Search

Recent comments

- seriously....

1 hour 15 min ago - monsters.....

1 hour 22 min ago - people for the people....

1 hour 58 min ago - abusing kids.....

3 hours 31 min ago - brainwashed tim....

7 hours 51 min ago - embezzlers.....

7 hours 58 min ago - epstein connect....

8 hours 9 min ago - 腐敗....

8 hours 28 min ago - multicultural....

8 hours 35 min ago - figurehead....

11 hours 43 min ago

Democracy Links

Member's Off-site Blogs

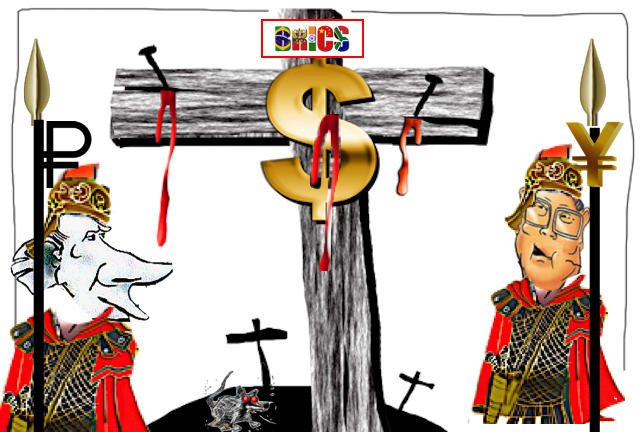

new currency exchange for BRICS and apology about too many countries....

The BRICS alliance has proposed setting up a new currency for trade among member countries as part of its de-dollarization strategy. Pending the August 2023 BRICS Summit, this initiative was speculated to be the principal topic of discussion. However, this proved to be wishful thinking. The possibility is still imminent, with Brazilian President Luiz Inacio Lula da Silva showing support for the BRICS currency last year.

Why can’t an institution like the BRICS bank have a currency to finance trade relations between Brazil and China and between Brazil and all the other BRICS countries? Who decided that the dollar was the (trade) currency after the end of gold parity?

As we reported recently, Kremlin aide Yury Ushakov disclosed that the alliance is working on a blockchain-based payment system. Fascinatingly, this could be extensively deliberated in the upcoming BRICS Summit in October 2024. A successful implementation could be a massive step towards the movement away from the US dollar. Unfortunately for the US, industry insiders believe that this could leave a grievous impact on their social and economic standing.

Trump to Step in With Tariff ThreatUS presidential candidate Donald Trump has pledged to resist this move by imposing a 100% tariff on goods from such countries entering the US during his presidency to prevent this from happening.

This is what he said at a rally in Wisconsin.

Many countries are leaving the dollar. They not going to leave the dollar with me. I’ll say, you leave the dollar, you’re not doing business with the United States because we’re going to put a 100% tariff on your goods.

Outside the BRICS strategies, Russia and China are almost ditching the US dollar completely as they settle a bilateral trade. In response, Trump proposed early this year that his administration would subject all China imports to a 60% increment when elected into office.

Expert Weighs the Cost and Benefit of this Decision on the US and the BRICSAnalyzing the potential impact, GROW Investment Group partner and chief economist Hao Hong disclosed that Trump’s decision could be a lose-lose situation for both the US and China.

Because the Chinese export sector has been so competitive, it’s been a driving force in lowering global inflation. If you put a 100% tariff on Chinese exports, for example, one could only imagine how high the U.S. inflation is going to go.

According to Hong, much of the US trade deficit would move to allies like Mexico and Canada. Defending Trump’s position, the expert explained that the campaign message was meant to protect the hegemony of the U.S. dollar in the financial market. The US dollar also dominates global forex reserves despite witnessing shares dropping by more than 70% in 1999.

Trump’s threat, according to analysts, could jeopardize the hope and position of Bitcoin (BTC) becoming a central currency within any of the alliances that seek to move away from the dollar. However, the broad digital asset market would not be impacted much even if this policy materializes.

Commenting on this, a Bitcoin influencer identified as “Beautyon” stated that moving away from the dollar is worth much more than the proposed 100% tariff.

If the BRICS are ditching the dollar as the result of logic and long-term thinking, then no, it will not be enough. BRICS will know that in the long run, getting the yoke of the dollar off of the necks of their people will be worth much more than the 100% tariffs the U.S. will… https://t.co/2PrULUsG5a— Beautyon (@Beautyon_) September 9, 2024

At press time, Bitcoin was trading at $55.2k, having surged by 1.3% in the last 24 hours.

