Search

Recent comments

- Blindly Bullshitting Corporation...

16 hours 57 min ago - nothing to say....

17 hours 57 min ago - CO2 footprints....

18 hours 7 min ago - nothingness....

19 hours 16 min ago - war by another name....

19 hours 22 min ago - obligations....

21 hours 3 min ago - of value(s)....

21 hours 41 min ago - "benevolence"....

1 day 10 hours ago - trump's BoP is worse....

1 day 18 hours ago - luce's....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

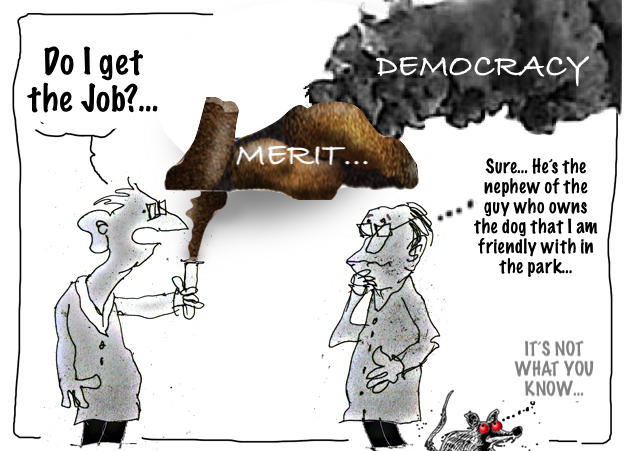

the smell of incompetence....

It is dispiriting that the Public Service Act Amendment Bill now before the Parliament says so little about ‘merit’. Nothing about secretary appointments and terminations and only a minor grammatical change to clarify that ministers are not able to direct agency heads about individuals’ employment.

Yet we have:

- the Robodebt Royal Commission highlighting ‘the lengths to which public servants were prepared to oblige ministers

- the Royal Commission drawing attention to the Thodey Report recommendations about secretary appointments, performance management and terminations

- the Government claiming it is examining all the Thodey recommendations rejected by the Morrison Government

- Zali Steggall and her ‘teal’ colleagues pressing for apolitical merit-based appointments of statutory office holders

- the Attorney-General abolishing the AAT so as to bring back apolitical merit-based appointments to tribunals, and

- Lynelle Briggs commissioned to examine merit-based appointments to government boards

It seems that the APS leadership, advising the Government on amending the PS Act, is yet to recognise just how important ‘merit’ is to a Westminster-based public service. It was at the core of the 1854 Northcote Trevelyan Report that began the development of a professional civil service. It is critical to not only fairness, non-partisanship and constraining corruption, but also to efficiency, effectiveness and overall civil service capability.

Yet over the last decade the APS has lost sight of its central importance.

The capability review of the APS Commission (APSC) released a week or so ago draws attention to just one indicator of how the APS has downgraded the importance of merit. The review noted how the separation of the Merit Protection Commissioner from the rest of the APSC has ‘marginalised its work and interaction with the broader Commission as well as the role of the Merit Protection Commissioner’. ‘Further, the role has been vacant since December 2022’. The downgrading of the MPC began under APS Commissioner John Lloyd who recommended a lowering of the position’s classification to the Remuneration Tribunal. Previous APS Commissioners included the MPC on the Commission’s executive, contributing to all the Commission’s work drawing on the MPC’s hands-on experience with merit issues across the APS.

Lloyd also withdrew the Commissioner from the previous critical role of ‘certifying’ all SES appointments that they followed proper merit-based processes.

The downgrading of the MPC was not an isolated incident. The 2014 amendment to the PS Act dropped ‘merit’ from the APS Values, leaving it as one of the new ‘Employment Principles’, but not the first one. I argued at the time, without success, that this was a mistake. The new legislation did attempt to strengthen secretary appointment processes but sackings later in 2014 by the Abbott Government revealed the changes had no material impact.

To be fair, Peter Woolcott as APS Commissioner repaired some of the damage caused by Lloyd, reintroducing the SES ‘certification’ process and strengthening the Commissioner’s support for merit-based advice to the Prime Minister on secretary appointments. But he did not bring the MPC back into the fold, and the secretary appointments and terminations under the Morrison Government demonstrated again the weakness of current legislative arrangements.

Given the Robodebt Royal Commission Report, it is surprising that recent speeches by APS leaders, while expressing deep regret for Robodebt, have claimed that they have not compromised ‘frank and fearless’ advice and that their ministers always welcomed such advice (Gordon de Brouwer even included Tony Abbott as an example, not mentioning the sackings in 2014).

