Search

Recent comments

- journalism....

5 hours 34 min ago - day three.....

6 hours 18 min ago - lawful law?....

6 hours 38 min ago - insurance....

6 hours 45 min ago - terrorists....

6 hours 56 min ago - nukes?...

9 hours 4 min ago - rape....

9 hours 42 min ago - devastation.....

11 hours 54 min ago - bibi's dream....

13 hours 43 min ago - thus war....

17 hours 55 min ago

Democracy Links

Member's Off-site Blogs

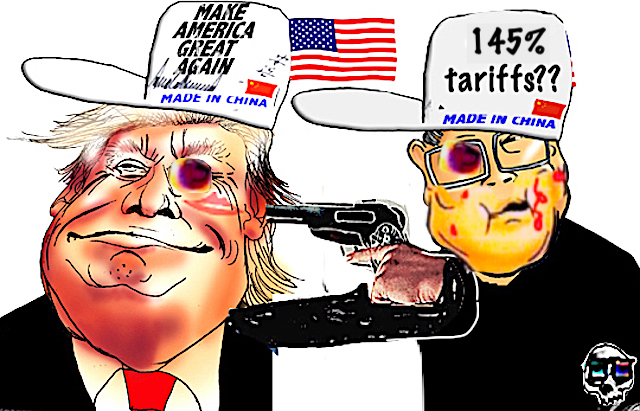

he knows how to play this game.......

MOSCOW (Sputnik) On April 2, Trump signed an executive order introducing "reciprocal" tariffs on imports from other countries. The baseline rate was set at 10%, while dozens of countries were hit with higher rates. The duties on most countries were reversed to 10% days later to allow for trade negotiations, while those on China were hiked to 145%.

The United States and China have started "soft" communications on tariffs and other trade issues through intermediaries, US Commerce Secretary Howard Lutnick said on Sunday.

"I think we have had soft — the way I would say this is soft entrees, you know, through intermediaries," Lutnick told ABC News when asked about whether Washington and China had recently had any contacts regarding their trade relations.

The US commerce secretary added that he was confident that US President Donald Trump and Chinese President Xi Jinping would be able to "work out" the differences and find a solution.

"Donald Trump has the ball ... He knows how to play this game. He knows how to deal with President Xi," Lutnick said.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

Trump administration to exempt smartphones and computers from tariffs

Announcement says tariffs – including those imposed on China – will also not apply to other electronic devices

SEE ALSO:

incoming financial bloodbath...- By Gus Leonisky at 14 Apr 2025 - 1:49pm

- Gus Leonisky's blog

- Login or register to post comments

privileges.....

Are Donald Trump's tariffs destroying America's 'exorbitant privilege'?

By business reporter Gareth Hutchens

These words were written 14 years ago:

"Serious economic and financial mismanagement by the United States is the one thing that could precipitate flight from the dollar.

"And serious mismanagement, recent events remind us, is not something that can be ruled out.

"We may yet suffer a dollar crash, but only if we bring it on ourselves. The Chinese are not going to do it to us."

Barry Eichengreen, professor of economics at the University of California, Berkeley, published that passage in the wake of the 2007-09 financial crisis.

And they came to mind last week when Martin Whetton, the head of Westpac's financial markets strategy, made a startling observation about the current chaos in our global economy.

Mr Whetton said it was "staggering" to witness on Wednesday last week, in the market dysfunction triggered by Donald Trump's tariffs, how traders had stopped treating the United States as a financial safe haven.

He said he'd never seen anything like it.

He said it signalled the end of US exceptionalism and "exorbitant privilege."

"The US has enjoyed the prime position in global finance since the end of WW2, cemented with Bretton Woods a generation ago," he said.

"Giving [up] that hegemony, that authority, that liquidity and reserve status … perhaps not willingly, but flippantly and without due consideration, is not something you just 'get back'."

When he shared his thoughts on the extraordinary situation, in a note on Thursday, he gave his note a tombstone inscription: "Exorbitant privilege: 1946-2025."

It emphasised the point he was making.

And his note quickly circulated through Australia's community of market analysts and economists, with many people agreeing with him.

