Search

Recent comments

- leave....

4 hours 35 min ago - costly....

5 hours 27 min ago - stormtroopers....

6 hours 45 min ago - friend-ships.....

8 hours 47 min ago - the lobby....

9 hours 45 min ago - not worth...

10 hours 55 min ago - illegal stuff....

11 hours 44 min ago - no shipping.....

21 hours 33 min ago - digging graves....

21 hours 45 min ago - BS draft...

21 hours 53 min ago

Democracy Links

Member's Off-site Blogs

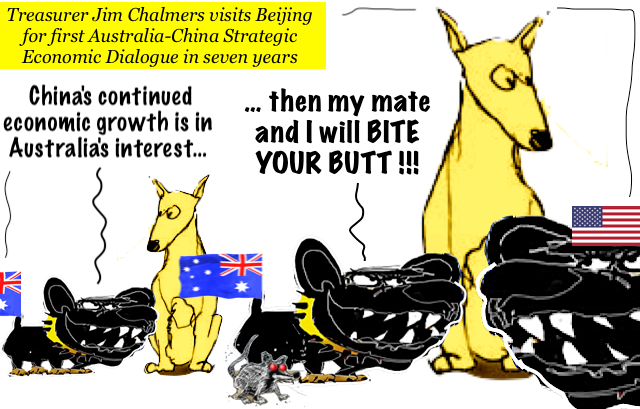

chinese economic growth and american empire growl.....

Treasurer Jim Chalmers says China's continued economic growth is in Australia's interest, as the world's second-largest economy struggles with an ongoing real estate crisis and low confidence among everyday Chinese consumers.

Mr Chalmers is in Beijing to co-chair the first Australia-China Strategic Economic Dialogue (SED) in seven years, alongside Zheng Shanjie from China's National Development and Reform Commission (NDRC).

During his two-day visit, the treasurer is seeking to better understand the challenges facing the Chinese economy, and with Beijing being Australia's largest trading partner, how those challenges might in turn affect Australia's economy.

Mr Chalmers is also expected to raise the remaining Chinese trade bans on Australian lobster and two red meat processors.

On the Chinese side, officials may ask Treasury's delegation for more details about foreign investment regulations which have impacted Chinese investment in Australia.

"In the face of dramatic environmental, technological, and geopolitical transformation, it is more important than ever that we continue cooperating and collaborating," Mr Chalmers said in his opening remarks to the strategic dialogue.

"Because it's only by working together that we will successfully manage all this churn and change in a way that sets up another generation of prosperity for our people.

"As our largest trading partner, we have a deep interest in China's continued and stable economic growth and a deep interest in finding ways to continue cooperating where we can."

Ahead of the meeting, the treasurer said he had met with business leaders, including executives from Rio Tinto, Wesfarmers, BHP, Woodside, Fortescue, GrainCorp and the Business Council of Australia.

Chairman Zheng made similar comments, pointing to the warming relations between the two countries.

"It is also a resumption of the SED between the NDRC and the Australian Treasury, after a seven-year hiatus at a time when the international situation is intricate and turbulent, when the world economy is at a crucial juncture," he said in his opening remarks.

"It is of great significance for both countries … to discuss economic development and cooperation opportunities together.

"Our development represents opportunities, rather than challenges, with each other."

Stimulus could boost Australian opportunitiesIt is an opportune time for the treasurer to be in China talking economics.

Earlier this week, the People's Bank of China announced a raft of stimulus measures, including cutting mortgage rates, and a Cadillac of funds to help prop up the stock market.

Meanwhile, just hours before the dialogue, China's politburo — comprising the country's top officials, including President Xi Jinping — called for more fiscal spending and measures to arrest the property market crisis.

"I look forward to hearing more about efforts to boost growth in the Chinese economy," Mr Chalmers said.

"Australia recognises that a big part of seizing opportunities in the defining decade ahead is about collaborating with our partners, including China."

Also in the meeting was Australia's ambassador to China, Scott Dewar, as well as AusTrade's general manager for China, Hong Kong and Taiwan, Dominic Trindade.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

- By Gus Leonisky at 27 Sep 2024 - 7:14am

- Gus Leonisky's blog

- Login or register to post comments

less corn....

https://www.youtube.com/watch?v=sFb-KcPCs3k

China Cut U.S Corn Imports and Sell U.S Debt While Stockpiling Gold – What’s Next?In this compelling analysis, we explore the evolving dynamics of US-China trade relations, focusing on the significant implications of agricultural exports, particularly corn. As the US threatens to "decouple" from China, Beijing is not standing still; it has begun to implement countermeasures that affect both technology and agricultural sectors. The reliance of the US on Chinese markets for its agricultural exports, especially corn and soybeans, is increasingly jeopardized. We delve into the effects of tariffs, trade wars, and policy shifts, highlighting how these factors have reshaped the corn trade landscape.

We discuss the historical context of the US-China trade war, the impact of changing market shares, and China's efforts to boost domestic corn production to reduce import dependency. Amidst these trade tensions, we also examine the broader economic implications for the US, including rising inflation, interest rate cuts, and the shifting landscape of global currency reliance. With gold emerging as a potential alternative to the dollar, we analyze the recent surge in gold prices and the strategies of central banks, particularly China's increased gold reserves.

This video offers a deep dive into how the intricate relationship between corn trade and broader economic policies reflects the shifting power dynamics in global trade, challenging the dominance of the US dollar and marking a significant turning point in US-China relations.

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

SEE ALSO: https://www.youtube.com/watch?v=PU_8nm7uYvM