Search

Recent comments

- difficult...

20 min 48 sec ago - no nukes...

28 min 54 sec ago - hairy...

2 hours 45 min ago - beaudifool....

3 hours 53 min ago - escalationing....

14 hours 9 min ago - not happy, john....

18 hours 29 min ago - corrupt....

23 hours 50 min ago - laughing....

1 day 1 hour ago - meanwhile....

1 day 3 hours ago - a long day....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

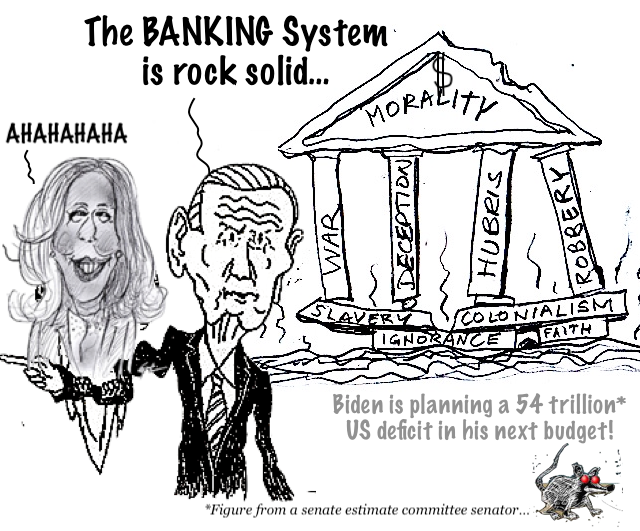

your deposits will be there when you need them......

NEW YORK (AP) — President Joe Biden on Monday told Americans the nation’s financial systems were safe, seeking to project calm following the swift and stunning collapse of two banks that prompted fears of a broader upheaval.

“Your deposits will be there when you need them,” he said.

U.S. regulators closed the Silicon Valley Bank on Friday after it experienced a traditional bank run, where depositors rushed to withdraw their funds all at once. It is the second largest bank failure in U.S. history, behind only the 2008 failure of Washington Mutual. But the financial bloodletting was swift; New York-based Signature Bank also failed.

The president, speaking from the White House shortly before a trip to the West Coast, said he’d seek to hold those responsible accountable, and pressed for better oversight and regulation of larger banks. And he promised no losses would be borne by taxpayers.

“We must get the full accounting of what happened,” he said. “American can have confidence that the banking system is safe.”

Biden also said management of the banks should be fired. “If the bank is taken over by the FDIC, the people running the bank should not work there anymore,” he said, referring to the Federal Deposit Insurance Corp., the agency responsible for ensuring the stability of the banking system.

At more than $110 billion in assets, Signature Bank is the third-largest bank failure in U.S. history. Another beleaguered bank, First Republic Bank, announced Sunday that it had bolstered its financial health by gaining access to funding from the Fed and JPMorgan Chase.

The developments left markets jittery as trading began Monday. The Asian and European markets fell but not dramatically, and U.S. futures were down.

In an effort to shore up confidence in the banking system, the Treasury Department, Federal Reserve and FDIC said Sunday that all Silicon Valley Bank clients would be protected and able to access their money.

“This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth,” the agencies said in a joint statement.

Under the plan, depositors at Silicon Valley Bank and Signature Bank, including those whose holdings exceed the $250,000 insurance limit, will be able to access their money on Monday.

Britain also moved quickly, working throughout the weekend to arrange the sale of Silicon Valley Bank UK Ltd., the California bank’s British arm, for the nominal sum of one pound.

While the bank is small, with less than 0.2% of U.K. bank deposits according to central bank statistics, it had a large role in financing technology and biotech startups that the British government is counting on to fuel economic growth.

Jeremy Hunt, Britain’s Treasury chief, said some of the country’s leading tech companies could have been “wiped out.”

“When you have very young companies, very promising companies, they’re also fragile,” Hunt told reporters, explaining the why authorities moved so quickly. “They need to pay their staff and they were worried that as of 8 a.m. this morning, they might literally not be able to access their bank account.”

He stressed that there was never a “systemic risk” to Britain’s banking system.

Silicon Valley Bank began its slide into insolvency when it was forced to dump some of its treasuries at at a loss to fund its customers’ withdrawals. Under the Fed’s new program, banks can post those securities as collateral and borrow from the emergency facility.

The Treasury has set aside $25 billion to offset any losses incurred. Fed officials said, however, that they do not expect to have to use any of that money, given that the securities posted as collateral have a very low risk of default.