I recall the debate I had with Peter Shergold in 2007 when he claimed that ‘frank and fearless is a function of character, not tenure’, to which I responded that it was both. Secretaries respond to the rewards context in which they work, choosing when to go out on a limb and whether or how to express an unwelcome view. In extreme cases, this leads to the ‘cowardice’ the Royal Commission found. In my experience, the pressures were greatest not on major policy matters but on matters of due process – meeting FOI Act responsibilities, when and what to publish, answering Parliamentary questions, advising on grants. There is plenty of evidence that this remains true today.

Sorting out secretaries’ tenure will not totally resolve the problem, but it is an essential step. The welcome work now underway to improve how secretary and other agency head appointments are made will not lead to sustained reform without legislative change that constrains future governments as well as this one.

The Bill now before the Parliament has nothing on this critical issue.

Nor does it reinstate ‘merit’ as an APS Value. Instead, it proposes adding ‘stewardship’, surely a responsibility of senior management not staff to ensure agencies have the capability – the skills, the systems, the data and the connections – to meet future requirements.

The Robodebt Royal Commission provides the Government, and the APS leadership, with a grand opportunity to deliver substantial and lasting reform. This Bill does not deliver this. There is an unofficial suggestion that it is a first tranche of reform and that there will be a sequence of measures over the next two years. First, I have seen no public statement by a minister committing to this; second, it seems a strange way to achieve coherent and comprehensive reform, involving all the risks of repeated Bills before the Parliament to amend the PS Act.

I hope the Bill does not proceed, but that a more comprehensive reform package is developed which gives priority to ‘merit’.

NOT ONLY IN AUSTRALIA:

https://www.youtube.com/watch?v=I7r8xSUEi6o

"You're so UNBELIEVABLY UNQUALIFIED!" Mad Ted Cruz brings the HAMMER DOWN on latest BIDEN NOMINEE

FREE JULIAN ASSANGE NOW####################

- By Gus Leonisky at 12 Aug 2023 - 2:09pm

- Gus Leonisky's blog

- Login or register to post comments

all's well in....

9 Signs That The U.S. Consumer Is About To BreakBy Michael Snyder

When the U.S. consumer is in healthy financial shape, the outlook for the U.S. economy is generally positive. But just like we witnessed prior to the Great Recession of 2008 and 2009, when the U.S. consumer is not in healthy financial shape, bad things tend to happen. Unfortunately, the numbers are telling us that current conditions are eerily similar to what we experienced during the run up to the Great Recession. Households don’t have enough money coming in, debt levels are soaring, delinquency rates are rising, and tens of millions of us are just barely scraping by from month to month. The following are 9 signs that the U.S. consumer is about to break…

#1 After adjusting for inflation and taxes, household income in the United States has fallen 9.1 percent since April 2020…

On the inflation issue, household income adjusted for inflation and taxes is running some 9.1% below where it was in April 2020, putting additional pressure on consumers, according to SMB Nikko Securities.

#2 Credit card debt has surpassed the one trillion dollar mark for the first time ever as struggling American households increasingly turn to credit cards to get by from month to month…

Americans increasingly turned to their credit cards to make ends meet heading into the summer, sending aggregate balances over $1 trillion for the first time ever, the New York Federal Reserve reported Tuesday.

Total credit card indebtedness rose by $45 billion in the April-through-June period, an increase of more than 4%. That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003.

#3 The average rate of interest on credit card balances is over 20 percent, and that is financially crippling millions of our fellow citizens…

The average credit card charges a near-record 20.53% interest rate, according to Bankrate.

#4 Credit card delinquency rates are hitting levels that we haven’t seen in more than a decade…

The Fed’s measure of credit card debt 30 or more days late climbed to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%.

#5 The number of Americans that are making emergency withdrawals from their 401(k) plans is absolutely surging…

More Americans are tapping their 401(k) accounts because of financial distress, according to Bank of America data released Tuesday.

The number of people who made a hardship withdrawal during the second quarter surged from the first three months of the year to 15,950, an increase of 36% from the second quarter of 2022, according to Bank of America’s analysis of clients’ employee benefits programs, which are comprised of more than 4 million plan participants.

#6 Over the past year it has become much more expensive to purchase a home…

Elevated mortgage rates and sales prices mean owning a home is about 20% more expensive than it was last year.

The typical U.S. homebuyer’s monthly mortgage payment was $2,605 during the four weeks ending July 30, down $32 from July’s record high but up 19% from a year prior, according to a Friday report from real estate listing company Redfin.