What is exorbitant privilege?While analysts debate Mr Whetton's argument, it's worth understanding what he meant by "exorbitant privilege."

Given everything that's happening in Trump's America, it may help to explain some of the trading behaviour we'll see in financial markets in coming years.

Professor Eichengreen explained the concept in his 2011 book, "Exorbitant Privilege: The rise and fall of the dollar and the future of the international monetary system."

It's where the quotes at the top of this piece come from.

The phrase "exorbitant privilege" was coined in the 1960s by Valéry Giscard d'Estaing (then French minister of finance), to refer to the financial privileges the US has enjoyed in the post-World War II era, due to its currency being the international reserve currency.

How did the US currency become the world's reserve currency?

In the aftermath of World War II, a new international monetary system was created.

Under the new system, dozens of countries agreed to peg their currencies to the US dollar (directly or indirectly), while the US dollar was pegged to the price of gold.

It was designed that way to replace the old rigid gold standard, which had disintegrated in the Depression, with a more flexible system.

"In practice, however, the system afforded the greatest flexibility to the United States, which enjoyed substantial freedom to pursue its domestic policy objectives as well as the ability to run sustained balance-of-payments deficits," Ben Bernanke, a former US Federal Reserve chair, has pointed out.

That's the gist of it.

What kind of privileges are there?Now, as Eichengreen explains, with the US economy sitting at the centre of the global system in the post-war period, the US dollar became the most important currency for invoicing and settling international transactions, including for imports and exports that never touched the shores of the United States.

He says it made sense to do things that way when the US economy accounted for more than half of the combined economic output of the so-called 'Great Powers' immediately after the war.

But that situation gave the US financial privileges.

"America being far and away the largest importer and main source of trade credit, it made sense for imports and exports to be denominated in dollars," he explains in his book.

"Since the United States was the leading source of foreign capital, it made sense that international financial business was transacted in dollars.

"And with these same considerations encouraging central banks to stabilise their currencies against the dollar, it made sense that they should hold dollars in reserve in case of a problem, in foreign exchange markets."

Under such a system, since there was so much demand for dollar-denominated assets, it meant the US could borrow at lower interest rates than other countries and pursue domestic and foreign policies with more freedom.

"This effect is substantial," Eichengreen wrote in his book.

"The interest rate that the United States must pay on its foreign liabilities is two to three percentage points less than the rate of return on its foreign investments.

"The US can run an external deficit in the amount of this difference, importing more than it exports and consuming more than it produces year after year without becoming more indebted to the rest of the world.

"Or it can scoop up foreign companies in that amount as the result of the dollar's singular status as the world's currency.

"This has long been a sore point for foreigners, who see themselves as supporting American living standards and subsidising American multinationals through the operation of this asymmetric financial system."

Are there more exorbitant privileges? Yes, there are.

According to Mr Eichengreen, another benefit for the US is the real resources other countries have to provide the United States to obtain US dollars.

"It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries have to pony up $100 of actual goods and services in order to obtain one," he wrote.

And there are others.

In the post-war period, traders have traditionally flocked to the US during periods of economic and financial crisis, and that has even happened when the crisis has been created by the US itself.

"In 2008, in the throes of the most serious financial crisis in 80 years, the [US] government was able to borrow vast sums at low interest rates because foreigners figured that the dollar was the safest currency to be in at a time of great turmoil," he wrote.

"And again in the spring of 2010, when financial volatility spiked, investors flew into the most liquid market, that for US treasury bonds, pushing down the cost of borrowing for the US government and, along with it, the mortgage interest rates to American households.

"This is what exorbitant privilege is all about," he said.

A world of multiple reserve currenciesThe post-war financial system has evolved significantly since the 1940s, and the US's economic dominance has weakened as countries such as China have risen.

There's a debate about how significant the US's exorbitant privilege is nowadays (which often highlights how the system has come with costs for the US too).

With the creation of the Euro, the US's reserve currency status has also had a small and imperfect competitor in recent decades (with ambitions to enjoy its own exorbitant privileges).

But Mr Whetton's point, that we saw something historic last week when traders uncharacteristically turned away from the US during a moment of extreme market dysfunction, is obviously worth noting.

What does it mean for the future?

