Search

Recent comments

- brainwashed tim....

3 hours 46 min ago - embezzlers.....

3 hours 53 min ago - epstein connect....

4 hours 4 min ago - 腐敗....

4 hours 23 min ago - multicultural....

4 hours 30 min ago - figurehead....

7 hours 38 min ago - jewish blood....

8 hours 37 min ago - tickled royals....

8 hours 44 min ago - cow bells....

22 hours 36 min ago - exiled....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

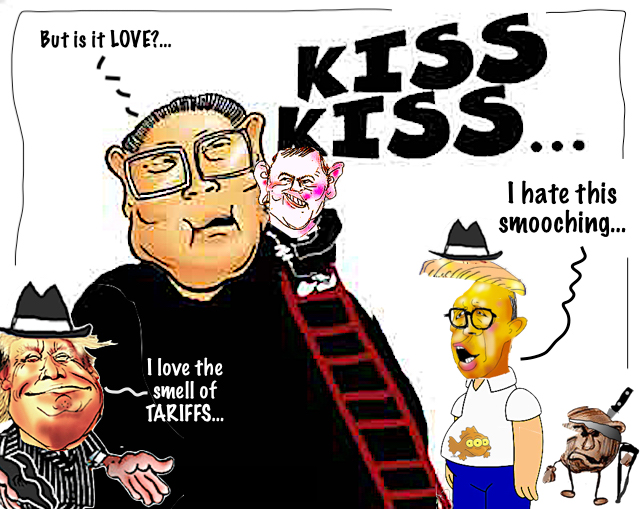

australia-china relations under international pressure and domestic scrutiny....

In the lead-up to the Australia election, new research examines the ALP and Coalition messaging and policy on the People’s Republic of China.

Framing the future: Australia’s China policy in the lead-up to the 2025 election

The report, from the Australia-China Relations Institute at the University of Technology Sydney, examines how these positions are evolving under increased international pressure and domestic scrutiny. The key findings of the report are:

- Labor and the Coalition both emphasise sovereignty and the national interest in their public messaging on the PRC, but diverge in tone and strategic emphasis. Labor leans towards stability and diplomatic management, while the Coalition projects strength through more explicit security framing.

- Labor has sought to present itself as a steady, non-ideological manager of the bilateral relationship, maintaining disciplined messaging and avoiding direct provocation. Its approach may face growing pressure amid global volatility.

- The Coalition has adopted a refined, but still hardline, stance with a tripartite messaging strategy. Opposition Leader Peter Dutton projects strength on national security while engaging constructively on trade and diaspora issues; shadow foreign and trade ministers adopt a pragmatic, moderate approach; and Defence and Home Affairs figures take a firm ideological line on PRC threats. Each portfolio group represents a messaging pillar, with the three pillars together forming a cohesive whole. Whether this balance could be maintained in government, under greater domestic and international scrutiny, remains uncertain.

- Across both parties, Australian-Chinese communities have become pivotal electoral constituencies, prompting sustained efforts at engagement and messaging sensitivity. This evolution reflects the growing recognition that domestic cohesion is inseparable from effective foreign policy.

- While bipartisanship remains the dominant feature of Canberra’s PRC policy, the contours of difference between Labor and the Coalition are becoming clearer. Much of this divergence reflects evolving global dynamics and an increasingly transactional international environment.

- Both parties support expanded trade with the PRC but differ in emphasis. Labor promotes risk-informed engagement grounded in commercial pragmatism while the Coalition frames trade through a more strategic and security-driven lens.

- However, critical minerals have been positioned as central to trade diplomacy for both parties. Labor has aligned more closely with the Coalition’s view that Australia’s resource wealth should be leveraged in alliance-building and strategic negotiations, particularly with Washington.

- Connected technologies like electric vehicles may be a growing fault line between the parties. Labor has thus far prioritised consumer access and affordability, backing PRC-made EVs, while monitoring for risks. The Coalition has taken a harder line – warning of data vulnerabilities and pushing for strict cybersecurity standards, signalling a likely regulatory shift should it win government.

- On the Port of Darwin and Comprehensive and Progressive Agreement for Trans-Pacific Partnership accession, positions converge but are framed differently. Both parties now support ending the PRC-linked lease of the port, with Labor emphasising resilience and domestic investment and the Coalition stressing national security. On the CPTPP, both endorse strict accession standards, but Labor prefers a process-driven approach while the Coalition has exhibited some willingness to frame the issue as values-based.

