Search

Recent comments

- more bombs....

7 hours 47 min ago - the middle-arse....

8 hours 2 min ago - AI trump?....

12 hours 1 min ago - meanwhile....

13 hours 28 min ago - drones....

13 hours 34 min ago - propagandum....

13 hours 56 min ago - bread and butter....

15 hours 49 min ago - activism....

17 hours 21 min ago - start writing!....

20 hours 4 min ago - beyond arrogance....

20 hours 10 min ago

Democracy Links

Member's Off-site Blogs

hard times .....

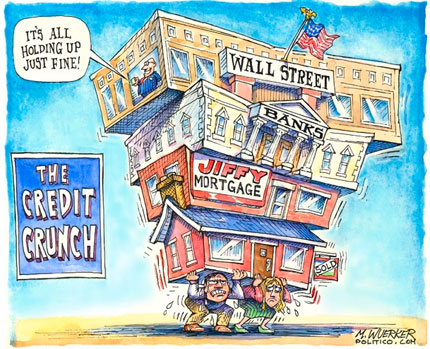

The soothsayers have slaughtered the ox and are examining the gloppy entrails for signs: Rising unemployment, a falling dollar, weak consumer spending, the credit crisis, a swooning stock market.

Could there be something wrong here?

Could we actually be approaching a, god forbid, recession? To which the only sane response is: Who cares?

According to a CNN poll, 57 percent of Americans thought we were already in a recession a month ago. Economists may complain that this is only because the public is ignorant of the technical - or at least the newspapers' standard - definition of a recession, which specifies that there must be at least two consecutive quarters of negative growth in the GDP.

But most of the public employs the more colloquial definition of a recession, which is hard times. If hard times have already fallen on a majority of Americans, then "recession" doesn't seem to be a very useful term any more.- By John Richardson at 11 Jan 2008 - 8:09pm

- John Richardson's blog

- Login or register to post comments

shonky sharks

Federal and New South Wales politicians are calling for an inquiry into online real estate agents who offer quick house sales to people who can no longer pay their mortgages.

It is feared the agents are exploiting people who are under pressure to sell their houses below market value due to falling prices and high interest rates.

Western Sydney MPs have written to federal Consumer Affairs Minister Chris Bowen, asking him to investigate some agents, which promise to sell houses in just days without the usual fees.

One organisation advertises for houses where owners are behind in repayments and face repossession.

The Real Estate Institute of Australia says homeowners should avoid dealing with the companies because they are not licensed agents.

Its president, Noel Dyett, says licensed agents are prevented by law and their own code of ethics from exploiting people struggling to keep up with their home loan repayments.

"Unfortunately, our society always has its share of bottom feeders who try to take unfair advantage of people who are in financial stress..." he said.