Search

Recent comments

- success....

3 hours 34 min ago - seriously....

6 hours 18 min ago - monsters.....

6 hours 26 min ago - people for the people....

7 hours 2 min ago - abusing kids.....

8 hours 35 min ago - brainwashed tim....

12 hours 55 min ago - embezzlers.....

13 hours 1 min ago - epstein connect....

13 hours 13 min ago - 腐敗....

13 hours 32 min ago - multicultural....

13 hours 38 min ago

Democracy Links

Member's Off-site Blogs

theatre behind the stage.....

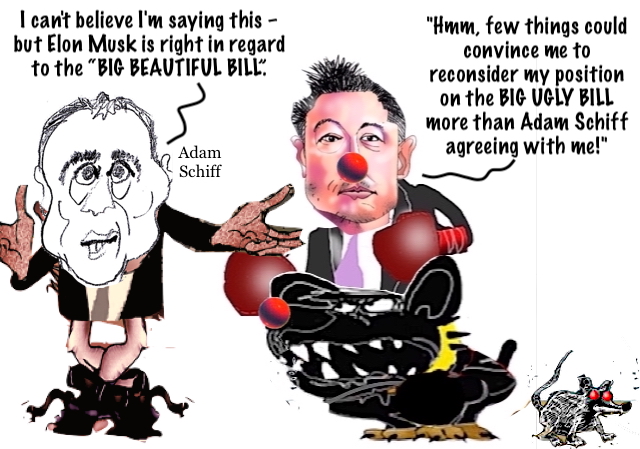

Elon Musk appeared to jokingly reconsider his stance on the Big Beautiful Bill after a California Democrat came to his defense.

Sen. Adam Schiff, D-Calif., wrote on X that "I can't believe I'm saying this – but [Elon Musk] is right." However, that seems to be the last point on which the two agree. They both object to the Big Beautiful Bill, viewing it as full of pork. Musk opposes the bill because he believes it raises government spending too much, while Schiff objects to what he calls its "far-right" content, which he describes as "dangerous."

Musk jokes about reconsidering stance on Big Beautiful Bill after Schiff's praise

'Few things could convince me to reconsider my position more,' Musk wrote in a post on X

By Rachel Wolf

Musk fired off a response rejecting Schiff’s alleged praise of the tech billionaire’s position on the bill.

"Hmm, few things could convince me to reconsider my position more than Adam Schiff agreeing with me!"

On May 30, Musk’s time with the administration came to an end, and he seemed to leave things on good terms. President Donald Trump thanked Musk for his work with the Department of Government Efficiency (DOGE) and gave him a symbolic "key to the White House" as a parting gift.

Following his departure from the White House, Musk said he was looking forward "to continuing to be a friend and adviser to the president." However, things took a sharp turn as a feud between Trump and Musk quickly heated up after the Tesla founder began publicly criticizing the Big Beautiful Bill.

After the legislation passed the House, Musk said that the "massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. "Shame on those who voted for it: you know you did wrong. You know it."

Musk’s criticisms received mixed reactions from Republicans, with some — such as Sen. Mike Lee, R-Utah, and Sen. Rand Paul, R-Ky. — agreeing with him. Meanwhile, House Speaker Mike Johnson said he was "surprised" by Musk’s reaction and claimed the two of them had a good discussion about the bill.

Trump and Musk then began slugging it out on their respective social media platforms — X and Truth Social — as well as TV. The president told reporters in the Oval Office that he was "very disappointed" with Musk and claimed that the former DOGE head knew what was in the bill, something that Musk denied.

The heated exchange led to two explosive tweets, both of which were later deleted. In one post, Musk claimed Trump was mentioned in files relating to Jeffrey Epstein, the deceased sex offender and disgraced financier. In his other post, Musk endorsed a message that called for Trump’s impeachment and said that Vice President J.D. Vance should take over.

While it’s unclear whether Trump and Musk will reconcile, for now it seems unlikely. Trump told Fox News chief political anchor Bret Baier that he was not interested in talking to Musk and that "Elon’s totally lost it."

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 9 Jun 2025 - 11:22am

- Gus Leonisky's blog

- Login or register to post comments

the OMGBBB.....

The Oh My God the Big Beautiful Bill is Great?...

below is about 5 per cent of the BBB...

GO DIRECTLY TO THE END TO SEE WHAT THE BBB MEANS....

119th CONGRESS

1st Session

H. R. 1

_______________________________________________________________________

AN ACT

To provide for reconciliation pursuant to title II of H. Con. Res. 14.

Be it enacted by the Senate and House of Representatives of the

United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the ``One Big Beautiful Bill Act''.

SEC. 2. TABLE OF CONTENTS.

The table of contents of this Act is as follows:

Sec. 1. Short title.

Sec. 2. Table of contents.

TITLE I--COMMITTEE ON AGRICULTURE

Subtitle A--Nutrition

Sec. 10001. Thrifty food plan.

Sec. 10002. Able bodied adults without dependents work requirements.

Sec. 10003. Able bodied adults without dependents waivers.

Sec. 10004. Availability of standard utility allowances based on

receipt of energy assistance.

Sec. 10005. Restrictions on internet expenses.

Sec. 10006. Matching funds requirements.

Sec. 10007. Administrative cost sharing.

Sec. 10008. General work requirement age.

Sec. 10009. National Accuracy Clearinghouse.

Sec. 10010. Quality control zero tolerance.

Sec. 10011. National education and obesity prevention grant program

repealer.

Sec. 10012. Alien SNAP eligibility.

Sec. 10013. Emergency food assistance.

Subtitle B--Investment in Rural America

Sec. 10101. Safety net.

Sec. 10102. Conservation.

Sec. 10103. Supplemental Agricultural Trade Promotion program.

Sec. 10104. Research.

Sec. 10105. Secure rural schools; forestry.

Sec. 10106. Energy.

Sec. 10107. Horticulture.

Sec. 10108. Miscellaneous.

TITLE II--COMMITTEE ON ARMED SERVICES

Sec. 20001. Enhancement of Department of Defense resources for

improving the quality of life for military

personnel.

Sec. 20002. Enhancement of Department of Defense resources for

shipbuilding.

Sec. 20003. Enhancement of Department of Defense resources for

integrated air and missile defense.

Sec. 20004. Enhancement of Department of Defense resources for

munitions and defense supply chain

resiliency.

Sec. 20005. Enhancement of Department of Defense resources for scaling

low-cost weapons into production.

Sec. 20006. Enhancement of Department of Defense resources for

improving the efficiency and cybersecurity

of the Department of Defense.

Sec. 20007. Enhancement of Department of Defense resources for air

superiority.

Sec. 20008. Enhancement of resources for nuclear forces.

Sec. 20009. Enhancement of Department of Defense resources to improve

capabilities of United States Indo-Pacific

Command.

Sec. 20010. Enhancement of Department of Defense resources for

improving the readiness of the Armed

Forces.

Sec. 20011. Improving Department of Defense border support and counter-

drug missions.

Sec. 20012. Enhancement of military intelligence programs.

Sec. 20013. Department of Defense oversight.

Sec. 20014. Military construction projects authorized.

Sec. 20015. Plan required.

Sec. 20016. Limitation on availability of funds.

TITLE III--COMMITTEE ON EDUCATION AND WORKFORCE

Subtitle A--Student Eligibility

Sec. 30001. Student eligibility.

Sec. 30002. Amount of need; cost of attendance; median cost of college.

Subtitle B--Loan Limits

Sec. 30011. Loan Limits.

Subtitle C--Loan Repayment

Sec. 30021. Loan repayment.

Sec. 30022. Deferment; forbearance.

Sec. 30023. Loan rehabilitation.

Sec. 30024. Public Service Loan Forgiveness.

Sec. 30025. Student loan servicing.

Subtitle D--Pell Grants

Sec. 30031. Eligibility.

Sec. 30032. Workforce pell grants.

Sec. 30033. Pell shortfall.

Subtitle E--Accountability

Sec. 30041. Agreements with institutions.

