Search

Recent comments

- closed....

4 hours 23 min ago - no excuses....

8 hours 50 min ago - STATEMENT....

9 hours 17 min ago - morally dead....

11 hours 12 min ago - condolences....

17 hours 9 min ago - in cold blood....

18 hours 32 min ago - LIES....

18 hours 39 min ago - journalism....

1 day 4 hours ago - day three.....

1 day 5 hours ago - lawful law?....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

what happens next is hard to know......

Vladimir Putin’s resounding victory in Russia’s presidential elections will act as a mandate to the Kremlin for fighting the Ukraine war to completion. At the same time, attacks on Russian territory have expectedly increased over the past several weeks as Kiev’s strategic position has steadily deteriorated. In addition to targeting civilian population centers with missile and drone strikes, forces of the pro-Ukrainian Russian Volunteer Corps (RDK) have also unsuccessfully attempted to invade and consolidate territory in the direction of Belgorod; such attacks were meant to coincide with the elections and intended to demoralize Russian citizens, thereby increasing pressure on the Putin regime by sending the message that the current administration does not have things under control.

BY Dominick Sansone

All of this is and was predictable. What is less clear, however, is how the Western world will respond to the increasingly poor prospects for the Ukrainian war effort moving forward. In a March 15 meeting with the highest-ranking members of the Russian security and defense services, Putin specifically referred to the involvement of “foreign mercenaries” and Western-backed Ukrainian forces in the attacks on Belgorod and Kursk. In his initial remarks to the country upon winning reelection, the Russian president again referred to troops from NATO countries operating in Ukraine, and warned of the potential for escalation to “full-scale World War III.” These statements were made only several days after Putin declared in an interview that he would not rule out the possibility of using nuclear weapons, should certain “redlines” be crossed in Ukraine.

But such heightened rhetoric is hardly surprising in response to recent statements by Western leaders. Most notably, France’s President Emmanuel Macron has doubled down on his insistence that the possibility of eventually involving foreign troops in Ukraine is indeed possible, if not likely. Poland’s Foreign Minister Radek Sikorski—husband of Atlantic columnist and prominent spokeswomen of the neoliberal order, Anne Applebaum—laudedMacron’s statements, and reiterated the latter’s evaluation that NATO troop deployments may eventually be called for.

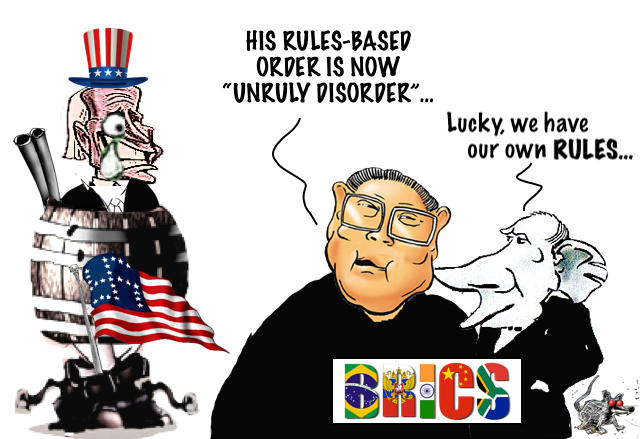

At the same time, the pressure campaign to punish Russia has failed to result in Moscow’s international ostracization, and instead served to accelerate the geopolitical reorientation of the non-transatlantic world. Russia may be just one (and by no means the strongest) of multiple centers of power in this emerging alternative to the “rules-based order”; it has nonetheless illustrated the conditions that must be established in order to successfully break with that previous order, as well as the characteristics of the developing new one.

For one, the Russian economy has largely been able to weather the massive sanctions regime launched against it. A large part of this has been due to its massive capacity for military production. Per the Wall Street Journal, the percent of federal expenditures devoted to defense related industries has jumped by 14 percent since 2020; tank production is 5.6 times greater than it was before the war, and ammunition and drone production are both 17 times greater. NATO intelligence likewise estimates that Russia is currently producing about 250,000 artillery shells per month, which is three times greater than U.S. and European production levels combined.

The broader economic effect of having the country on the war footing has been to stabilize GDP and soften the effect of the sanctions for the Russian population. Russia’s economy beat expectations by growing at 3.6 percent in 2023, higher than all other G7 countries. The IMF predicts growth levels of 2.6 percent this year, twice as much as its previous forecasts; this looks particularly favorable when compared to the 0.9 percent growth level predicted for Europe. And while inflation remains rather high, its effects have been somewhat mitigated by an all-time low unemployment rate of 2.9 percent.

