Search

Recent comments

- abusing kids.....

59 min 43 sec ago - brainwashed tim....

5 hours 19 min ago - embezzlers.....

5 hours 25 min ago - epstein connect....

5 hours 37 min ago - 腐敗....

5 hours 56 min ago - multicultural....

6 hours 2 min ago - figurehead....

9 hours 10 min ago - jewish blood....

10 hours 9 min ago - tickled royals....

10 hours 17 min ago - cow bells....

1 day 9 min ago

Democracy Links

Member's Off-site Blogs

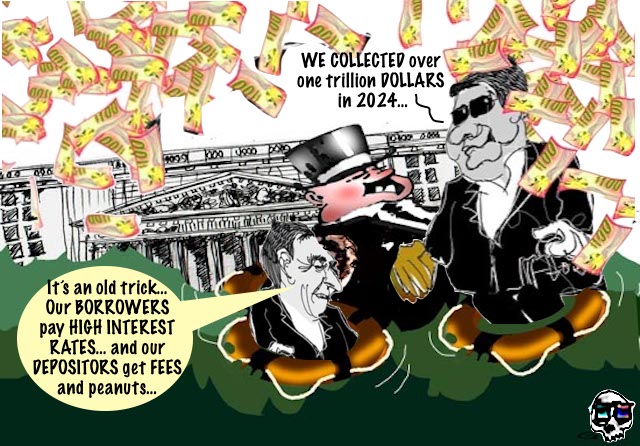

depositors pay for their own misery... the banks cash in........

$1 TRILLION DEAL: Big US Banks Enjoy Billions in Profit as Depositors Are Taken Advantage Of

https://www.youtube.com/watch?v=exyk98RI0RE

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

- By Gus Leonisky at 14 Oct 2024 - 5:22am

- Gus Leonisky's blog

- Login or register to post comments

risks....

https://www.youtube.com/watch?v=-NJw5TbTp6c

$14.5 Trillion Geopolitical Risk: Exposing Key Breaking Points as Chances of Global Conflict RiseREAD FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

financial war....

The US elections: an internal war against financial capitalism

BY Alessandro VOLPI

In the US presidential election, the challenge between Harris-Walz and Trump-Vance should rather be defined as a clash between the financial capitalism of the "Big Three" and those who want to weaken its monopoly. Without bothering with the "left" - "right" opposition.

After the announcement of Joe Biden's withdrawal from the presidential race, a permanent conflict within financial capitalism in the US has become increasingly clear. I will try to summarize it and perhaps even simplify it. After the choice of Vance as vice president, after Musk's positions, the ranks of Trump supporters - and financiers - are growing. Issues that refer to a capitalism that is trying to stem the overwhelming power of the Big Three, that is to say the superfunds, Vanguard, Black Rock and State Street, now resolutely linked to the Democrats. Biden and Kamala Harris have had and still have personalities from Black Rock in their team. A character like Jamie Dimon, CEO of J.P. Morgan, the superfund bank, whitewashed by Trump, has long been a candidate for the Democrats. The Fed chairman, with the support of Yellen, has supported the strategies of these same superfunds, by buying their ETFs [Exchange Traded Funds, listed investment funds that follow the performance of an index: editor's note].

The Trumpian rope team against the "Democratic" financial oligopolies.

Faced with this symbiosis, a rope team of figures has emerged, as has been said, who want to use the political power of the Trump presidency to combat or limit precisely the overwhelming power of the Big Three. In this sequence appear some large speculative funds, like that of John Paulson, worried about the progressive marginalization of a "market" standardized by superfunds, some oil companies not directly linked to the energy giants in the hands of the Big Three, like Timothy Dunn and Harold Hamm of Continental Resources, but also long-time billionaires like the Mellons, annoyed by Fink's excessive power, and people like Bernie Marcus, the founder of Home Depot, a behemoth of 500,000 employees, hostile to the fabless model of the big technology companies that he sees emerging in his creation, sold to Vanguard, Black Rock and State Street. Among Trump's capitalists, we also find casino owners, like Steve Wynn and Phil Ruffin, frightened by the advance of the big funds even in their sectors, and typically Trumpian characters like Linda McMahon, founder with her husband of World Wrestling Entertainment. In short, the possibility of Trump's success has triggered a brutal shock within American capitalism, destined to change its internal balance and weaken it.

