Search

Recent comments

- naked.....

14 hours 28 min ago - darkness....

14 hours 50 min ago - 2019 clean up before the storm....

20 hours 10 min ago - to death....

20 hours 49 min ago - noise....

20 hours 56 min ago - loser....

23 hours 36 min ago - relatively....

23 hours 59 min ago - eternally....

1 day 4 min ago - success....

1 day 10 hours ago - seriously....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

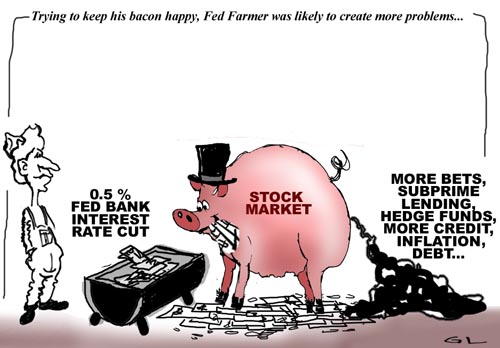

subprime porking .....

from Crikey

The Fed bails out the fat and the dodgy. And Wall Street

Glenn Dyer writes …..

Excuse me for being cynical, but the US Fed's 0.50% cut on the button overnight was nothing but a bail out of Wall Street urgers, dodgy London and European financiers and fat, complacent Australian banks.

Once again the Fed has realised its proper role: if the wider US economy is threatened, then Wall Street is threatened and nothing must be allowed to damage one of the few industries where the US has a definable advantage over the rest of the world, even China with its $US1.4 trillion in reserves.

Just as Alan Greenspan bailed out the Wall Street banks and their mates after the tech booms of the late 90s (remember his "irrational exuberance") by driving interest rates down to one per cent, Ben Bernanke has moved to ease pressure on a Wall Street beset with problems stemming from the crisis it caused and financed: the subprime mortgage mess and credit markets freeze.

But he had no option. To do nothing would have created an even bigger black hole because, believe it or not, our central bankers are operating in a information vacuum. It's not me saying that, our Reserve Bank Governor, Glenn Stevens, said it yesterday when he made this remark about the lack of accurate information on where the risks currently lie:

At the moment, there is widespread suspicion in the absence of clear information. It would be very damaging for that lack of information to lead to a lengthy period of severely reduced credit flow to perfectly good borrowers simply because investors cannot tell who is sound and who is not. More information is needed.

This aside, there is no one to blame for the current problems than the banks and their advisors on Wall Street and in other financial centres.

They are responsible for the problems in financial markets, the erosion of confidence, the problems which have hit banks in Britain, Germany and France and the huge losses for hedge funds and other highly leveraged (and highly paid) fund managers.

The "buck" (to use Harry Truman's great phrase in all its meanings) started and stops with Wall Street and those people who invented not only subprime mortgages but the way they were sold to punters in the US and elsewhere, and the way they were then parcelled up, turned into Collateralised Debt Obligations and solid off to eager, yield hungry, corner-cutting bankers and investors around the world, including Australia.

And with September 30 -- when the banks, hedge funds and all other manner of investors in the US and around the world have to mark these investments to market -- approaching, the Fed has made sure there won't be another slashing of values.

Bernanke has made sure that some of these hard-to-value assets (liabilities really due to the dodgy nature of the underlying assets), have some value that can be pencilled into the books at September 30, thereby sparing us another round of nervousness and credit market problems in October (a really bad month for Wall Street, remember 1929 and 1987) and November.

But this said there is a problem in the wider US economy: the latest foreclosure figures from RealtyTrac, a US company which measures and tallies up foreclosure moves, said overnight that the number of US housing loans and houses in the foreclosure process had doubled in August, compared to August 2006.

US inflation is not as strong as it was two months ago, so there was room for a rate cut. But if you look at the relief shown by the extreme rally on Wall Street: the Dow up by over 330 points, gold up, copper and other commodities linked to economic activity higher and oil up over a record $US82 a barrel - speculators know that a renewed outbreak in inflation is still an option with an attempt to boost the wider economy.

The US dollar fell and rates on 10 year US Government bonds rose because they are sensitive to inflation and traders in these markets know where the dangers from the Fed's cut lie. But the wider US economy isn't in negative territory yet, despite the housing and financial markets problems.

The Australian and New Zealand dollars rose strongly as a result because investing here and getting more than 6.5% (7% in the short term market) and 8.25% in New Zealand, is a lot better than 4.75% or 5% in the US.

Reserve Bank Governor, Glenn Stevens, made it clear yesterday, we should not expect a rate cut here. He said the Bank was content to see the higher short term interest rates last longer here. And if they start easing there was a very firm hint that rates could rise.

