Search

Recent comments

- conspiracy....

9 hours 5 min ago - brutal USA....

11 hours 33 sec ago - men....

11 hours 21 min ago - oil....

11 hours 57 min ago - system....

12 hours 44 min ago - not invited....

13 hours 19 min ago - whistleblow.....

1 day 2 hours ago - demosocialism....

1 day 11 hours ago - front cover up....

1 day 12 hours ago - the trick....

1 day 22 hours ago

Democracy Links

Member's Off-site Blogs

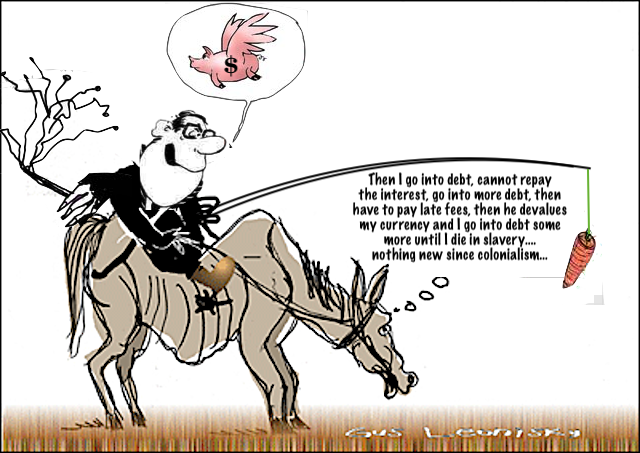

debt is a weapon far more dangerous than an AK47......

GUS: DEBT HAS BEEN USED BY THE WEST, AKA THE USA, AS A MEANS TO KEEP MANY NATIONS UNDERFOOT. IT'S THE NEW (OLD) FORM OF COLONIALISM THAT IS MANIPULATED BY THE SUPPLIERS OF CASH. ALTHOUGH THERE ARE REGULATIONS IN REGARD TO PERSONNAL DEBT IN MANY COUNTRIES, THERE ARE NO OVERSEERS TO THE WAY, SAY THE IMF OR THE WORLD BANK TWEAK THE DEBTS TO KEEP MANY COUNTRIES IN A STATE OF SLAVERY. MANIPULATION OF CURRENCIES LIKE THOSE MADE BY SOROS AND OTHERS, INCLUDING THE IMF AND THE WORLD BANK SHOULD BE ILLEGAL AS MORE OFTEN THAN NOT THEY DO NOT REFLECT THE TRUE NATURE OF THE MARKETS...

SO HERE WE GO:

The external debt of the world’s low- and middle-income countries at the end of 2021 totaled $9 trillion, more than double the amount a decade ago. Such debt is expected to increase by an additional $1.1 trillion in 2023.

Moreover, the debt-service payments, projected to top $62 billion in 2022, put the biggest squeeze on poor countries since 2000, according to the World Bank.

(As defined by the Organization for Economic Cooperation and Development, or OECD, debt service refers to payments in respect of both principal and interest and any late payment fees. Scheduled debt service is the set of payments required through the life of the debt.)

High Risk of Debt Stress

According to the World Bank’s International Debt Report, the poorest countries eligible to borrow from the World Bank’s International Development Association (IDA) now spend over a 10th of their export revenues to service their long-term public and publicly guaranteed external debt — the highest proportion since 2000.

In addition, rising interest rates and slowing global growth risk tipping a large number of countries into debt crises. “About 60% of the poorest countries are already at high risk of debt distress or already in distress.”

Over the past decade, the composition of debt owed by IDA countries has changed significantly. The share of external debt owed to private creditors has increased sharply. At the end of 2021, low- and middle-income economies owed 61 percent of their public and publicly guaranteed debt to private creditors — an increase of 15 percentage points from 2010.

Unbearable Impact

The same day the World Bank’s report was released, on Dec. 6, another international institution, the U.N. Conference on Trade and Development (UNCTAD), warned that the spiraling debt in low-and middle-income countries has compromised their chances of sustainable development.

Rebeca Grynspan, the head of this U.N. trade facilitation agency, reported that between 70 percent and 85 percent of the debt that emerging and low-income countries are responsible for, is in a foreign currency. “This has left them highly vulnerable to the kind of large currency shocks that hit public spending — precisely at a time when populations need financial support from their governments.”

