Search

Recent comments

- escalationing....

5 hours 11 min ago - not happy, john....

9 hours 30 min ago - corrupt....

14 hours 52 min ago - laughing....

16 hours 46 min ago - meanwhile....

18 hours 15 min ago - a long day....

20 hours 9 min ago - pressure....

20 hours 56 min ago - peer pressure....

1 day 12 hours ago - strike back....

1 day 12 hours ago - israel paid....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

on a rusted iron horse .....

Timothy Geithner and his predecessor Henry Paulson have been the public faces of the U.S. government's battle against the global economic crisis.

But even as the secretaries of the Treasury have garnered the headlines -- as well as popular anger surrounding bank bailouts and corporate bonuses -- another official has quickly amassed great influence by committing trillions of dollars to keep markets afloat, radically redefining his institution and taking on serious risks as he seeks to rescue the American economy. Without a doubt, this crisis is now Ben Bernanke's war.

Bernanke has become the country's economist in chief, the banker for the United States and perhaps the world, and has employed every weapon in the Federal Reserve's arsenal. He has overseen the broadest use of the Fed's powers since World War II, and the regulation proposals working their way through Congress seem likely to empower the institution even further.

Although his actions may be justified under today's circumstances, Bernanke's willingness to pump money into the economy risks unleashing the most serious bout of U.S. inflation since the early 1980s, in a nation already battered by rising unemployment and negative growth.If he succeeds in restarting growth while avoiding high inflation, Bernanke may well become the most revered economist in modern history. But for the moment, he is operating in uncharted territory.

When he first joined the Federal Reserve's Board of Governors in 2002, and later when he became chairman in 2006, there was little reason to expect Bernanke to revolutionize central banking. After all, it was the Age of Greenspan the Triumphant. Almost two decades of sustained growth and low inflation had created the illusion of central banking as a precise science, with the Fed simply reading economic statistics and nudging short-term interest rates up or down to keep the American economy humming and inflation low.Shortly after succeeding Alan Greenspan as Fed chairman, Bernanke credited his predecessor's monetary policy with helping to reduce wide swings in U.S. economic performance -- the so-called "Great Moderation" -- and revive the productivity of American workers. This apparent success also lent staying power to some of Greenspan's conviction that the Fed should regulate the banking system with a light touch, relying on the free market and private-sector incentives.

Bernanke initially maintained Greenspan's hands-off approach to the emerging housing bubble.

As the financial crisis deepened in late 2007 and early 2008, however, the Fed began expanding its lending efforts to financial institutions that couldn't raise money in private markets. This was Bernanke's first departure from the Greenspan school, in which tweaking interest rates was the instrument that mattered.http://www.washingtonpost.com/wp-dyn/content/article/2009/04/02/AR2009040202573_pf.html

- By Gus Leonisky at 6 Apr 2009 - 11:17pm

- Gus Leonisky's blog

- Login or register to post comments

no traction...

Parsing the G-20’s $1 Trillion Pledge

By MARK LANDLERWASHINGTON — It is an extraordinary number for extraordinary times: $1.1 trillion in aid, to be pumped into the world’s financial bloodstream. For the leaders gathered in London last week, it was tangible evidence that their economic summit meeting had yielded impressive results.

Yet on closer inspection, the $1 trillion figure looks as wishful as the soaring words in the communiqué issued by the Group of 20. Some of the money has yet to be pledged, some is double-counted and some would be counted in a “synthetic currency” that is not actually real money.

Given that the global economic recession is at least partly a crisis of confidence, experts said there was value in announcing a blockbuster sum — even a notional one. Investors were buoyed, and the news media printed and broadcast the headline number without stopping to parse it.

But some experts warn that the squishy mathematics could come back to haunt the leaders, particularly if the economy does not recover or if some of the major pledges do not come through.

“The lack of concreteness in the numbers is troubling, because further down the line, they’re going to have to come to grips with the details,” said Eswar S. Prasad, a former China division chief at the International Monetary Fund who now teaches at Cornell University.

---------------

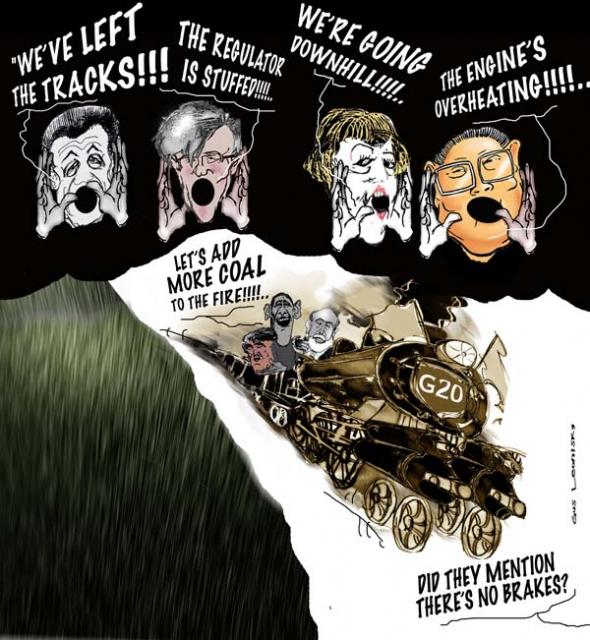

see toon at top...

a thousand words...

Few economists saw our current crisis coming, but this predictive failure was the least of the field’s problems. More important was the profession’s blindness to the very possibility of catastrophic failures in a market economy. During the golden years, financial economists came to believe that markets were inherently stable — indeed, that stocks and other assets were always priced just right. There was nothing in the prevailing models suggesting the possibility of the kind of collapse that happened last year. Meanwhile, macroeconomists were divided in their views. But the main division was between those who insisted that free-market economies never go astray and those who believed that economies may stray now and then but that any major deviations from the path of prosperity could and would be corrected by the all-powerful Fed. Neither side was prepared to cope with an economy that went off the rails despite the Fed’s best efforts.

--------------------------

I am not an economist but on this site I did shout quite a few times since 2005 that the way economies of the world were being run, including that of Australia, something was going to give. I pay attention to the "differentials" and the "derivatives". In an economically stable world they should be "in step" more or less. But then the derivatives stretched the horizontal credibility beyond comprehension while the differential of credit was building skyscrapers over big holes. I use images a lot. A picture is worth a thousand words. A small spark in the housing bubble was bound to ignite this powder keg...

We're not out of the woods yet unless some major equitable realignments are made... See toon at top...

think tanked...

The US recession is probably over but the economy will remain weak for some time due to unemployment, Federal Reserve chairman Ben Bernanke has said.

"From a technical perspective, the recession is very likely over," he told a Washington think tank. He said the consensus is the economy is growing.

--------------------

see toon at top...