"Given the macroeconomic situation of the Australian economy thus far, some additional restraint would perhaps not be unwelcome. But just how much such restraint will occur as a result of a market tightening in credit conditions is not yet clear." That's Central Banker-ese for "there's been a rise in short term rates, we don't know how long it is going to last, but we are thankful because it means we don't have to consider another rate rise this side of a Federal election".

- By Gus Leonisky at 19 Sep 2007 - 10:18pm

- Gus Leonisky's blog

- Login or register to post comments

The illusion of equality

The Conscience of a Liberal.

Paul Krugman

....

The great divergence: Since the late 1970s the America I knew has unraveled. We’re no longer a middle-class society, in which the benefits of economic growth are widely shared: between 1979 and 2005 the real income of the median household rose only 13 percent, but the income of the richest 0.1% of Americans rose 296 percent.

The wild west...

From the NYT

A Catastrophe Foretold

By PAUL KRUGMAN

Published: October 26, 2007

So, once again, why was nothing done to head off this disaster? The answer is ideology.

In a paper presented just before his death, Mr. Gramlich wrote that “the subprime market was the Wild West. Over half the mortgage loans were made by independent lenders without any federal supervision.” What he didn’t mention was that this was the way the laissez-faire ideologues ruling Washington — a group that very much included Mr. Greenspan — wanted it. They were and are men who believe that government is always the problem, never the solution, that regulation is always a bad thing.

Unfortunately, assertions that unregulated financial markets would take care of themselves have proved as wrong as claims that deregulation would reduce electricity prices.

Oink oink....

Fed Lowers Key Interest Rate by a Quarter Point

By EDMUND L. ANDREWS

Published: October 31, 2007

WASHINGTON, Oct. 31 — The Federal Reserve gave investors what they wanted today, lowering short-term rates for the second time in two months.

But it quietly warned Wall Street not to assume that more reductions are ahead

-------------------

Gus: Things are not that bad... But the fat pigs are after more swill... Oink oink...

So instead of letting "market forces" do what they're supposed to do, the Feds bend-ze-knees and bring more swill to be turned into fertiliser... But as the animals feed, it's most likely a lot of the swill will be squandered... For an economy that relies on and trumpets "free market", that's a stinker... But then, we all know that "free market" is a shonk in which the spruikers (the sellers of illusory dreams) and the ratbags are likely to line their pockets, parading as doktors, while the average Joe remains a clueless John doe in the hospital of high fee capitalism.

---------------

In a statement accompanying its decision, the Fed acknowledged that the housing collapse is like[ly] to slow the economy. But it said “some inflation risks remain” and that the risks of inflation were “roughly balanced” against the risk of slower growth.

That was more sanguine than the view of many investors and analysts on Wall Street, who have been clamoring for easier money from the Fed. But it also reflected the conflicting pressures that face the central bank: despite an unprecedented downward spiral in housing, the rest of the economy has yet to show signs of serious trouble.

Yet just a few hours before the Fed announced its decision, the Commerce Department reported that the nation’s gross domestic product expanded at a healthy pace of 3.9 percent in the quarter that ended Sept. 30.

-----------

Gus: Thus, the poor who have been swindled by subprime deals will cop the rough end of the pineapple while the gamblers on the stock-market can make bigger bets... All's well is the best of the world... See toon at the beginning of this line of articles...

Oink, oink, oink...

Stocks Fall on Exxon Earnings and Citi Woes

By MICHAEL M. GRYNBAUM

Published: November 1, 2007

A bad day on Wall Street got even rougher late in the session today as the Dow Jones industrials closed down more than 360 points, a sell-off set in motion by a weak earnings report from the oil giant Exxon Mobil and concern that Citigroup’s woes may be worsening.

The Dow, down 200 points through much of the day, finished at 13,567.87, a loss of 362.14, or 2.6 percent, erasing gains from yesterday’s decision by the Federal Reserve to cut interest rates.

--------------------

Gus: "therrrrre izzz... NO BIN-GO!!!"... See article above and the toon at the head of this line of stuff, and count your pennies... please note that "Profit-taking and uncertainty overtook the commodities markets as well." Someone somewhere sucked that Fed Bank generous bone in two days, flat. And the stench persists...

oink oink oink oink...

just teasing .....

from Crikey …..

Bush sub-prime plan is symbolic claptrap. A con

Glenn Dyer writes:

President Bush has acted to arrest the sense of crisis around the US housing and mortgage market.

As Forbes.com reported: For the second time in less than three months, the Bush administration signaled Wall Street that it's willing to contain the subprime mortgage mess.

On Thursday Bush unveiled his plan to freeze "teaser rates" on some adjustable-rate mortgages, to keep 1.2 million borrowers away from foreclosure if they aren't able to make their loan payments once the introductory rate expires.

It's a private sector plan, brokered by Treasury Secretary Henry Paulson and Housing and Urban Development Secretary Alphonso Jackson.