Now, if we go through the list of Kamala Harris’s donors, we find many representatives of finance linked, in various capacities, to large funds. Indeed, the names of Reid Hoffman, creator of LinkedIn, sold in 2016 to Microsoft for 26 billion dollars and, since then, member of the board of directors of Microsoft itself, of which, as we know, Vanguard, Black Rock and State Street hold more than 20%. Hoffman himself, today, has a significant stake in Airbnb, where the Big Three are major shareholders. Alongside Hoffman, we find Roger Altman, long-time Democratic financier, associated with Carter and Clinton in very delicate roles, who worked for Lehman and Blackstone, and who is today director of the bank Evercore, of which Vanguard holds 9.46%, Black Rock 8.6 and State Street 2.6. Next come Reed Hastings, chairman of Netflix, of which Vanguard holds 8.5%, Black Rock 5.7% and State Street 3.8%, Brad Karp, longtime legal adviser to Jp Morgan, Ray McGuire, chairman of Lazard Inc, of which Vanguard is the largest shareholder with 9.5%, followed by Black Rock with 8.5%, Marc Lasry, CEO of Avenue Capital Group, the hedge fund close to the Big Three, and Frank Baker, owner of a private equity firm. Kamala Harris’ donors also include several members of the Soros family and several key players in major American consulting firms such as Jon Henes and Ellen Goldsmith-Vein. In short, the new potential candidate has gathered a vast cordon of donors who see in Trumpian finance a danger to the "soothing" monopoly carefully cultivated by the super funds, central shareholders of the main companies in the S&P 500 index: one could thus imagine a line-up that intends to defend the main players in global asset management and the shareholders of the giants in the name of protecting savers against the shocks generated by a Republican victory. With, however, signs of "cross" conditioning.

Kamala's "short rope"

Kamala Harris ran in North Carolina to present her program aimed at defending the middle class, identified as those whose income does not exceed $400,000 per year, by committing to supporting private social housing, and by indicating a strategy to curb price speculation. In short, a very generic program, which the Democratic candidate described as an opportunity economy. However, the reference to the desire to hamper price speculation has frightened the Big Three, who, as noted, invested in the Democrats to avoid the "other capitalism" domiciled in the Trump clan. Thus, the New York Post published, shortly after mid-August, a blatant headline in which Mrs. Harris was called a communist, precisely because she wanted to control prices and increase federal spending. In this regard, it is worth noting that the "Post" is owned by News Corp, of which Rupert Murdoch and the Big Three are shareholders, the latter holding more than 20% of the capital. It seems clear that the super funds have been diligent in using a Trumpian vehicle to make Harris understand what he cannot do. In practice, he cannot make policy against the monopoly of speculation. In fact, some seem to think that Mr. Harris is a bit of a communist.

Interesting misunderstandings

In the August 21, 2024 issue of La Repubblica, Paolo Mastrolilli interviewed, with a certain complacency, Bernie Sanders, the “only socialist senator” of the United States. Mastrolilli’s complacency is explained by the fact that Sanders declared that he supported Harris with conviction, almost with adoration. Starting from the premise that Trump is a dangerous fascist, Sanders praised Biden, the most “progressive” president in modern US history, and urged people to vote for Harris so that she could continue her work. Of course, he added, Bernie will have to overcome the resistance of the 1% of the population made up of the super-rich who, he candidly said, “have never been so well off.” Perhaps because the last presidents have done everything to facilitate them? Sanders had written a book on the US economic system, attacking big business; he must have forgotten it when moving.