#7 The nationwide average rent-to-income ratio has been over 30 percent for the past two years. This is the first time in U.S. history that this has ever happened.

#8 It is being reported that vehicle repair costs have gone up by almost 20 percent over the past year…

Car repair costs are up almost 20% in the past year, according to the consumer price index — more than six times the national inflation rate and among the largest annual price increases of any household good or service.

So, what’s driving up prices?

It’s a combination of factors, experts said. Some emerged in the pandemic era while others are longer-term trends in the auto market, they said.

#9 A whopping 69 percent of all U.S. consumers that live in urban areas are currently living paycheck to paycheck…

Sixty-nine percent of consumers in urban areas live paycheck to paycheck, which is 25% more than their suburban counterparts, 55% of whom live paycheck to paycheck. Additionally, 63% of rural consumers reported living paycheck to paycheck. These regional concentrations of paycheck-to-paycheck consumers could be attributed to the high percentage of millennials living in urban areas (48%) as well as the large share of baby boomers and seniors — many of whom are retired and living on a fixed income — living in rural areas (32%).

After seeing all those numbers, is there anyone out there that still wishes to argue that the average U.S. consumer is in good shape?

The truth is that economic conditions are rough, and they are deteriorating a little bit more with each passing day.

On Tuesday, Moody’s decided to downgrade ratings for 10 different U.S. banks, and they are warning that more downgrades may be coming…

US bank stocks declined after Moody’s Investors Service lowered its ratings for 10 small and midsize lenders and said it may downgrade major firms including U.S. Bancorp, Bank of New York Mellon Corp., State Street Corp., and Truist Financial Corp.

Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate are among strains prompting the review, Moody’s said late Monday.

And Tyson Foods has just announced that it will be shutting down four more chicken plants…

But despite everything that has already happened, Fed officials are telling us that “multiple rate hikes” may still be necessary.

Is this some kind of a sick joke?

The historic economic meltdown that we have long been warned about is unfolding right in front of our eyes, and they want to raise rates even higher?

Either they are extremely incompetent, or they are doing this to us on purpose.

In any event, much rougher times for the economy are on the horizon, and that is really bad news for the U.S. consumer.

Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

About the Author: My name is Michael and my brand new book entitled “End Times” is now available on Amazon.com. In addition to my new book I have written six other books that are available on Amazon.com including “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, and “Living A Life That Really Matters”. (#CommissionsEarned) When you purchase any of these books you help to support the work that I am doing, and one way that you can really help is by sending copies as gifts to family and friends. Time is short, and I need help getting these warnings into the hands of as many people as possible. I have also started a brand new Substack newsletter, and I encourage you to subscribe so that you won’t miss any of the latest updates. I have published thousands of articles on The Economic Collapse Blog, End Of The American Dream and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe. I always freely and happily allow others to republish my articles on their own websites, but I also ask that they include this “About the Author” section with each article. The material contained in this article is for general information purposes only, and readers should consult licensed professionals before making any legal, business, financial or health decisions. I encourage you to follow me on social media on Facebook and Twitter, and any way that you can share these articles with others is definitely a great help. These are such troubled times, and people need hope. John 3:16 tells us about the hope that God has given us through Jesus Christ: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life.” If you have not already done so, I strongly urge you to invite Jesus Christ to be your Lord and Savior today.

https://www.activistpost.com/2023/08/9-signs-that-the-u-s-consumer-is-about-to-break.html

NOTE: GUS LEONISKY IS A RABID ATHEIST.....

SEE: I have enough understanding to be an atheist.....MEANWHILE:

Suicide and deaths of despair have reached historic levels in the United States, according to the latest data from the Centers of Disease Control and Prevention (CDC). There were a record high of 49,369 suicide deaths in 2022 alone and since 2011, nearly 540,000 individuals have been lost to suicide.

For youths and young adults over ages 10 to 24 years the incidence of suicides in the US in the last two decades has risen from 6.9 per 100,000 to 11 per 100,000, or a harrowing increase of 60 percent. Although the incidence for preteens is much lower overall and has remained stable over the last three years, they are up three-fold from 2007. Since 2011, the percent change for suicide deaths for 12 to 17 has been highest compared to any older age category with a rise of 47.7 percent.

In 2020, suicide was listed as the twelfth leading cause of death overall in the US. Among youth and young adults, it ranked in the top four: it was second in those that were 10 to 14 and 25 to 34 age categories, third for those between 15 and 24, and fourth for individuals 35 to 44. For those between five and nine years of age, the CDC stated it was the tenth leading cause of death.

https://www.wsws.org/en/articles/2023/08/12/suou-a12.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW..........