Sec. 30042. Campus-based aid programs.

Subtitle F--Regulatory Relief

Sec. 30051. Regulatory relief.

Subtitle G--Limitation on Authority

Sec. 30061. Limitation on authority of the Secretary to propose or

issue regulations and executive actions.

TITLE IV--ENERGY AND COMMERCE

Subtitle A--Energy

Sec. 41001. Rescissions relating to certain Inflation Reduction Act

programs.

Sec. 41002. Natural gas exports and imports.

Sec. 41003. Funding for Department of Energy loan guarantee expenses.

Sec. 41004. Expedited permitting.

Sec. 41005. De-risking Compensation Program.

Sec. 41006. Strategic Petroleum Reserve.

Subtitle B--Environment

Part 1--Repeals and Rescissions

Sec. 42101. Repeal and rescission relating to clean heavy-duty

vehicles.

Sec. 42102. Repeal and rescission relating to grants to reduce air

pollution at ports.

Sec. 42103. Repeal and rescission relating to Greenhouse Gas Reduction

Fund.

Sec. 42104. Repeal and rescission relating to diesel emissions

reductions.

Sec. 42105. Repeal and rescission relating to funding to address air

pollution.

Sec. 42106. Repeal and rescission relating to funding to address air

pollution at schools.

Sec. 42107. Repeal and rescission relating to low emissions electricity

program.

Sec. 42108. Repeal and rescission relating to funding for section

211(o) of the Clean Air Act.

Sec. 42109. Repeal and rescission relating to funding for

implementation of the American Innovation

and Manufacturing Act.

Sec. 42110. Repeal and rescission relating to funding for enforcement

technology and public information.

Sec. 42111. Repeal and rescission relating to greenhouse gas corporate

reporting.

Sec. 42112. Repeal and rescission relating to environmental product

declaration assistance.

Sec. 42113. Repeal of funding for methane emissions and waste reduction

incentive program for petroleum and natural

gas systems.

Sec. 42114. Repeal and rescission relating to greenhouse gas air

pollution plans and implementation grants.

Sec. 42115. Repeal and rescission relating to Environmental Protection

Agency efficient, accurate, and timely

reviews.

Sec. 42116. Repeal and rescission relating to low-embodied carbon

labeling for construction materials.

Sec. 42117. Repeal and rescission relating to environmental and climate

justice block grants.

Part 2--Repeal of EPA Rules Relating to Greenhouse Gas and Multi-

pollutant Emissions Standards

Sec. 42201. Repeal of EPA rules relating to greenhouse gas and multi-

pollutant emissions standards.

Part 3--Repeal of NHTSA Rules Relating to CAFE Standards

Sec. 42301. Repeal of NHTSA rules relating to CAFE standards.

Subtitle C--Communications

Part 1--Spectrum Auctions

Sec. 43101. Identification and auction of spectrum.

Part 2--Artificial Intelligence and Information Technology

Modernization

Sec. 43201. Artificial intelligence and information technology

modernization initiative.

Subtitle D--Health

Part 1--Medicaid

subpart a--reducing fraud and improving enrollment processes

Sec. 44101. Moratorium on implementation of rule relating to

eligibility and enrollment in Medicare

Savings Programs.

Sec. 44102. Moratorium on implementation of rule relating to

eligibility and enrollment for Medicaid,

CHIP, and the Basic Health Program.

Sec. 44103. Ensuring appropriate address verification under the

Medicaid and CHIP programs.

Sec. 44104. Modifying certain State requirements for ensuring deceased

individuals do not remain enrolled.

Sec. 44105. Medicaid provider screening requirements.

Sec. 44106. Additional Medicaid provider screening requirements.

Sec. 44107. Removing good faith waiver for payment reduction related to

certain erroneous excess payments under

Medicaid.

Sec. 44108. Increasing frequency of eligibility redeterminations for

certain individuals.

Sec. 44109. Revising home equity limit for determining eligibility for

long-term care services under the Medicaid

program.

Sec. 44110. Prohibiting Federal financial participation under Medicaid

and CHIP for individuals without verified

citizenship, nationality, or satisfactory

immigration status.

Sec. 44111. Reducing expansion FMAP for certain States providing

payments for health care furnished to

certain individuals.

subpart b--preventing wasteful spending

Sec. 44121. Moratorium on implementation of rule relating to staffing

standards for long-term care facilities

under the Medicare and Medicaid programs.

Sec. 44122. Modifying retroactive coverage under the Medicaid and CHIP

programs.

Sec. 44123. Ensuring accurate payments to pharmacies under Medicaid.

Sec. 44124. Preventing the use of abusive spread pricing in Medicaid.

Sec. 44125. Prohibiting Federal Medicaid and CHIP funding for gender

transition procedures.

Sec. 44126. Federal payments to prohibited entities.

subpart c--stopping abusive financing practices

Sec. 44131. Sunsetting eligibility for increased FMAP for new expansion

States.

Sec. 44132. Moratorium on new or increased provider taxes.

Sec. 44133. Revising payments for certain State directed payments.

Sec. 44134. Requirements regarding waiver of uniform tax requirement

for Medicaid provider tax.

Sec. 44135. Requiring budget neutrality for Medicaid demonstration

projects under section 1115.

subpart d--increasing personal accountability

Sec. 44141. Requirement for States to establish Medicaid community

engagement requirements for certain

individuals.

Sec. 44142. Modifying cost sharing requirements for certain expansion

individuals under the Medicaid program.

Part 2--Affordable Care Act

Sec. 44201. Addressing waste, fraud, and abuse in the ACA Exchanges.

Sec. 44202. Funding cost sharing reduction payments.

Part 3--Improving Americans' Access to Care

Sec. 44301. Expanding and clarifying the exclusion for orphan drugs

under the Drug Price Negotiation Program.

Sec. 44302. Streamlined enrollment process for eligible out-of-state

providers under Medicaid and CHIP.

Sec. 44303. Delaying DSH reductions.

Sec. 44304. Modifying update to the conversion factor under the

physician fee schedule under the Medicare

program.

Sec. 44305. Modernizing and Ensuring PBM Accountability.

TITLE V--COMMITTEE ON FINANCIAL SERVICES

Sec. 50001. Green and resilient retrofit program for multifamily family

housing.

Sec. 50002. Public Company Accounting Oversight Board.

Sec. 50003. Bureau of Consumer Financial Protection.

Sec. 50004. Consumer Financial Civil Penalty Fund.

Sec. 50005. Financial Research Fund.

TITLE VI--COMMITTEE ON HOMELAND SECURITY

Sec. 60001. Border barrier system construction, invasive species, and

border security facilities improvements.

Sec. 60002. U.S. Customs and Border Protection personnel and fleet

vehicles.

Sec. 60003. U.S. Customs and Border Protection technology, vetting

activities, and other efforts to enhance

border security.

Sec. 60004. State border security reimbursement.

Sec. 60005. State and local law enforcement presidential residence

protection.

Sec. 60006. State homeland security grant program.

TITLE VII--COMMITTEE ON THE JUDICIARY

Subtitle A--Immigration Matters

Part 1--Immigration Fees

Sec. 70001. Applicability of the immigration laws.

Sec. 70002. Asylum fee.

Sec. 70003. Employment authorization document fees.

Sec. 70004. Parole fee.

Sec. 70005. Special immigrant juvenile fee.

Sec. 70006. Temporary protected status fee.

Sec. 70007. Unaccompanied alien child sponsor fee.

Sec. 70008. Visa integrity fee.

Sec. 70009. Form I-94 fee.

Sec. 70010. Yearly asylum fee.

Sec. 70011. Fee for continuances granted in immigration court

proceedings.

Sec. 70012. Fee relating to renewal and extension of employment

authorization for parolees.

Sec. 70013. Fee relating to termination, renewal, and extension of

employment authorization for asylum

applicants.

Sec. 70014. Fee relating to renewal and extension of employment

authorization for aliens granted temporary

protected status.

Sec. 70015. Diversity immigrant visa fees.

Sec. 70016. EOIR fees.

