Search

Recent comments

- epibatidine....

5 hours 28 min ago - cryptohubs...

6 hours 27 min ago - jackboots....

6 hours 35 min ago - horrid....

6 hours 43 min ago - nothing....

9 hours 6 min ago - daily tally....

10 hours 28 min ago - new tariffs....

12 hours 19 min ago - crummy....

1 day 6 hours ago - RC into A....

1 day 8 hours ago - destabilising....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

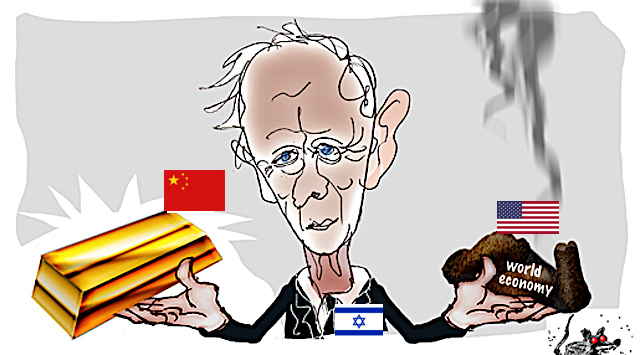

don't buy gold! buy shit instead!....

The role of the US dollar as the world reserve currency could diminish due to Washington using its leverage over the global financial system to pursue its geopolitical goals through sanctions, Secretary of the Treasury Janet Yellen has admitted. However, there is no obvious candidate to is replace it, she insisted.

Yellen was asked during an interview on Sunday by CNN’s Fareed Zakaria about the efficiency of the anti-Russia sanctions and about Washington’s track record of what he described as the “weaponization of the dollar.”

Zakaria cited recent statements by Brazil’s President Lula da Silva and other politicians about the risk of dependency on the US currency. He asked whether the present time would be remembered as the moment when “the dollar’s hegemony and its status as a reserve currency began to falter.”

Yellen acknowledged that use of financial sanctions “could undermine the hegemony of the dollar”in the long run, but promised that Washington was using this “important tool” judiciously and with the backing of its allies.

Regardless, she added, the role of the American greenback is explained by factors such as the volume of the US treasuries market, its wide use in international trade, and a “rule of law” in the US that other nations cannot offer.

“We haven’t seen any other country that has this basic infrastructure and institutional infrastructure that would enable its currency to serve the world like this,” she explained.

Opponents of US domination in global finances are not necessarily advocating replacing the dollar with another currency serving the same role. Russia’s leadership has prioritized a transition away from the dollar and into regional currencies.

An absence of a single global reserve currency would be a natural element of multipolarity, supporters of such a model say. The West’s use of unprecedented sanctions against Russia, including bans on trade, seizure of national reserves and denial of financial services to Russian companies, has merely sped up the transition, in their view.

“It’s not a coincidence that the talk about a switch to national currencies have been spurred now,”Russian Foreign Minister Sergey Lavrov remarked in February during a discussion on Russia-Brazil trade. “Nobody knows who the US president could find unappealing after getting up on the wrong side of the bed.”

Yellen also mentioned the issue of frozen Russian assets in her interview with CNN, arguing that “Russia should pay for the damage that it has done to Ukraine.”

READ MORE:

https://www.rt.com/news/574869-yellen-dollar-hegemony-sanctions/

What drives the price of gold ?

1. Central Banks

Net purchases of gold by central banks can affect the price.

2. U. S Dollar Value

When the USD is strong, people are more optimistic and prefer to trade in USDs, pushing the price of gold down.

3. Economic Uncertainty

Gold is seen as a "safe haven" to store wealth during volatile and uncertain times.

4. Worldwide Jewellery Demand

Around half of all gold demand is driven by jewellery with China, India and the US being primary buyers

https://www.marketindex.com.au/gold

THE IMF "CONTROLS" THE PRICE OF GOLD

The IMF holds around 90.5 million ounces (or 2,814.1 metric tons) of gold at designated depositories.

Until the early 1970s, the IMF acquired its gold holdings through four main channels:

1. At the IMF’s founding in 1944, member countries paid 25 percent of their initial quotas in gold. They did the same with quota increases over the next three decades. These payments represent the largest source of the IMF's gold.

2. Members normally paid all interest owed on IMF credit in gold.

3. Members also could use gold to repay credit extended by the IMF.

4. Members seeking to acquire another member’s currency could do so by selling gold to the IMF, as South Africa did in 1970–71.

