Search

Recent comments

- sicko....

5 hours 4 min ago - brink...

5 hours 20 min ago - gigafactory.....

7 hours 7 min ago - military heat....

7 hours 49 min ago - arseholic....

12 hours 33 min ago - cruelty....

13 hours 49 min ago - japan's gas....

14 hours 30 min ago - peacemonger....

15 hours 27 min ago - see also:

1 day 28 min ago - calculus....

1 day 42 min ago

Democracy Links

Member's Off-site Blogs

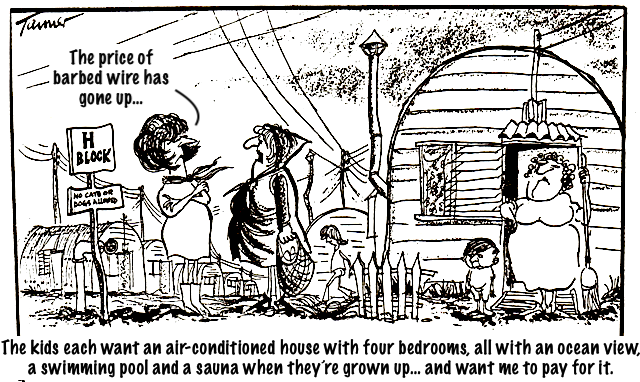

housing crisis in aussieland.....

House values in a string of sought-after Sydney suburbs have dropped more than 20 per cent over the past year, new figures show, and declines in some pockets of Melbourne and Brisbane are not far behind.

Popular inner-city and coastal Sydney suburbs have had median values plummet this year as consecutive interest rate hikes and affordability constraints reined in buyer demand and spending power.

The 10 largest house value drops nationally were all in Sydney suburbs, CoreLogic’s annual Best of the Best report, released on Tuesday, shows.

House values fell 26.8 per cent in Narrabeen over the year to November 30, to a median just shy of $2,593,000.

Declines of about 25 per cent were recorded in inner-city Surry Hills and Redfern, and falls of more than 20 per cent occurred in nearby suburbs such as Darlington, Camperdown and Newtown, as well as in Birchgrove in the inner west, and Waverley in the eastern suburbs.

READ MORE:

- By Gus Leonisky at 13 Dec 2022 - 7:05am

- Gus Leonisky's blog

- Login or register to post comments

transport has been privatised....

https://yourdemocracy.net/drupal/node/45958

housing crumbs.....

MEANWHILE, FIVE YEARS AGO....

By P&I Guest ArchiveApr 26, 2017

Australia lacks any enumerated and resourced plan for expanding affordable housing. Recent growth opportunities in this industry have largely been small-scale, fragmented and ad hoc. As a result, providers have been highly constrained in their ability to predict and plan for growth. This has disrupted capacity-building and undermined capacity-retention.

With a shortfall of affordable rental homes that reached 271,000 in 2011 and a crumbling public housing system, it’s encouraging to note Scott Morrison’s recent recognition that private investment in low cost rental provision must be stepped up and that government can help to make this happen. Albeit amid many contradictory housing policy signals from Canberra, hopes are rising that the May budget could include meaningful steps towards making this a reality.

But any new framework for stepped-up private investment in low-cost rental provision will likely re-awaken questions about the capacity of Australia’s affordable housing industry to provide an effective delivery vehicle for such a push.

The past decade has, in fact, seen our not-for-profit (NFP) housing sector experiencing rapid growth and somewhat greater public visibility. But by comparison with international benchmarks, the sector remains relatively small and asset-poor. And longstanding questions about the NFP sector’s ability to further expand its role – such as through taking responsibility for restoring public housing at scale – were restated only in 2016 by the Treasurer’s Affordable Housing Working Group report. With such concerns in mind, AHURI-funded researchers (led by UNSW and also involving Swinburne University, RMIT, the University of Tasmania and the University of Queensland) have been investigating the affordable housing industry’s capacity to take on such challenges and looking to identify the ways that governments and industry players can best assist in overcoming existing constraints.

What is the affordable housing industry?

The affordable housing industry can be thought of as a government-enabled system providing for low to moderate income households inadequately served by the mainstream market. Importantly, this system-wide conception of the industry broadens the gaze beyond the organisations directly responsible for providing low-cost rental accommodation (mainly NFP community and Indigenous housing providers, but also a few for-profit firms) to also include the supporting entities and institutions that assist providers in their effective operation. Involved in this way are a wide variety of service delivery partners, lenders, professional support services, specialist trainers and peak and trade bodies. Importantly, this ‘supporting cast’ also encompasses government players including policymakers, program managers and regulators.