Sec. 70017. ESTA fee.

Sec. 70018. Immigration user fees.

Sec. 70019. EVUS fee.

Sec. 70020. Fee for sponsor of unaccompanied alien child who fails to

appear in immigration court.

Sec. 70021. Fee for aliens ordered removed in absentia.

Sec. 70022. Customs and Border Protection inadmissible alien

apprehension fee.

Sec. 70023. Amendment to authority to apply for asylum.

Part 2--Use of Funds

Sec. 70100. Executive Office for Immigration Review.

Sec. 70101. Adult alien detention capacity and family residential

centers.

Sec. 70102. Retention and signing bonuses for U.S. Immigration and

Customs Enforcement personnel.

Sec. 70103. Hiring of additional U.S. Immigration and Customs

Enforcement personnel.

Sec. 70104. U.S. Immigration and Customs Enforcement hiring capability.

Sec. 70105. Transportation and removal operations.

Sec. 70106. Information technology investments.

Sec. 70107. Facilities upgrades.

Sec. 70108. Fleet modernization.

Sec. 70109. Promoting family unity.

Sec. 70110. Funding section 287(g) of the Immigration and Nationality

Act.

Sec. 70111. Compensation for incarceration of criminal aliens.

Sec. 70112. Office of the Principal Legal Advisor.

Sec. 70113. Return of aliens arriving from contiguous territory.

Sec. 70114. State and local participation in homeland security efforts.

Sec. 70115. Unaccompanied alien children capacity.

Sec. 70116. Department of Homeland Security checks for unaccompanied

alien children.

Sec. 70117. Department of Health and Human Services checks for

unaccompanied alien children.

Sec. 70118. Information about sponsors and adult residents of sponsor

households.

Sec. 70119. Repatriation of unaccompanied alien children.

Sec. 70120. United States Secret Service.

Sec. 70121. Combating drug trafficking and illegal drug use.

Sec. 70122. Investigating and prosecuting immigration related matters.

Sec. 70123. Expedited removal for criminal aliens.

Sec. 70124. Removal of certain criminal aliens without further hearing.

Subtitle B--Regulatory Matters

Sec. 70200. Review of agency rulemaking.

Subtitle C--Other Matters

Sec. 70300. Limitation on donations made pursuant to settlement

agreements to which the United States is a

party.

Sec. 70301. Solicitation of orders defined.

Sec. 70302. Restriction on enforcement.

TITLE VIII--COMMITTEE ON NATURAL RESOURCES

Subtitle A--Energy and Mineral Resources

Part 1--Oil and Gas

Sec. 80101. Onshore oil and gas lease sales.

Sec. 80102. Noncompetitive leasing.

Sec. 80103. Permit fees.

Sec. 80104. Permitting fee for non-Federal land.

Sec. 80105. Reinstate reasonable royalty rates.

Part 2--Geothermal

Sec. 80111. Geothermal leasing.

Sec. 80112. Geothermal royalties.

Part 3--Alaska

Sec. 80121. Coastal plain oil and gas leasing.

Part 4--Mining

Sec. 80131. Superior National Forest lands in Minnesota.

Part 5--Coal

Sec. 80141. Coal leasing.

Sec. 80142. Future coal leasing.

Sec. 80143. Coal royalty.

Sec. 80144. Authorization to mine Federal minerals.

Part 6--NEPA

Sec. 80151. Project sponsor opt-in fees for environmental reviews.

Sec. 80152. Rescission relating to environmental and climate data

collection.

Part 7--Miscellaneous

Sec. 80161. Protest fees.

Part 8--Offshore Oil and Gas Leasing

Sec. 80171. Mandatory offshore oil and gas lease sales.

Sec. 80172. Offshore commingling.

Sec. 80173. Limitations on amount of distributed qualified outer

Continental Shelf revenues.

Part 9--Renewable Energy

Sec. 80181. Renewable energy fees on Federal lands.

Sec. 80182. Renewable energy revenue sharing.

Subtitle B--Water, Wildlife, and Fisheries

Sec. 80201. Rescission of funds for investing in coastal communities

and climate resilience.

Sec. 80202. Rescission of funds for facilities of National Oceanic and

Atmospheric Administration and national

marine sanctuaries.

Sec. 80203. Surface water storage enhancement.

Sec. 80204. Water conveyance enhancement.

Subtitle C--Federal Lands

Sec. 80301. Rescission of Forest Service Funds.

Sec. 80302. Rescission of National Park Service and Bureau of Land

Management Funds.

Sec. 80303. Rescission of Bureau of Land Management and National Park

Service Funds.

Sec. 80304. Rescission of National Park Service Funds.

Sec. 80305. Celebrating America's 250th Anniversary.

Sec. 80306. Long-Term Contracts for the Forest Service.

Sec. 80307. Long-Term Contracts for the Bureau of Land Management.

Sec. 80308. Timber production for the Forest Service.

Sec. 80309. Timber Production for the Bureau of Land Management.

TITLE IX--COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM

Sec. 90001. Elimination of the FERS annuity supplement for certain

employees.

Sec. 90002. Election for at-will employment and lower FERS

contributions for new Federal civil service

hires.

Sec. 90003. Filing fee for Merit Systems Protection Board claims and

appeals.

Sec. 90004. FEHB protection.

TITLE X--COMMITTEE ON TRANSPORTATION AND INFRASTRUCTURE

Sec. 100001. Coast Guard assets necessary to secure the maritime border

and interdict migrants and drugs.

Sec. 100002. Vessel tonnage duties.

Sec. 100003. Registration fee on motor vehicles.

Sec. 100004. Deposit of registration fee on motor vehicles.

Sec. 100005. Motor carrier data.

Sec. 100006. IRA rescissions.

Sec. 100007. Air traffic control staffing and modernization.

Sec. 100008. John F. Kennedy Center for the Performing Arts.

TITLE XI--COMMITTEE ON WAYS AND MEANS, ``THE ONE, BIG, BEAUTIFUL BILL''

Sec. 110000. References to the Internal Revenue Code of 1986, etc.

Subtitle A--Make American Families and Workers Thrive Again

Part 1--Permanently Preventing Tax Hikes on American Families and

Workers

Sec. 110001. Extension of modification of rates.

Sec. 110002. Extension of increased standard deduction and temporary

enhancement.

Sec. 110003. Termination of deduction for personal exemptions.

Sec. 110004. Extension of increased child tax credit and temporary

enhancement.

Sec. 110005. Extension of deduction for qualified business income and

permanent enhancement.

Sec. 110006. Extension of increased estate and gift tax exemption

amounts and permanent enhancement.

Sec. 110007. Extension of increased alternative minimum tax exemption

and phase-out thresholds.

Sec. 110008. Extension of limitation on deduction for qualified

residence interest.

Sec. 110009. Extension of limitation on casualty loss deduction.

Sec. 110010. Termination of miscellaneous itemized deduction.

Sec. 110011. Limitation on tax benefit of itemized deductions.

Sec. 110012. Termination of qualified bicycle commuting reimbursement

exclusion.

Sec. 110013. Extension of limitation on exclusion and deduction for

moving expenses.

Sec. 110014. Extension of limitation on wagering losses.

Sec. 110015. Extension of increased limitation on contributions to ABLE

accounts and permanent enhancement.

Sec. 110016. Extension of savers credit allowed for ABLE contributions.

Sec. 110017. Extension of rollovers from qualified tuition programs to

ABLE accounts permitted.

Sec. 110018. Extension of treatment of certain individuals performing

services in the Sinai Peninsula and

enhancement to include additional areas.

Sec. 110019. Extension of exclusion from gross income of student loans

discharged on account of death or

disability.

Part 2--Additional Tax Relief for American Families and Workers

Sec. 110101. No tax on tips.

Sec. 110102. No tax on overtime.

Sec. 110103. Enhanced deduction for seniors.

Sec. 110104. No tax on car loan interest.

Sec. 110105. Enhancement of employer-provided child care credit.

Sec. 110106. Extension and enhancement of paid family and medical leave

credit.