Speaking at the 13th UNCTAD Debt Management Conference, Grynspan explained that so far this year, at least 88 countries have seen their currencies depreciate against the U.S. dollar, which is still the reserve currency of choice for many in times of global economic stress. And the currencies of 31 of these countries have dropped by more than 10 percent.

This has had a hugely negative impact on many African nations, where the UNCTAD chief noted that currency depreciations have increased the cost of debt repayments “by the equivalent of public health spending in the continent.”

Wave of Global Crises

UNCTAD’s conference — held online on Dec. 6- 7 in Geneva — took place as a “wave of global crises has led many developing countries to take on more debt to help citizens cope with the fallout.”

Government debt levels as a share of Gross Domestic Product increased in over 100 developing countries between 2019 and 2021, said UNCTAD.“Excluding China, this increase is estimated at about $2 trillion.”

This has not happened because of bad behaviour of one country. This has happened because of systemic shocks that have hit many countries at the same time, Grynspan said.

Sharp Rise of Interest Rates

With interest rates rising sharply, the debt crisis is putting enormous strain on public finances, especially in developing countries that need to invest in education, health care, their economies and adapting to climate change.

Support CN’s Winter Fund Drive!

“Debt cannot and must not become an obstacle for achieving the 2030 Agenda and the climate transition the world desperately needs,” she argued.

UNCTAD advocates for the creation of a multilateral legal framework for debt restructuring and relief.

Such a framework is needed to facilitate timely and orderly debt crisis resolution with the involvement of all creditors, building on the debt reduction programme established by the Group of 20 major economies (G20) known as the Common Framework.

Debts to Increase to $10 Trillion

UNCTAD said that if the median increase in rated sovereign debts since 2019 were fully reflected in interest payments, then governments would pay an additional $1.1 trillion on the global debt stock in 2023, estimates show.

This amount is almost four times the estimated annual investment of $250 billion required for climate adaptation and mitigation in developing countries, according to an UNCTAD report.

Indebted countries have reiterated once and again that they have already exceeded several times the total amount of their debts in the form of interest rates they have been paying.

Alongside a high number of economists and experts, they have reiterated their appeals for cancelling those debts.

Uselessly: such a fair — and due — step continues to fall on deaf ears.

Baher Kamal is senior advisor to IPS Director General on Africa & the Middle East. He is an Egyptian-born, Spanish-national, secular journalist, with over 43 years of experience. Since the late 70s, he specialised in all development related issues, as well as international politics. Follow him on Twitter .

This article is from Inter Press Service.

The views expressed in this article and may or may not reflect those of Consortium News.

- By Gus Leonisky at 21 Dec 2022 - 12:16pm

- Gus Leonisky's blog

- Login or register to post comments

dollar pauper king.....

by Bruno Bertez

The question of dedollarization arises.

It arises as the political will of the countries which are subject to the dollar and which contest this imperial submission.

I do not believe in a success of the political will of dedollarization.

Dollarization was a product of circumstances: namely World War II.

It was consecrated by a monetary reform which confirmed the nascent hegemony of the United States while favoring it; dollarization is a product of the state of the system at that point in history. Dedollarization will also be the product of a more or less chaotic mutation of the system when the time comes.

Dollarization allowed a great cycle of credit favorable to the USA but also to the whole world as evidenced by the emergence of many countries.

Dollarization produces its opposite, ie the need and the necessity to dedollarize.

Indeed the rise of the new hegemonic competitor, the rise of China, has been enabled and stimulated by the overabundance of the dollar, by the American deficits themselves produced by the imperialism of the dollar.

American overconsumption authorized by the king dollar has produced accelerated overinvestment by China, which has thus become its strategic rival. .

Any system, and the dollar is system, perishes according to its internal contradictions, excessive credit and its external antagonisms, the rise of China.

The long cycle of Bretton Woods I and II credit is coming to an end, we are playing overtime.

Like all credit cycles, it is exhausted by its excesses. It is rotten and everything is subprime, including its bedrock, its cornerstone: the American debt.

It's always like that. Credit is easy and humans always go down the easy slope.

The end of the great credit cycle will coincide with the end of the reign of the dollar, they will fall together into the chaos that will ensue when the delights of overstimulation by debt have been exhausted.

The rise in the dollar that has been noted for many months is a rise of misery, it is not a rise that testifies to real health or real vigor.

The dollar is sought after, because it was issued in too large a quantity and it streamed all over the world. Having streamed over the whole world, debtors got into debt in dollars at almost zero rates, sold off; they got trapped like idiots.