When will a BRICS currency be released? There's no definitive launch date as of yet, but the countries' leaders have discussed the possibility at length. During the 14th BRICS Summit, held in mid-2022, Russian President Vladimir Putin said the BRICS countries plan to issue a "new global reserve currency," and are ready to work openly with all fair trade partners.

In April 2023, Brazilian President Luiz Inacio Lula da Silva showed support for a BRICS currency, commenting, “Why can’t an institution like the BRICS bank have a currency to finance trade relations between Brazil and China, between Brazil and all the other BRICS countries? Who decided that the dollar was the (trade) currency after the end of gold parity?”

In the lead up to the 2023 BRICS Summit last August, there was speculation that an announcement of such a currency could be on the table. This proved to be wishful thinking, however.

"The development of anything alternative is more a medium to long term ambition. There is no suggestion right now to creates a BRICS currency," Leslie Maasdorp, CFO of the New Development Bank, told Bloomberg at the time. The bank represents the BRICS bloc.

South Africa's BRICS ambassador, Anil Sooklal, has said as many as 40 countries have expressed interest in joining BRICS. At the 2023 BRICS Summit , six countries were invited to become BRICS members: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates. All but Argentina officially joined the alliance in January 2024.

In recent years, the US has placed numerous sanctions on Russia and Iran. The two countries are working together to bring about a BRICS currency that would negate the economic impacts of such restrictions, according to Iranian Ambassador to Russia Kazem Jalal, speaking at a press conference during the Russia–Islamic World: KazanForum in May 2024.

Some experts believe that a BRICS currency is a flawed idea, as it would unite countries with very different economies. There are also concerns that non-Chinese members might increase their dependence on China's yuan instead. That said, when Russia demanded in October 2023 that India pay for oil in yuan, India refused to use anything other than the US dollar or rupees. Russia is struggling to use its excess supply of rupees.

Will BRICS have a digital currency?BRICS nations do not as of yet have their own specific digital currency, but a BRICS blockchain-based payment system is in the works, according to Kremlin aide Yury Ushakov in March 2024. Known as the BRICS Bridge multisided payment platform, it would connect member states' financial systems using payment gateways for settlements in central bank digital currencies.

The planned system would serve as an alternative to the current international cross-border payment platform, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system, which is dominated by US dollars.

“We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics,” Ushakov said in an interview with Russian news agency TASS.

https://www.nasdaq.com/articles/how-would-new-brics-currency-affect-us-dollar-updated-2024

Russian state-funded news outlet RT retracted a report that incorrectly said 159 countries had adopted a "new BRICS payment system" but not before the false claim spread across social media. RT misquoted a Russian official who said that 159 "participants" – not 159 countries -- had adopted Moscow's SPFS system for bank transfers, which sanctions-hit Russia uses as an alternative to the global SWIFT system.

"Big move coming! 159 countries will adopt the new BRICS payment system," read an August 18 post on X, formerly Twitter, written in simplified Chinese.

The BRICS bloc of emerging economies -- made up of Brazil, Russia, India, China and South Africa – has been pushing alternatives to international financial institutions like the World Bank and IMF.

Moscow has called for BRICS countries to introduce a common payment system and increase use of members' national currencies for trade in a bid to free themselves from the dollar.

Russia has increasingly developed its domestic financial infrastructure, including the SPFS system for bank transfers and the Mir card payments system, after it was cut off by the West from the SWIFT global payments system over Putin's war in Ukraine.

The X post shows an RT video report about the introduction of the "BRICS payment system" by 159 countries.

https://factcheck.afp.com/doc.afp.com.36F22VT

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

METHINKS THAT THE MISQUOTE WAS DELIBERATE TO SPOOK THE MARKET AHEAD OF THE BRICS MEET IN OCTOBER....

SEE ALSO: brics vs g7.....

- By Gus Leonisky at 23 Sep 2024 - 5:37pm

- Gus Leonisky's blog

- Login or register to post comments

cashed up BRICS....

Pepe Escobar: Will a BRICS Bretton Woods Take Place in Kazan?BY PEPE ESCOBAR

With less than a month before the crucial BRICS annual summit in Kazan under the Russian presidency, serious informed discussions are raging in Moscow and other Eurasian capitals on what should be at the table in the de-dollarization and alternative payment system front.