Critically, as our preliminary 2016 report contends, since the industry exists to provide non-market products and services, it can do so only to the extent that official policy, resourcing and regulatory frameworks enable its work. At its broadest, therefore, these frameworks are part and parcel of the affordable housing industry itself.

What is capacity?

Capacity, as we define it, is the industry’s ability to perform the work and achieve the goals that governments and industry stakeholders envisage for it. Capacity questions concern various aspects. Often first to mind would be whether provider organisations have the governance, people skills and business systems to fulfil their current responsibilities and, ideally, to expand their role.

Under our conception of the ‘affordable housing industry’, capacity within government is another highly relevant dimension. Here we are talking about not only the political leadership and stability needed to champion and foster a new industry (think renewable energy or disability services) but also the enduring administrative capacity to carry through reforms and successfully implement and regulate intended policy directions.

Also in play is the ability of the industry as a whole to operate cohesively in promoting its goals, in developing industry skills and capacity, and in maintaining effective influence with an ever-changing cast of politicians and higher order policymakers.

For a subsidised industry like affordable housing, however, perhaps the foremost issue is the adequacy of the policy and resourcing framework. The standard business model is built on blending private finance (debt and equity) with public subsidies (in various forms) to produce long term housing affordable for lower income households. The adequacy and surety of the government subsidy component therefore, is central to the industry’s prospects.

Current capacity shortcomings

As detailed in our newly-published final report, the greatest capacity constraints lie in four areas.

Firstly, and above all, Australia lacks any enumerated and resourced plan for expanding affordable housing. Recent growth opportunities in this industry have largely been small-scale, fragmented and ad hoc. As a result, providers have been highly constrained in their ability to predict and plan for growth. This has disrupted capacity-building and undermined capacity-retention.

Secondly, albeit in common with some other areas of government, housing policy has suffered a major erosion of policymaker expertise over the past 10-20 years. Partly associated with this problem has been the disappointing failure to fulfill the 2010 aspiration for consistent national industry regulation. Following the collapse of Commonwealth leadership here, many of the foreshadowed benefits (such as a single national market and standardised performance data) have failed to materialise.

Thirdly, there is a need for much stronger and more enduring government and industry leadership On the provider side, the industry has yet to recover from the 2014 de-funding of its national peak body. Recent leadership has been fragmented and representations by the industry have not had the necessary power and influence to shape future directions. Across governments, political and bureaucratic leadership in this policy realm has been at best sporadic and, at worst, absent.

Last, but by no means least, is the necessity to address capacity issues affecting the Indigenous housing sector. With low rates of home ownership, Indigenous households rely disproportionately on the provision of forms of affordable housing. Hundreds of Indigenous organisations (IHOs) play important roles within the industry – e.g. by acting as a gateway to the broader housing system for Indigenous clients, as well as providing culturally appropriate housing. Support for this segment of the industry has generally lagged behind that for mainstream providers and many IHOs are small and face an uncertain future.

Implications for Australia’s affordable housing industry development

Underpinned by extensive research evidence, we advocate industry development directions including:

Growth and development of industry capacity go hand-in-hand. Thus market expansion and further capacity-building can be expected to follow from establishing a clearly defined role and purpose for the industry, along with national and state governments committing to firm targets that will enable steady growth in the supply of affordable housing.

Australia’s leading affordable housing providers are, in our judgement, ready for further growth. This would more fully exploit what is, for at least some organisations, under-utilised internal capacity. With the right leadership, resourcing and regulatory accountability, they have what it takes to deliver and manage significantly expanded portfolios. Government direction and impetus for growth are the essential ingredients now required to enable this emerging industry to progressively expand the affordable housing provision that the country manifestly needs.

Professor Hal Pawson is Associate Director, City Futures Research Centre. Associate Professor Vivienne Milligan is Senior Visiting Fellow, City Futures Research Centre. This article was first published in City Futures Blog on 20 April 2017.

READ MORE:

https://johnmenadue.com/vivienne-milligan-and-hal-pawson-ready-for-growth-has-australias-affordable-housing-industry-got-what-it-takes/

READ FROM TOP.

NOTHING MUCH HAS CHANGED SINCE 2011 OR 1995 OR 1949 OR....

https://yourdemocracy.net/drupal/node/45958