Sec. 110107. Enhancement of adoption credit.

Sec. 110108. Recognizing Indian tribal governments for purposes of

determining whether a child has special

needs for purposes of the adoption credit.

Sec. 110109. Scholarship granting organizations.

Sec. 110110. Additional elementary, secondary, and home school expenses

treated as qualified higher education

expenses for purposes of 529 accounts.

Sec. 110111. Certain postsecondary credentialing expenses treated as

qualified higher education expenses for

purposes of 529 accounts.

Sec. 110112. Reinstatement of partial deduction for charitable

contributions of individuals who do not

elect to itemize.

Sec. 110113. Exclusion for certain employer payments of student loans

under educational assistance programs made

permanent and adjusted for inflation.

Sec. 110114. Extension of rules for treatment of certain disaster-

related personal casualty losses.

Sec. 110115. Trump accounts.

Sec. 110116. Trump accounts contribution pilot program.

Part 3--Investing in Health of American Families and Workers

Sec. 110201. Treatment of health reimbursement arrangements integrated

with individual market coverage.

Sec. 110202. Participants in CHOICE arrangement eligible for purchase

of Exchange insurance under cafeteria plan.

Sec. 110203. Employer credit for CHOICE arrangement.

Sec. 110204. Individuals entitled to part A of Medicare by reason of

age allowed to contribute to health savings

accounts.

Sec. 110205. Treatment of direct primary care service arrangements.

Sec. 110206. Allowance of bronze and catastrophic plans in connection

with health savings accounts.

Sec. 110207. On-site employee clinics.

Sec. 110208. Certain amounts paid for physical activity, fitness, and

exercise treated as amounts paid for

medical care.

Sec. 110209. Allow both spouses to make catch-up contributions to the

same health savings account.

Sec. 110210. FSA and HRA terminations or conversions to fund HSAs.

Sec. 110211. Special rule for certain medical expenses incurred before

establishment of health savings account.

Sec. 110212. Contributions permitted if spouse has health flexible

spending arrangement.

Sec. 110213. Increase in health savings account contribution limitation

for certain individuals.

Sec. 110214. Regulations.

Subtitle B--Make Rural America and Main Street Grow Again

Part 1--Extension of Tax Cuts and Jobs Act Reforms for Rural America

and Main Street

Sec. 111001. Extension of special depreciation allowance for certain

property.

Sec. 111002. Deduction of domestic research and experimental

expenditures.

Sec. 111003. Modified calculation of adjusted taxable income for

purposes of business interest deduction.

Sec. 111004. Extension of deduction for foreign-derived intangible

income and global intangible low-taxed

income.

Sec. 111005. Extension of base erosion minimum tax amount.

Sec. 111006. Exception to denial of deduction for business meals.

Part 2--Additional Tax Relief for Rural America and Main Street

Sec. 111101. Special depreciation allowance for qualified production

property.

Sec. 111102. Renewal and enhancement of opportunity zones.

Sec. 111103. Increased dollar limitations for expensing of certain

depreciable business assets.

Sec. 111104. Repeal of revision to de minimis rules for third party

network transactions.

Sec. 111105. Increase in threshold for requiring information reporting

with respect to certain payees.

Sec. 111106. Exclusion of interest on loans secured by rural or

agricultural real property.

Sec. 111107. Treatment of certain qualified sound recording

productions.

Sec. 111108. Modifications to low-income housing credit.

Sec. 111109. Increased gross receipts threshold for small manufacturing

businesses.

Sec. 111110. Global intangible low-taxed income determined without

regard to certain income derived from

services performed in the Virgin Islands.

Sec. 111111. Extension and modification of clean fuel production

credit.

Sec. 111112. Restoration of taxable REIT subsidiary asset test.

Part 3--Investing in the Health of Rural America and Main Street

Sec. 111201. Expanding the definition of rural emergency hospital under

the Medicare program.

Subtitle C--Make America Win Again

Part 1--Working Families Over Elites

Sec. 112001. Termination of previously-owned clean vehicle credit.

Sec. 112002. Termination of clean vehicle credit.

Sec. 112003. Termination of qualified commercial clean vehicles credit.

Sec. 112004. Termination of alternative fuel vehicle refueling property

credit.

Sec. 112005. Termination of energy efficient home improvement credit.

Sec. 112006. Termination of residential clean energy credit.

Sec. 112007. Termination of new energy efficient home credit.

Sec. 112008. Restrictions on clean electricity production credit.

Sec. 112009. Restrictions on clean electricity investment credit.

Sec. 112010. Repeal of transferability of clean fuel production credit.

Sec. 112011. Restrictions on carbon oxide sequestration credit.

Sec. 112012. Restrictions on zero-emission nuclear power production

credit.

Sec. 112013. Termination of clean hydrogen production credit.

Sec. 112014. Phase-out and restrictions on advanced manufacturing

production credit.

Sec. 112015. Phase-out of credit for certain energy property.

Sec. 112016. Income from hydrogen storage, carbon capture added to

qualifying income of certain publicly

traded partnerships treated as

corporations.

Sec. 112017. Limitation on amortization of certain sports franchises.

Sec. 112018. Limitation on individual deductions for certain State and

local taxes, etc.

Sec. 112019. Excessive employee remuneration from controlled group

members and allocation of deduction.

Sec. 112020. Expanding application of tax on excess compensation within

tax-exempt organizations.

Sec. 112021. Modification of excise tax on investment income of certain

private colleges and universities.

Sec. 112022. Increase in rate of tax on net investment income of

certain private foundations.

Sec. 112023. Certain purchases of employee-owned stock disregarded for

purposes of foundation tax on excess

business holdings.

Sec. 112024. Unrelated business taxable income increased by amount of

certain fringe benefit expenses for which

deduction is disallowed.

Sec. 112025. Exclusion of research income limited to publicly available

research.

Sec. 112026. Limitation on excess business losses of noncorporate

taxpayers.

Sec. 112027. 1-percent floor on deduction of charitable contributions

made by corporations.

Sec. 112028. Enforcement of remedies against unfair foreign taxes.

Sec. 112029. Modification of treatment of silencers.

Sec. 112030. Modifications to de minimis entry privilege for commercial

shipments.

Sec. 112031. Limitation on drawback of taxes paid with respect to

substituted merchandise.

Sec. 112032. Treatment of payments from partnerships to partners for

property or services.

Part 2--Removing Taxpayer Benefits for Illegal Immigrants

Sec. 112101. Permitting premium tax credit only for certain

individuals.

Sec. 112102. Disallowing premium tax credit during periods of Medicaid

ineligibility due to alien status.

Sec. 112103. Limiting Medicare coverage of certain individuals.

Sec. 112104. Excise tax on remittance transfers.

Sec. 112105. Social security number requirement for American

opportunity and lifetime learning credits.

Part 3--Preventing Fraud, Waste, and Abuse

Sec. 112201. Requiring Exchange verification of eligibility for health

plan.

Sec. 112202. Disallowing premium tax credit in case of certain coverage

enrolled in during special enrollment

period.

Sec. 112203. Eliminating limitation on recapture of advance payment of

premium tax credit.

Sec. 112204. Implementing artificial intelligence tools for purposes of

reducing and recouping improper payments

under Medicare.

Sec. 112205. Enforcement provisions with respect to COVID-related

employee retention credits.

Sec. 112206. Earned income tax credit reforms.

Sec. 112207. Task force on the termination of Direct File.

Sec. 112208. Increase in penalties for unauthorized disclosures of

taxpayer information.

Sec. 112209. Restriction on regulation of contingency fees with respect

to tax returns, etc.

Subtitle D--Increase in Debt Limit

Sec. 113001. Modification of limitation on the public debt.

TITLE I--COMMITTEE ON AGRICULTURE

Subtitle A--Nutrition

SEC. 10001. THRIFTY FOOD PLAN.

Section 3(u) of the Food and Nutrition Act of 2008 (7 U.S.C.