We are therefore indeed facing the internal shock of a capitalism that, on the one hand, builds its fortune on the financial monopoly understood as an instrument of risk reduction for citizens who have become financial subjects through their policies, and on the other hand, experiences the formation of a bloc intended to weaken this monopoly in the hope of not being excluded from the current bubble and which needs politics, starting with monetary policy, with decidedly more favorable rates, to count. Beyond the popular narratives, which are nevertheless fundamental, these elections conceal a fierce war between financial groups.

The Democrats' political-economic model has been, until now, very understandable. Jerome Powell, the chairman of the Federal Reserve, has announced several times that American interest rates would remain high. The Powell affair, in this sense, is very interesting. Collaborator of Nicholas Brady, Deputy Secretary of the Treasury under Bush, he joined the Carlyle group and created his own private investment bank, then joined the board of directors of the Federal Reserve, with Jeremy Stein, on the nomination of President Obama. Appointed by Trump in February 2018 to head the Federal Reserve, replacing Janet Yellen, considered too close to the Democrats, he was confirmed by Biden, whose line of fighting inflation through a restrictive monetary policy he adopted during his presidency, which certainly favored the large holders of administered savings - the Big Three, in fact - withdrawing liquidity from the markets and contributing, at the same time, to slowing down the dollarization pursued by Biden himself to finance his enormous federal spending, built on debt.

High rates and geopolitics

It is clear that the United States wants to continue to drain savings from around the world to finance its economy, but to pay such high rates to attract savers from around the world, it needs the dollar to be the only global currency, accepted both in financial and geopolitical terms. With this in mind, Joe Biden preferred the path of increasing federal spending to finance the recovery of a productive economy in the United States, made possible by the strength of the dollar, to a competitive dynamic facilitated by lower interest rates. This is also why at the NATO summit in June 2024, the entry of Ukraine was proclaimed, with the immediate support of a Europe very satisfied with its Atlanticism, which imposes the dollar with which the United States finances its economy to the detriment of the European economy. If the United States flexes its muscles and the European "allies" fall into line, the greenback will remain the only currency in the West and the American economy will be able to start producing again, and not just paper. Meanwhile, the rating agencies, owned by major funds, have downgraded the debt of "socialist" France because prevention is better than cure. NATO, rating agency reports and an aggressive foreign policy are the three cornerstones of the democratic "model" that cannot accept any form of isolationism and must pursue global military supremacy, according to Harris' own statements.

Trump's hostility towards NATO, on the other hand, is a sign of tangible political opposition to the Democratic project and expresses the idea that the military alliance cannot be used for economic and monetary purposes, for which other strategies are necessary. The Republican candidate at the Nashville "Miners" conference declared himself in favor of bitcoin and cryptocurrencies, announcing the creation of an ad hoc strategic reserve and a presidential council on the subject. He argued, modifying his old positions, that cryptocurrencies can represent an asset for the American economy, capable of protecting the dollar itself from the risks of international disinterest. Trump does not appreciate the Federal Reserve's high interest rate policy, which generates a dollar that is too strong for the exports of star and striped companies, burdened precisely by the cost of credit, and which risks limiting the spread of the greenback, because it is excessively expensive for its users, especially emerging countries. Trump, cryptocurrencies and the project of a new US monetary centrality

In this perspective, bitcoin and cryptocurrencies become not only an object on which to build speculative operations, perhaps carried out by hedge funds close to Trump himself, but also the means to define a new monetary instrumentation, "ideologically" more popular and anti-state, capable of maintaining monetary centrality by moving it to the digital plane. In this sense, Trump wants to "Americanize" crypto and, consistent with this attitude, he has made it known that he will not put back into circulation the cryptocurrencies seized by the federal authorities, almost 9 billion dollars, in order to constitute the aforementioned strategic reserve and avoid shocks to the approximately 50 million Americans in possession of cryptocurrencies. Above all, he has declared that he will replace the leaders of the SEC, the stock market supervisory authority, starting with Gary Genser, who has always been hostile to this type of payment instrument. Trump himself has also mentioned the possibility of logistically linking energy-intensive AI factories with Miners, in order to optimize the exploitation of otherwise dispersed energy peaks, to aim for global leadership in artificial intelligence and mining. In the same vein, he indicated that government purchases of bitcoins should reach 4 or 5% of the total available volume. The strategy of stablecoins with stable value cryptocurrencies goes in the same direction: companies that issue dollar-linked stablecoins must buy the equivalent in government bonds of the. Thus, by replacing the eurodollar circuit with that of stablecoins, the United States would in fact regain control of the monstrous dollar money supply scattered around the world and today mainly controlled by the City.