The Russian rouble has likewise proved to be more resilient than expected. The percent of Russian export settlements being conducted in the U.S. dollar or the euro has plummeted from around 90 percent at the beginning of 2022 to less than 30 percent today; meanwhile, those in the rouble have increased from about 10 to more than 30 percent, with the share of transactions being conducted in other currencies—mostly the Chinese renminbi—higher than 40 percent. Despite Western boasting of its campaign to destroy the rouble, the currency has remained relatively stable despite temporary fluctuations, disproving the promises of its impending demise thanks in large part to capital controls (and perhaps an element of loyalty on the part of Russia’s exporting firms).

There is of course legitimate criticism that an economy built upon weapons production inevitably siphons investment from other sectors; Russia’s inflation level may also be representative of the more widespread systemic dangers of relying on massive state spending to keep things running hot. Still, as long as Moscow is able to keep revenue coming in, its deficit should remain manageable.

No single factor in keeping that revenue flowing and subsequently fortifying the Russian economy is more significant than that of its energy trade. At the same time, no single example stands as a better representation of Moscow’s defiance to the West’s punitive measures than the circumvention of Washington’s $60 price cap. Instituted around the beginning of 2023, the intention was to punish Russia by decreasing its revenue from the oil trade; the mechanism through which these caps are enforceable is that Russian ships transporting oil use Western maritime insurance and financial services.

Expectedly, enforcement was largely ineffective at the outset, although the United States has since attempted to crack down. For instance, Washington pledged to increase its enforcement of the oil caps at the end of 2023, with sanctions placed on two tankers due to their flouting of the regulations last October. Most recently, oil shipments headed to India were rerouted to China due to New Delhi’s apprehension of tougher enforcement.

Almost exactly one year since the sanctions really started to bite, and Russian seaborne crude shipments remain high. Even with its massive budget amid the significant defense spending mentioned earlier, Moscow’s current deficit remains manageable at somewhere between 1 and to 2 percent, and the massive windfall from oil revenues will certainly keep the state coffers buoyed for the foreseeable future. Despite temporarily falling below $60/barrel for its Ural crude blend at various points over the past year, the average price has stayed above the price cap; and after starting off 2024 at around $60, the price per barrel at present stands close to $80.

The politics around the oil trade further demonstrates Russia’s hardly isolated position in the international economy. Increased revenue based on such prices as those listed above can be expected for at least the next several months—if not beyond—as OPEC and its partners initiate coordinated oil cuts that will drive up prices. Cuts will take place over the next several months, with Russia choosing to focus on decreasing production rather than exports. One factor in the latter decision is that Ukraine and its Western backers recognize the independence and geopolitical maneuverability that the oil trade gives to Moscow, and have therefore specifically targeted refining facilities with drone and missile strikes as part of their attacks on Russian territory. The cuts to production could provide the needed space to implement repairs.

Of course, the U.S.-led West still exerts enormous influence on the world stage, as represented by India’s denial of the shipments of Russian crude in the face of mounting pressure. Yet Russia at present remains near the top of India’s oil imports, specifically due to the discounted prices since the start of the Ukraine war; New Delhi started off the year with a 41 percent year on year increase of shipments from Russia. It is hard to believe that India will permanently shun Moscow at the behest of Washington, rather than figure out a way to circumnavigate the sanctions regime.

India may look to the United States in helping to balance China, but Russia’s growing relationship with both of the two Asian heavyweights has provided leverage in its geopolitical maneuvering. (Xi and Modi were both among the first to call and congratulate Putin on his electoral victory, as was Mohamed bin Salman of Saudi Arabia.) The diverted Sokol oil shipments from India ending up in China is likewise no coincidence; Beijing subsequently set a record for the amount of Russian oil imports for a single month in March. A major meeting between Xi and Putin has also been scheduled for May; it is to be the Russian president’s first trip abroad since winning reelection. Putin reaffirmed that the two leaders share a similar outlook in international relations, ensuring that bilateral cooperation between the two nations will continue to expand in the coming years.

Meanwhile in Europe, Ukraine’s Energy Minister German Galushchenko announced this past Sunday that his country will refuse to prolong a five-year deal on the transport of Russian gas through pipelines in its territory. The agreement expires on December 31, and besides attempting to harm Moscow’s revenue flows further, the halt in gas transits is undoubtedly intended to leverage Ukraine’s position between Russia and energy-hungry NATO members.