- By Gus Leonisky at 17 Apr 2023 - 6:25pm

- Gus Leonisky's blog

- Login or register to post comments

degolding in 1930s....

Until the 1930s, the United States dollar was backed by gold, with holders able head to their local bank and swap a $20 bill and change for a troy ounce of the precious metal. That changed during the Great Depression. What prompted the US government's decision? And what were its consequences?

Thursday marks the 90th anniversary of the April 20, 1933 proclamation by President Franklin Roosevelt (FDR) on the suspension of the convertibility of dollar notes into gold, the nationalization of private stocks of the precious metal, and the effective suspension of the gold standard, with dollars convertible into gold only in official international transactions from thereon out.

Two weeks earlier, on April 5, 1933, Roosevelt issued an executive order requiring Americans to hand over all gold coins, bullion or bullion certificates they owned to their nearest Federal Reserve-affiliated bank. Anyone who failed to do so could face a hefty $10,000 fine (about $230k today), ten years in jail, or both.

What Motivated FDR’s Decision?

In his first-ever Fireside Chat address in March 1933, Roosevelt explained how, in the first weeks of his administration, the United States suffered a series of bank runs so severe that even “the soundest banks could not get enough currency to meet the demand.”

On the advice of economist George Warren, FDR took the US off the gold standard, which, it was hoped, would curb market and banking volatility, ease restrictions on government spending, help restore America’s blighted agricultural sector and ultimately end the Great Depression that began with the stock market crash of October 1929.

A year later, with the passage of the Gold Reserve Act of 1934, the president was given the power to determine by proclamation the value of America's gold relative to dollars. Roosevelt subsequently raised the statutory price of gold from $20.67 per troy ounce to $35, thereby devaluing the gold value of the dollar to 59 percent of the price set by the Gold Act of 1900, and devaluing Federal Reserve notes backed by the precious metal.

The US moved to de-link its currency from gold pretty late relative to other major economies, with Britain, Germany and Austria, Australia, New Zealand and Canada doing so in 1931, and France, the Netherlands, Switzerland, Czechoslovakia, Belgium and other countries completing the process by the mid-1930s. The USSR was one of the last major economies to abandon gold, doing so in 1961 (although in practice, convertibility was possible only in foreign trade).

The US hobbled along with its quasi-gold standard until August 15, 1971, when the Nixon administration, citing an economic crisis and rampant inflation, announced that the United States wouldn't convert dollars into gold at a fixed value any longer, thus nixing the gold standard altogether. President Ford lifted restrictions on the private purchase and ownership of gold in late 1974, after which it became a popular long-term hedge against inflation.

Was FDR’s Gamble a Success?

Yes and no. Going off gold, combined new infrastructure spending, the rise of new federal agencies, banking regulations, relief for the unemployed, and old age Social Security, did help the US recover from the Depression, with the country restoring its pre-crisis era GDP by the late 1930s. But it was ultimately World War II that put the Great Depression to an end for good, as millions of new defense related jobs were created, and the USA became the only major economy not directly impacted by the war. Pent up wealth and spending power helped to assure America's post-war boom, lasting over two decades.

Over the long-term, the US has faced some of the downsides of the use of fiat currency, including inflation (one dollar in 1933 is equivalent to over $23 today) and out of control government spending. These impacts took many years to be felt by ordinary Americans, because for decades after the Second World War, the US was able to take advantage of the dollar’s de facto world reserve currency status to continue introduction trillions of additional dollars into the economy without suffering rampant, Wiemar Germany-style hyperinflation. However, a growing number of observers are now confident that the dollar’s place under the sun is coming to an end, which means the ability of the government to endlessly ramp up spending and debt may also be nearing its conclusion.

READ MORE:

https://sputnikglobe.com/20230420/why-did-roosevelt-kill-the-gold-standard-1109668899.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

gold heist.....

An air cargo container with millions of dollars worth of gold and additional valuables inside disappeared Monday from a Canadian airport after a plane arrived and was unloaded.

The incident happened at the Toronto Pearson international airport when the plane’s cargo was taken to a holding facility, which is the usual procedure, Peel Regional Police Inspector Stephen Duivesteyn told reporters, NBC News reported Friday.

READ MORE:

https://www.breitbart.com/crime/2023/04/21/police-15m-worth-of-gold-valuables-disappears-from-toronto-airport-our-goal-is-to-solve-this-theft/

MANY MANY QUESTIONS COME TO MIND.... YOU WORK THEM OUT....

READ FROM TOP.

FREE JULIAN ASSANGE NOW....