Such a clear-cut position can be read as yet another polemic of wild capitalism against the Big Three, which use bitcoins to create ETFs but have always shown great distrust of the entire crypto landscape because bitcoin and cryptocurrencies would reduce the monopoly on liquidity held by the Big Three themselves through managed savings. Multiplying payment instruments favors those who are outside the monopoly on liquidity and opens up a free space, including in speculative terms, outside the choices of Vanguard, Black Rock, State Street and their armed wing J.-P. Morgan. The position taken in Nashville was therefore, once again, aimed at building a consensus towards the Republican candidate on the part of this large part of Americans who did not recognize themselves in the "democratic" model of the large funds, which were able to reduce risk thanks to their monopoly status and were thus able to guarantee millions of Americans health and social protection policies not covered by the State. Cryptocurrencies are a piece of the libertarian paradigm and the "competitive" spirit of capitalism that Trump wants to decline in a patriotic sauce against the Wall Street of the elites, according to candidate Vance. It is likely, in view of these elements, that in addition to Gary Genser, Trump, in the event of victory, would also get rid of Jerome Powell, precisely because of his high-rate policy, currently fueled by a huge amount of short-term emissions, designed to keep long-term rates high without depreciating securities. Trump's victory would be a real financial earthquake on the institutional side that would force the "masters of the world" to accommodate politics, perhaps by modifying the upper structure of financial capital; a "reshuffle" necessary to define the tensions with the Chinese communist economy, currently totally irreconcilable with the democratic-Big Three ensemble.

Progressivism is not synonymous with "left".

Almost the entire Italian press, including Il Manifesto, celebrated Tim Walz’s vice-presidential candidacy as a “left” choice. This is a decidedly far-fetched definition for a figure who, in terms of economic and financial policy, largely aligns himself with Harris. It is no coincidence that, to support this definition, the local media cited Trump’s statements and the support of an increasingly confused Sanders. The real problem is that for the Italian press, “left” is a narrow synonym for “progressivism”; a category that combines broad openings on rights and freedoms with a deeply rooted capitalist faith. Therefore, Harris-Walz vs Trump-Vance should be defined in terms of a clash between capitalisms, without bothering with the term “left” and without having to mention Dick Cheney’s support for Harris, who has even declared himself in favor of hydraulic fracturing.

October 5, 2024

https://www.legrandsoir.info/les-elections-americaines-une-guerre-interne-contre-le-capitalisme-financier.html

TRANSLATION BY JULES LETAMBOUR.

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

"democratically" robbing you....

By Jonathan Cook

Jonathan-Cook.net

Chris Hedges hosts a very interesting discussion with Guardian columnist George Monbiot on his new book about capitalism and its modern incarnation, neoliberalism. Monbiot rightly sees capitalism as a supremely “coercive, destructive and exploitative mode of economic organisation.”

Neoliberalism, observes Monbiot, emerged as capitalism’s response to its biggest challenge: democracy.

After centuries of struggle, Western publics managed to win the vote. The capitalist ruling class faced a major problem. The public sought to use its newfound political power to secure other rights, such as labour protections. Workers organised into trade unions to demand a bigger share of the value of the commodities they created. These new voters also wanted a better quality of life, including weekends off and proper housing, and an environment free of industrial pollutants that were (and still are) contaminating the air they breathed, the food they ate, and the water they drank.

