Search

Recent comments

- cow bells....

6 hours 43 sec ago - exiled....

11 hours 3 min ago - whitewashing a turd....

12 hours 2 min ago - send him back....

13 hours 32 min ago - the original...

15 hours 20 min ago - NZ leaks....

1 day 1 hour ago - help?....

1 day 2 hours ago - maps....

1 day 2 hours ago - bastards...

1 day 8 hours ago - narcissist.....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

DIY expertise comes in various format......

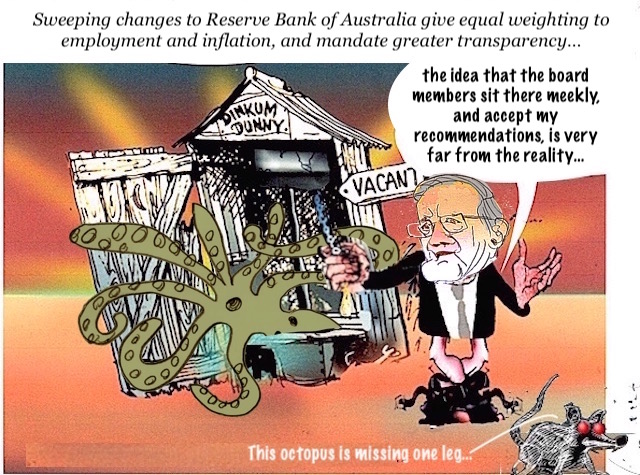

The Reserve Bank governor, Philip Lowe, has rejected comments by the review panel about the workings of his board, saying the description provided in the final report “didn’t really resonate with me”.

While describing the overall review’s finding as “kind of excellent”, Lowe told a media conference on Thursday that the panel had not sat in the boardroom, and their description of the manner of the board discussions about interest rates was inaccurate.

The nine board members were “deeply engaged in the questions, [bringing] a great deal of expertise to the issues we’re dealing with”.“They’re probing, they challenge me and sometimes I speak last in the meeting,” Lowe said. “So the idea that the board members sit there meekly, and accept the recommendation that I put to them, is very far from the reality that I’ve lived as the governor.”

Lowe’s defence of his board came as he and the RBA generally welcomed the findings of the review and its 51 recommendations. If implemented, the changes – including the creation of a specialised board dealing with monetary policy – would amount to the biggest shake-up of the central bank in about four decades.

The review panel advocated a different “skills matrix” for the new monetary policy board. As with the current one, it would have nine members – including the RBA governor, deputy governor and treasury secretary – but the six external appointees would prioritise open-economy macroeconomics, the financial system, labour economics and knowledge of the supply side of the economy.

Lowe said the current members work “very diligently and have expertise, but that’s not to say we couldn’t have a different structure”.

Lowe said he would accept an extension of his role after his seven-year term ends in September if offered.

“It is a great honour and it is a great privilege to have the job that I have, and I would also say it is a great responsibility,” he said. “If I was asked to continue, I would. If I’m not asked to continue I will find another way to contribute to Australian society.”

Guardian Australia understands review panellists did not participate in a board meeting out of concern their presence might affect the decision or behaviour of participants. They did, however, speak with all current board members, any former board members, bank governors and treasury secretaries.The report also identified three examples where, in the panellists’ views, more information or expertise may have resulted in different decisions.

READ MORE:

IT SEEMS THAT THE NEW "SKILL MATRIX" IN REGARD TO THE RBA IS LIKE "HOME IMPROVEMENT" — THE COMEDY SERIES... THE OVERSEAS INFLUENCE OF THE US DOLLAR THAT IS PRESENTLY TANKING (DESPITE A FEW "EXPERTS" WHO REFUSE TO BUY GOLD) IS LIKE AN INDICATOR OF BITTER THINGS TO COME... NEW CONSIDERATION ABOUT "EMPLOYMENT" AND "PEOPLE" WON'T MAKE MUCH CHANGES TO THE WAY INTEREST RATES ARE SET IN THE FACE OF INFLATION DUE TO POLITICAL DECISION TO INFLICT DAMAGE TO THE RUSSIA ECONOMY (WHICH IS DOING FAR BETTER THAN CHICAGO WHERE WALMART HAD TO CLOSE FOUR LARGE STORES) AND ON POINTING A SUBMARINE (NUCLEAR AND EXPENSIVELY USELESS) AT CHINA.

- By Gus Leonisky at 22 Apr 2023 - 5:24am

- Gus Leonisky's blog

- Login or register to post comments

paying for services.....

A Patron of Democracy at Work asks: "Please explain the role of the bond market (US Treasuries) in the failure of capitalism and democracy." This is Professor Richard Wolff's video response. Submit your own question to be considered for a video response by Prof. Wolff on Patreon: https://www.patreon.com/democracyatwo....

https://www.youtube.com/watch?v=CNcOumyBe8g

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

the art of making money....

https://www.youtube.com/watch?v=L9t1R_jAWKU

Skip the waitlist and invest in blue-chip art for the very first time by signing up for Masterworks: https://www.masterworks.art/historyle...