Though Sunday’s steps marked the most extensive government intervention in the banking system since the 2008 financial crisis, the actions are relatively limited compared with what was done 15 years ago. The two failed banks themselves have not been rescued, and taxpayer money has not been provided to them.

READ MORE: Silicon Valley Bank’s failure shakes companies worldwide, from wine country to London

Some prominent Silicon Valley executives feared that if Washington didn’t rescue their failed bank, customers would make runs on other financial institutions in the coming days. Stock prices plunged over the last few days at other banks that cater to technology companies, such as First Republic and PacWest Bank.

Among the bank’s customers are a range of companies from California’s wine industry, where many wineries rely on Silicon Valley Bank for loans, and technology startups devoted to combating climate change.

Tiffany Dufu, founder and CEO of The Cru, a New York-based career coaching platform and community for women, posted a video Sunday on LinkedIn from an airport bathroom, saying the bank crisis was testing her resiliency.

Given that her money was tied up at Silicon Valley Bank, she had to pay her employees out of her personal bank account. With two teenagers to support who will be heading to college, she said she was relieved to hear that the government’s intent is to make depositors whole.

“Small businesses and early-stage startups don’t have a lot of access to leverage in a situation like this, and we’re often in a very vulnerable position, particularly when we have to fight so hard to get the wires into your bank account to begin with, particularly for me, as a Black female founder,” Dufu said.

Rugaber and Megerian reported from Washington. Sweet and Bussewitz reported from New York. Associated Press Writers Hope Yen in Washington, Jennifer McDermott in Providence, Rhode Island, and Danica Kirka in London contributed to this report.

Related- Federal government moves urgently to avert potential banking crisis

- Yellen says there will be no bailout for collapsed Silicon Valley Bank

- Silicon Valley Bank’s failure shakes companies worldwide, from wine country to London

- By Gus Leonisky at 22 Mar 2023 - 8:46am

- Gus Leonisky's blog

- Login or register to post comments

thin air money.....

By Jeffrey Sachs

The banking crisis that hit Silicon Valley Bank (SVB) last week has spread. We recall with a shudder two recent financial contagions: the 1997 Asian Financial Crisis, which led to a deep Asian recession, and the 2008 Great Recession, which led to a global downturn. The new banking crisis hits a world economy already disrupted by pandemic, war, sanctions, geopolitical tensions, and climate shocks.

At the root of the current banking crisis is the tightening of monetary conditions by the Fed and the European Central Bank (ECB) after years of expansionary monetary policy. In recent years, both the Fed and ECB held interest rates near zero and flooded the economy with liquidity, especially in response to the pandemic. Easy money resulted in inflation in 2022, and both central banks are now tightening monetary policy and raising interest rates to staunch inflation.

Banks like SVB take in short-term deposits and use the deposits to make long-term investments.

The banks pay interest on the deposits and aim for higher returns on the long-term investments. When the central banks raise short-term interest rates, rates paid on deposits may exceed the earnings on long-term investments. In that case, the banks’ earnings and capital fall. Banks may need to raise more capital to stay safe and in operation. In extreme cases, some banks may fail.

Even a solvent bank may fail if depositors panic and suddenly try to withdraw their deposits, an event known as a bank run. Each depositor dashes to withdraw deposits ahead of the other depositors. Since the bank’s assets are tied up in long-term investments, the bank lacks the liquidity to provide ready cash to the panicked depositors. SVP succumbed to such a bank run and was quickly taken over by the US Government.

Bank runs are a standard risk but can be avoided in three ways. First, banks should keep enough capital to absorb losses. Second, in the event of a bank run, central banks should provide banks with emergency liquidity, thereby ending the panic. Third, government deposit insurance should calm depositors.

All three mechanisms may have failed in the case of SVB. First, SVB apparently allowed its balance sheet to become seriously impaired, and regulators did not react in time. Second, for unclear reasons, US regulators closed SVB rather than provide emergency central bank liquidity. Third, US deposit insurance guaranteed deposits only up to $US 250,000, and so did not stop a run by large depositors. After the run, US regulators announced they would guarantee all deposits.

The immediate question is whether SVB’s failure is the start of a more general bank crisis. The rise of market interest rates caused by Fed and ECB tightening has impaired other banks as well. Now that a banking crisis has occurred, panics by depositors are more likely.

Future bank runs can be avoided if the world’s central banks provide ample liquidity to banks facing runs. The Swiss central bank provided a loan to Credit Suisse for exactly this reason. The Federal Reserve has provided $152 billion in new lending to US banks in recent days.