Those rights inherently threatened the maximisation of profit — the goal of capitalism.

Neoliberalism offered a solution. It sought to make capitalism invisible to the public by reframing it as the “natural order.” Like gravity, it came to be treated as “just something that was there, not something that was invented by people,” as Monbiot aptly puts it.

“Wealth creators” — the billionaires leeching off the common good — were recast as secular gods. Any interference in the so-called “free market” — in fact, a market not free at all, but carefully rigged to benefit a tiny, monopolistic wealth elite — was considered sacrilegious.

A network of think-tanks, secretly funded by the billionaires, was established to manufacture a consensus about capitalism’s immutability and benevolence — a message that was enthusiastically amplified by the billionaire-owned media.

Central to the confidence trick at the heart of neoliberalism was the suggestion that any dissent, any limit placed on the rapacious greed of the capitalist class, would inexorably lead to totalitarianism, to Stalinism.

Capitalism became synonymous with freedom, innovation and self-expression. To question capitalism was an attack on freedom itself. This idea lay at the heart of the relentless assault on the labour movement that shifted up several gears during the Thatcher-Reagan years of the 1980s. Trade unions were presented as a threat to the smooth working of the economy, to growth and to “freedom.”

This was also around the time the Trilateral Commission was founded by a group of senior Washington policy officials, keen to address a problem they defined as an “excess of democracy.” It is worth noting that the current British Prime Minister, Sir Keir Starmer, secretly joined the Trilateral Commission around 2017, while he was serving in the Labour shadow cabinet. He was one of only two MPs — out of 650 — to be invited to become a member in that period.

Starmer personifies the way neoliberalism has made parliamentary politics irrelevant. British voters, like U.S. ones, now have a choice between two hardcore wings of capitalism. Margaret Thatcher’s TINA slogan — “There Is No Alternative” — has finally borne fruit.

In practice, we are all neoliberals today. Any other way of organising society than the one we have — which depends on runaway consumption, requiring unsustainable, slash-and-burn economic growth — has become impossible for most people to imagine.

On all of this, Monbiot’s argument is strong and clear.

But I have an urgent question for this critic of capitalism: Is the Guardian Media Group Monbiot works for a capitalist news organisation or not?

Monbiot has always defended his paper as exceptional: the one supposedly “nice” corporate outlet. He has decried all other media as unequivocally as he does capitalism. But he insists The Guardian is different. How?

If he’s right about capitalism, and I think he is, then it is difficult to understand how he has not reached the conclusion that The Guardian too is a product of capitalism’s coercive, destructive, exploitative mode of economic organisation.

The Guardian depends on corporate advertising. In other words, it has to keep its advertisers happy — that is, advertisers embedded in, and enriched by, the capitalist system.

The Guardian is owned and run by a corporation, the Guardian Media Group, that is tied into a complex of other corporations with economic interests entirely dependent on the success of a capitalist system driven by consumption and profit. (Some gullible people still mistakenly believe the paper is owned by some charity-like trust rather than a limited company.)

That The Guardian is deeply rooted in the West’s capitalist system makes sense of why it took such a central role in trashing and smearing Jeremy Corbyn, the only leader of a major British party in living memory to seek to challenge the neoliberal status quo.

It makes sense of why the paper so visibly helped to destroy Julian Assange, the founder of WikiLeakswho exposed the West’s war and resource-grabbing industries like no one before him. He did so by bringing into the light of day classified official documents that proved the ruling class’s crimes.

It makes sense of why The Guardian has been so unconscionably feeble in giving any kind of voice to the millions of Britons, many on the left it supposedly represents, who are shocked and appalled by Israel’s genocide of the people of Gaza, and the utter complicity of the British and U.S. governments.