- Labor is likely to continue to publicly condemn PRC human rights abuses and cyber attacks but avoid unilateral Magnitsky-style sanctions in favour of multilateral diplomacy. The Coalition advocates a firmer approach, including targeted sanctions as a tool of cyber deterrence and values-based policy.

- Foreign interference will remain a national security priority, but approaches are likely to diverge. Labor is likely to maintain a restrained, risk-managed model; the Coalition would take a more interventionist route. While Labor has expanded Australia’s counter-interference toolkit, it has adopted a broadly country-agnostic approach. The Coalition has called for more direct attribution and stronger enforcement. A key priority for the Coalition is the restoration of the Department of Home Affairs to its “rightful place as the pre-eminent domestic national security policy and operations portfolio”. It has also proposed structural reforms, including annual reporting by the Office of National Intelligence and reform of the Foreign Influence Transparency Scheme.

- Both parties support the one China policy and oppose unilateral change to the status quo, but differ in emphasis. Labor maintains strategic ambiguity and prioritises multilateral deterrence, while the Coalition signals closer alignment with US deterrence efforts. AUKUS deepens Australia’s integration with US planning, potentially narrowing future flexibility in any military escalation involving Taiwan.

- Whichever party wins the 2025 election, it will confront a foreign policy landscape defined by intensifying strategic competition and heightened expectations for decisive leadership.

Read the full text of the report below:

Framing the future: Australia's China policy in the lead-up to the 2025 election

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 29 Apr 2025 - 7:22am

- Gus Leonisky's blog

- Login or register to post comments

cheap ships....

The Chinese stranglehold Donald Trump is desperate to break

By Szu Ping Chan

Donald Trump is lamenting the loss of American shipbuilding.

“We used to build a ship a day, and now we don’t build a ship a year practically,” the US president said this month before signing an executive order to restore “America’s maritime dominance”.

Shipbuilding in the US peaked during World War II and has been falling since.

The number of commercial vessels in the pipeline has fallen to fewer than five a year, a remarkable decline when America was churning out 70 ships per year in 1975.

By comparison, China builds roughly 1700 ships a year, while South Korea builds 700 and Japan 500. Together, these three countries account for 90 per cent of the global market.

Trump believes this Eastern dominance of shipbuilding reduces competition and raises the risk of espionage while also creating a dependency on China and lining Beijing’s pockets.

“The commercial shipbuilding capacity and maritime workforce of the US has been weakened by decades of government neglect, leading to the decline of a once-strong industrial base while simultaneously empowering our adversaries and eroding United States national security,” Trump’s executive order warns.

While shipbuilding may be a source of national pride, it also has real-world consequences for trade.

While the US exports vast amounts of energy overseas – it ships millions of tonnes of liquefied natural gas (LNG) around the world each month – none of the ships used to transport the gas were built in America, and none are currently on order.

No containers used to move commodities around the world are built by the US. Similarly, none of the ship-to-shore cranes used to load and unload containers are manufactured at home, compared with 80 per cent in China.

In addition, the White House warned that Chinese state-owned software is increasingly being installed in port operations across the US “with limited to no alternatives”.

China has overtaken the US to operate the world’s largest maritime fighting force, operating 234 warships to the US Navy’s 220.

It’s not just Trump who has concerns. The White House is continuing an investigation initiated by the Biden administration in what seems like a rare bipartisan issue over the risks posed to American security.

The Centre for Strategic and International Studies (CSIS), a Washington, DC-based think tank, has warned that foreign companies were effectively funding China’s navy expansion.

Last month it warned that China’s highly efficient “dual-use” facilities were able to churn out commercial vessels paid for by Western companies alongside their battle fleet – increasing China’s military prowess.

Now, China has overtaken the US to operate the world’s largest maritime fighting force, with 234 warships to the US Navy’s 220. That poses an imminent risk for America’s ability to counter China in the military stakes.

“The erosion of US and allied shipbuilding capabilities poses an urgent threat to military readiness, reduces economic opportunities and contributes to China’s global power-projection ambitions,” the CSIS warned.

Trump had proposed drastic action, including charging Chinese ships up to $US1.5 million ($2.4 million) per port call, or $US1000 per net tonne of the vessel’s capacity. He also wanted the share of US goods transported on American ships to rise from below 1 per cent today to 15 per cent over seven years.