In 2011, Mr Eichengreen argued we should all be preparing for a multi-polar world with multiple reserve currencies.

"Aside from the very peculiar second half of the twentieth century, there has always been more than one international currency," he wrote.

"There is no reason that a few years from now countries on China's border could not use the renminbi in their international transactions, while countries in Europe's neighbourhood use the euro, and countries doing business with the United States use the dollar."

Given last week's financial market dysfunction, has the world taken a substantial step towards that future?

https://www.abc.net.au/news/2025-04-13/trumps-tariffs-destroying-americas-exorbitant-privilege/105164676

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

chaotics.....

Billionaire investor Ray Dalio has warned that the United States is facing economic risks far greater than a typical recession, arguing that President Donald Trump’s aggressive tariff policies and ballooning debt could trigger a breakdown of the global financial system.

Speaking on NBC’s Meet the Press on Sunday, the founder of Bridgewater Associates said the world is at a critical juncture, marked by profound changes in the political, economic, and geopolitical order – factors which he says have historically led to severe crises.

“I think that right now we are at a decision-making point and very close to a recession,” Dalio said. “And I’m worried about something worse than a recession if this isn’t handled well.”

Dalio explained that the US economy is confronting several overlapping challenges: rising debt, internal political divisions, growing geopolitical tensions, and shifts in global power.

Such times are very much like the 1930s,” he warned. “If you take tariffs, if you take debt, if you take the rising power challenging the existing power – those changes in the orders, the systems, are very, very disruptive.”

Asked about the worst-case scenario, Dalio pointed to a potential breakdown of the dollar’s role as a store of wealth, combined with internal conflict beyond the norms of democratic politics and escalating international tensions – potentially even military conflict.

“That could be like the breakdown of the monetary system in ‘71. It could be like 2008. It’s going to be very severe,” Dalio said. “I think it could be more severe than those if these other matters simultaneously occur.”

READ MORE: Xi warns US will isolate itselfWhile acknowledging that tariffs could serve as a useful tool to bring back manufacturing and generate revenue, Dalio cautioned that the method of implementation matters deeply.

How that’s done – whether in a practical and stable way, with quality negotiations – or whether that’s done in a chaotic and disruptive way that produces great conflict, makes all the difference in the world,” he said.

Describing Trump’s recent tariff moves as “very disruptive,”Dalio said the real test will come after the current 90-day negotiation period ends. “What was put there is like throwing rocks into the production system,” he said, warning of “enormous” impacts on global efficiency and costs.

Goldman Sachs raised the odds of a US recession in the next 12 months to 45% last week, following Trump’s April 2 announcement of a minimum 10% tariff on all imports – but before he placed a three-month hold on further “reciprocal” duties of 11% to 50% targeting dozens of nations. China, however, was still hit with a 145% tariff hike – and retaliated with a 125% levy of its own.

https://www.rt.com/business/615718-ray-dalio-worse-recession/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

no parking....

The upheaval in stocks has been grabbing all the headlines, but there is a bigger problem looming in another corner of the financial markets that rarely gets headlines: Investors are dumping US government bonds.

Treasury bonds are essentially IOUs from the US government, and they’re how Washington pays its bills despite collecting less in revenue than it spends. Investors normally rush to them at any whiff of economic chaos – but now they are selling them, as not even the lure of higher interest payments on the bonds is luring buyers.

The freak development has experts worried that big banks, funds and traders are losing faith in America as a stable, predictable place to store their money.

“The fear is the US is losing its standing as the safe haven,” said George Cipolloni, a fund manager at Penn Mutual Asset Management. “Our bond market is the biggest and most stable in the world, but when you add instability, bad things can happen.”

That could be bad news for taxpayers paying interest on the ballooning US debt, consumers taking out mortgages or car loans – and for President Donald Trump, who had hoped his tariff pause earlier this week would restore confidence in the markets.

A week ago, the yield on the 10-year Treasury was 4.01%. On Friday, the yield shot as high as 4.58% before sliding back to around 4.50%. That’s a major swing for the bond market, which measures moves by the hundredths of a percentage point.

Among the possible knock-on effects is a big hit to ordinary Americans in the form of higher interest rates on mortgages, car financing and other loans.