And since it involves no government money, it keeps the administration a step away from being accused of a bailout.

Talk about symbolic claptrap and the credulous American investor: they have fallen for a three-card trick from a US administration whose only concern is to look as though it is doing something to help as many people as possible in headline terms, but as few as possible in reality.

Wall Street rises, investors buy banks and start smiling, even though figures are released showing mortgage foreclosures are now at 20 year highs, and expected to worsen and worse still, US house prices are expected to drop 30% before the bottom of the slump is reached. US rating agencies were sceptical, although they supported the intent of the plan.

The Bush proposal came as the number of US borrowers who are behind on their mortgage payments hit a 20-year high in the third quarter.

According to the US Mortgage Bankers Association the share of all home loans with payments more than 30 days late (including prime and fixed-rate loans) rose to a seasonally adjusted 5.59%, the highest since 1986. New foreclosures hit an all-time high for the second consecutive quarter in a survey that goes back to 1972.

According to the independent economic forecast arm of Moody's rating agency, Moody's Economy.com: The current housing recession is expected to run through early 2009 and will ultimately be severe enough to be characterized as a housing crash.

Home sales are expected to hit bottom in early 2008, declining by over 40% from their peak, housing starts will reach their nadir in mid-2008, falling by 55%, and house prices are expected to decline by 12% through early 2009.

The study said the reason for the long time to recovery was simple: too many unsold houses: "The housing market’s most fundamental problem is it is awash in unsold inventory" and that excess was the biggest since 1945! And Bush, Paulson and their supporters expect "The Plan" to solve the problem against that backdrop?

The real winners will be the Wall Street mates of US Treasury Secretary, Hank Paulson.

While the plan to help subprime borrowers is a step in the right direction, the small print makes it clear it is only a sop: only a tiny proportion of subprime borrowers will qualify.

The plan allows a five-year freeze in interest rates only for borrowers current with their monthly payments; it will streamline the mortgage modification process for many distressed borrowers, but it excludes anyone more than 30 days late at the time the mortgage would be modified or anyone who has been more than 60 days late at any time within the previous 12 months.

So that effectively rules out anyone who got into trouble and fell behind this year or in 2006, when the crisis started.

But the real crisis is on Wall Street, in the City of London, in Florida's thousands of cities and towns: its the value of the mortgages and their associated credit derivatives that are falling, generating big losses for banks, investors and others.

The bottom line is that the problem isn't on Main Street any more, its on Wall Street and in the balance sheets of investors, promoters and inventors of these securities.

The Masters of the Universe have been shown to fools and charlatans, and that's the Bush-Paulson plan is aimed at protecting them from retribution and responsibility.

consuming confidence

September 16, 2008

Shares Fall in Europe; U.S. Index Futures Slide

By MATTHEW SALTMARSH and KEITH BRADSHER

PARIS — Stocks in Europe and Asia tumbled Monday and futures on Wall Street and the dollar slid as the collapse of Lehman Brothers and the takeover of Merrill Lynch battered investor confidence.

On Wall Street, stock index futures were down sharply, suggesting that shares would drop when trading opened in New York on Monday morning.

In one of the most dramatic days on Wall Street in recent memory, Merrill Lynch agreed Sunday to sell itself to Bank of America for roughly $50 billion to avert a deepening financial crisis, while another prominent securities firm, Lehman Brothers, filed for Chapter 11 bankruptcy protection.

The humbling moves dented confidence in the markets in Europe where banks and insurers bore the brunt of fears about more write-downs in the financial sector and the possible need for government support.

Shares in UBS of Switzerland, the European bank hit hardest by mortgage-related losses, fell 7.2 percent.

“Confidence has really collapsed,” said Yann Azuelos, fund manager at Meeschaert, an asset manager in Paris. “With the rescue of Fannie and Freddie, we thought the worst had passed. Now we know it hasn’t.”

He was referring to the Treasury’s decision this month to take control of the giant mortgage lenders, Fannie Mae and Freddie Mac.

In Europe, the Dow Jones Stoxx 600 Index declined 3.4 percent to 270.81 points, while the FTSE fell 3.8 percent and the CAC-40 in Paris lost 4.1 percent. Stock markets in Japan, South Korea, Hong Kong and China were closed for holidays, tempering losses in Asia although other markets there declined. The benchmark Taiwan index shed 4.1 percent.

------------

see toon at top...