2012(u)) is amended to read as follows:

``(u)(1) `Thrifty food plan' means the diet required to feed a

family of 4 persons consisting of a man and a woman 20 through 50, a

child 6 through 8, and a child 9 through 11 years of age, based on

relevant market baskets that shall only be changed pursuant to

paragraph (3). The cost of such diet shall be the basis for uniform

allotments for all households regardless of their actual composition.

The Secretary shall only adjust the cost of the diet as specified in

paragraphs (2) and (4).

``(2) Household Adjustments.--The Secretary shall make household-

size adjustments based on the following ratios of household size as a

percentage of the maximum 4-person allotment:

``(A) For a 1-person household, 30 percent.

``(B) For a 2-person household, 55 percent.

``(C) For a 3-person household, 79 percent.

``(D) For a 4-person household, 100 percent.

``(E) For a 5-person household, 119 percent.

``(F) For a 6-person household, 143 percent.

``(G) For a 7-person household, 158 percent.

``(H) For an 8-person household, 180 percent.

``(I) For a 9-person household, 203 percent.

``(J) For a 10-person household, 224 percent.

``(K) For households with more than 10 persons, such

adjustment for each additional person shall be 224 percent plus

the product of 21 percent and the difference in the number of

persons in the household and 10.

``(3) Reevaluation of market baskets.--

``(A) Evaluation.--Not earlier than October 1,

2028, and at not more frequently than 5-year intervals

thereafter, the Secretary may reevaluate the market

baskets of the thrifty food plan taking into

consideration current food prices, food composition

data, consumption patterns, and dietary guidance.

``(B) Notice.--Prior to any update of the market

baskets of the thrifty food plan based on a

reevaluation pursuant to subparagraph (A), the

methodology and results of any such revelation shall be

published in the Federal Register with an opportunity

for comment of not less than 60 days.

``(C) Cost neutrality.--The Secretary shall not

increase the cost of the thrifty food plan based on a

reevaluation or update under this paragraph.

``(4) Allowable cost adjustments.--On October 1 immediately

following the effective date of this paragraph and on each

October 1 thereafter, the Secretary shall--

``(A) adjust the cost of the thrifty food plan to

reflect changes in the Consumer Price Index for All

Urban Consumers, published by the Bureau of Labor

Statistics of the Department of Labor, for the most

recent 12-month period ending in June;

``(B) make cost adjustments in the thrifty food

plan for urban and rural parts of Hawaii and urban and

rural parts of Alaska to reflect the cost of food in

urban and rural Hawaii and urban and rural Alaska

provided such cost adjustment shall not exceed the rate

of increase described in the Consumer Price Index for

All Urban Consumers, published by the Bureau of Labor

Statistics of the Department of Labor, for the most

recent 12-month period ending in June; and

``(C) make cost adjustments in the separate thrifty

food plans for Guam and the Virgin Islands of the

United States to reflect the cost of food in those

States, but not to exceed the cost of food in the 50

States and the District of Columbia, provided that such

cost adjustment shall not exceed the rate of increase

described in the Consumer Price Index for All Urban

Consumers, published by the Bureau of Labor Statistics

of the Department of Labor, for the most recent 12-

month period ending in June.''.

SEC. 10002. ABLE BODIED ADULTS WITHOUT DEPENDENTS WORK REQUIREMENTS.

(a) Section 6(o)(3) of the Food and Nutrition Act of 2008 is

amended to read as follows:

``(3) Exception.--Paragraph (2) shall not apply to an

individual if the individual is--

``(A) under 18 or over 65 years of age;

``(B) medically certified as physically or mentally

unfit for employment;

``(C) a parent or other member of a household with

responsibility for a dependent child under 7 years of

age;

``(D) otherwise exempt under subsection (d)(2);

``(E) a pregnant woman;

``(F) currently homeless;

``(G) a veteran;

``(H) 24 years of age or younger and was in foster

care under the responsibility of a State on the date of

attaining 18 years of age or such higher age as the

State has elected under section 475(8)(B)(iii) of the

Social Security Act (42 U.S.C. 675(8)(B)(iii)); or

``(I) responsible for a dependent child 7 years of

age or older and is married to, and resides with, an

individual who is in compliance with the requirements

of paragraph (2).''.

(b) Sunset Provision.--The exceptions in subparagraphs (F) through

(H) shall cease to have effect on October 1, 2030.

SEC. 10003. ABLE BODIED ADULTS WITHOUT DEPENDENTS WAIVERS.

Section 6(o) of the Food and Nutrition Act of 2008 (7 U.S.C.

2015(o)) is amended--

(1) by amending paragraph (4)(A) to read as follows:

``(A) In general.--On the request of a State agency

and with the support of the chief executive officer of

the State, the Secretary may waive the applicability of

paragraph (2) for not more than 12 consecutive months

to any group of individuals in the State if the

Secretary makes a determination that the county, or

county-equivalent (as recognized by the Census Bureau)

in which the individuals reside has an unemployment

rate of over 10 percent.''; and

(2) in paragraph (6)(F) by striking ``8 percent'' and

inserting ``1 percent''.

SEC. 10004. AVAILABILITY OF STANDARD UTILITY ALLOWANCES BASED ON

RECEIPT OF ENERGY ASSISTANCE.

(a) Allowance to Recipients of Energy Assistance.--

(1) Standard utility allowance.--Section 5(e)(6)(C)(iv)(I)

of the of the Food and Nutrition Act of 2008 (7 U.S.C.

2014(e)(6)(C)(iv)(I)) is amended by inserting ``with an elderly

or disabled member'' after ``households''.

(2) Conforming amendments.--Section 2605(f)(2)(A) of the

Low-Income Home Energy Assistance Act is amended by inserting

``received by a household with an elderly or disabled member''

before ``, consistent with section 5(e)(6)(C)(iv)(I)''.

(b) Third-party Energy Assistance Payments.--Section 5(k)(4) of the

Food and Nutrition Act of 2008 (7 U.S.C. 2014(k)(4)) is amended--

(1) in subparagraph (A) by inserting ``without an elderly

or disabled member'' after ``household'' the 1st place it

appears; and

(2) in subparagraph (B) by inserting ``with an elderly or

disabled member'' after ``household'' the 1st place it appears.

SEC. 10005. RESTRICTIONS ON INTERNET EXPENSES.

Section 5(e)(6) of the Food and Nutrition Act of 2008 (7 U.S.C.

2014(e)(6)) is amended by adding at the end the following:

``(E) Restrictions on internet expenses.--Service

fees associated with internet connection, including,

but not limited to, monthly subscriber fees (i.e., the

base rate paid by the household each month in order to

receive service, which may include high-speed

internet), taxes and fees charged to the household by

the provider that recur on regular bills, the cost of

modem rentals, and fees charged by the provider for

initial installation, shall not be used in computing

the excess shelter expense deduction.''.

SEC. 10006. MATCHING FUNDS REQUIREMENTS.

(a) In General.--Section 4(a) of the Food and Nutrition Act of 2008

(7 U.S.C. 2013(a)) is amended--

(1) by striking ``(a) Subject to'' and inserting the

following:

``(a) Program.--

``(1) Establishment.--Subject to''; and

(2) by adding at the end the following:

``(2) Matching Funds Requirements.--

``(A) In general.--

``(i) Federal share.--Subject to subparagraph (B),

the Federal share of the cost of allotments described

in paragraph (1) in a fiscal year shall be--

``(I) for each of fiscal years 2026 and

2027, 100 percent; and

``(II) for fiscal year 2028 and each fiscal

year thereafter, 95 percent.

``(ii) State share.--Subject to subparagraph (B),

the State share of the cost of allotments described in

paragraph (1) in a fiscal year shall be--

``(I) for each of fiscal years 2026 and

2027, 0 percent; and

``(II) for fiscal year 2028 and each fiscal

year thereafter, 5 percent.