The hardball tactics are logical, as Kiev needs to do all it can to tip the scales in favor of greater Western intervention. Over the past several decades, the United States has continually placed Moscow in a position either to accept the fait accompli of NATO expansion at the expense of Russian security interests, or to escalate with force and suffer the consequences of increased economic and political ostracization. This disincentive to avoid escalation has been effectively removed. Explicating the altered state of international relations is not cheerleading for the Russian position—although it may be treated as such by those who disingenuously present any realistic assessment of the situation as “appeasement”—but rather illustrating how Moscow has insulated itself from Western ostracization, thus changing the entire balance of power in not only Europe, but the world.

Now, it is Russia that has the West on the horns of a dilemma: It can either watch the Kremlin achieve its strategic objectives, guaranteed in a one-sided negotiated settlement or through the continued attrition of Ukrainian forces, or it can escalate with force. Putin’s statement regarding nuclear weapons was not mere rhetoric—it was the Russian president defining the limits of the current conflict from a position of authority.

Anything short of total Ukrainian victory is therefore an implicit admission that the “rules-based” economic and political order has been irreversibly altered. Despite getting the premises right, Putin may have subsequently erred in his conclusion that Western leaders understand the Ukraine war as a mere matter of improving their tactical position. With the likelihood of official NATO deployments increasing by the day, the world stands on edge to see where things go next.

https://www.theamericanconservative.com/the-rules-based-order-is-already-over/

FREE JULIAN ASSANGE NOW.... astounding......

- By Gus Leonisky at 27 Mar 2024 - 11:54am

- Gus Leonisky's blog

- Login or register to post comments

stupid move.....

America’s latest move to block China’s economic rise By Percy AllanUS lawmakers have introduced a bill that would bar US mutual funds from investing in indexes that track Chinese stocks (Bloomberg). According to Bloomberg “The legislation targets mutual funds that invest in indexes tracking primarily Chinese stocks, rather than those investing in indexes that only include some Chinese companies, according to Sherman’s office. However, the lawmakers left it to the Securities and Exchange Commission to write rules that’d ultimately determine which products are impacted.”

In both Emerging Market and Asian (ex-Japan) share funds (e.g. VanEck MSCI Multifactor Emerging Markets Equity ETF and Fidelity’s MSCI All Country Asia ex-Japan Fund) Chinese stocks are the biggest component (between 25% and 35%). That’s more than just “some Chinese companies”.

At present Chinese stocks are depressed so several analysts see them as good value on fundamentals such as share price to earnings and return on equity ratios. See Fig.1 below. To omit Chinese shares from a share fund portfolio would be to exclude the companies of the world’s second largest economy after the USA. It would also make global share indices more US share oriented at a time when the US share market looks extremely overvalued by historic standards.

Stopping US mutual funds from having a major exposure to Chinese stocks would have a spillover effect globally including Australia because a lot of locally registered Asian stock funds are simply offshoots of US based funds or are based on Asian asset allocation indices devised by MSCI, FTSE, S&P, Down Jones, and Morningstar. Also, global share funds allocate a portion of their assets to Chinese listed companies based on such indices.

The US has clearly declared economic war against China by wanting to bar or hinder interaction with it on trade, investment, and technology. It cites security grounds, but most Chinese companies are involved in electronics, pharmaceuticals, energy, construction, finance, consumer goods, and transportation not defence industries.

Should the US Congress approve the new bill (which seems likely since Sinophobia unites both Democrats and Republicans) it could affect both institutional and private investors such as industry and retail super funds, self-managed super funds, and private investment portfolios that use indexed funds to obtain investment exposure to large and profitable Chinese companies like Tencent, Alibaba,

PetroChina, Bank of China and China Construction Bank. Since Australia’s prosperity depends on China’s economic growth not being interrupted, America’s move to stop investors buying a stake in successful Chinese multinational companies is not in our best interests.

Except for Australian owned Beta Shares Asia Technology Tigers ETF (exchange traded fund) which seems to use its own Asian share allocation index, other Asian share funds seem to base their share investment allocations on US designed and proprietary share indices except for the FTSE indices. The FTSE Group is owned by the London Stock Exchange, but since it sells its portfolio indices to US funds managers it could buckle to pressure to stop including Chinese shares in them.

