Search

Recent comments

- journalism....

7 hours 24 min ago - day three.....

8 hours 8 min ago - lawful law?....

8 hours 28 min ago - insurance....

8 hours 35 min ago - terrorists....

8 hours 46 min ago - nukes?...

10 hours 53 min ago - rape....

11 hours 32 min ago - devastation.....

13 hours 44 min ago - bibi's dream....

15 hours 33 min ago - thus war....

19 hours 44 min ago

Democracy Links

Member's Off-site Blogs

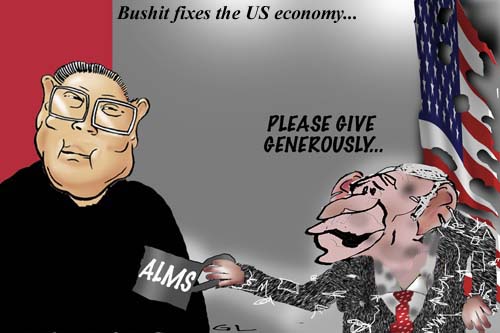

beggarman chief .....

To pay for World War II, Americans bought savings bonds and put extra notches in their belts. President Harry Truman raised taxes and cut non-military spending to pay for the Korean conflict. During Vietnam, the US raised taxes but still watched deficits soar.

But to pay for the ongoing wars in Iraq and Afghanistan, the US has used its credit card, counting on the Chinese and other foreign buyers of its debt to pay the bills. ...

Unlike in previous major wars, the United States has cut taxes at the same time it has increased military spending. "It's fair to say all of the money spent on the war has been borrowed," says Richard Kogan, a senior fellow at the Center on Budget and Policy Priorities, a think tank in Washington. "But eventually everything has to be paid for."

Congress hopes to hold hearings on the financial implications of the war before the president releases his budget proposal for fiscal year 2008 on Feb. 5. Democrats, now in the majority, plan to ask a wide range of questions, from the future costs of the war to how those costs should be budgeted.

"We won't balance the budget in one year. The best we can expect is five years," says Rep. John Spratt (D) of South Carolina, the new chairman of the House Budget Committee, in a phone interview. "But we need to know: What is the bar we need to reach?"

Estimating the budget deficit has become more difficult in recent years because the White House has funded much of the war through emergency supplemental bills, which are not included in the federal budget. According to a Congressional Research Service report, it is a practice that other administrations have employed since the Korean War. This year, the White House is expected to ask for another $100 billion in supplemental war funds, but Representative Spratt says he would like to get the war back on the budget since it can be argued the war is no longer an emergency.- By Gus Leonisky at 28 Jan 2008 - 12:04am

- Gus Leonisky's blog

- Login or register to post comments

asleep at the wheel...

Paying the Price for the Fed’s Success

By JAMES GRANT

Published: January 27, 2008

HIGH finance, like some unreliable common stock, goes lower and lower. How did so many experts misjudge so badly? How could the supposedly “contained” subprime mortgage problem metastasize into a global financial panic (some days to the down side, other days to the up side)? And after this drama, what?

Ben S. Bernanke, the chairman of the Federal Reserve, inadvertently warned of the coming troubles four years ago. Speaking to fellow economists in Washington, he described the peace and quiet that, for 20 years, had been gradually settling over the American economy. Compared to the 1970s, recessions were mild and scarce, he noted. Inflation, that bane of yesteryear, was dormant. Economic growth was no longer spasmodic but smooth and almost predictable. The name he gave to these manifold blessings was the Great Moderation, and he thanked the Fed, in which he then served as a governor under Alan Greenspan, for helping to bring them about.

But it was actually the Great Complacency that Mr. Bernanke had put his finger on.

-------------

Gus: in fact the rot was deep and some people were milking the system beyond what should have been permissible. Even with the stock market going like a yo-yo, there are people who make money when the market goes down and make money when it goes up...

The only time they don't make money is when the market is flat.

Thus it is in their interests to talk the market up and down as forward or backwards, they collect moneys on the shifts, not on the "real" (if there is such thing) values. A bit like fungus. It does not care if the tree is alive or dead as long as it's there to decompose. In bits or as a whole...

It was clear something was smelly. The housing market was being used as a booster for the economy for far too long. We mentioned this repeatedly on this site way back... I believe banks knew that too and onlsold housing contracts to other profiteers who onsold it for more and so on until the value was way over the reality. Not only that, the banks had to know the original mortgagees would at one time not be able to pay fanciful interest rates.

The Fed Bank would have had to know that, like Dubya and his generals had to know there was no WMDs in Iraq — hidden by Saddam — otherwise they would not have attacked...

When Greenspan was at the helm, he would have had to know of and warn of the sub-prime lending practice to the government to find a more private equitable way to house the poor... But no. They seem to have chosen to let the rot set in slowly, quietly. They knew. If they did not know, they are guilty of incompetence. If they knew they are guilty of being lazy...

And some people still suck the system whether it's going up or down... Meanwhile, the dumb president is heavily borrowing from the Chinese to feed his war addiction.

Bushit the besieger

Three years after the devastating US assault, our correspondent enters besieged Iraqi city left without clean water, electricity and medicine

By Patrick Cockburn

Monday, 28 January 2008

Fallujah is more difficult to enter than any city in the world. On the road from Baghdad I counted 27 checkpoints, all manned by well-armed soldiers and police. "The siege is total," says Dr Kamal in Fallujah Hospital as he grimly lists his needs, which include everything from drugs and oxygen to electricity and clean water.

in Dumbya footsteps...

Gordon Brown will this weekend call on China and oil-producing countries in the Gulf to pump hundreds of billions of dollars into the International Monetary Fund to prevent the global financial "contagion" from destroying vulnerable economies.

As the IMF finalises plans to shore up the Hungarian and Ukrainian economies with combined loans of $29bn, the prime minister will make clear that more needs to be done to ensure the fund can step in to help struggling economies.

------------------

see toon at top...