It makes sense of why The Guardian has been a cheerleader for an entirely avoidable war in Ukraine triggered by NATO’s decades-long expansion ever closer to Russia’s border with Ukraine over Moscow’s protests. It was a move that Western experts long ago warned would signal to Russia that the West was seeking confrontation, would erode the Kremlin’s confidence that the principle of nuclear deterrence could be maintained, and was bound ultimately to provoke an equally violent reaction.

It makes sense of why The Guardian has been paying lip service to concerns about a looming climate catastrophe while actively stoking the very consumer habits and expectations that make reducing CO2 levels impossible.

And finally it makes sense of why The Guardian works so very hard to fashion itself as a uniquely leftwing and progressive publication. In doing so, The Guardian has become capitalism’s handmaiden-in-chief.

When a genuinely leftwing party leader emerges, as Corbyn did, The Guardian can maul him or her from the left much more effectively than papers such as The Daily Telegraph and The Daily Mail can from the right. The bipartisan assault on Corbyn proved far more convincing and credible than if it had been carried out solely by the rightwing press.

Similarly with wars. If The Guardian backs the latest war — as it invariably does – then these wars must be a good thing because the left and right agree. The rightwing press can sell war to its readers on the basis of “terror threats” and a “clash of civilisations,” while The Guardian can sell it to readers on the basis of “humanitarianism” or the need to topple the latest “new Hitler.”

The capitalist system needs a media corporation like The Guardian if only to stop a genuinely independent, genuinely anti-capitalist, genuinely anti-war outlet from ever gaining a foothold in the public space.

This is also why The Guardian has been so central in the effort to inflame fears about “populism” — of both the right and left varieties — and “fake news” on social media. It smears the progressive, anti-capitalist, anti-war left as dictator-appeasers, genocide-belitters and anti-Semites as enthusiastically as it denounces the white supremacy of the Trumpian right. It excels in this, its own specialised form of disinformation.

Which brings us back to Monbiot.

I have written many articles over the years criticising Monbiot. And every time I do so, I am inundated with comments that this is another example of the left eating the left, of sour grapes, of cheap point-scoring.

Which is to entirely miss the point.

This isn’t chiefly about Monbiot. It’s about his function in a capitalist economy — and how he contributes to The Guardian’s role of undermining an anti-capitalist, anti-war left. Monbiot doesn’t have to understand the function he plays to still play it. In fact, all the evidence is that he is entirely blind to his function.

It also highlights how we, the progressive left, are caught in a trap that the capitalist class has engineered for us. Monbiot’s book on neoliberalism, if his interview with Hedges is anything to go by, is doubtless excellent. And because it is excellent, it will win Monbiot more devotees, and more kudos on the left. Which will make him even more useful to The Guardian in proving its leftwing credentials.

Monbiot isn’t chiefly to blame for that. Our gullibility as readers, as critical thinkers, is.

Speaking the quiet part out loud, Joe Biden admitted many years ago that the United States would have had to invent Israel if it did not already exist.

What he meant was that Israel serves a function that benefits Washington elites: as a disguised U.S. aircraft carrier in the Middle East; as the lightning rod for protest as the West projects its violent power into the oil-rich region; as the catalyst for stoking ethnic and sectarian divisions that have prevented the consolidation of a secular Arab nationalism; as the Bible-citing colonial hegemon that has fomented an Islamic fundamentalism to mirror Israel’s Jewish-Zionist fundamentalism; and as an insurance policy, allowing U.S. politicians to smear domestic critics of its Middle East policy as anti-Semites.

Similarly, capitalism would need to invent a Guardian, if it did not already exist. And in turn, the Guardian would need to invent a Monbiot if he was not already one of its columnists.

The Guardian is critically important to neoliberalism’s efforts at maintaining the legitimacy of capitalism by making it invisible. It does so by suggesting capitalism’s righteousness is so uncontested that it enjoys universal political support. Meanwhile, The Guardian needs George Monbiot so that it can demonstrate to the left that all sides are being given a platform, that the free press really is free, that there is no need for any greater pluralism.