Existing Australian based global share funds (ASX listed or unlisted) that invest in Chinese shares include Schroder All China Equity Opportunities Fund, iShares China Large-Cap ETF (ASX: IZZ), Van Eck’s China A50 ETF (ASX: CETF) and Magellan High Conviction (ASX: MHHT). Global share funds also allocate a portion of their share mix to Chinese companies – for example Vanguard Global Value Equity Active ETF (Managed Fund) (ASX: VVLU), Claremont Global Fund, Forager International Shares Fund, Hyperion Global Growth Companies Fund, and Munro Global Growth Fund. Should the bill pass, and the Securities and Exchange Commission deem any share fund or index with a significant exposure to Chinese companies to be illegal then the net would be cast wider than just specific China share funds.

https://johnmenadue.com/americas-latest-move-to-block-chinas-economic-rise/

READ FROM TOP

FREE JULIAN ASSANGE NOW....

killing germany......

Eric Zuesse (blogs at https://theduran.com/author/eric-zuesse/)

This is about neoconservatives (advocates for expanding the U.S. empire) and the empire’s billionaires who hire them to increase the market-values of their primary corporate stocks: armaments-producers such as Lockheed Martin, extraction firms such as ExxonMobil, and high-tech firms such as Google. It is about the individuals who control the U.S. Government and the Governments in its colonies such as Germany.

An article on 1 April 2024 by the pre-eminent economist Michael Hudson,titled “Germany as Collateral Damage in America’s New Cold War”, opened:

The dismantling of German industry since 2022 is collateral damage in America’s geopolitical war to isolate China, Russia and allied countries whose rising prosperity and self-sufficiency is viewed as an unacceptable challenge to U.S. hegemony. To prepare for what promises to be a long and costly fight, U.S. strategists made a pre-emptive move in 2022 to turn Europe away from its trade and investment relations with Russia. In effect, they asked Germany to commit industrial suicide and become a U.S. dependency. That made Germany the first and most immediate target in America’s New Cold War.

My 28 September 2022 “How America Is Crushing Europe” documented the start of “The dismantling of German industry since 2022”; and my 24 June 2023 “Now the Pay-off Comes from Blowing Up the Nord Stream Pipeline” deepened the portrayal of the U.S. regime’s dismantling Germany’s economy, by describing the just-then-signed 20-year contract between Germany’s Government (“SEFE Securing Energy for Europe GmbH (SEFE) is an integrated energy company owned by the Federal Republic of Germany that is active in various stages along the value chain. Headquartered in Berlin”) and the Louisiana-based Venture Global Partners, which “received venture-capital funding of $125M in 2015, then in February 2021 $500M debt-funding from Morgan Stanley, Mizuho Capital, Bank of America, and JP Morgan, and then in January 2023, an additional loan of $1B from an unspecified source,” so that those U.S.-empire private mega-banks and their billionaires would now get vast returns on their start-up investments which were made not only soon after their Government blew up the Nord Stream natural-gas pipelines from Russia to Germany, but even (in 2015) before they were blown up. And, of course, German firms own 31% of Nord Stream, with a Russian firm owning 51%; Dutch and French firms own 9% each, so that the two German gas-firms (Wintershall and PEG, each of which owned 15.5%) lost, and now Germans would be spending far more to Venture Global Partners for canned, compressed, trans-Atlantic-shipped, natural gas from America, than for the pipelined-in natural gas from Russia, that had kept Germany economically competitive. How much more expensive is this American gas, than Russia’s pipelined gas? Hudson says:

The result has been to lock Germany, France and other countries into a dependency relationship on the United States. As the Americans euphemistically describe these NATO-sponsored trade and financial sanctions in Orwellian doublespeak, Europe has “freed itself” from dependency on Russian gas by importing U.S. liquified natural gas (LNG) at prices three to four times higher, and divesting itself of its business linkages with Russia, and moving some of its major industrial companies to the United States (or even China) to obtain the gas needed to produce their manufactures and chemicals.

These harms to Germans, and benefits to U.S.-and-allied billionaires (and to their agents, such as Olaf Scholz and Annalena Baerbock and Robert Habeck and Josep Borrel and Ursula von der Leyen and Emmanuel Macron and Georgia Meloni and hundreds of others), aren’t mainly from the blowing-up of the Nord Stream pipelines, but instead from the U.S.-Government-applied secondary sanctions, punishing violations of America’s primary sanctions that are directly against Russia — these secondary sanctions that enforce German and other U.S.-‘allied’ (stooge-controlled) compliance with the American primary sanctions.

Hudson goes on to say:

Joining the war in Ukraine has also led Europe to deplete its military stocks. It is now being pressured to turn to U.S. suppliers to rearm – with equipment that has not performed well in Ukraine. U.S. officials are promoting the fantasy that Russia may invade Western Europe. The hope is not only to rearm Europe with U.S. weapons but that Russia will exhaust itself as it increases its own military spending in response to that of NATO. There is general refusal to see Russia’s policy as defensive against NATO’s threat to perpetuate and even escalate attacks to grab Russia’s Crimea naval base in pursuit of the dream of breaking up Russia.