``(B) State quality control incentive.--Beginning in fiscal

year 2028, any State that has a payment error rate, as defined

in section 16, for the most recent complete fiscal year for

which data is available, of--

``(i) equal to or greater than 6 percent but less

than 8 percent, shall have its Federal share of the

cost of allotments described in paragraph (1) for the

current fiscal year equal 85 percent, and its State

share equal 15 percent;

``(ii) equal to or greater than 8 percent but less

than 10 percent, shall have its Federal share of the

cost of allotments described in paragraph (1) for the

current fiscal year equal 80 percent, and its State

share equal 20 percent; and

``(iii) equal to or greater than 10 percent, shall

have its Federal share of the cost of allotments

described in paragraph (1) for the current fiscal year

equal 75 percent, and its State share equal 25

percent.''.

(b) Rule of Construction.--The Secretary of Agriculture may not pay

towards the cost of allotments described in paragraph (1) of section

4(a) of the Food and Nutrition Act of 2008 (7 U.S.C. 2013(a)), as

designated by subsection (a), an amount greater than the applicable

Federal share described in paragraph (2) of such section 4(a), as added

by subsection (a).

SEC. 10007. ADMINISTRATIVE COST SHARING.

Section 16(a) of the Food and Nutrition Act of 2008 (7 U.S.C.

2025(a)) is amended by striking ``50 per centum'' and inserting ``25

percent''.

SEC. 10008. GENERAL WORK REQUIREMENT AGE.

Section 6(d) of the Food and Nutrition Act of 2008 (7 U.S.C.

2015(d)) is amended--

(1) in paragraph (1)(A), in the matter preceding clause

(i), by striking ``over the age of 15 and under the age of 60''

and inserting ``over the age of 17 and under the age of 65'';

and

(2) in paragraph (2)--

(A) by striking ``child under age six'' and

inserting ``child under age seven''; and

(B) by striking ``between 1 and 6 years of age''

and inserting ``between 1 and 7 years of age''.

SEC. 10009. NATIONAL ACCURACY CLEARINGHOUSE.

Section 11(x)(2) of the Food and Nutrition Act of 2008 (7 U.S.C.

2020(x)(2)) is amended by adding at the end the following:

``(D) Data sharing to prevent other multiple

issuances.--A State agency shall use each indication of

multiple issuance, or each indication that an

individual receiving supplemental nutrition assistance

program benefits in 1 State has applied to receive

supplemental nutrition assistance program benefits in

another State, to prevent multiple issuances of other

Federal and State assistance program benefits that a

State agency administers through the integrated

eligibility system that the State uses to administer

the supplemental nutrition assistance program in the

State.''.

SEC. 10010. QUALITY CONTROL ZERO TOLERANCE.

Section 16(c)(1)(A)(ii) of the Food and Nutrition Act of 2008 (7

U.S.C. 2025(c)(1)(A)(ii)) is amended--

(1) in subclause (I), by striking ``and'' at the end;

(2) in subclause (II)--

(A) by striking ``fiscal year thereafter'' and

inserting ``of fiscal years 2015 through 2025''; and

(B) by striking the period at the end and inserting

``; and''; and

(3) by adding at the end the following:

``(III) for each fiscal year

thereafter, $0.''.

SEC. 10011. NATIONAL EDUCATION AND OBESITY PREVENTION GRANT PROGRAM

REPEALER.

The Food and Nutrition Act of 2008 (7 U.S.C. 2011 et seq.) is

amended by striking section 28 (7 U.S.C. 2036a).

SEC. 10012. ALIEN SNAP ELIGIBILITY.

Section 6(f) of the Food and Nutrition Act of 2008 (7 U.S.C.

2015(f)) is amended to read as follows:

``(f) No individual who is a member of a household otherwise

eligible to participate in the supplemental nutrition assistance

program under this section shall be eligible to participate in the

supplemental nutrition assistance program as a member of that or any

other household unless he or she is--

``(1) a resident of the United States; and

``(2) either--

``(A) a citizen or national of the United States;

``(B) an alien lawfully admitted for permanent

residence as an immigrant as defined by sections

101(a)(15) and 101(a)(20) of the Immigration and

Nationality Act, excluding, among others, alien

visitors, tourists, diplomats, and students who enter

the United States temporarily with no intention of

abandoning their residence in a foreign country;

``(C) an alien who is a citizen or national of the

Republic of Cuba and who--

``(i) is the beneficiary of an approved

petition under section 203(a) of the

Immigration and Nationality Act;

``(ii) meets all eligibility requirements

for an immigrant visa but for whom such a visa

is not immediately available;

``(iii) is not otherwise inadmissible under

section 212(a) of such Act; and

``(iv) is physically present in the United

States pursuant to a grant of parole in

furtherance of the commitment of the United

States to the minimum level of annual legal

migration of Cuban nationals to the United

States specified in the U.S.-Cuba Joint

Communique on Migration, done at New York

September 9, 1994, and reaffirmed in the Cuba-

United States: Joint Statement on Normalization

of Migration, Building on the Agreement of

September 9, 1994, done at New York May 2,

1995; or

``(D) an individual who lawfully resides in the

United States in accordance with a Compact of Free

Association referred to in section 402(b)(2)(G) of the

Personal Responsibility and Work Opportunity

Reconciliation Act of 1996.

The income (less, at State option, a pro rata share) and

financial resources of the individual rendered ineligible to

participate in the supplemental nutrition assistance program

under this subsection shall be considered in determining the

eligibility and the value of the allotment of the household of

which such individual is a member.''.

SEC. 10013. EMERGENCY FOOD ASSISTANCE.

Section 203D(d)(5) of the Emergency Food Assistance Act of 1983 (7

U.S.C. 7507(d)(5)) is amended by striking ``2024'' and inserting

``2031''.

Subtitle B--Investment in Rural America

SEC. 10101. SAFETY NET.

(a) Reference Price.--Section 1111(19) of the Agricultural Act of

2014 (7 U.S.C. 9011(19)) is amended to read as follows:

``(19) Reference price.--

``(A) In general.--Subject to subparagraphs (B) and

(C), the term `reference price', with respect to a

covered commodity for a crop year, means the following:

``(i) For wheat, $6.35 per bushel.

``(ii) For corn, $4.10 per bushel.

``(iii) For grain sorghum, $4.40 per

bushel.

``(iv) For barley, $5.45 per bushel.

``(v) For oats, $2.65 per bushel.

``(vi) For long grain rice, $16.90 per

hundredweight.

``(vii) For medium grain rice, $16.90 per

hundredweight.

``(viii) For soybeans, $10.00 per bushel.

``(ix) For other oilseeds, $23.75 per

hundredweight.

``(x) For peanuts, $630.00 per ton.

``(xi) For dry peas, $13.10 per

hundredweight.

``(xii) For lentils, $23.75 per

hundredweight.

``(xiii) For small chickpeas, $22.65 per

hundredweight.

``(xiv) For large chickpeas, $25.65 per

hundredweight.

``(xv) For seed cotton, $0.42 per pound.

``(B) Effectiveness.--Effective beginning with the

2031 crop year, the reference prices defined in

subparagraph (A) with respect to a covered commodity

shall equal the reference price in the previous crop

year multiplied by 1.005.

``(C) Limitation.--In no case shall a reference

price for a covered commodity exceed 115 percent of the

reference price for such covered commodity listed in

subparagraph (A).''.

(b) Base Acres.--Section 1112 of the Agricultural Act of 2014 (7

U.S.C. 9012) is amended--

(1) in subsection (d)(3)(A), by striking ``2023'' and

inserting ``2031''; and

(2) by adding at the end the following:

``(e) Additional Base Acres.--

``(1) In general.--As soon as practicable after the date of

enactment of this subsection, and notwithstanding subsection

(a), the Secretary shall provide notice to owners of eligible

farms pursuant to paragraph (4) and allocate to those eligible

farms a total of not more than an additional 30,000,000 base

acres in the manner provided in this subsection.

``(2) Content of notice.--The notice under paragraph (1)

shall include the following:

``(A) Information that the allocation is occurring.

``(B) Information regarding the eligibility of the

farm for an allocation of base acres under paragraph

(4).