The fact that Monbiot has written a book critiquing capitalism and neoliberalism is another of the great paradoxes of the system. But sadly, it is one that The Guardian, and capitalism, can not only accommodate but weaponise against the left.

If this is difficult to accept, consider the climate catastrophe. The Guardian is probably the most outspoken corporate media outlet on this topic — though, admittedly, that is a very low bar indeed. Many readers are absolutely committed to supporting The Guardian financially each month because of its coverage of a climate crisis already upon us. And yet the Guardian Media Group is embedded in a system of consumption promotion — of flights to paradisal destinations, and of luxury cars — that is fuelling the very climate disaster The Guardian is supposedly sounding the alarm against.

In other words, it is propagandising for the very consumption model that it is also warning us is destroying our planet. It works because human beings have a very large capacity for cognitive dissonance, for accommodating two contradictory thoughts at the same time. It is precisely why propaganda is so successful, and why we make such poor critical thinkers unless we exercise this faculty like an additional muscle.

Monbiot is as much a victim of this human tendency towards cognitive dissonance as anyone else. In fact, he appears supremely vulnerable to it.

As I have noted in a previous article, Monbiot has been a consistently outspoken champion of the West’s endless wars, apparently oblivious to the fact that they are integral to capitalism’s efforts to rationalise vacuuming up huge sums of money to enrich the wealth elite through the war industries rather than looking after the public, and that these wars come at an incalculable cost to the environment, as the destruction of Gaza and now Lebanon should underscore.

As I wrote two years ago:

“Monbiot holds as a cherished piety what should be two entirely inconsistent positions: that British and Western elites are pillaging the planet for corporate gain, immune to the catastrophe they are wreaking on the environment and oblivious to the lives they are destroying at home and abroad; and that these same elites are fighting good, humanitarian wars to protect the interests of poor and oppressed peoples overseas, from Syria and Libya to Ukraine, peoples who coincidentally just happen to live in areas of geostrategic significance.

Because of the vice-like corporate hold on Britain’s political priorities, Monbiot avers, nothing the corporate media tells us should be believed – except when those priorities relate to protecting peoples facing down ruthless foreign dictators, from Syria’s Bashar al-Assad to Russia’s Vladimir Putin. Then the media should be believed absolutely.”

But worse, Monbiot isn’t just gullible. He has been the corporate media’s most effective attack dog on the anti-war left.

He has expended a great deal of his time and energies on policing the left’s discourse and smearing its most long-standing figureheads, from Noam Chomsky to the late John Pilger. He has tarred both as “genocide belittlers” in at least two columns for questioning what the West’s “humanitarian wars” are really about. And he did so while he was also claiming to be too busy to make the time to write a column about Assange’s years-long torture and show trial for doing journalism about the West’s war crimes.

The West’s latest “humanitarian war”— Israel supposedly “defending itself” through genocide against the Palestinian people it has been belligerently occupying for decades and whose lands it has stolen — has been an especially hard sell for the corporate media. But it is precisely where we were bound to end up by ignoring – or worse invalidating – the voices of figures like Chomsky and Pilger who were trying to show us the bigger picture of what these wars were really about.

And Monbiot served precisely that role at The Guardian of invalidating them.

Read his new book on capitalism if you need to. Absorb its lessons. But remember, the biggest one is this: Monbiot can be right about the wickedness of capitalism while himself being thoroughly complicit in its wickedness.

Jonathan Cook is an award-winning British journalist. He was based in Nazareth, Israel, for 20 years. He returned to the U.K. in 2021.He is the author of three books on the Israel-Palestine conflict: Blood and Religion: The Unmasking of the Jewish State (2006), Israel and the Clash of Civilisations: Iraq, Iran and the Plan to Remake the Middle East (2008) and Disappearing Palestine: Israel’s Experiments in Human Despair (2008). If you appreciate his articles, please consider offering your financial support.

https://consortiumnews.com/2024/10/18/capitalisms-in-house-critic-hedges-monbiot-interview/

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.