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

See important Masterworks disclosures: https://www.masterworks.com/about/dis...

Russian Armed Forces broke through Ukraine's last major defenses in West Bakhmut. The road linking Khromove to Chasiv War has been cut. 8,000 Ukrainians face encirclement inside the last quarters of the city. One reason behind this swift push is the "new" FAB-500 glide bombs that Russian fighter jets are dropping all over Bakhmut. With Ukraine's decreasing Air Defense capabilities, these airstrikes can become a real menace.

NOTE: GUS DOES NOT ENDORSE INVESTMENTS IN ART EXCEPT HIS OWN....

MEANWHILE:

JPMorgan Chase reported first-quarter revenue this week that beat analysts’ expectations thanks to a nearly 50% surge in net interest income amid higher interest rates.

The Wall Street bank posted a profit of $12.6 billion, or $4.10 per share, in the first three months of the year, up from $8.3 billion, or $2.63 per share, from the same period a year ago, a gain of 52%.

Revenue surged 25% companywide to $39.34 billion, driven by a sharp rise in net interest income due to the US Federal Reserve’s most aggressive rate-hiking campaign in decades. The bank’s net interest income, a measure of how much it earns from lending, surged 49% to $20.8 billion.

Revenue at the lender’s consumer and community banking unit soared by 80% to $5.2 billion on the back of higher interest rates.

JPMorgan CEO Jamie Dimon said that the US consumer and economy overall remain healthy but cautioned that the banking crisis could turn lenders more conservative and may affect consumer spending.

“The storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks,” he said, adding that banks will likely rein in lending as they become more conservative ahead of a possible downturn.

JPMorgan is the largest US bank with $3.67 trillion in assets. Its deposits soared to $2.38 trillion in the first quarter from the $2.34 trillion posted in the fourth quarter of last year. Analysts say that JPMorgan benefited from an influx of deposits as customers sought refuge in larger banks after two regional lenders, Silicon Valley Bank and Signature Bank, collapsed within days of each other in early March following massive deposit runs.

READ MORE:

https://www.rt.com/business/574751-jpmorgan-bank-record-profits/

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

going digital......

The Digital Currency Monetary Authority has unveiled a digital coin designed to speed cross-border transactions.

Introduced Monday (April 10) at the spring meeting of the International Monetary Fund, the authority’s Universal Monetary Unit (UMU) is an international version of a central bank digital currency (CBDC).

UMU is “legally a money commodity, can transact in any legal tender settlement currency, and functions like a CBDC to enforce banking regulations and to protect the financial integrity of the international banking system,” the DCMA said in a news release.

Banks can attach SWIFT codes and bank accounts to a UMU digital currency wallet and transact “SWIFT-like cross-border payments over digital currency rails,” a reference to the SWIFT payment system, per the release.

This allows users to bypass “the correspondent banking system at best-priced wholesale FX rates and with instantaneous real-time settlement,” the release said.

The DCMA pointed in the release to comments from Tobias Adrian, financial counsellor at the IMF, who envisioned a “multilateral platform … that could improve cross-border payments — at the same time transforming foreign exchange transactions, risk sharing, and more generally, financial contracting.”

DCMA Executive Director Darrell Hubbard said in the release UMU is “the exact solution” to the vision the IMF has expressed.

The authority said UMU adopts “a global localization public monetary system architecture” and can be configured to meet “the central banking regulations of each participating jurisdiction.”

The launch comes amid a flurry debate about CBDCs in the U.S. Last month saw Florida Gov. Ron DeSantis and Texas Sen. Ted Cruz propose bans on the use of the currency.

DeSantis, often mentioned as a possible 2024 presidential candidate, has proposed legislation that would bar the use of both federal and foreign CBDC as money and called on other states to add similar prohibitions to their uniform commercial codes.

Two days later, Cruz introduced a bill that would prohibit the Federal Reserve from developing a direct-to-consumer CBDC.

Speaking to PYMNTS earlier this month, Martin Hargreaves, chief product officer at Quant, acknowledged there are privacy concerns around CBDCs, especially in the U.S., where the currency is seen as a threat to financial markets.

However, Hargreaves dismissed such concerns, pointing to a conscious effort by regulators in the U.K. to make sure that the digital pound is on par with other payment systems.

READ MORE:

https://www.pymnts.com/cbdc/2023/digital-currency-monetary-authority-debuts-international-cbdc/

SEE ALSO:

Oh SH*T, the end of paper currency just go closer | Redacted with Natali and Clayton Morrishttps://www.youtube.com/watch?v=ZwsdCateM6U

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

jail for cash....

Discussion of so-called “digital currency” has been proliferating among a range of countries around the globe, nowhere more avidly than in the European Union. And there’s no more avid advocate in the EU than European Central Bank President Christine Lagarde, who raves about the greater “control” digital currency will give elites over the masses while relishing the prospect of anyone who spends more than 1,000 Euro being thrown in jail.

https://www.youtube.com/watch?v=ouf6xhiPh-c

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....

FREE JULIAN ASSANGE NOW....