Since the US suffered the consequences of a weak dollar – the rise in prices – they had to tighten the production of dollars a little. The dollar was made a bit rarer and more expensive. Dollar debtors found themselves at the yard to buy back what they had actually sold – in practice – short.

It's a weak currency twist, not a hard currency twist.

Bloomberg: Suddenly everyone is looking for alternatives to the US dollarTired of a greenback that is too strong and moreover turned into a weapon, some of the largest economies in the world are exploring ways to circumvent the American currency.

Smaller nations, including at least a dozen in Asia, are also experimenting with dedollarization. And companies around the world are selling an unprecedented share of their local currency debt, wary of renewed dollar strength.

No one is saying that the greenback will soon be dethroned from its reign as the main medium of exchange. Calls for the "peak of the dollar" have often proved premature. But not so long ago, it was almost unthinkable for countries to explore payment mechanisms that bypassed US currency or the SWIFT network that underpins the global financial system.

Today, the strength of the dollar, its use under Biden to impose sanctions on Russia this year, and new technological innovations encourage nations to begin to reduce its hegemony.

« It will simply intensify the efforts of Russia and China to try to manage their share of the global economy without the dollar. said Paul Tucker, former Deputy Governor of the Bank of England in a podcast Bloomberg.

Writing in a newsletter last week, John Mauldin, an investment strategist and chairman of Millennium Wave Advisors with more than three decades of experience in the markets, said the Biden administration made a mistake in weaponizing the U.S. dollar and the global payment system.

« This will force non-US investors and nations to diversify their holdings outside of the traditional US safe haven. Mauldin said.

Plans already underway in Russia and China to promote their currencies for international payments, including through the use of blockchain technologies, rapidly accelerated after the invasion of Ukraine. Russia, for example, has begun to seek to charge for its energy supplies in rubles.

Countries like Bangladesh, Kazakhstan and Laos have also stepped up negotiations with China to increase their use of the yuan. India has started to speak louder about the internationalization of the rupiah and only this month it started to secure a bilateral payment mechanism with the United Arab Emirates.

However, progress seems slowYuan accounts have not gained popularity in Bangladesh, for example due to the country's large trade deficit with China. " Bangladesh has attempted to pursue de-dollarization of trade with China, but the flow is almost one-sided said Salim Afzal Shawon, Head of Research at Dhaka-based BRAC EPL Stock Brokerage Ltd.

A major driver of these plans was the decision by the United States and Europe to cut Russia off from the global financial messaging system known as SWIFT. The action, described as a " financial nuke by the French, has left most major Russian banks remote from a network that facilitates tens of millions of transactions every day, forcing them to rely on their own much smaller version.

This had two implications.

First, US sanctions on Russia have fueled fears that the dollar is becoming more permanently an overt political tool – a concern shared particularly by China, but also beyond Beijing and Moscow. India, for example, has developed its own local payment system that would partly mimic SWIFT.

Secondly, the move by the United States to use the currency as part of a more aggressive form of economic policy puts additional pressure on Asian economies to choose sides. Without an alternative payment system, they would run the risk of being forced into compliance or applying sanctions they might not agree with – and losing trade with key partners.

« The complicating factor in this cycle is the wave of sanctions and seizures on dollar holdings said Taimur Baig, managing director and chief economist at DBS Group Research in Singapore. " In this context, regional measures to reduce dependence on the USD are not surprising. "

Just as officials across Asia are loath to pick a winner in the US-China standoff and would prefer to maintain relations with both, US sanctions on Russia are pushing governments to go their own way. Sometimes the action takes on a political or nationalistic tone – including due to resentment of Western pressure to adopt sanctions against Russia.

Moscow has sought to convince India to use an alternative system to keep transactions moving. Burma's junta spokesperson said the dollar was used to " bully small nations ". And Southeast Asian countries pointed to the episode as a reason to trade more in local currencies.

« Sanctions make it harder – by design – for countries and companies to remain neutral in geopolitical confrontations said Jonathan Wood, head of global risk analytics at Control Risks. " Countries will continue to weigh economic and strategic relations. Businesses are more than ever caught in the crossfire and face increasingly complex compliance obligations and other competing pressures ».

It is not only the sanctions that contribute to accelerating the trend towards dedollarization.

The US currency's gains also made Asian officials more aggressive in their attempts to diversify.

