ASSANGE NOW..................