“As yields move higher, you’ll see your borrowing rates move higher, too,” said Brian Rehling, head of fixed income strategy at Wells Fargo Investment Institute. "And every corporation uses these funding markets. If they get more expensive, they’re going to have to pass along those costs customers or cut costs by cutting jobs.”

To be sure, no one can say exactly what mix of factors is behind the developing bond bust or how long it will last, but it’s rattling Wall Streetnonetheless.

Bonds are supposed to move in the opposite direction as stocks, rising when stocks are falling. In this way, they act like shock absorbers to 401(k)s and other portfolios in stock market meltdowns, compensating somewhat for the losses.

“This is Econ 101,” said Jack McIntyre, portfolio manager for Brandywine Global, adding about the bond sell-off now, “It’s left people scratching their heads.”

The latest trigger for bond yields to go up was Friday's worse-than-expected reading on sentiment among US consumers, including expectations for much higher inflation ahead. But the unusual bond yield spike this week also reflects deeper worries as Trump’s tariffs threats and erratic policy moves have made America seem hostile and unstable — fears that are not likely to go away even after the tariff turmoil ends.

“When the issue is a broader loss of confidence in the United States, even a much fuller retreat on trade might not work” to bring yields down, wrote Sarah Bianchi and other analysts at investment bank Evercore ISI. “We’re not sure any of the tools remaining in Trump’s toolkit will be sufficient to fully staunch the bleeding.”

US Treasury Secretary Scott Bessent has said the yield spike is not unusual or worrisome, pinning the blame on professional investors who had borrowed too much and needed to sell.

“I think that it is an uncomfortable but normal deleveraging that's going on,” he told Fox News Thursday, adding that it “happens every couple of years.”

Speaking to reporters on Air Force One Friday night, Trump said "The bond market’s going good. It had a little moment, but I solved that problem very quickly. I’m very good at this.”

Trump acknowledged that the bond market played a role in his decision Wednesday to put a 90-day pause on many tariffs, saying investors “were getting a little queasy.”

If indeed it was the bond market, and not stocks, that made him change course, it wouldn't come as a surprise.

The bond market's reaction to her tax and budget policy was behind the ouster of United Kingdom’s Liz Truss in 2022, whose 49 days made her Britain’s shortest-serving prime minister. James Carville, adviser to former U.S. President Bill Clinton, also famously said he’d like to be reincarnated as the bond market because of how much power it wields.

The instinctual rush into US debt is so ingrained in investors it even happens when you’d least expect.

People poured money into US Treasury bonds during the 2009 financial crisis, for instance, even though the US was the source of the problem, specifically its housing market.

But to Wall Street pros it made sense: US Treasurys are liquid, stable in price and you can buy and sell them with ease even during a panic, so of course businesses and traders would rush into them to wait out the storm.

Yields on US bonds quickly fell during that crisis, which had a benefit beyond cushioning personal financial portfolios. It also lowered borrowing costs, which helped businesses and consumers recover.

This time that natural corrective isn’t kicking in.

Aside from sudden jitters about the US, several other things could be triggering the bond sell-off.

Some experts speculate that China, a vast holder of US government bonds, is dumping them in retaliation. But that seems unlikely since that would hurt the country, too. Selling Treasurys, or essentially exchanging US dollars for Chinese yuan, would make China's currency strengthen and its exportsmore expensive.

Another explanation is that a favored strategy of some hedge funds involving US debt and lots of borrowing — called the basis trade — is going against them. That means their lenders are asking to get repaid and they need to raise cash.

“They are selling Treasurys and that is pushing up yields — that’s part of it,” said Mike Arone, chief investment strategist at State Street Global Advisors. “But the other part is that US has become a less reliable global partner.”

Wells Fargo's Rehling said he’s worried about a hit to confidence in the US, too, but that it's way too early to be sure and that the sell-off may stop soon, anyway.

“If Treasurys are no longer the place to park your cash, where do you go?,” he said. “Is there another bond out there that is more liquid? I don’t think so.”

(FRANCE 24 with AP)

https://www.france24.com/en/business/20250412-investors-dump-us-government-bonds-faith-america-falters-tariffs-trump

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.