The reality is that Russia has decided to turn eastward as a long-term policy. The world economy is fracturing into two opposing systems that leaves Germans caught in the middle, with their government having decided to lock the nation into the unipolar U.S. system. The price of its choice to live in the American dream of maintaining a U.S.-centered hegemony is to suffer industrial depression. What Americans call “dependency” on Russia has been replaced by a dependency on more expensive U.S. suppliers while Germany has lost its Russian and Asian markets.

Germany has 231 U.S. military bases on its soil. How can it declare its independence from the U.S. regime so as to regain sovereignty over itself? It cannot happen unless and until Sarah Wagenknecht becomes Chancellor. This will entail repudiating all of the political Parties that oppose her, and re-establishing Germany apart from any cross-Atlantic alliance with the Western Hemisphere, but instead as being a part of EurAsia, which it is and always was and inevitably will again become. The longer that that is delayed, the deeper will be and become Germany’s decline.

Back on 21 December 2019, the Australian Broadcasting Corporation headlined “Germany hits back at US for placing sanctions on critical European gas pipeline”, and reported that when the U.S. regime had just issued sanctions against the Nord Stream 2 pipeline, and:

In response, Germany’s finance minister and vice-chancellor Olaf Scholz told German broadcaster ARD that Berlin “firmly rejected” Washington’s decision.

“Such sanctions are a serious interference in the internal affairs of Germany and Europe and their sovereignty. We firmly reject this,” Mr Scholz said.

“It is clear to us that we will not accept the imposition of such a sanction, and we will make this clear to the American Government.”

However, he did not announce any concrete retaliatory action against the US.

Such chameleons fool the public to believe that the chameleons for whom the public votes represent not America’s billionaires but — in this case Germany’s — sovereign democratic control over the nation’s own land. Such liars must never be trusted again. And this also means that their ‘news’-media, such as Die Zeit and almost all of the others, are allies and propagandists of those very same U.S.-and-allied billionaires against that colony’s ever again becoming independent and free of this vile foreign domination.

Michael Hudson’s article ends by asking the question “Is economic vassalage to the United States worth forfeiting the opportunity for mutual prosperity with the fastest growing world markets?” The U.S.-and-allied answer is “Yes.” Will Germany’s answer ever be “No”? And, if not now, then when? The longer that this decision for radical change in Germany is delayed, the deeper the pain and suffering of the German people will descend. Is it to descend as deep as happened during the Weimar years? Everyone knows what that led into.

For America’s billionaires, the only way forward is to expand their empire even more. Are they now at the point where the only way to do that is to cannibalize its vassal nations? (This is an act of desperation in order to postpone their empire’s final collapse.) If so, then should Germans accept it, or, instead, get rid of their traitors right now?

—————

Investigative historian Eric Zuesse’s latest book, AMERICA’S EMPIRE OF EVIL: Hitler’s Posthumous Victory, and Why the Social Sciences Need to Change, is about how America took over the world after World War II in order to enslave it to U.S.-and-allied billionaires. Their cartels extract the world’s wealth by control of not only their ‘news’ media but the social ‘sciences’ — duping the public.

https://theduran.com/the-stupidity-and-vileness-of-the-u-s-empires-leaders/

READ FROM TOP.

it's time for being earnest.....grains....

https://www.youtube.com/watch?v=Oan6U7Zn6LA

BRICS NEXT WIN: Russia's Initiative to Create Commodities Exchange Threatens Western Influencehttps://www.youtube.com/watch?v=7Jj1Ou8_wJ8

What is China REALLY Like in 2024? The Media WON'T Show You This!What is China like in 2024? China is one of the most misunderstood countries in the world. On one hand Western media teaches us to fear China and for US citizens our government tells us that traveling to China is dangerous! But I just went to Chongqing, the largest city in China, and this vlog will teach everyone the truth about what is China in 2024!

https://www.youtube.com/watch?v=hRwzx7WnT7s

Project mBRIDGE Explained: BRICS, Multi Currency Reality Via New Blockchain Settlement Systemhttps://www.youtube.com/watch?v=oM16iOYaEEQ

BRICS on the Rise, Countries Ditching the Dollar & U.S. Empire Declines w/ Prof. Richard WolffREAD FROM TOP.