Emergency lending, however, partly offsets the central banks’ efforts to control inflation. Central banks are in a quandary. By pushing up interest rates, they make bank runs more likely. If they keep interest rates too low, however, inflationary pressures are likely to persist.

The central banks will try to have it both ways: higher interest rates plus emergency liquidity, if needed. This is the right approach but comes with costs. The US and European economies were already experiencing stagflation: high inflation and slowing growth. The banking crisis will worsen the stagflation and possibly tip the US and Europe into recession.

Some of the stagflation was the consequence of COVID-19, which induced the central banks to pump in massive liquidity in 2020, causing inflation in 2022. Some of the stagflation is the result of shocks caused by long-term climate change. Climate shocks could become worse this year if a new El Niño develops in the Pacific, as scientists say is increasingly likely.

Yet stagflation has also been intensified by economic disruptions caused by the Ukraine War, US and EU sanctions against Russia, and rising tensions between the US and China. These geopolitical factors have disrupted the world economy by hitting supply chains, pushing up costs and prices while hindering output.

We should regard diplomacy as a key macroeconomic tool. If diplomacy is used to end the Ukraine War, phase out the costly sanctions on Russia, and reduce tensions between the US and China, not only will the world be much safer, but stagflation will also be eased. Peace and cooperation are the best remedies to rising economic risks.

Jeffrey D. Sachs, Professor of Sustainable Development and Professor of Health Policy and Management at Columbia University, is Director of Columbia’s Center for Sustainable Development and the UN Sustainable Development Solutions Network. He has served as Special Adviser to three UN Secretaries-General. His books include The End of Poverty, Common Wealth, The Age of Sustainable Development, Building the New American Economy, and most recently, A New Foreign Policy: Beyond American Exceptionalism.READ MORE:

https://johnmenadue.com/the-global-banking-crisis-and-world-economy/

READ FROM TOP.

ONE THING THAT HAS TO BE UNDERSTOOD IS THAT UNDER THE US FEDERAL SYSTEM ONLY DEPOSITS UNDER $400,000 ARE INSURED BY THE GOVERNMENT. SVB ONY HAD 2.7 PER CENT OF ITS DEPOSITS IN THIS CATEGORY. THUS IN THE MIDDLE OF THE BANKING GAME, THE GOVERNMENT INSTRUCT THE FEDERAL BANK (A PRIVATE CONSORTIUM OF THE BIG BANKS) TO INSURE EVERYONE... THINK ABOUT IT.... THIS IS SOCIALISM OF LOSSES WHILE PROFITS ARE STILL PRIVATE.... WE KNEW THIS DIDN'T WE?

FREE JULIAN ASSANGE NOW....

too small to fail......

How Financial Institutions Like Silicon Valley Bank Fund the Weapons IndustryThe collapse of Silicon Valley Bank last week sparked a number of debates. Was SVB “too big to fail?” Was the Biden administration response a “bailout?” Are the libertarian-leaning tech CEOs hypocrites? Is this a sign that the Fed’s interest rate hikes should come to an end?

But one element of the SVB collapse has been lost in all the discussion of naive tech bros and their questionable banking habits: the importance of the bank, of the tech industry, and of finance to the project of US global power.

As Fortune put it, SVB was the “central artery for financing the startup ecosystem.” Nearly all of the bank’s depositors were young tech firms backed by speculative venture capital — and the bank’s collapse threatened the very survival of both the tech and VC industries. While many have been rightly focused the potential fallout of the collapse for the US banking system, the geopolitical dynamics of these events have mostly flown under the radar.

The Financial Times reports that “amid fears the government was prepared to let SVB and its uninsured depositors go to the wall, venture capitalists launched a concerted lobbying effort” via their industry group, the National Venture Capital Association (NVCA). The lobbyists argued that the failure of SVB “would not only have big economic repercussions, with companies struggling to write paycheques, but also that an outright failure would have geopolitical ramifications.”

As one participant in the lobbying meetings told the Financial Times: “The theme was: ‘this is not a bank.’. . . This is the innovation economy. This is the US versus China. You can’t kill these innovative companies.”

Leaning into the US-China rivalry is not just deft lobbying from NVCA. And posing this as a threat to the “innovation economy” is not simply a reflection of an ideology that sets venture capital–backed start-ups on the new frontiers of capitalism. Indeed, while every facet of the US economy in the twenty-first century — from manufacturing to consumption — is dependent on access to credit, the peculiarities of SVB bring the relationship between this type of finance and the US military-industrial complex into stark relief.On the list of major firms that was set to lose about $5 billion in SVB deposits (alongside start-ups in the media, software, and pharmaceutical industries) was at least one semiconductor producer and two aerospace and defense firms. One of them, Rocket Lab, has recently been in the news for “weaponizing space,” while the other, Astra, works closely with Defense Advanced Research Projects Agency (DARPA) on a number of projects.