The dollar has strengthened by around 7% this year, on track for its strongest annual advance since 2015, an index shows. Bloomberg of the dollar. The gauge hit a record high in September as the appreciation of the dollar sent everything from the pound sterling to the Indian rupee to historic lows.

Huge headacheThe strength of the dollar is a huge headache for Asian countries which have seen food purchase prices soar, debt repayment burdens deepen and poverty deepen.

Sri Lanka is an example, defaulting on its dollar debt for the first time ever as the soaring greenback crippled the country's ability to repay. Vietnamese officials at one point blamed the appreciation of the dollar for the fuel supply difficulties.

Hence measures such as India's deal with the United Arab Emirates, which is accelerating a long campaign to conduct more rupee transactions and implement trade settlement agreements that bypass the US currency.

Meanwhile, sales of dollar-denominated bonds by non-financial corporations have fallen to a record 37% of the global total in 2022. They accounted for more than 50% of debt sold in a year to several times over the past decade. .

While all of these measures may have limited impact on the market in the short term, the end result could be an eventual weakening of demand for the dollar. The shares of the Canadian dollar and the Chinese yuan in all currency exchanges, for example, are already slowly rising.

Technological progress is another factor facilitating efforts to abandon the greenback.

Several economies are reducing the use of the dollar through efforts to create new payment networks – a campaign that predates the surge in the greenback. Malaysia, Indonesia, Singapore and Thailand have set up systems for transactions between them in their local currency rather than in dollars. Taiwanese can pay with a QR code system linked to Japan.

Overall, the efforts move further away from a Western-led system that has been the bedrock of global finance for more than half a century. What is emerging is a three-tier structure with the dollar still very much in the lead, but growing bilateral payment lanes and alternative spheres such as the yuan looking to benefit from any potential excesses from the United States.

Despite all the turmoil and action underway, the dollar's dominant position is unlikely to be challenged anytime soon. The strength and size of the US economy remains undisputed, Treasury bills are still one of the safest ways to store capital, and the dollar makes up the lion's share of foreign exchange reserves.

The dedollarization is a slow process which will accelerate suddenly according to the events and the alternatives which will be offered.

The renminbi's share of all foreign exchange transactions, for example, may have jumped to 7%, but the dollar still accounts for an 88% side of those transactions.

« It is very difficult to compete on the cash front – we have the Russians doing it by forcing the use of the rouble, and there is also mistrust with the yuan said George Boubouras, a three-decade veteran of the markets and head of research at the hedge fund. K2 Asset Management in Melbourne. " At the end of the day, investors still prefer liquid assets and in that sense, nothing can replace the dollar.. "

Nonetheless, the combination of moves away from the dollar is a challenge to what then-French finance minister Valéry Giscard d'Estaing described as the “exorbitant privilege” enjoyed by the United States. The term, which he coined in the 1960s, describes how greenback hegemony shields the United States from exchange rate risk and projects the country's economic power.

And they could finally test the whole Bretton Woods model, a system that established the dollar as the leader of the monetary order, which was traded in a hotel in a sleepy New Hampshire town at the end of the Second World War.

The last efforts indicate that the global commerce and settlement platform we have used for decades may be starting to fracture said Homin Lee, Asia macro strategist at Lombard Odier in Hong Kong, whose firm oversees the equivalent of $66 billion.

« This whole network that grew out of the Bretton Woods system – the Eurodollar market in the 1970s, then financial deregulation and the floating rate regime in the 1980s – this platform that we've developed so far maybe starting to evolve in a more fundamental sense “said Lee.

valuable lessonThe net result: King Dollar may still reign supreme for decades to come, but the growing momentum of alt-currency trading shows no signs of abating, particularly if the geopolitical wildcards continue to convince officials to go their own way.

And the US government's willingness to use its currency in geopolitical fights could ironically weaken its ability to pursue such methods as effectively in the future.

« The war in Ukraine and the sanctions against Russia will provide a very valuable lesson,” Indonesian Finance Minister Sri Mulyani Indrawati told the Bloomberg CEO Forum on the sidelines of the G-20 meetings in Bali last month. ».

« Many countries feel that they can transact directly – bilaterally – using their local currencies, which I think is good for the world to have a much more balanced use of currencies and payment systems. "

• https://finance.yahoo.com/suddenly-everyone-hunting-alternatives-us

source: Bruno Bertez

READ FROM TOP.

FREE JULIAN ASSANGE NOW....