Where is the money for the

Many people believe that

Many people believe that economic growth is healthy. Indeed, high growth would solve many problems, like poverty, the trade deficit, the debt, etc. But it is impossible for economic growth to continue in a world of limited resources. The population explosion -- which has been created by improved science and productive technology -- is already running into declining resources in grain, seafood, meat, and fresh water. The result will be mass starvation and pitched competition for survival. The alternative is a sustained economy, which holds both the population and production levels constant.The promotion of the national economy depends on a suitable environment for the growth of the private sector. An environment free from bureaucratic impediments, rigid procedure and corruptive practices. This calls for a constant endeavor to simplification and facilitation of local enterprise and encouragement of the flow of foreign investments in productive projects that create satisfying jobs for local citizens. Market labor agencies should disclose transparency in their institutions. The E-Government Act of 2002 has made it clear that government organizations have to make their data available to the public, which is a great move towards greater transparency. Google Public Data is a new Google service where you can search for public data, such as unemployment rates and so forth.

hi sally ....

Hi Sally,

For my money, we need both a reduction in population growth & different economic models that are not driven by growth in consumptio of finite, non-renewable resources, if we are to survive. Sadly, I can see little evidence of our politicians recognising these realities.

Cheers,

John.

mea-culpa-ish...

WASHINGTON — In his most detailed examination of the causes of the financial crisis, Alan Greenspan, the former Federal Reserve chairman, acknowledged that the Fed failed to grasp the magnitude of the housing bubble but argued that its policy of low interest rates from 2002 to 2005 did not cause the bubble.

In a 48-page paper that he is to present on Friday at the Brookings Institution, Mr. Greenspan, who stepped down as Fed chairman in January 2006, expressed some remorse but stood by his conviction that little could be done to identify a bubble before it burst, much less to pop it.

“We had been lulled into a sense of complacency by the only modestly negative economic aftermaths of the stock market crash of 1987 and the dot-com boom,” Mr. Greenspan wrote. “Given history, we believed that any declines in home prices would be gradual. Destabilizing debt problems were not perceived to arise under those conditions.”

Mr. Greenspan added that raising capital requirements and liquidity ratios was the most effective response to blunting the impact of future crises. He suggested that discussions under way in the United States to watch out for systemic risks to the financial system would be of limited use.

“Unless there is a societal choice to abandon dynamic markets and leverage for some form of central planning, I fear that preventing bubbles will in the end turn out to be infeasible,” Mr. Greenspan wrote. “Assuaging their aftermath seems the best we can hope for.”

Mr. Greenspan has defended his once-celebrated tenure as Fed chairman on previous occasions: notably in testimony before Congress in 2008, a new epilogue to his 2007 autobiography that year and a speech to the Economic Club of New York last year. But the Brookings paper was his most extensive response yet.

-------------------

see toon at top

mind your dots, queues and peas...

A missing dot in an email address might mean messages end up in the hands of cyber thieves, researchers have found.

By creating web domains that contained commonly mistyped names, the investigators received emails that would otherwise not be delivered.

Over six months they grabbed 20GB of data made up of 120,000 wrongly sent messages.

Some of the intercepted correspondence contained user names, passwords, and details of corporate networks.

About 30% of the top 500 companies in the US were vulnerable to this security shortcoming according to researchers Peter Kim and Garret Gee of the Godai Group.

The problem arises because of the way organisations set up their email systems. While most have a single domain for their website, many use sub-domains for individual business units, regional offices or foreign subsidiaries.

Dots or full stops are used to separate the words in that sub domain.

http://www.bbc.co.uk/news/technology-14842691

the subprime con-artists are still selling their wares...

A Risky Lifeline for Seniors Is Costing Some Their Homes

By JESSICA SILVER-GREENBERG

The very loans that are supposed to help seniors stay in their homes are in many cases pushing them out.

Reverse mortgages, which allow homeowners 62 and older to borrow money against the value of their homes and not pay it back until they move out or die, have long been fraught with problems. But federal and state regulators are documenting new instances of abuse as smaller mortgage brokers, including former subprime lenders, flood the market after the recent exit of big banks and as defaults on the loans hit record rates.

Some lenders are aggressively pitching loans to seniors who cannot afford the fees associated with them, not to mention the property taxes and maintenance. Others are wooing seniors with promises that the loans are free money that can be used to finance long-coveted cruises, without clearly explaining the risks. Some widows are facing eviction after they say they were pressured to keep their name off the deed without being told that they could be left facing foreclosure after their husbands died.

Now, as the vast baby boomer generation heads for retirement and more seniors grapple with dwindling savings, the newly minted Consumer Financial Protection Bureau is working on new rules that could mean better disclosure for consumers and stricter supervision of lenders. More than 775,000 of such loans are outstanding, according to the federal government.

Concerns about the multibillion-dollar reverse mortgage market echo those raised in the lead-up to the financial crisis when consumers were marketed loans — often carrying hidden risks — that they could not afford.

read more: http://www.nytimes.com/2012/10/15/business/reverse-mortgages-costing-some-seniors-their-homes.html?hp&_r=0&pagewanted=print