Lars Robert Pedersen, from the Baltic and International Maritime Council (BIMCO), one of the world’s largest international shipping associations, says if the administration instead decided to charge by the tonne, it would end up costing mega-ships $US100 million per port call.

A backlash from the global maritime industry led the Trump administration to drastically water down proposals.

From October, Chinese-built and owned ships will only be charged $US50 per net tonne, or $US120 for each container discharged, whichever is higher. These amounts will increase over the next three years, but are still a far cry from the $US1000 per tonne originally proposed.

Chinese-built ships bearing a different flag will be charged $US18 per tonne, with annual fee increases of $US5 over the same period.

The administration also exempted ships that only move between domestic ports, Caribbean islands and US territories. LNG exports will also move towards being carried by US ships, but on a very long timeline. Just 1 per cent of exports will be required on US-built, operated and flagged vessels within four years.

Despite the climbdown, Jamieson Greer, the US trade representative, continues to talk tough.

“Ships and shipping are vital to American economic security and the free flow of commerce,” he said. “The Trump administration’s actions will begin to reverse Chinese dominance, address threats to the supply chain and send a demand signal for US-built ships.”

But reversing a decades-long tide that has seen the demise of more than 20,000 domestic shipbuilding suppliers and shipyards shuttering across the country will be difficult.

The first issue is cold, hard cash.

Building a medium-range tanker able to transport 200,000 barrels of oil costs $US50 million in South Korea. In the US, that same ship costs $US250 million, according to BIMCO.

The century-old Jones Act already dictates that goods shipped between US ports must be transported on US-flagged vessels.

This means the ships must be registered in the US, built there and crewed mostly by American staff – making it more expensive.

Today, most Chinese vessels don’t even carry the Chinese flag because in maritime law, the flag of the ship represents its nationality.

Many fly under the Liberian or Panama “flag of convenience” to avoid stricter regulations and costs at home. BIMCO adds that even if ships can be identified as Chinese, they are unlikely to be the ones footing the final bill.

The ships already built of Chinese origin will not disappear from the world fleet if the proposed port fees are introduced. Rather, the shipping industry will seek to avoid paying fees.

Analysis by Signal Ocean shows there were 18,386 port calls in the US last year, with Chinese-built ships accounting for 6480 of them.

Cary Davis, chief executive of the American Association of Port Authorities, warns that attempts to minimise costs will hurt smaller ports hardest.

Speaking ahead of the Trump administration’s decision, he said: “Most concerningly for our ports, the proposed fees would incentivise ocean carriers to consolidate traffic to the nation’s largest ports, while cutting out small and medium-sized ports from their routes.

“This would cause significant congestion at large ports and the collapse of business lines at small and medium-sized ports. The results would be higher inflation, more unemployment, and higher trade deficits.”

BIMCO’s Pedersen says reviving the US shipbuilding sector remains a pipe dream. “US shipbuilding has not been competitive for a long time.

“If it is required to carry US exports on US-built, US-flagged tonnage, and that such tonnage is becoming available, the transport cost would increase significantly and impact US export’s competitiveness on the world market. This is especially true for low-value commodities such as grain and soy.”

For example, soybeans are one of America’s biggest exports, with $US24.6 billion worth sent abroad last year. In commodities trading, where margins are razor-thin, this would represent a serious blow to exporters.

The CSIS believes the Trump administration should encourage “friend-shoring” – a strategy which seeks to offer better deals to key US allies – as a counterweight to China.

“Despite the salient national security risks of buying vessels from China, it will be impossible to fully shift order books away from Chinese shipyards, and the US shipbuilding industry is itself not a sizeable player,” it said.

“In the short to medium term, efforts should focus on shifting market share from Chinese tier-one and tier-two shipyards to South Korea and Japan, which are the only two countries with existing capacity to absorb shifting supply chains.”

There must also be a focus on key areas rather than a drive to dominate everything, the think tank adds.

“The US is not currently poised to compete in the global shipbuilding industry, but there is a clear strategic rationale for maintaining a domestic shipbuilding industry,” it said.

“The ability to build, maintain, and crew a merchant marine fleet can provide sealift capacity for national security needs – especially during wartime.”

The Telegraph, London

https://www.smh.com.au/business/companies/the-chinese-stranglehold-donald-trump-is-desperate-to-break-20250428-p5lutz.html

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.