``(C) Information regarding how an owner may appeal

a determination of ineligibility for an allocation of

base acres under paragraph (4) through an appeals

process established by the Secretary.

``(3) Opt-out.--An owner of a farm that is eligible to

receive an allocation of base acres may elect to not receive

that allocation by notifying the Secretary.

``(4) Eligibility.--

``(A) In general.--Subject to subparagraph (D),

effective beginning with the 2026 crop year, a farm is

eligible to receive an allocation of base acres if,

with respect to the farm, the amount described in

subparagraph (B) exceeds the amount described in

subparagraph (C).

``(B) 5-year average sum.--The amount described in

this subparagraph, with respect to a farm, is the sum

of--

``(i) the 5-year average of--

``(I) the acreage planted on the

farm to all covered commodities for

harvest, grazing, haying, silage or

other similar purposes for the 2019

through 2023 crop years; and

``(II) any acreage on the farm that

the producers were prevented from

planting during the 2019 through 2023

crop years to covered commodities

because of drought, flood, or other

natural disaster, or other condition

beyond the control of the producers, as

determined by the Secretary; plus

``(ii) the lesser of--

``(I) 15 percent of the total acres

on the farm; and

``(II) the 5-year average of--

``(aa) the acreage planted

on the farm to eligible

noncovered commodities for

harvest, grazing, haying,

silage, or other similar

purposes for the 2019 through

2023 crop years; and

``(bb) any acreage on the

farm that the producers were

prevented from planting during

the 2019 through 2023 crop

years to eligible noncovered

commodities because of drought,

flood, or other natural

disaster, or other condition

beyond the control of the

producers, as determined by the

Secretary.

``(C) Total number of base acres for covered

commodities.--The amount described in this

subparagraph, with respect to a farm, is the total

number of base acres for covered commodities on the

farm (excluding unassigned crop base), as in effect on

September 30, 2024.

``(D) Effect of no recent plantings of covered

commodities.--In the case of a farm for which the

amount determined under clause (i) of subparagraph (B)

is equal to zero, that farm shall be ineligible to

receive an allocation of base acres under this

subsection.

``(E) Acreage planted on the farm to eligible

noncovered commodities defined.--In this paragraph, the

term `acreage planted on the farm to eligible

noncovered commodities' means acreage planted on a farm

to commodities other than covered commodities, trees,

bushes, vines, grass, or pasture (including cropland

that was idle or fallow), as determined by the

Secretary.

``(5) Number of base acres.--Subject to paragraphs (4) and

(7), the number of base acres allocated to an eligible farm

shall--

``(A) be equal to the difference obtained by

subtracting the amount determined under subparagraph

(C) of paragraph (4) from the amount determined under

subparagraph (B) of that paragraph; and

``(B) include unassigned crop base.

``(6) Allocation of acres.--

``(A) Allocation.--The Secretary shall allocate the

number of base acres under paragraph (5) among those

covered commodities planted on the farm at any time

during the 2019 through 2023 crop years.

``(B) Allocation formula.--The allocation of

additional base acres for covered commodities shall be

in proportion to the ratio of--

``(i) the 5-year average of--

``(I) the acreage planted on the

farm to each covered commodity for

harvest, grazing, haying, silage, or

other similar purposes for the 2019

through 2023 crop years; and

``(II) any acreage on the farm that

the producers were prevented from

planting during the 2019 through 2023

crop years to that covered commodity

because of drought, flood, or other

natural disaster, or other condition

beyond the control of the producers, as

determined by the Secretary; to

``(ii) the 5-year average determined under

paragraph (4)(B)(i).

``(C) Inclusion of all 5 years in average.--For the

purpose of determining a 5-year acreage average under

subparagraph (B) for a farm, the Secretary shall not

exclude any crop year in which a covered commodity was

not planted.

``(D) Treatment of multiple planting or prevented

planting.--For the purpose of determining under

subparagraph (B) the acreage on a farm that producers

planted or were prevented from planting during the 2019

through 2023 crop years to covered commodities, if the

acreage that was planted or prevented from being

planted was devoted to another covered commodity in the

same crop year (other than a covered commodity produced

under an established practice of double cropping), the

owner may elect the covered commodity to be used for

that crop year in determining the 5-year average, but

may not include both the initial covered commodity and

the subsequent covered commodity.

``(E) Limitation.--The allocation of additional

base acres among covered commodities on a farm under

this paragraph may not result in a total number of base

acres for the farm in excess of the total number of

acres on the farm.

``(7) Reduction by the secretary.--In carrying out this

subsection, if the total number of eligible acres allocated to

base acres across all farms in the United States under this

subsection would exceed 30,000,000 acres, the Secretary shall

apply an across-the-board, pro-rata reduction to the number of

eligible acres to ensure the number of allocated base acres

under this subsection is equal to 30,000,000 acres.

``(8) Payment yield.--Beginning with crop year 2026, for

the purpose of making price loss coverage payments under

section 1116, the Secretary shall establish payment yields to

base acres allocated under this subsection equal to--

``(A) the payment yield established on the farm for

the applicable covered commodity; and

``(B) if no such payment yield for the applicable

covered commodity exists, a payment yield--

``(i) equal to the average payment yield

for the covered commodity for the county in

which the farm is situated; or

``(ii) determined pursuant to section

1113(c).

``(9) Treatment of new owners.--In the case of a farm for

which the owner on the date of enactment of this subsection was

not the owner for the 2019 through 2023 crop years, the

Secretary shall use the planting history of the prior owner or

owners of that farm for purposes of determining--

``(A) eligibility under paragraph (4);

``(B) eligible acres under paragraph (5); and

``(C) the allocation of acres under paragraph

(6).''.

(c) Producer Election.--Section 1115 of the Agricultural Act of

2014 (7 U.S.C. 9015) is amended--

(1) in subsection (a), in the matter preceding paragraph

(1) by striking ``2023'' and inserting ``2031''; and

(2) in subsection (c)--

(A) in the matter preceding paragraph (1), by

striking ``2014 crop year or the 2019 crop year, as

applicable'' and inserting ``2014 crop year, 2019 crop

year, or 2026 crop year, as applicable'';

(B) in paragraph (1), by striking ``2014 crop year

or the 2019 crop year, as applicable,'' and inserting

``2014 crop year, 2019 crop year, or 2026 crop year, as

applicable,''; and

(C) in paragraph (2)--

(i) in subparagraph (A), by striking

``and'' at the end;

(ii) in subparagraph (B), by striking the

period at the end and inserting ``; and''; and

(iii) by adding at the end the following:

``(C) the same coverage for each covered commodity

on the farm for the 2026 through 2031 crop years as was

applicable for the 2024 crop year.''.

(d) Price Loss Coverage.--Section 1116 of the Agricultural Act of

2014 (7 U.S.C. 9016) is amended--

(1) in subsection (a)(2), in the matter preceding

subparagraph (A), by striking ``2023'' and inserting ``2031'';

(2) in subsection (c)(1)(B)--

(A) in the subparagraph heading, by striking

``2023'' and inserting ``2031''; and

(B) in the matter preceding clause (i), by striking

``2023'' and inserting ``2031'';

(3) in subsection (d), by striking ``2025'' and inserting

``2031''; and

(4) in subsection (g), by striking ``2012 through 2016''

each place it appears and inserting ``2017 through 2021''.

(e) Agriculture Risk Coverage.--Section 1117 of the Agricultural

Act of 2014 (7 U.S.C. 9017) is amended--

(1) in subsection (a), in the matter preceding paragraph

(1), by striking ``2023'' and inserting ``2031'';

(2) in subsection (c)--

(A) in paragraph (1), by inserting ``for each of

the 2014 through 2024 crop years and 90 percent of the

benchmark revenue for each of the 2025 through 2031

crop years'' before the period at the end;

(B) by striking ``2023'' each place it appears and

inserting ``2031''; and

(C) in paragraph (4)(B), in the subparagraph

heading, by striking ``2023'' and inserting ``2031'';

(3) by amending subsection (d)(1)(B) to read as follows:

``(B)(i) for each of the crop years 2014 through

2024, 10 percent of the benchmark revenue for the crop

year applicable under subsection (c); and

``(ii) for each of the crop years 2025 through

2031, 12.5 percent of the benchmark revenue for the

crop year applicable under subsection (c).''; and

(4) in subsections (e), (g)(5), and (i)(5), by striking

``2023'' each place it appears and inserting ``2031''.

