Search

Recent comments

- a speech never made....

2 hours 26 min ago - wardonald...

3 hours 59 min ago - MAGA fools

13 hours 18 min ago - the ugliest excuse to go to war.....

23 hours 29 min ago - morons....

1 day 1 hour ago - idiots...

1 day 1 hour ago - no reason....

1 day 2 hours ago - ask claude...

1 day 5 hours ago - dumb blonde....

1 day 13 hours ago - unhealthy USA....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

so much bull .....

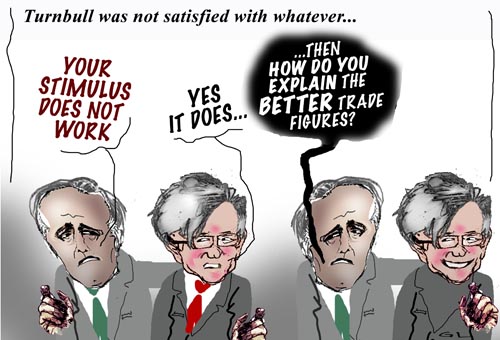

Today's surprise rise in the country's growth figures has prompted a war of words in Federal Parliament over what exactly is responsible for the jump.

The increase in growth of 0.4 per cent for the March quarter means that Australia has avoided falling into a technical recession.

Prime Minister Kevin Rudd says the growth would not have happened without the Government's economic stimulus measures, including cash handouts and infrastructure spending.

But Opposition Leader Malcolm Turnbull maintains the strongest contributor to the figure was from net exports and has challenged Mr Rudd over his stimulus claims during Question Time.

http://www.abc.net.au/news/stories/2009/06/03/2588457.htm?section=justin

- By Gus Leonisky at 3 Jun 2009 - 9:46pm

- Gus Leonisky's blog

- Login or register to post comments

dancing in the wall streets...

Yesterday's rate hike by the Reserve Bank has spurred confidence around the world that the global economy might be on the mend.

Media in the US and Britain have widely heralded the bank's move to lift interest rates to 3.25 per cent as bold and courageous.

Share markets in Europe and the United States rallied overnight as crude oil prices rose and the gold price hit a record.

Economists in countries like the US, where the official rate is close to zero, thought the RBA might eventually act, but not this soon.

"Everyone expected the RBA to be hawkish and pave the way for a rate hike, but not many people expected them to jump the gun and hike interest rates now," said economist Kathy Lien.

Ms Lien says she believes the RBA has set the course for other central banks to move or consider moving once the global emergency is over. But she says it could be a long wait.

"Next in line is the Reserve Bank of New Zealand, because based upon the options on interest rate futures, we see that the market is beginning to price in a possible move by the RBNZ as well.

---------------

see toon above...