Earlier this month Andrey Mikhailishin, head of the task force on financial services of the BRICS Business Council, detailed the list of top projects under consideration. They include:

A common unit of account - as in The Unit, whose contours were first revealed exclusively by Sputnik.

A platform for multilateral settlements and payments in BRICS digital currencies, connecting the financial markets of BRICS members: that’s BRICS Bridge, which bears similarities with the Bank of International Settlements-linked MBridge, already in effect. That will complement intrabank systems already in action, as in Russia’s SPFS and Iran’s CPAM settling financial transactions – and 60% of their trade - in their own currencies.

A blockchain-based payment system that entirely bypasses the US dollar: BRICS Pay. Arguably 159 participants may be ready to adopt this sanction-evading, similar-to-SWIFT mechanism right away.

A settlement depository (Clear).

An insurance system.

And crucially a BRICS rating agency, independent from the Western giants.

What’s at stake is the extremely complex design of a brand-new financial system – decentralized and using digital technology. BRICS Clear, for instance, will be using blockchain to record securities and exchange them.

As for The Unit, the value of the common unit of account is pegged by 40% to gold and by 60% to a basket of BRICS member’s national currencies. The BRICS Business Council considers The Unit a “convenient and universal” instrument, since a unit can be converted into any national currency.

That would definitely solve the nagging problem of exchange rate volatility when cash balances accumulate from settlements in national currencies; for example, a mountain of Indian rupees used to pay for Russian energy.

Who Do I Call to Talk to BRICS?

I asked a very direct question to two Russian analysts, one of them a finance tech executive with vast experience across Europe, and the other the head of an investment fund with global reach. Considering the sensitivity of their posts, they prefer to remain anonymous.

The question: Is BRICS ready to become an actor in Kazan next month, and what should be on the table in terms of the strategy to establish an alternative payment system?

The Answers. Analyst 1:

“Time has come for BRICS to become a real actor. The world demands it. The leaders of BRICS countries clearly understand it. They have the moral power and the political will to set up an organization to provide a number for BRICS to be called in – that’s the best question for the upcoming summit.”

The analyst is referring to what could be dubbed “the Kissinger moment”, when Dr. K famously quipped, in the Cold War era, “when I want to talk to Europe, who do I call?”

Now to Analyst 2:

“For a BRICS agreement amongst countries to mean something, countries need to agree on a framework of action and that means accepting some responsibilities in exchange for certain rights. And it sounds there’s no better way to achieve that than to arrive at mutually agreed obligations on settlement of financial transactions.”

One of the analysts added a very important, specific point: “By now the situation is pretty clear, to properly address the issue of cross-border payments. The best mechanism should be based on the New Development Bank (NDB), given that Russia has a mandate to propose the new president of that organization. Whoever the candidate will be, cross-border payments should be at the top of his agenda.”

The NDB is the BRICS bank, based in Shanghai. The analyst hopes this decision on the future of the NDB will be made before the BRICS summit: “Given the diplomatic and political considerations, the candidate should be made known, formally or informally to the member countries.”

New BRICS blockchain payment system to be game-changer amid 'unstoppable' dedollarization - expert

Moscow’s decision to create a new BRICS blockchain-based payment system is a “game changing” development for the multipolar world, Christopher Douglas Emms, head of the Brokerage… pic.twitter.com/4cEBFb3c7c

— Sputnik (@SputnikInt) September 4, 2024

As it stands, the talk of the town in Moscow informed circles is that Alexey Mohzin, the IMF’s executive director for Russia, has a 60% chance to be appointed to the NDB. In parallel, Ksenia Yudaeva, a former G20 sherpa and former deputy of Russia Central Bank’s Elvira Nabiullina, may become the new representative with the IMF.

So what may be in the cards is a NDB/IMF reshuffle on the Russian front. The focus should be on the potential for future productive change – rather than missed opportunities; the NDB’s policies so far have not been exactly revolutionary - considering that the bank’s statutes are linked to the US dollar.

The new deal could place the NDB as leverage for a reform of the IMF, rather than an alternative to it.

The “Kissinger moment” does play a key role in this equation. It will highlight that until the moment turns into reality, the NDB should be the sole actor for effective changes in crucial matters like the stability of the financial infrastructure.

And from that perspective, as one of the analysts note, “The UNIT and all other similar projects may be presented as complementary risk management tools hedging against reckless monetary policies and Global Financial Crisis-2 risks.”

Time though is running out – fast. President Putin recently met with the Russian Union of Industrialists. They have sent a letter to the administration and the Russian Central Bank outlining what they consider the most promising ideas.