These firms’ military ties are not unique. Silicon Valley has a long history of collaboration with the US military. Indeed, the first initial public offering in Silicon Valley was for Varian in 1956, which sold microwave tubes for military uses. In the 1960s, Fairchild Semiconductor, considered one of the pioneers of today’s Silicon Valley, started its business through military contracts. These links have evolved to include technologies from microchips to data mining to Apple’s Siri. As Silicon Valley historian Leslie Berlin notes: “All of modern high tech has the U. S. Department of Defense to thank at its core.”

But more than that, the venture capital supporting these start-ups has become increasingly enmeshed with military procurement in recent years, as the Pentagon has turned to private financing to direct military research and development.

This is simply the latest form of a decades-old relationship. Starting in the 1990s, private equity became an important player in the merger boom of armaments firms. This merger boom was key in the transition of the defense industry from a medley of hundreds of small- and medium-sized industrial firms into the handful of massive, publicly traded companies that we know today.

So while SVB may not have been ‘too big to fail,’ it was certainly ‘too important to fail’ — not only to the banking system, but to the project of US world power.

This boom was facilitated by the US government, in an effort to increase efficiency and cut costs during the post–Cold War defense drawdown. But if it was the government pushing the mergers, it was the financial institutions that facilitated them — and reaped the rewards.

Searching for profitable investments in the wake of the savings and loan crisis of the early 1990s, many financial institutions turned to the defense industry as a possible boon. Few in the industry expected the post–Cold War drawdown to last, and investors bet that an industry backed by US federal military spending would be a safe investment.

Big banks, such as JP Morgan, provided funding for a number of major mergers, such as Lockheed Martin’s $9.1-billion acquisition of Loral Corporation in 1996. In addition to big banks, the defense industry piqued the interest of a number of private equity groups, and institutions like the Carlyle Group and the Vanguard Group became specialists in investing in military firms.

Underwriting the merger boom, these bankers and venture capitalists reaped the benefits of the extraordinary growth in military firm profits in the coming decades, as the United States’ wars in the twenty-first century meant a boom in the aerospace and defense sectors.

Today private equity has taken on an even wider role in the armaments industry than in the 1990s, responsible for thousands of investments in aerospace and defense firms. The Pentagon has even established an office dedicated to facilitating the linkages between start-ups with military potential and venture capitalists. Industry leaders thus unsurprisingly see private equity and venture capital as the future of military innovation.

So when the lobbyists argued that the SVB collapse wasn’t just threatening the individual depositors, but also that it was a possible “extinction-level event” for Silicon Valley — and that the VC business model itself was in danger — they were correct to point out that a collapse of these industries would disrupt the military-industrial ecosystem at a time of escalating conflict with Russia and mounting rivalry with China.

While SVB’s heavy concentration of VC-backed tech firms makes it a particularly clear example of these industries’ ties with the US military-industrial complex, it is not unique. Indeed, the US financial system writ large is intertwined with US war-making in the twenty-first century — creating a dangerous situation for the world.

Decades of endless war have dramatically increased the opportunities for militarized profit-making — making military industries an ideal investment for financial capital — and a growing number of financial firms are expanding their military sector investments. This draws the interests of financial capitalists together with those of military-industrial firms and hawkish officials.

As Shana Marshall notes, the interlocking interests of financiers and military leaders in the pursuit of war “ensures a steady delivery of investment in militarized technologies and high returns for finance capital from continued US commitment to a highly militaristic foreign policy.”

READ MORE:

https://jacobin.com/2023/03/how-financial-institutions-like-silicon-valley-bank-fund-the-weapons-industry

READ FROM TOP.

common sense.....

Lynette Zang, Chief Market Analyst at ITM Trading, and Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, discuss the ongoing banking crisis, and why Zang believes that it may have been engineered to reset the financial system and bring in central bank digital currencies and a "full surveillance economy." They also discuss accelerating de-dollarization led by the BRICS. Zang explains why she thinks the International Monetary Fund (IMF) is complicit in advancing the demise of the U.S. dollar, and why she thinks the IMF's Special Drawing Rights (SDR) will be used as the next global reserve currency as the dollar is dethroned. Zang gives her perspective on how investors should prepare for all of this.

https://www.youtube.com/watch?v=PZyc13m_ymU

FREE JULIAN ASSANGE NOW....