(f) Equitable Treatment of Certain Entities.--

(1) In general.--Section 1001 of the Food Security Act of

1985 (7 U.S.C. 1308) is amended--

(A) in subsection (a)--

(i) by redesignating paragraph (5) as

paragraph (6); and

(ii) by inserting after paragraph (4) the

following:

``(5) Qualified pass-through entity.--The term `qualified

pass-through entity' means--

``(A) a partnership (within the meaning of

subchapter K of chapter 1 of the Internal Revenue Code

of 1986);

``(B) an S corporation (as defined in section 1361

of that Code);

``(C) a limited liability company that does not

affirmatively elect to be treated as a corporation; and

``(D) a joint venture or general partnership.'';

(B) in subsections (b) and (c), by striking

``except a joint venture or general partnership'' each

place it appears and inserting ``except a qualified

pass-through entity''; and

(C) in subsection (d), by striking ``subtitle B''

and all that follows through the end and inserting

``title I of the Agricultural Act of 2014.''.

(2) Attribution of payments.--Section 1001(e)(3)(B)(ii) of

the Food Security Act of 1985 (7 U.S.C. 1308(e)(3)(B)(ii)) is

amended--

(A) in the clause heading, by striking ``joint

ventures and general partnerships'' and inserting

``qualified pass-through entities'';

(B) by striking ``a joint venture or a general

partnership'' and inserting ``a qualified pass-through

entity'';

(C) by striking ``joint ventures and general

partnerships'' and inserting ``qualified pass-through

entities''; and

(D) by striking ``the joint venture or general

partnership'' and inserting ``the qualified pass-

through entity''.

(3) Persons actively engaged in farming.--Section

1001A(b)(2) of the Food Security Act of 1985 (7 U.S.C. 1308-

1(b)(2)) is amended--

(A) in subparagraphs (A) and (B), by striking ``in

a general partnership, a participant in a joint

venture'' each place it appears and inserting ``a

qualified pass-through entity''; and

(B) in subparagraph (C), by striking ``a general

partnership, joint venture, or similar entity'' and

inserting ``a qualified pass-through entity or a

similar entity''.

(4) Joint and several liability.--Section 1001B(d) of the

Food Security Act of 1985 (7 U.S.C. 1308-2(d)) is amended by

striking ``partnerships and joint ventures'' and inserting

``qualified pass-through entities''.

(5) Exclusion from agi calculation.--Section 1001D(d) of

the Food Security Act of 1985 (7 U.S.C. 1308-3a(d)) is amended

by striking ``, general partnership, or joint venture'' each

place it appears.

(g) Payment Limitations.--Section 1001 of the Food Security Act of

1985 (7 U.S.C. 1308) is amended--

(1) in subsection (b)--

(A) by striking ``The'' and inserting ``Subject to

subsection (i), the''; and

(B) by striking ``$125,000'' and inserting

``$155,000'';

(2) in subsection (c)--

(A) by striking ``The'' and inserting ``Subject to

subsection (i), the''; and

(B) by striking ``$125,000'' and inserting

``$155,000''; and

(3) by adding at the end the following:

``(i) Adjustment.--For the 2025 crop year and each crop year

thereafter, the Secretary shall annually adjust the amounts described

in subsections (b) and (c) for inflation based on the Consumer Price

Index for All Urban Consumers published by the Bureau of Labor

Statistics of the Department of Labor.''.

(h) Adjusted Gross Income Limitation.--Section 1001D(b) of the Food

Security Act of 1985 (7 U.S.C. 1308-3a(b)) is amended--

(1) in paragraph (1), by striking ``paragraph (3)'' and

inserting ``paragraphs (3) and (4)''; and

(2) by adding at the end the following:

``(4) Exception for certain operations.--

``(A) Definitions.--In this paragraph:

``(i) Excepted payment or benefit.--The

term `excepted payment or benefit' means--

``(I) a payment or benefit under

subtitle E of title I of the

Agricultural Act of 2014 (7 U.S.C. 9081

et seq.);

``(II) a payment or benefit under

section 196 of the Federal Agriculture

Improvement and Reform Act of 1996 (7

U.S.C. 7333); and

``(III) a payment or benefit

described in paragraph (2)(C) received

on or after October 1, 2024.

``(ii) Farming, ranching, or silviculture

activities.--The term `farming, ranching, or

silviculture activities' includes agritourism,

direct-to-consumer marketing of agricultural

products, the sale of agricultural equipment by

a person or legal entity that owns such

equipment, and other agriculture-related

activities, as determined by the Secretary.

``(B) Exception.--In the case of an excepted

payment or benefit, the limitation established by

paragraph (1) shall not apply to a person or legal

entity during a crop, fiscal, or program year, as

appropriate, if greater than or equal to 75 percent of

the average gross income of the person or legal entity

derives from farming, ranching, or silviculture

activities.''.

(i) Marketing Loans.-- BLAH BLAH BLAH....

FROM: https://jacobin.com/2025/05/trump-2026-budget-cuts-military

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

debt....

The $34 ($37) trillion US debt is just the tip of the iceberg – unfunded obligations make the insolvency crisis far worse, Marc Ostwald, chief economist at ADM Investor Services International, told Sputnik.

The unfunded liabilities—over $100 trillion—from Medicare and Social Security don't show up on traditional debt balance sheets, but they are very real long-term obligations, he emphasized, noting: “No one wants to talk about it in political circles, because the problem is so large and no one has a clue how to resolve it.”

Unsustainable pay-as-you-go

There is no pool of funds for these programs, as payments going into them by workers are used to pay out the benefits for retirees, Action Economics Principal Director Michael R. Englund explains. In the past, this system worked because:

There were more workers per retiree.

People didn’t live as long.

The population was younger overall.

Changed demographics mean this imbalance is creating a structural deficit feeding into the broader insolvency threat.

Since then-President George W. Bush’s aborted attempt in 2001, no major reforms have been attempted, Englund noted. “Democrats want to increase the tax payments and Republicans want to delay the retirement age, and neither side is willing to budge,” he said. Unless there is new legislation to trim costs and/or raise revenues, this gridlock sets the stage for a future full-blown fiscal crisis sometime within 10-20 years, Englund summed up.

https://sputnikglobe.com/20250610/how-100t-debt-time-bomb-fuels-americas-looming-fiscal-crisis-1122225021.html

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

MIND YOU THE TOTAL BETS ON DERIVATIVES STANDS AT GAZILLIONS (CONSERVATIVELY SAY $1,500 TRILLION)...

SHORT STORY: Pick something of value, make bets on the future value of "something", add contract & you have a derivative.

Banks make massive profits on derivatives, and when the bubble bursts chances are the tax payer will end up with the bill.

This visualizes the total coverage for derivatives (notional). Similar to insurance company's total coverage for all cars.

LONG STORY: A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. Ex- A derivative buys you the option (but not obligation) to buy oil in 6 months for today's price/any agreed price, hoping that oil will cost more in future. (I'll bet you it'll cost more in 6 months). Derivative can also be used as insurance, betting that a loan will or won't default before a given date. So its a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value. The system is not regulated what-so-ever, and you can buy a derivative on an existing derivative.

Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Deriv. market has blown a galactic bubble, just like the real estate bubble or stock market bubble (that's going on right now). Since there is literally no economist in the world that knows exactly how the derivative money flows or how the system works, while derivatives are traded in microseconds by computers, we really don't know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times, that will be catastrophic for the world financial system since the 9 largest banks shown below hold a total of $228.72 trillion in Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout. Lets take a look at what banks have the biggest Derivative Exposures and what scandals they've been lately involved in.

https://demonocracy.info/infographics/usa/derivatives/bank_exposure.html