The Unit is one of them. Prime Minister Mishustin’s government is now on the final stages of deciding which projects to support: for the BRICS summit in Kazan, and one week before, for the annual summit of the BRICS Business Council in Moscow.

A BRICS Bretton Woods?

I posed the same BRICS question to the Russian analysts also to indispensable Prof. Michael Hudson – who actually provided a concise in-depth critique of what may be on the table, while offering a different solution.

For Prof. Hudson, “a new institution has to be created - a Central Bank empowered to issue credit to finance the trade and payments deficits of some countries, with an artificial bancor-type SDR [Special Drawing Rights].”

Prof. Hudson argues “this would be different (his italics) from a clearing house system for existing banks. It would be a BRICS' IMF. Its bancors credit or balance sheet would only be for settlements among governments, not a generally traded currency. Indeed, making the bancor widely traded as a speculative vehicle (such as the UNIT is) would introduce major instability and have nothing to do with the needed bank transfer balance sheet.”

A reformed NDB, possibly next year under a new Russian presidency, should have all it takes to become a “BRICS’ IMF.”

Prof. Hudson adds that “to succeed, the Kazan conference should be a full-fledged BRICS Bretton Woods. Maybe it is too soon to actually introduce a fait accompli. Perhaps it would be a venue to throw open a set of alternatives -- including what would happen by ‘doing nothing’ and going with the current IMF system. The fact that the IMF just cancelled its trip to analyze the Russian economy may be a catalyst.”

Prof. Hudson in fact refers directly to Executive Director for Russia, Alexey Mohzin, who confirmed that the IMF should have come to Russia for consultations, part of their annual review of the Russian economy, but cancelled it because of “technical unpreparedness”.

All that brings us once again to the “Kissinger moment”; it’s unclear whether Kazan will come up with a “BRICS number” anyone could call.

Leaving the dollar-based system for good: What are the digital ruble and BRICS Bridge?

By July 1, 2025, the largest Russian banks will have to provide their clients with the ability to conduct transactions in digital rubles, according to the Russian Central Bank. Pilot testing… pic.twitter.com/fXlp0He0X3

— Sputnik (@SputnikInt) September 16, 2024

Prof. Hudson makes an essential last point on the Global South’s dollar debt: he stresses “how to handle BRICS members existing overhang of dollar debts” is a major problem.

What is clear is that “the BRICS bank [the NDB] should not finance deficits by member countries for such payments. In practice, there would have to be a moratorium on such payments - in view of the present weaponization of Western finance.”

Prof. Hudson recalls the chapter in his book Super Imperialism “on how the US moved against Britain in 1944 to get an agreement that it then presented as a pro-US fait accompli to Europe.” The book “reviews all the arguments that took place there.”

Prof. Hudson wishes he would be part of the new, ongoing process. Imagine if BRICS+ manages to pull it off: getting a Global Majority-approved agreement on a new, equitable, fair financial system then presented to the $35 trillion-indebted superpower as a fait accompli.

https://sputnikglobe.com/20240923/pepe-escobar-will-a-brics-bretton-woods-take-place-in-kazan-1120257701.html

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

crash....

https://www.youtube.com/watch?v=1VY72BWh7n4

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

95%....

BEIJING (Sputnik) - Today, 95% of settlements between Russia and China are carried out without the participation of third-country currencies, Russian Ambassador to China Igor Morgulov said in an interview with Sputnik.

In March-April of this year, a slight decline was observed in bilateral Russian-Chinese trade. In particular, in March, for the first time since 2022, the total export of goods from China to Russia decreased year-on-year. Many attributed this to the difficulty of mutual settlements.

"As for the problem of settlements, let's not forget that today they are already 95% carried out in rubles and yuan, that is, without the participation of third-country currencies," Morgulov said.

Trade between China and Russia increased by 26.3% to a record $240.11 billion in 2023. Russian and Chinese leaders, Vladimir Putin and Xi Jinping, previously set the goal of doubling trade from $100 billion a year in 2018 to $200 billion by 2024, a figure that was reached in November 2023. Russia and China celebrate the 75th anniversary of the establishment of diplomatic relations on October 2. The Soviet Union became the first country to recognize the People's Republic of China the day after its proclamation.

https://sputnikglobe.com/20241001/russia-china-settling-95-of-payments-in-own-currencies---russian-ambassador-in-china-1120368868.html

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.